Withdrawal Bond Paperwork Requirements

Understanding Withdrawal Bond Paperwork Requirements

When dealing with financial transactions, especially those involving significant amounts like withdrawal bonds, it’s crucial to understand the paperwork requirements. A withdrawal bond, in simple terms, is a type of surety bond that guarantees the repayment of funds withdrawn from a specific account or investment. The process of obtaining and managing such bonds involves careful consideration of legal and financial implications, making the associated paperwork a critical aspect.

Key Components of Withdrawal Bond Paperwork

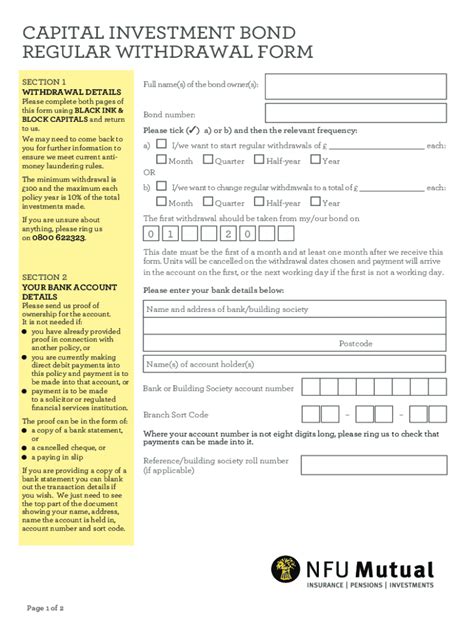

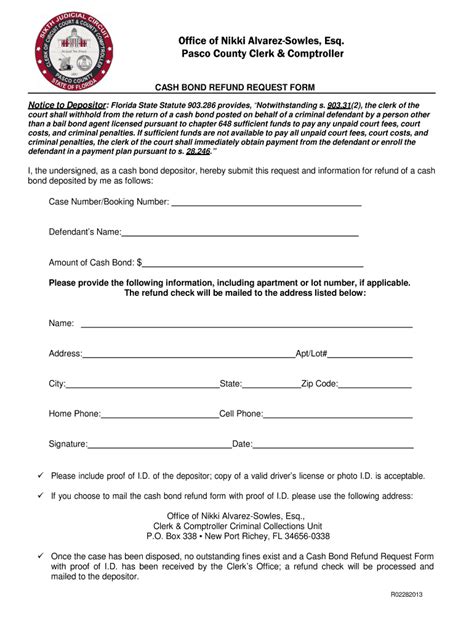

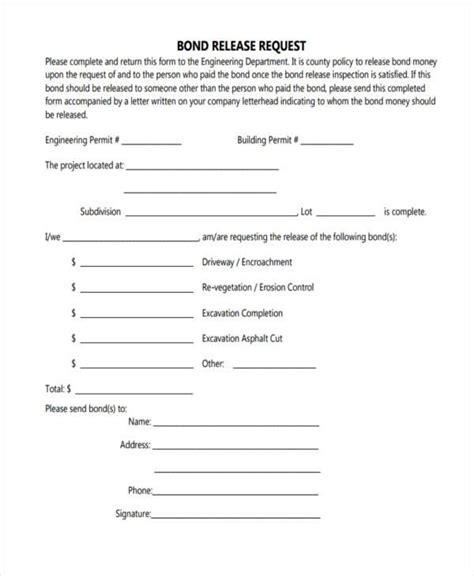

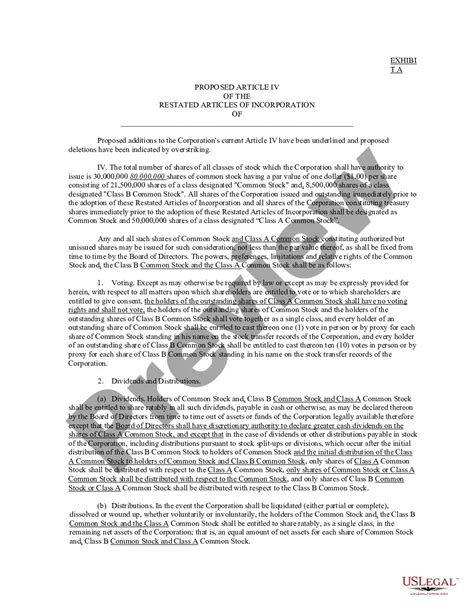

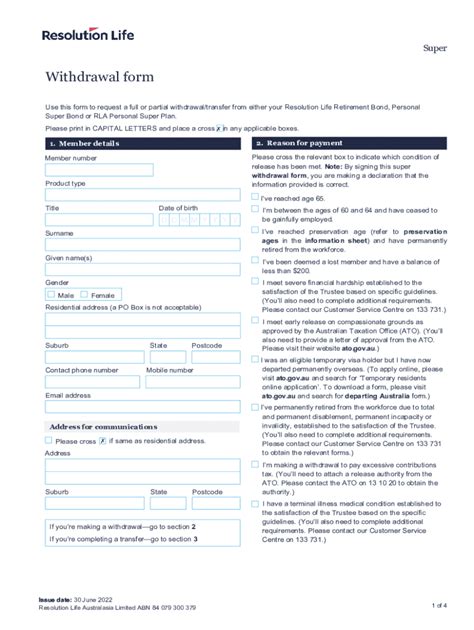

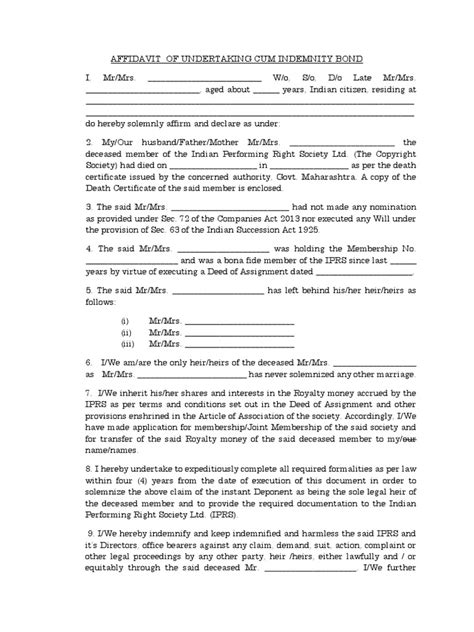

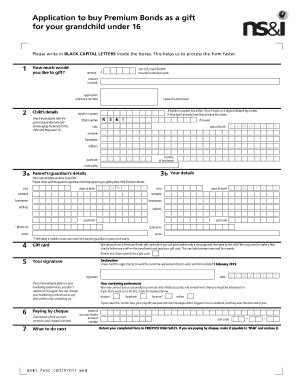

The paperwork for a withdrawal bond typically includes several key components designed to protect both the issuer and the holder of the bond. These components may vary depending on the jurisdiction and the specific terms of the bond but generally include: - Bond Application Form: This is the initial document that applicants fill out to apply for a withdrawal bond. It requires detailed information about the applicant, the purpose of the bond, and the amount of the bond. - Indenture Agreement: This document outlines the terms and conditions of the bond, including the obligations of both the issuer and the bondholder. - Collateral Documents: Depending on the type of bond and the creditworthiness of the applicant, collateral may be required. Documents proving ownership and value of the collateral are essential. - Financial Statements: Recent financial statements are often required to assess the financial health and stability of the applicant. - Legal Opinions: In some cases, especially for larger bonds, legal opinions may be necessary to verify the legality of the bond issuance and the compliance of the transaction with relevant laws and regulations.

Process of Obtaining a Withdrawal Bond

Obtaining a withdrawal bond involves several steps, each with its own set of requirements and paperwork: - Application: The process begins with the submission of an application, which includes providing all necessary documentation as outlined above. - Review and Approval: The application is then reviewed, and if approved, the terms of the bond are agreed upon. - Issuance: After approval, the bond is issued, and the necessary paperwork is completed. - Monitoring and Compliance: Throughout the term of the bond, there are ongoing requirements for monitoring and compliance to ensure that the conditions of the bond are met.

Importance of Accurate Paperwork

Accurate and complete paperwork is vital in the process of obtaining and managing a withdrawal bond. Errors or omissions can lead to delays, increased costs, or even the rejection of the bond application. Furthermore, compliance with all legal and regulatory requirements is essential to avoid legal issues or penalties.

Common Challenges and Solutions

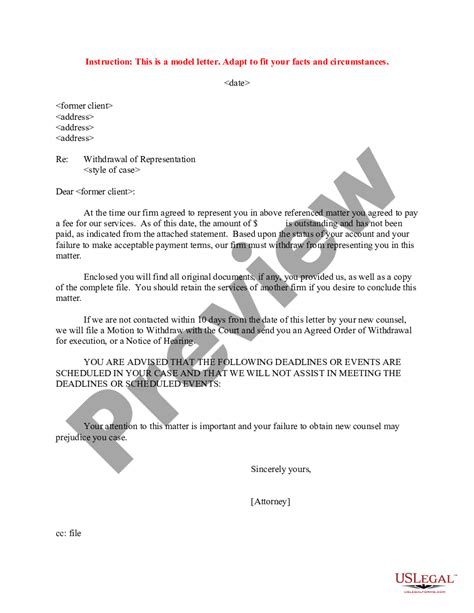

One of the common challenges faced by individuals and organizations in the process of obtaining a withdrawal bond is navigating the complex legal and financial requirements. To overcome these challenges, it’s often beneficial to seek the advice of financial and legal professionals who specialize in surety bonds. They can provide guidance on the specific paperwork required, help ensure compliance with all regulations, and facilitate a smoother application process.

| Document | Purpose | Requirements |

|---|---|---|

| Bond Application Form | Initial application for the bond | Personal and business information, purpose of the bond, amount |

| Indenture Agreement | Outlines terms and conditions of the bond | Terms of repayment, obligations of parties involved |

| Collateral Documents | Proof of collateral for the bond | Ownership and value of collateral |

📝 Note: It's essential to carefully review all documents and seek professional advice to ensure compliance with all requirements and regulations.

As the process of obtaining and managing a withdrawal bond involves complex financial and legal considerations, understanding the associated paperwork requirements is crucial. By being well-informed and prepared, individuals and organizations can navigate this process more efficiently, ensuring that their financial transactions are secure and compliant with all relevant laws and regulations.

In wrapping up the discussion on withdrawal bond paperwork requirements, it’s clear that thorough preparation and understanding of the process are key to a successful application and management of the bond. The importance of accurate and complete paperwork cannot be overstated, as it directly impacts the efficiency and legality of the transaction. With the right guidance and attention to detail, the challenges associated with withdrawal bonds can be effectively managed, leading to more secure and reliable financial transactions.

What is the primary purpose of a withdrawal bond?

+

The primary purpose of a withdrawal bond is to guarantee the repayment of funds withdrawn from a specific account or investment, providing a form of security for the issuer.

What are the common documents required for a withdrawal bond application?

+

Common documents include the bond application form, indenture agreement, collateral documents, and financial statements. The specific requirements may vary based on the jurisdiction and the terms of the bond.

Why is it important to seek professional advice when applying for a withdrawal bond?

+

Seeking professional advice is important because it helps navigate the complex legal and financial requirements associated with withdrawal bonds, ensuring compliance and reducing the risk of errors or omissions in the application process.