Financed Car Tagging Paperwork Requirements

Introduction to Financed Car Tagging Paperwork

When purchasing a vehicle through financing, it’s essential to understand the paperwork requirements involved in the process. Financed car tagging refers to the process of registering and titling a vehicle that has been purchased with a loan. This process can be complex, and it’s crucial to ensure that all necessary documents are in order to avoid any delays or penalties. In this article, we will explore the paperwork requirements for financed car tagging, highlighting the key documents and steps involved in the process.

Required Documents for Financed Car Tagging

To complete the financed car tagging process, you will need to gather the following documents: * Vehicle title: The vehicle title is a critical document that proves ownership of the vehicle. When purchasing a vehicle through financing, the lender will typically hold the title until the loan is paid off. * Registration application: You will need to complete a registration application, which can usually be obtained from your state’s department of motor vehicles (DMV) website or office. * Proof of insurance: You will need to provide proof of insurance to register your vehicle. This can be in the form of an insurance card or a letter from your insurance provider. * Loan documents: You will need to provide documentation from your lender, including the loan agreement and any other relevant paperwork. * Identification: You will need to provide identification, such as a driver’s license or passport, to complete the registration process.

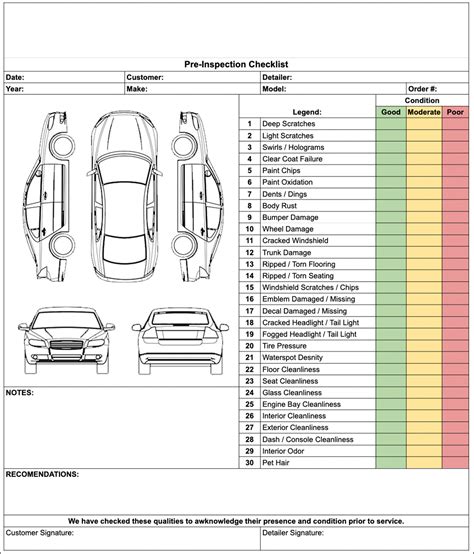

Step-by-Step Guide to Financed Car Tagging

Here is a step-by-step guide to the financed car tagging process: 1. Obtain the vehicle title: The seller or dealer will provide you with the vehicle title, which should be signed over to you. 2. Complete the registration application: Fill out the registration application, providing all required information, including your name, address, and vehicle details. 3. Gather proof of insurance: Obtain proof of insurance from your insurance provider, which should include the vehicle’s VIN and your policy details. 4. Provide loan documents: Provide your lender with the necessary documentation, including the loan agreement and any other relevant paperwork. 5. Submit the registration application: Submit the registration application, along with all required documents, to your state’s DMV office. 6. Pay registration fees: Pay the required registration fees, which will vary depending on your state and vehicle type.

Important Considerations for Financed Car Tagging

When completing the financed car tagging process, it’s essential to consider the following: * Lienholder information: If you have a loan on the vehicle, the lender will be listed as the lienholder on the title. This means that the lender has a legal interest in the vehicle until the loan is paid off. * Registration fees: Registration fees will vary depending on your state and vehicle type. Be sure to check with your state’s DMV office to determine the required fees. * Insurance requirements: You will need to maintain insurance on the vehicle, as required by your state and lender.

📝 Note: It's essential to review and understand your loan agreement and registration requirements to avoid any delays or penalties in the financed car tagging process.

Benefits of Financed Car Tagging

Financed car tagging offers several benefits, including: * Convenience: The process is typically handled by the dealer or lender, making it convenient for the buyer. * Streamlined process: The financed car tagging process is designed to be efficient, allowing you to quickly and easily register your vehicle. * Compliance with regulations: The process ensures that you are in compliance with all relevant regulations and laws, including registration and insurance requirements.

Common Mistakes to Avoid in Financed Car Tagging

When completing the financed car tagging process, it’s essential to avoid the following common mistakes: * Incomplete documentation: Failing to provide all required documents can delay the registration process. * Inaccurate information: Providing inaccurate information on the registration application can lead to delays or penalties. * Failure to maintain insurance: Failing to maintain insurance on the vehicle can result in penalties and fines.

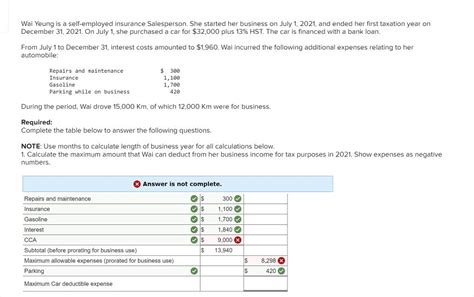

Registration Fees and Taxes

Registration fees and taxes will vary depending on your state and vehicle type. Here is a table outlining some of the typical fees and taxes associated with financed car tagging:

| State | Registration Fee | Sales Tax |

|---|---|---|

| California | 50</td> <td>7.25%</td> </tr> <tr> <td>Florida</td> <td>25 | 6% |

| New York | $50 | 4% |

To summarize, the financed car tagging process involves gathering the necessary documents, completing the registration application, and submitting the application to the DMV office. It’s essential to understand the requirements and considerations involved in the process to avoid any delays or penalties. By following the steps outlined in this article and avoiding common mistakes, you can ensure a smooth and efficient financed car tagging process.

What is the purpose of financed car tagging?

+

The purpose of financed car tagging is to register and title a vehicle that has been purchased with a loan, ensuring that the lender has a legal interest in the vehicle until the loan is paid off.

What documents are required for financed car tagging?

+

The required documents for financed car tagging include the vehicle title, registration application, proof of insurance, loan documents, and identification.

How long does the financed car tagging process take?

+

The length of time it takes to complete the financed car tagging process will vary depending on the state and DMV office, but it’s typically a few days to a few weeks.