Paperwork

Remortgage Paperwork Needed

Introduction to Remortgaging

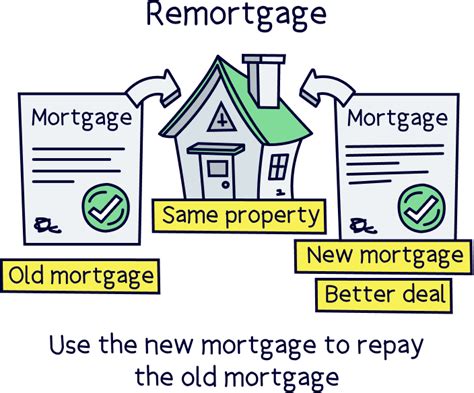

Remortgaging is the process of switching your current mortgage to a new deal, either with your existing lender or a new one. This can be done to reduce monthly payments, release equity from your property, or to consolidate debts. Before starting the remortgaging process, it’s essential to understand the required paperwork and the steps involved. In this article, we will guide you through the necessary documents and procedures to ensure a smooth remortgaging experience.

Remortgage Paperwork Checklist

To begin the remortgaging process, you’ll need to gather the following documents:

- Identification documents: Passport, driving license, or other government-issued ID

- Proof of income: Pay slips, P60, or accounts if you’re self-employed

- Proof of address: Utility bills, bank statements, or council tax bills

- Current mortgage details: Mortgage statements, loan amount, and interest rate

- Property details: Property deeds, valuation reports, or estate agent’s details

- Bank statements: Recent statements showing your income and expenditure

- Credit reports: Your credit history and score, which can be obtained from credit reference agencies

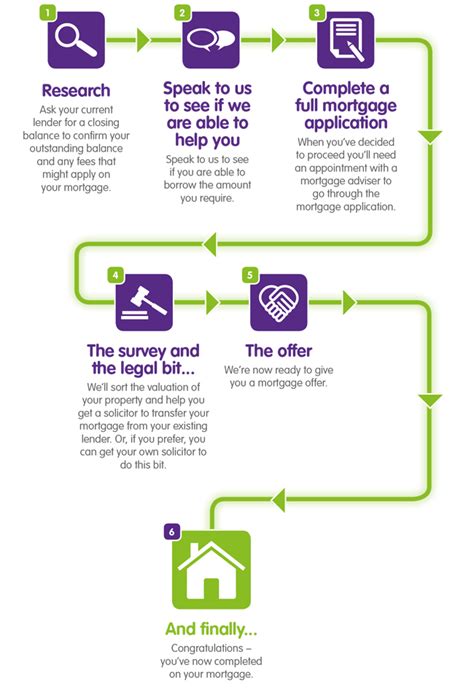

Steps to Remortgage

The remortgaging process typically involves the following steps:

- Review your current mortgage: Check your existing mortgage deal, including the interest rate, loan term, and any early repayment charges

- Research new mortgage deals: Compare rates and terms from different lenders to find the best option for your needs

- Apply for a new mortgage: Submit your application, providing the necessary paperwork and information

- Valuation and conveyancing: The lender will conduct a property valuation, and you may need to hire a conveyancer to handle the legal aspects

- Complete the remortgaging process: Finalize the new mortgage, and your old mortgage will be repaid from the new loan

Remortgage Costs and Fees

When remortgaging, you’ll encounter various costs and fees, including:

| Fee Type | Description |

|---|---|

| Arrangement fee | A fee charged by the lender for setting up the new mortgage |

| Valuation fee | A fee for the property valuation, which can range from £150 to £1,500 |

| Conveyancing fee | A fee for the legal work involved in the remortgaging process, which can range from £500 to £1,500 |

| Early repayment charge | A fee charged by your existing lender for repaying your mortgage early |

These costs can add up, so it’s essential to factor them into your decision-making process.

📝 Note: It's crucial to carefully review the terms and conditions of your new mortgage, including any fees and charges, before signing the agreement.

Remortgaging with Bad Credit

If you have bad credit, remortgaging can be more challenging. However, there are still options available, such as:

- Subprime mortgages: Mortgage deals specifically designed for borrowers with poor credit history

- Adverse credit mortgages: Mortgage deals for borrowers with a history of credit problems

- Specialist lenders: Lenders that cater to borrowers with bad credit, often offering more flexible terms

In the end, remortgaging can be a complex process, but with the right guidance and preparation, you can navigate it successfully. By understanding the required paperwork, steps involved, and associated costs, you’ll be better equipped to make an informed decision and find the best mortgage deal for your needs. Remember to carefully review the terms and conditions of your new mortgage and seek professional advice if you’re unsure about any aspect of the process.