Paperwork

Tax My Car Paperwork Needed

Introduction to Taxing Your Car

When it comes to taxing your car, there are several pieces of paperwork that you will need to have in order. The process can seem daunting, especially if you are new to car ownership, but with the right information, you can navigate it with ease. In this article, we will break down the paperwork needed to tax your car, as well as provide some helpful tips and explanations to make the process as smooth as possible.

Understanding Car Tax

Before we dive into the paperwork, it’s essential to understand what car tax is and why it’s necessary. Car tax, also known as Vehicle Excise Duty (VED), is a tax levied on most vehicles in the UK. The tax is used to fund the maintenance and improvement of the road network, as well as other related projects. The amount of tax you pay will depend on the type of vehicle you own, its emission levels, and other factors.

Required Paperwork

To tax your car, you will need to have the following paperwork:

- V5C registration certificate: This is the registration document for your vehicle, which shows your name and address as the keeper of the vehicle.

- MoT certificate: If your vehicle is over three years old, you will need to have a valid MoT certificate to tax it.

- Insurance certificate: You will need to have valid insurance to tax your vehicle.

- Payment details: You will need to have a valid payment method, such as a credit or debit card, to pay for your car tax.

How to Tax Your Car

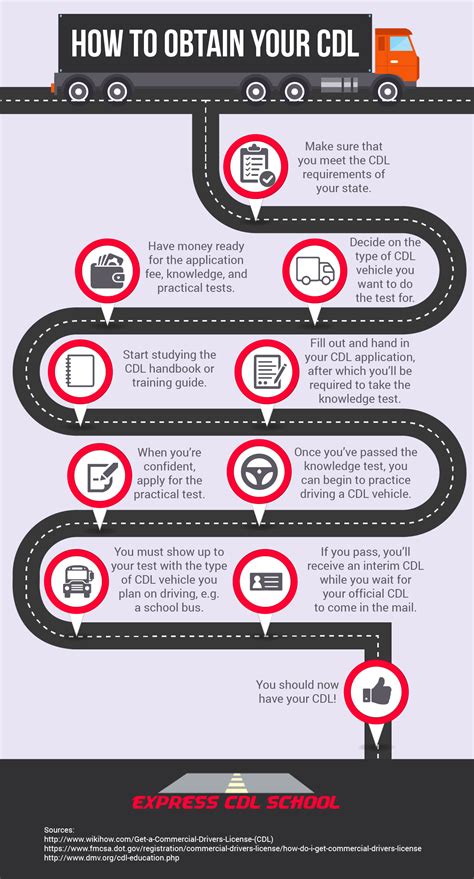

Now that we have covered the required paperwork, let’s take a look at the steps involved in taxing your car:

- Go to the GOV.UK website and click on “Tax your vehicle”.

- Enter your vehicle’s registration number and follow the prompts to begin the tax process.

- Upload your required documents, including your V5C, MoT certificate, and insurance certificate.

- Pay for your car tax using a valid payment method.

- Print out your tax disc or save it to your device.

Tax Exemptions

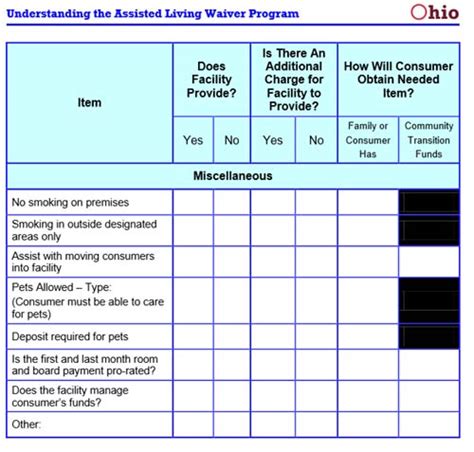

There are some instances where you may be exempt from paying car tax. These include:

- Disabled vehicles: If you have a vehicle that is exempt from tax due to a disability, you will need to provide proof of your exemption.

- Historic vehicles: If you have a vehicle that is over 40 years old, you may be eligible for a tax exemption.

- Electric or hybrid vehicles: Some electric or hybrid vehicles are exempt from car tax, or may be eligible for a reduced rate.

🚨 Note: If you are unsure about your tax exemption status, you should contact the DVLA for further guidance.

Making Changes to Your Vehicle

If you make any changes to your vehicle, such as changing the engine or adding a new registration plate, you will need to update your V5C and notify the DVLA. Failure to do so can result in fines and penalties.

Penalties for Not Taxing Your Car

If you fail to tax your car, you can face significant penalties, including:

- Fines: You can be fined up to £1,000 for not taxing your vehicle.

- Clamping or towing: Your vehicle can be clamped or towed away if it is found to be untaxed.

- Increased insurance premiums: If you are caught driving an untaxed vehicle, your insurance premiums may increase.

Conclusion and Final Thoughts

Taxing your car is an essential part of vehicle ownership, and it’s crucial to have the right paperwork in order to avoid any issues. By following the steps outlined in this article, you can ensure that your vehicle is properly taxed and that you avoid any potential penalties. Remember to stay on top of your tax payments and update your paperwork as necessary to avoid any complications.

What happens if I forget to tax my car?

+

If you forget to tax your car, you can face significant penalties, including fines and clamping or towing of your vehicle. It’s essential to stay on top of your tax payments to avoid any issues.

How do I know if I’m eligible for a tax exemption?

+

To determine if you’re eligible for a tax exemption, you should contact the DVLA or check the GOV.UK website for more information. You may need to provide proof of your exemption, such as a disability certificate or proof of historic vehicle status.

Can I tax my car online?

+

Yes, you can tax your car online using the GOV.UK website. You will need to have your V5C, MoT certificate, and insurance certificate ready, as well as a valid payment method.