Refinance Mortgage Paperwork Requirements

Introduction to Refinance Mortgage Paperwork

When considering refinancing a mortgage, one of the most critical steps is gathering and understanding the necessary paperwork. Refinancing a mortgage involves replacing an existing mortgage with a new one, often to secure a better interest rate, lower monthly payments, or to tap into home equity. The process can be complex, and the paperwork requirements can vary depending on the lender, the type of mortgage, and the borrower’s financial situation. In this guide, we will explore the typical refinance mortgage paperwork requirements and provide insights into how to navigate this process efficiently.

Understanding Refinance Mortgage Paperwork

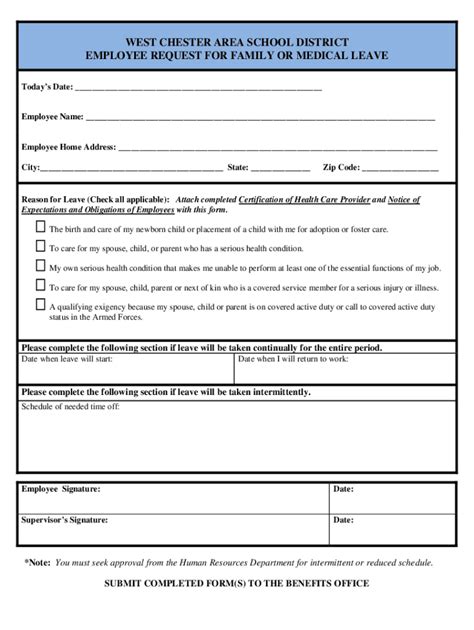

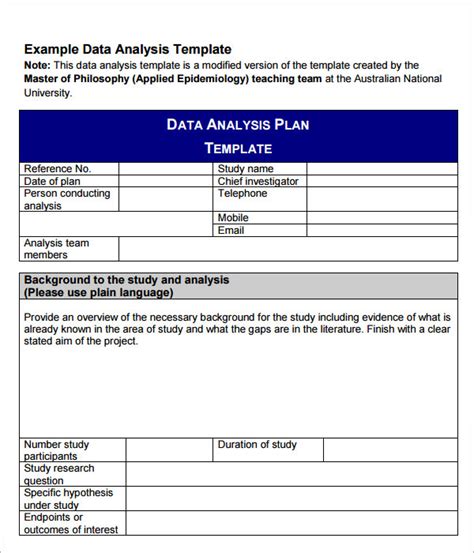

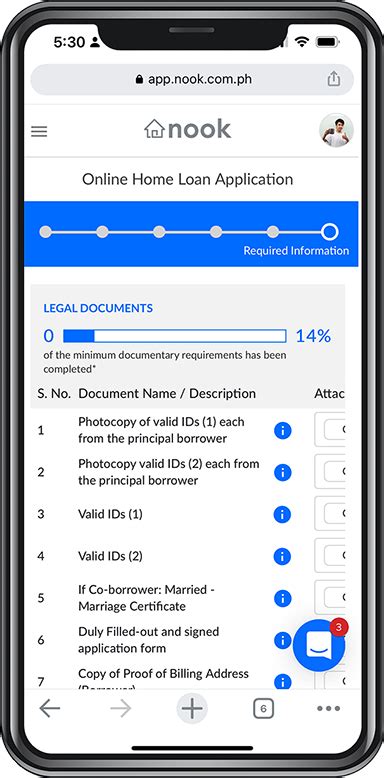

The paperwork for a refinance mortgage is extensive and is designed to ensure that the lender has a complete understanding of the borrower’s financial situation, the value of the property, and the risks involved in the loan. Key documents typically include: - Identification Documents: These can include a driver’s license, passport, or state ID. - Income Verification: Pay stubs, W-2 forms, and tax returns are used to verify the borrower’s income. - Asset Documentation: Bank statements and investment accounts are reviewed to assess the borrower’s assets. - Credit Reports: The borrower’s credit history is crucial in determining the interest rate and approval. - Appraisal Report: For some refinance options, an appraisal may be required to determine the current value of the property. - Title Report and Insurance: These documents ensure the borrower has clear ownership of the property and protect the lender against defects in the title.

Steps to Gather Refinance Mortgage Paperwork

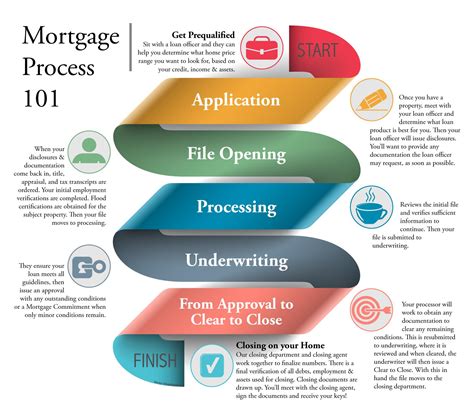

Gathering the necessary paperwork is the first step in the refinance process. Here are some steps to follow: - Check Credit Score: Knowing the credit score will help in understanding the potential interest rates and terms that can be offered. - Gather Financial Documents: Collect all financial documents, including income verification, asset documentation, and identification. - Research Lenders: Different lenders may have slightly different requirements, so it’s essential to research and compare. - Apply for Refinance: Submit the application and supporting documents to the chosen lender. - Wait for Processing: The lender will process the application, which includes reviewing the paperwork, ordering an appraisal if necessary, and underwriting the loan.

Types of Refinance Mortgages and Their Paperwork Requirements

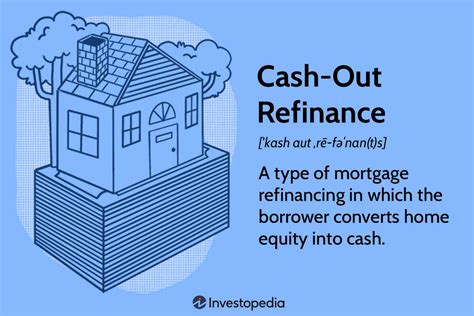

There are several types of refinance mortgages, each with its own set of paperwork requirements: - Cash-Out Refinance: This involves taking out a new mortgage for more than the current outstanding balance, with the difference paid out in cash. The paperwork includes all standard refinance documents plus additional forms related to the cash-out portion. - Rate-and-Term Refinance: This type of refinance changes the interest rate and/or the term of the mortgage without advancing new money. The paperwork requirements are similar to a standard refinance. - Streamline Refinance: Offered by some government-backed loans, this option has reduced documentation requirements and is designed for borrowers who are current on their mortgage payments.

Common Challenges in Refinance Mortgage Paperwork

Despite the best preparations, challenges can arise during the refinance process. Common issues include: - Incomplete Documentation: Missing or incomplete paperwork can delay the process. - Credit Issues: Unexpected credit problems can affect the interest rate or even the approval of the refinance. - Appraisal Values: If the appraisal value comes in lower than expected, it can impact the loan-to-value ratio and the terms of the refinance. - Underwriting Delays: The underwriting process can be lengthy, especially if the lender requires additional documentation.

💡 Note: It's crucial to address any issues promptly and maintain open communication with the lender to ensure a smooth process.

Conclusion and Next Steps

Refinancing a mortgage can be a beneficial financial move, offering lower monthly payments, cash-out options, or the chance to remove private mortgage insurance. Understanding the paperwork requirements and being prepared can significantly streamline the process. By gathering all necessary documents, researching lenders, and being aware of potential challenges, borrowers can navigate the refinance process with confidence. Whether seeking to improve financial stability or tap into home equity, refinancing a mortgage can be a strategic move when approached with the right information and preparation.

What are the primary documents required for a refinance mortgage application?

+

The primary documents include identification, income verification (pay stubs, W-2 forms, tax returns), asset documentation (bank statements, investment accounts), and credit reports.

How does the refinance process differ for a cash-out refinance versus a rate-and-term refinance?

+

A cash-out refinance involves taking out a new mortgage for more than the current outstanding balance and requires additional documentation related to the cash-out portion. A rate-and-term refinance changes the interest rate and/or term without advancing new money and has similar paperwork requirements to a standard refinance.

What are some common challenges encountered during the refinance mortgage paperwork process?

+

Common challenges include incomplete documentation, unexpected credit issues, lower-than-expected appraisal values, and underwriting delays. Addressing these issues promptly and maintaining open communication with the lender can help resolve them efficiently.