5 Tax Forms

Understanding Tax Forms: A Comprehensive Guide

When it comes to filing taxes, one of the most crucial aspects is navigating through the various tax forms that are required. These forms are designed to help individuals and businesses report their income, claim deductions, and pay their fair share of taxes. In this guide, we will delve into 5 key tax forms that are essential for a smooth and compliant tax filing process.

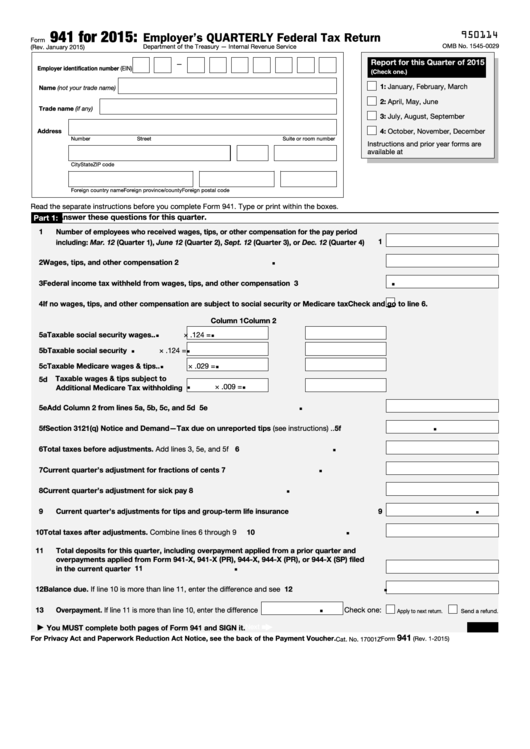

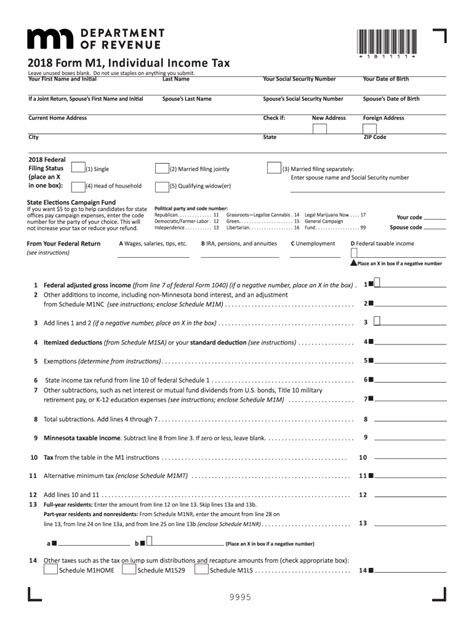

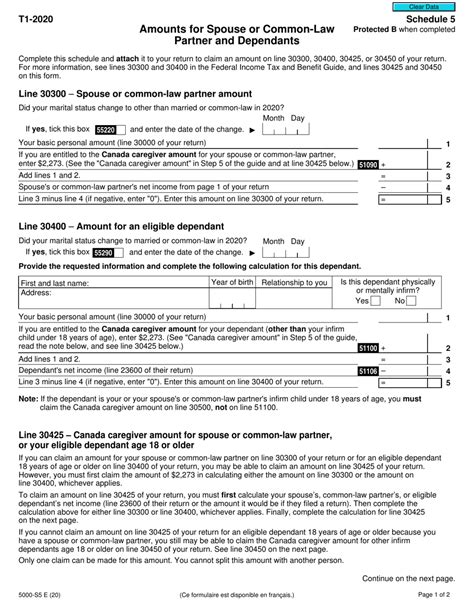

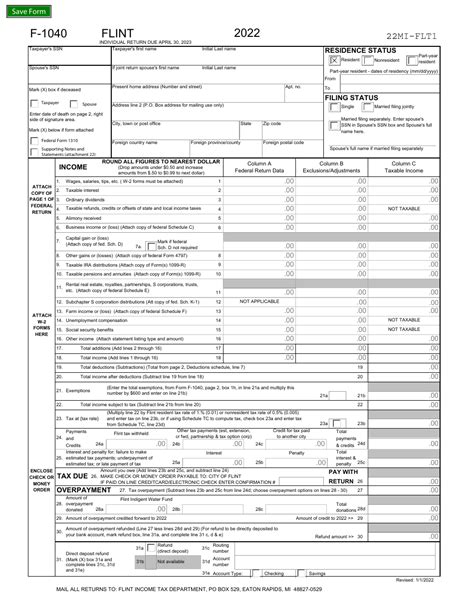

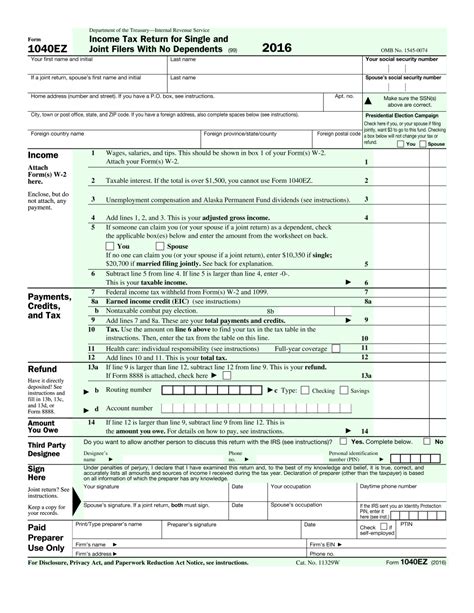

1. Form 1040: The Standard Tax Return Form

The Form 1040 is the standard form used by individuals to file their federal income tax returns. This form is used to report income, claim deductions and credits, and calculate the amount of tax owed or the refund due. It is a comprehensive form that covers various aspects of an individual’s tax situation, including income from jobs, investments, and self-employment, as well as deductions for items like mortgage interest, charitable donations, and medical expenses.

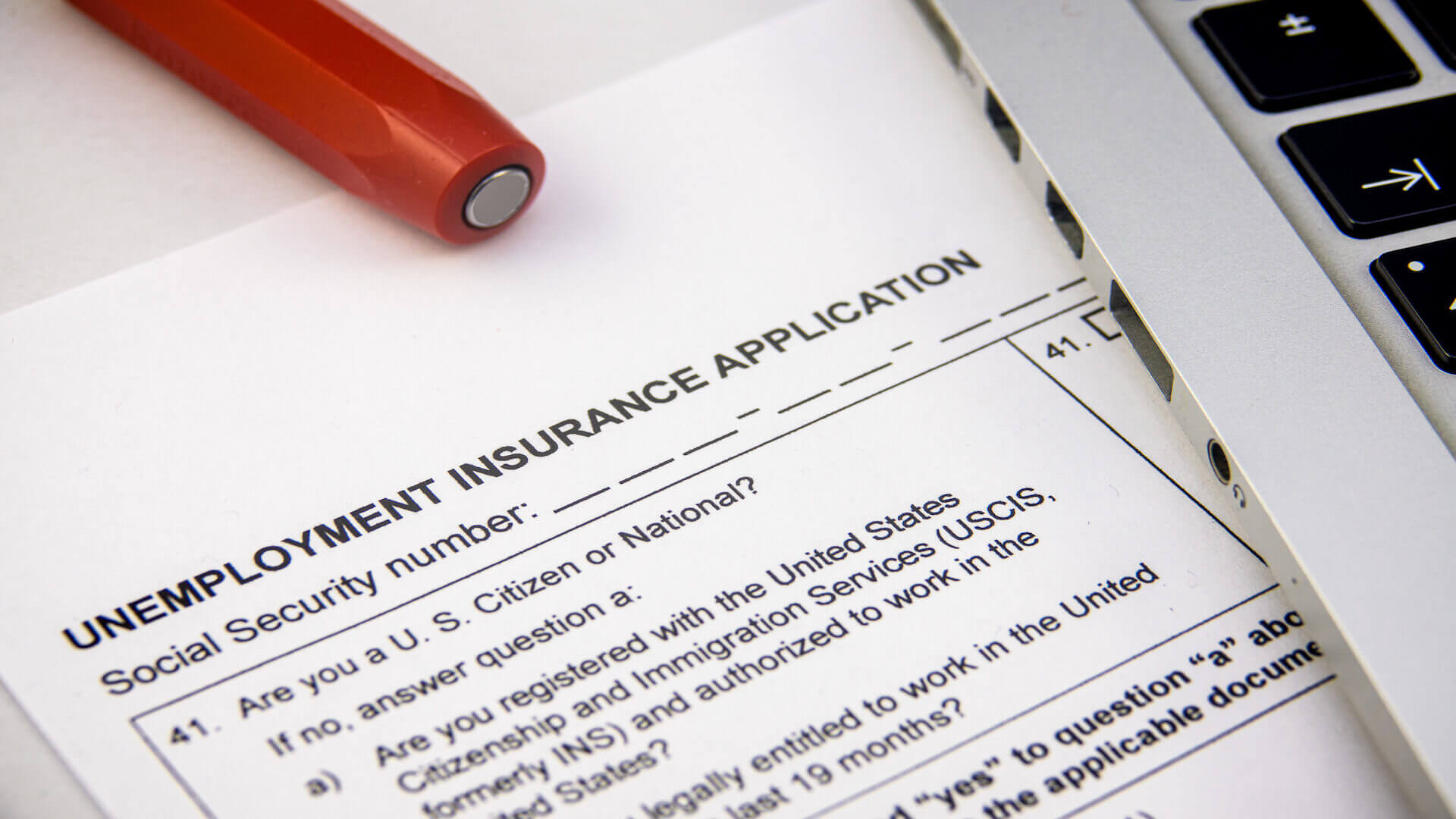

2. Form W-2: The Wage and Tax Statement

The Form W-2 is a critical document provided by employers to their employees, detailing the employee’s income and the amount of taxes withheld from their paycheck. This form is essential for individuals when filing their tax returns, as it provides the necessary information to report their income accurately. Employers are required to provide a W-2 form to each employee by the end of January each year, reflecting the previous year’s earnings and tax withholdings.

3. Form 1099: The Miscellaneous Income Form

The Form 1099 series is used to report various types of income that are not subject to withholding, such as freelance work, interest, dividends, and capital gains. There are several types of 1099 forms, each designed for specific types of income. For example, Form 1099-MISC is used for miscellaneous income, while Form 1099-INT is used for interest income. These forms are crucial for accurately reporting income from sources other than employment.

4. Form 8962: The Premium Tax Credit Form

The Form 8962 is used by individuals who have purchased health insurance through the Health Insurance Marketplace and are eligible for the Premium Tax Credit (PTC). This form helps calculate the amount of the PTC that can be claimed, which can significantly reduce the cost of health insurance premiums. It is an essential form for those who rely on the Marketplace for their health insurance needs.

5. Form 8829: The Expenses for Business Use of Your Home Form

The Form 8829 is used by self-employed individuals and small business owners who use a portion of their home for business purposes. This form is necessary to calculate the business use percentage of the home, which can then be used to deduct a portion of rent or mortgage interest, utilities, and other expenses as business expenses on the tax return. It’s a valuable form for those looking to maximize their business deductions.

📝 Note: It's essential to keep accurate records and understand the specific requirements for each form to ensure compliance and avoid any potential audits or penalties.

When navigating these tax forms, it’s crucial to understand the deadlines, requirements, and any potential changes due to tax law updates. The IRS provides extensive resources and guidelines to help individuals and businesses comply with tax regulations. For those who find the process overwhelming, seeking the advice of a tax professional can be incredibly beneficial.

In the realm of tax filing, knowledge is power. Understanding the role and requirements of each tax form can make a significant difference in ensuring a smooth and compliant tax filing process. Whether you’re an individual with a simple tax situation or a business with complex tax needs, recognizing the importance of these forms is the first step towards managing your tax obligations effectively.

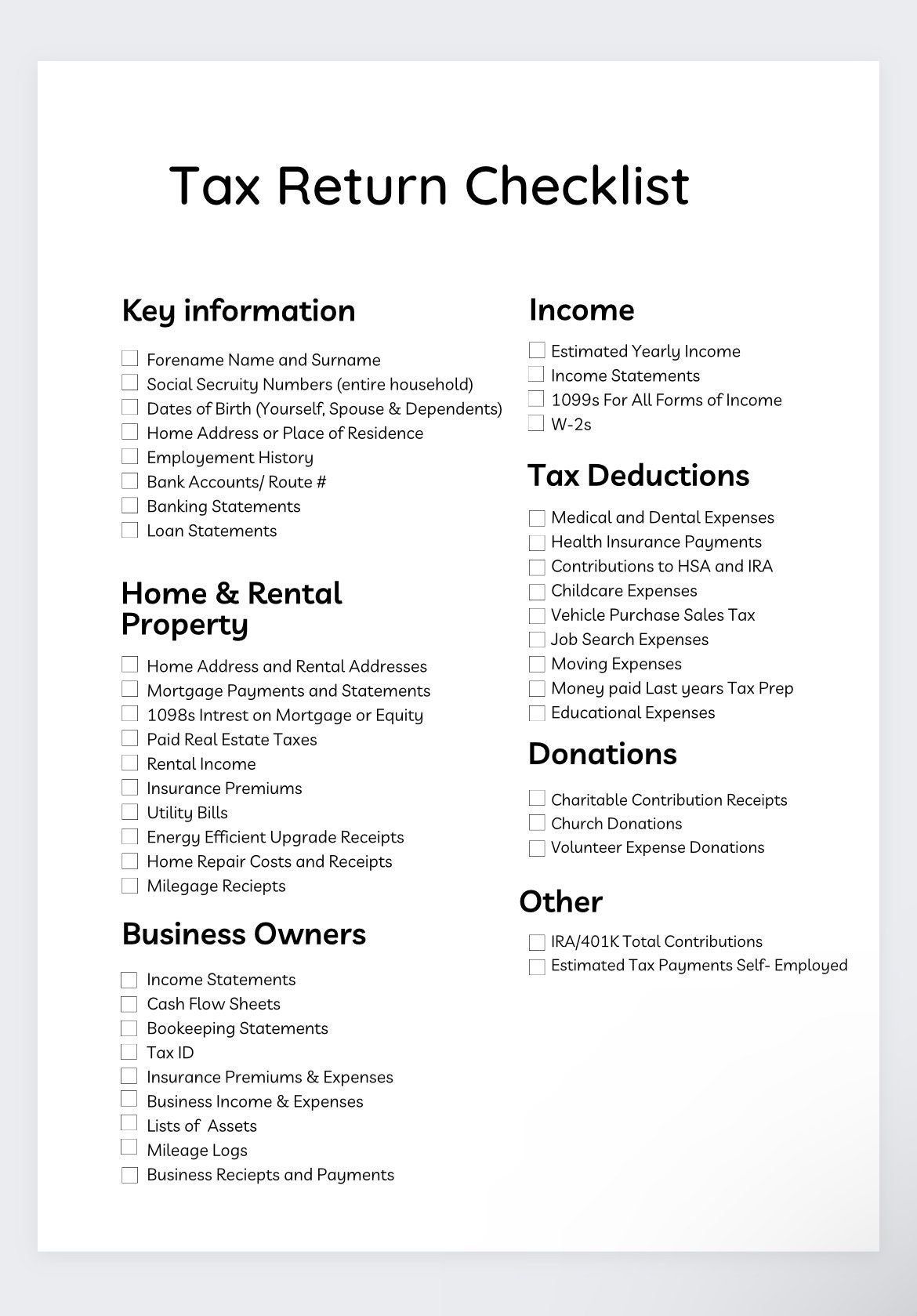

To enhance your understanding and compliance with tax regulations, consider the following key points: - Accuracy is Key: Ensure all information provided on the tax forms is accurate and up-to-date. - Keep Records: Maintain detailed records of income, expenses, and deductions to support the information reported on the tax forms. - Seek Professional Help: If unsure about any aspect of the tax forms or the filing process, consider consulting a tax professional.

In summary, tax forms are the backbone of the tax filing process, providing the structure through which individuals and businesses report their financial activities to the government. By understanding the purpose and requirements of each form, taxpayers can ensure they are meeting their tax obligations accurately and efficiently. Whether it’s the standard Form 1040, the detailed Form 8829, or any other tax form, each plays a vital role in the tax compliance process.