5 HSA Forms Needed

Introduction to HSA Forms

The Health Savings Account (HSA) is a tax-advantaged account that allows individuals with high-deductible health plans to save for medical expenses. To manage and administer an HSA, various forms are required for different purposes, such as enrollment, contributions, and distributions. In this article, we will discuss the 5 essential HSA forms that individuals and employers need to be familiar with.

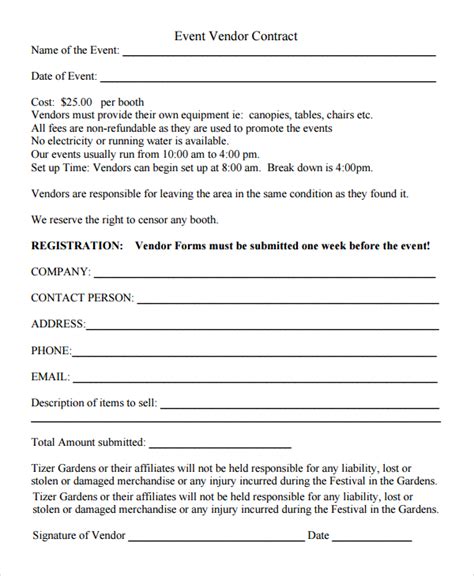

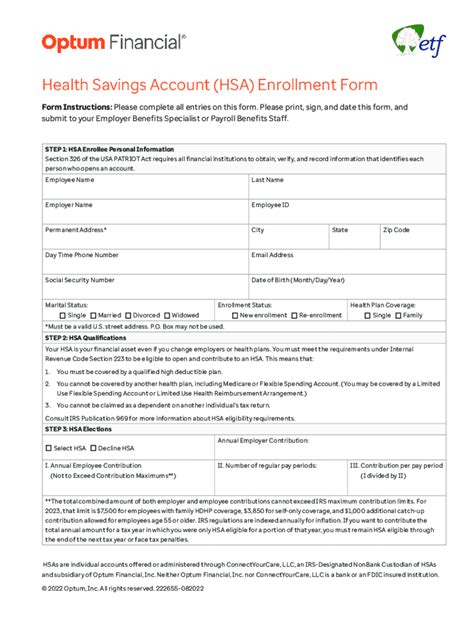

Form 1: HSA Enrollment Form

The HSA enrollment form is used to establish an HSA account. This form typically requires personal and employment information, as well as details about the high-deductible health plan. Employers often provide this form to their employees as part of the benefits enrollment process. The form may ask for the following information: * Name and address * Social Security number * Date of birth * Employment status * Health plan information

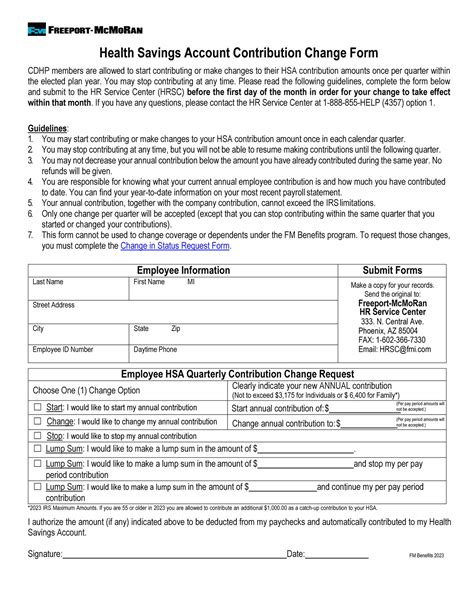

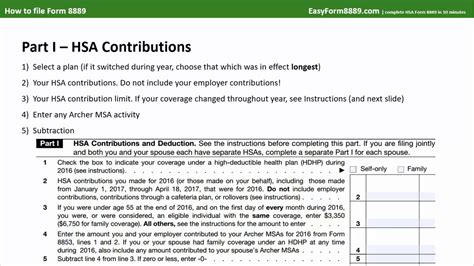

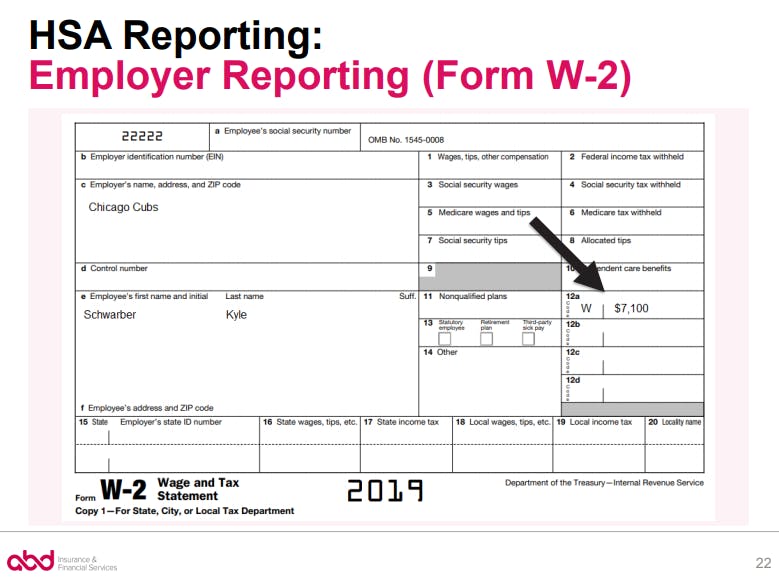

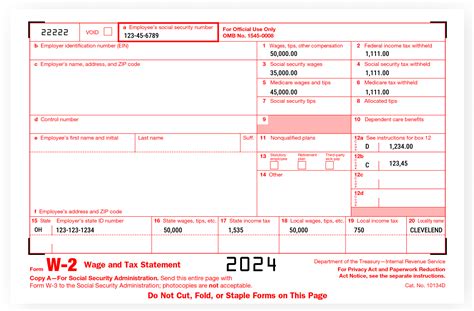

Form 2: HSA Contribution Form

The HSA contribution form is used to make contributions to an HSA account. This form can be used for one-time or recurring contributions, and it may require the following information: * Account holder’s name and address * Contribution amount * Contribution frequency (e.g., monthly, annually) * Payment method (e.g., check, electronic funds transfer) * Employer contribution information (if applicable)

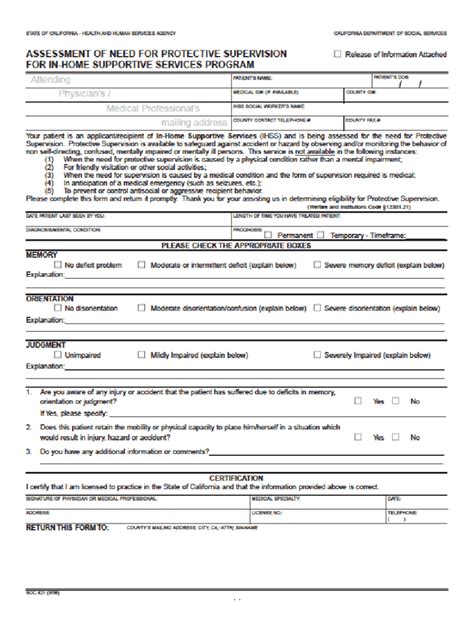

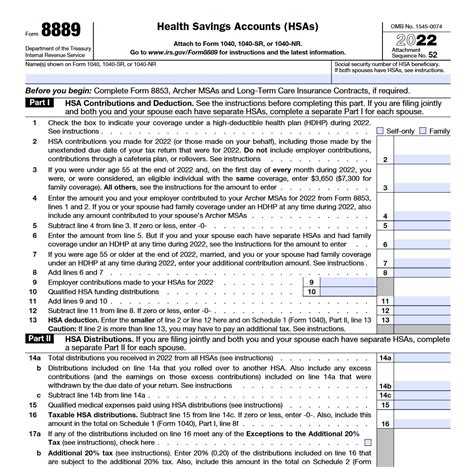

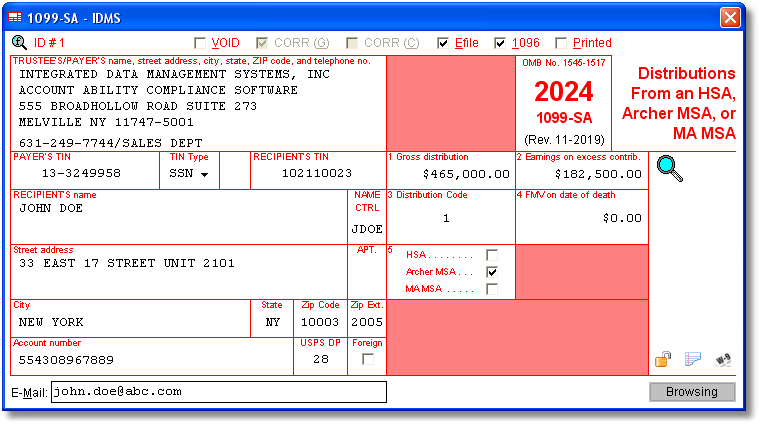

Form 3: HSA Distribution Form

The HSA distribution form is used to request a distribution from an HSA account. This form typically requires the following information: * Account holder’s name and address * Distribution amount * Purpose of the distribution (e.g., medical expense, non-medical expense) * Tax withholding information (if applicable) * Certification that the distribution is for a qualified medical expense (if applicable)

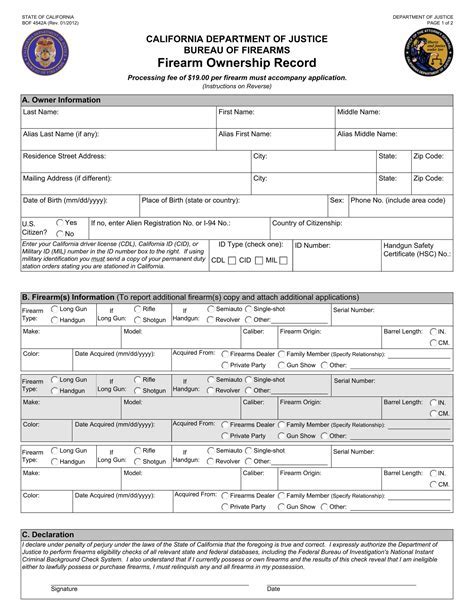

Form 4: HSA Transfer Form

The HSA transfer form is used to transfer funds from one HSA account to another. This form may require the following information: * Account holder’s name and address * Current HSA account information * New HSA account information * Transfer amount * Reason for the transfer (e.g., change of employer, change of HSA provider)

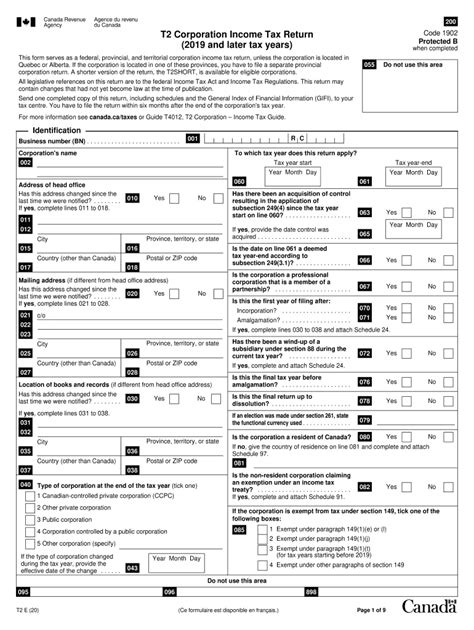

Form 5: HSA Beneficiary Designation Form

The HSA beneficiary designation form is used to designate a beneficiary for an HSA account. This form typically requires the following information: * Account holder’s name and address * Beneficiary’s name and address * Beneficiary’s relationship to the account holder * Percentage of the account balance to be distributed to the beneficiary * Contingent beneficiary information (if applicable)

📝 Note: It is essential to review and understand the requirements and rules for each HSA form to ensure compliance with IRS regulations and to avoid any penalties or fines.

To summarize, the 5 essential HSA forms are crucial for managing and administering an HSA account. These forms help individuals and employers navigate the process of enrolling, contributing, distributing, transferring, and designating beneficiaries for HSA accounts. By understanding the purpose and requirements of each form, individuals can ensure that they are using their HSA accounts correctly and maximizing their tax benefits. In the end, being familiar with these forms can help individuals make the most of their HSAs and achieve their healthcare and financial goals.

What is the purpose of the HSA enrollment form?

+

The HSA enrollment form is used to establish an HSA account and requires personal and employment information, as well as details about the high-deductible health plan.

Can I use the HSA distribution form for non-medical expenses?

+

Yes, you can use the HSA distribution form for non-medical expenses, but you may be subject to income tax and a 20% penalty on the distribution amount.

How do I designate a beneficiary for my HSA account?

+

You can designate a beneficiary for your HSA account by completing the HSA beneficiary designation form, which requires information about the beneficiary and the percentage of the account balance to be distributed to them.