File Tax Return Paperwork

Introduction to Tax Return Paperwork

Filing tax return paperwork is an essential task for individuals and businesses to report their income and expenses to the government. The process involves gathering necessary documents, filling out forms, and submitting them to the relevant tax authority. In this blog post, we will guide you through the steps of filing tax return paperwork, highlighting key points and providing tips to make the process smoother.

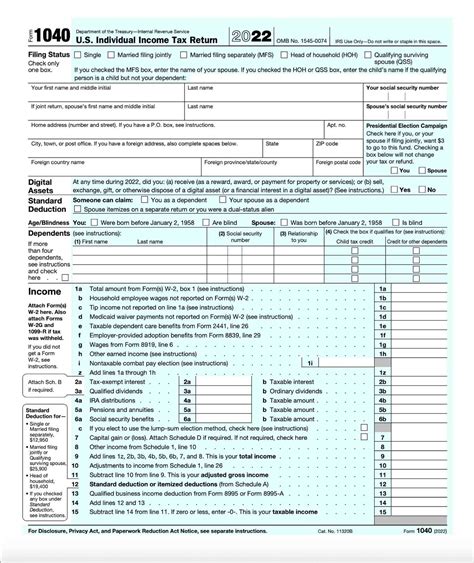

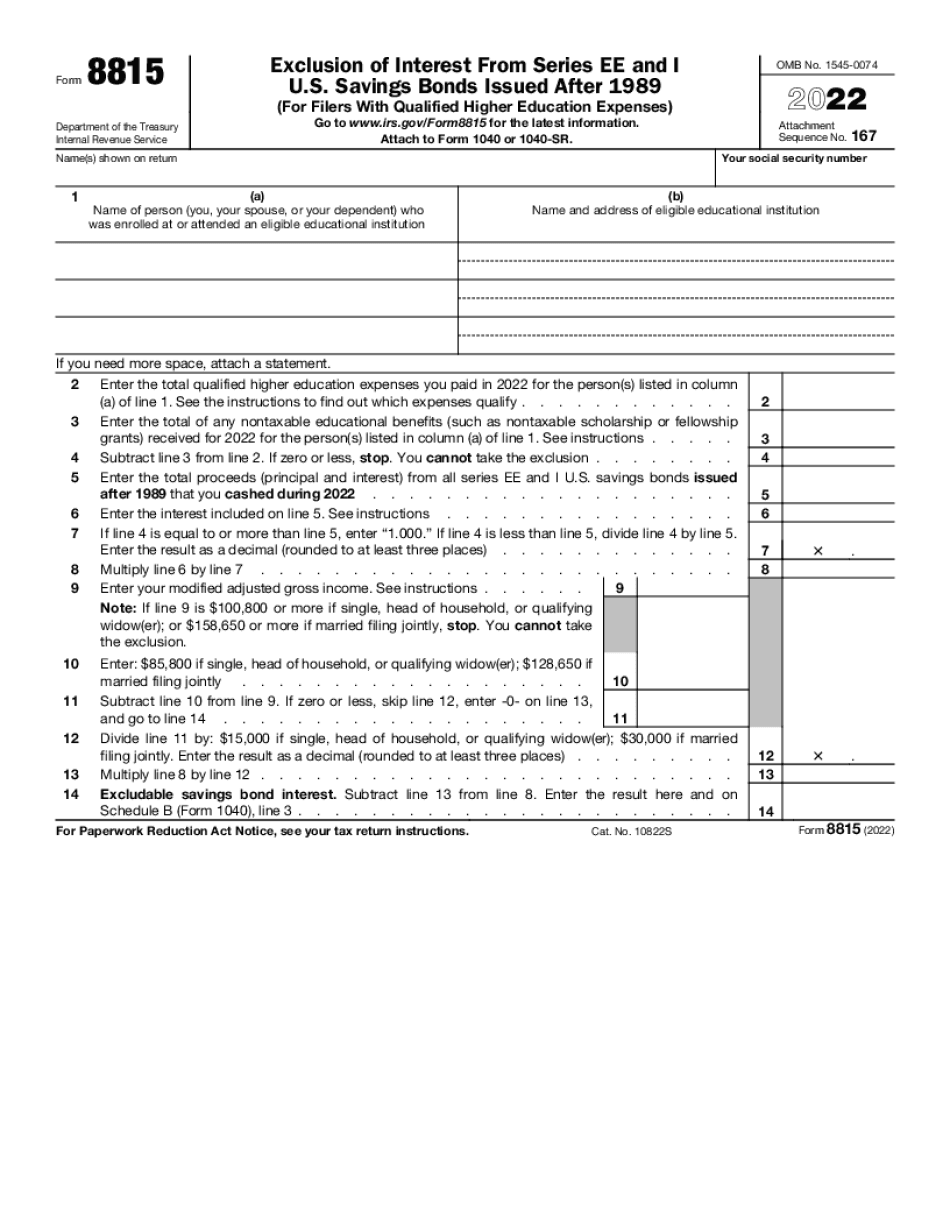

Understanding Tax Return Forms

The first step in filing tax return paperwork is to understand the different types of forms required. The most common forms include: * Form 1040: The standard form for personal income tax returns * Form 1065: The form for partnership tax returns * Form 1120: The form for corporate tax returns Each form has its own set of instructions and requirements, so it’s essential to choose the correct one for your situation.

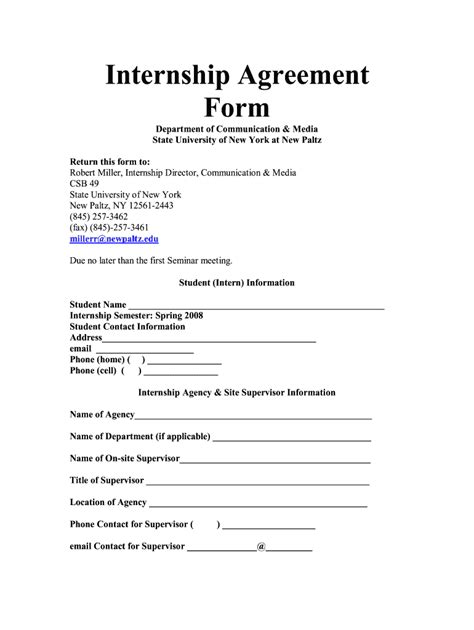

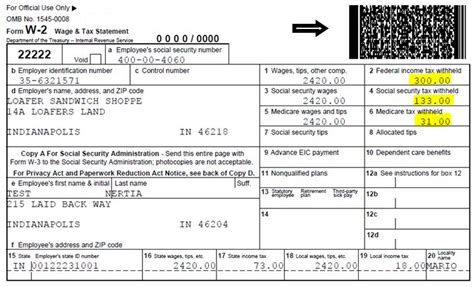

Gathering Necessary Documents

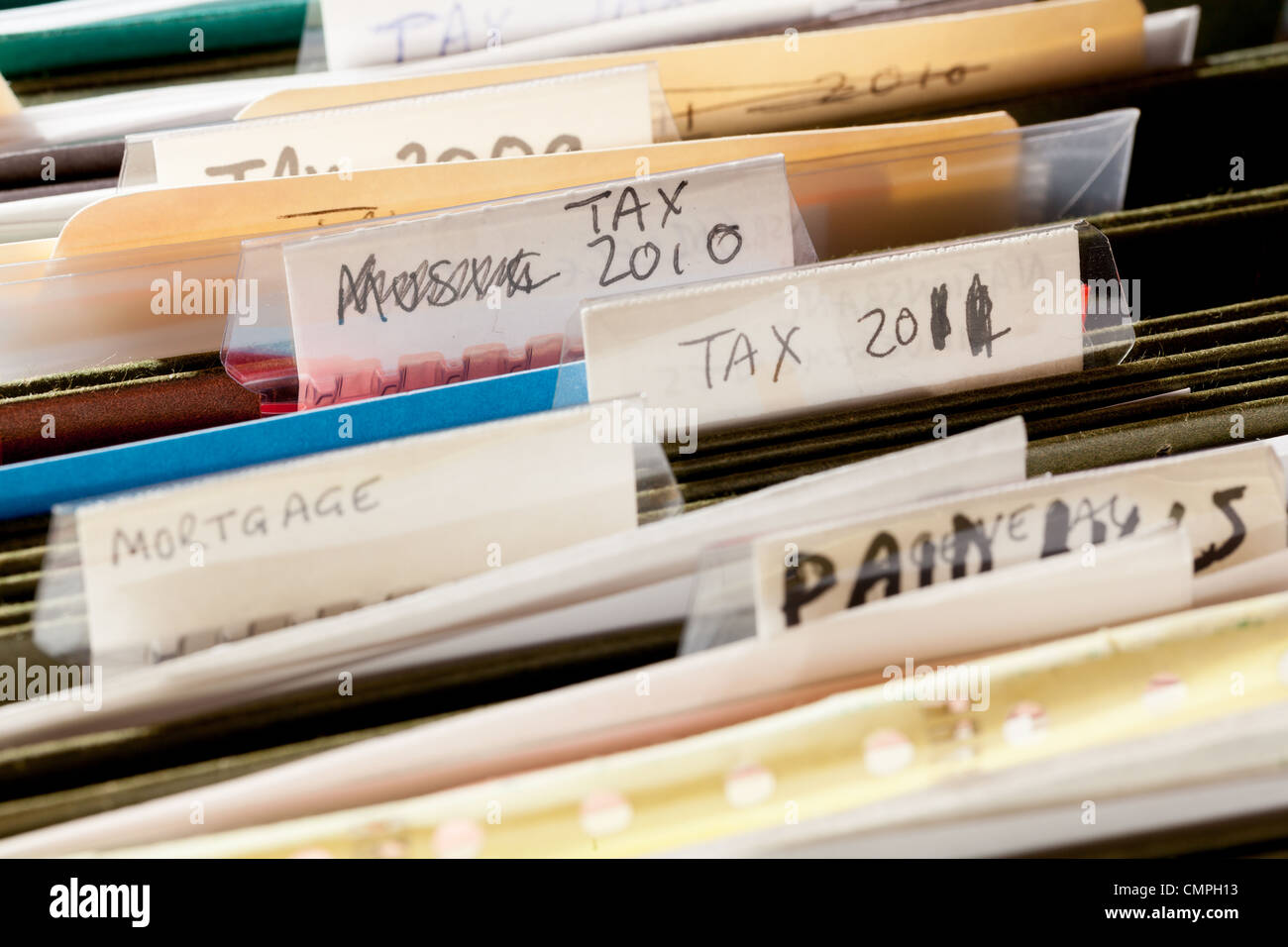

To complete your tax return paperwork, you’ll need to gather various documents, including: * W-2 forms: Showing your income and taxes withheld * 1099 forms: Showing income from freelance work or investments * Receipts and invoices: For business expenses or charitable donations * Bank statements: To report interest income or investments Make sure to keep all these documents organized and easily accessible to avoid delays in the filing process.

Filing Tax Return Paperwork

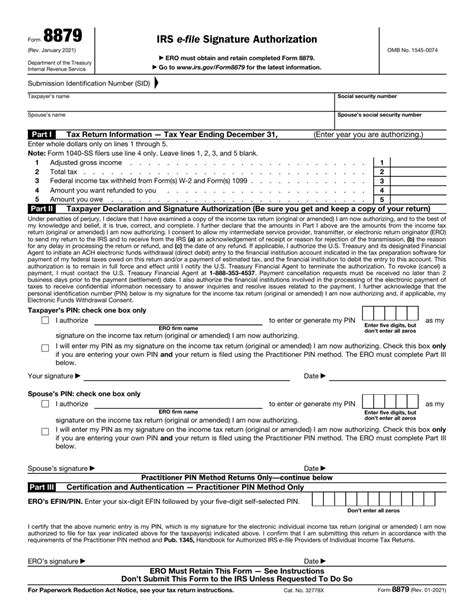

Once you have all the necessary documents, you can start filling out your tax return forms. You can choose to: * E-file: Submit your tax return electronically through the tax authority’s website or a third-party service * Mail: Send your tax return forms by mail to the tax authority’s address * Use tax software: Utilize tax preparation software to guide you through the process and submit your return electronically Regardless of the method you choose, make sure to follow the instructions carefully and double-check your information to avoid errors.

Deadline and Penalties

It’s crucial to meet the tax filing deadline to avoid penalties and interest on any owed taxes. The deadline for filing tax returns typically falls on April 15th of each year, but it may vary depending on your location and type of tax return. If you’re unable to file on time, you can request an extension, but be aware that this may still result in penalties and interest.

Tips for Filing Tax Return Paperwork

To make the process of filing tax return paperwork more efficient, consider the following tips: * Start early: Give yourself plenty of time to gather documents and fill out forms * Seek professional help: If you’re unsure about any aspect of the process, consider consulting a tax professional * Keep records: Maintain accurate and detailed records of your income and expenses throughout the year * Take advantage of deductions: Claim all eligible deductions and credits to minimize your tax liability

| Form | Description |

|---|---|

| Form 1040 | Personal income tax return |

| Form 1065 | Partnership tax return |

| Form 1120 | Corporate tax return |

📝 Note: Make sure to keep a copy of your tax return paperwork for your records, as you may need to refer to it in the future.

In the end, filing tax return paperwork requires attention to detail and a thorough understanding of the process. By following the steps outlined in this blog post and taking advantage of the tips provided, you’ll be well on your way to completing your tax return with ease and accuracy. Remember to stay organized, seek help when needed, and take advantage of eligible deductions to minimize your tax liability.

What is the deadline for filing tax returns?

+

The deadline for filing tax returns typically falls on April 15th of each year, but it may vary depending on your location and type of tax return.

Can I file my tax return electronically?

+

Yes, you can file your tax return electronically through the tax authority’s website or a third-party service.

What documents do I need to file my tax return?

+

You’ll need to gather various documents, including W-2 forms, 1099 forms, receipts and invoices, and bank statements, to complete your tax return.