Paperwork

Paperwork to Keep and For How Long

Introduction to Paperwork Management

When it comes to managing personal or business finances, keeping track of paperwork is essential. This includes invoices, receipts, bank statements, and tax documents, among others. Knowing what paperwork to keep and for how long can help in case of audits, tax returns, or other financial inquiries. In this article, we will delve into the world of paperwork management, discussing the types of documents to keep, the duration for which they should be retained, and tips on how to organize them efficiently.

Understanding the Importance of Paperwork

Effective paperwork management is crucial for both individuals and businesses. It not only helps in maintaining a clear record of financial transactions but also ensures compliance with legal and tax requirements. Proper documentation can serve as evidence in case of disputes or audits, protecting one’s interests. Moreover, organized paperwork can simplify the process of filing tax returns and applying for loans or credit.

Types of Paperwork to Keep

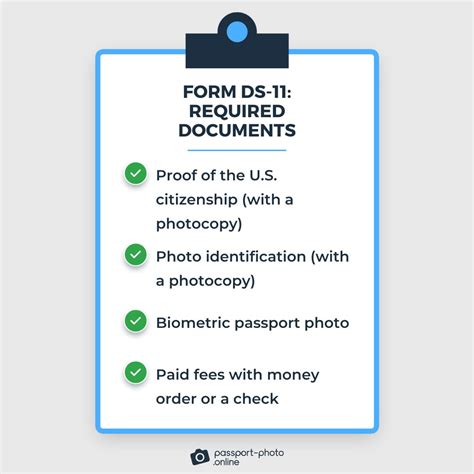

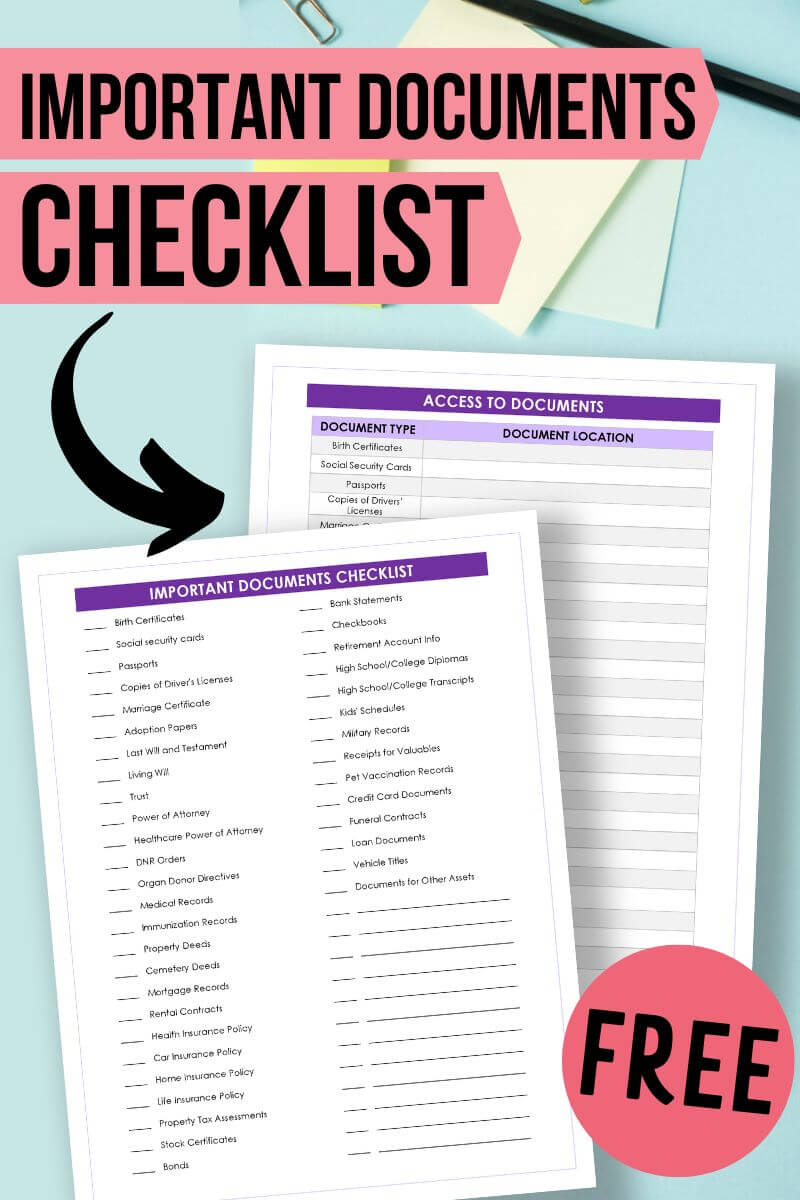

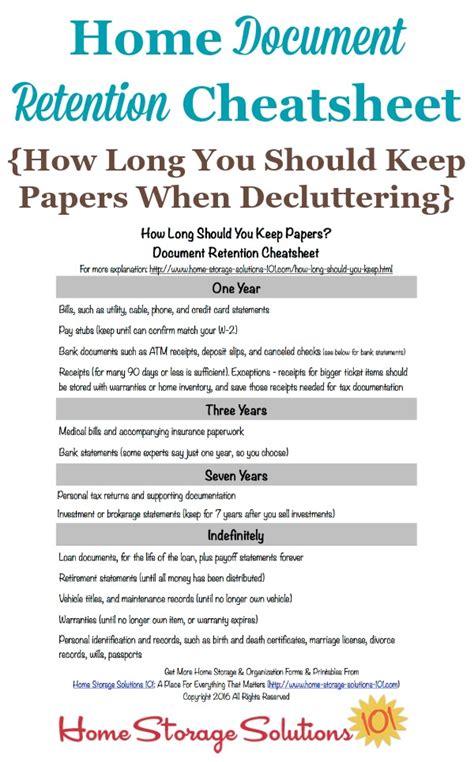

There are several types of paperwork that individuals and businesses should keep. These include: - Tax Documents: W-2 forms, 1099 forms, tax returns, and any other documents related to tax filings. - Financial Statements: Bank statements, investment accounts, and loan documents. - Receipts and Invoices: For major purchases, business expenses, and any items that might be deductible on tax returns. - Insurance Documents: Health, auto, home, and life insurance policies. - Legal Documents: Wills, trusts, property deeds, and any other legal agreements.

Duration for Keeping Paperwork

The duration for keeping paperwork varies depending on the type of document and its significance for tax purposes or legal requirements. Here are some general guidelines: - Tax-Related Documents: Typically, these should be kept for at least three years from the date of filing in case of an audit. However, if you claim a loss from worthless securities or a bad debt deduction, you should keep records for seven years. - Financial Statements and Receipts: It’s a good idea to keep these for one to three years, depending on their relevance for future reference or tax purposes. - Insurance and Legal Documents: These should be kept indefinitely, as they provide crucial information about your legal and financial obligations and protections.

Organizing Paperwork

Organizing paperwork efficiently can make a significant difference in managing your finances and complying with legal requirements. Here are some tips: - Digitalize Documents: Consider scanning your documents and saving them digitally. This not only saves space but also makes it easier to retrieve and share documents when needed. - Use Filing Systems: Whether physical or digital, a well-structured filing system can help you locate documents quickly. - Secure Storage: Ensure that your documents, especially sensitive ones, are stored securely to protect against unauthorized access or data breaches.

📝 Note: Always back up your digital files to an external drive or cloud storage to prevent loss in case of a technical failure.

Best Practices for Disposing of Paperwork

When disposing of paperwork, especially sensitive documents, it’s essential to do so securely to prevent identity theft or unauthorized access to your information. Here are some best practices: - Shredding: Use a shredder to destroy documents that contain personal or financial information. - Secure Erase: For digital documents, use secure erase methods to ensure that data is completely deleted and cannot be recovered.

Conclusion and Final Thoughts

Managing paperwork effectively is a critical aspect of personal and business finance. By understanding what paperwork to keep, for how long, and how to organize it, individuals and businesses can ensure compliance with legal requirements, simplify financial management, and protect their interests. Remember, organization and security are key when it comes to paperwork management. Implementing a systematic approach to handling paperwork can lead to better financial health and reduced stress in the long run.

What are the most important documents to keep for tax purposes?

+

The most important documents to keep for tax purposes include W-2 forms, 1099 forms, tax returns, and any receipts or invoices for deductible expenses.

How long should I keep financial statements and receipts?

+

It’s generally recommended to keep financial statements and receipts for at least one to three years, depending on their relevance for future reference or tax purposes.

What is the best way to dispose of sensitive paperwork?

+

The best way to dispose of sensitive paperwork is by shredding physical documents and using secure erase methods for digital files to prevent unauthorized access.