Paperwork

Bankruptcy Filing Paperwork Needed

Introduction to Bankruptcy Filing

When considering bankruptcy as an option to manage debt, understanding the necessary paperwork is crucial. The process of filing for bankruptcy involves several steps and requires a significant amount of documentation. This post will guide you through the essential paperwork needed for a bankruptcy filing, ensuring you are well-prepared for the process.

Types of Bankruptcy

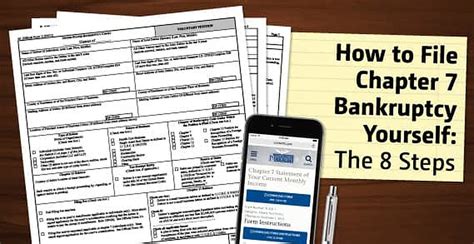

Before diving into the paperwork, it’s essential to understand the two main types of bankruptcy for individuals: Chapter 7 and Chapter 13. - Chapter 7 Bankruptcy: This type involves the liquidation of non-exempt assets to pay off creditors. It’s often referred to as “straight bankruptcy.” - Chapter 13 Bankruptcy: This type involves creating a repayment plan to pay off a portion of debts over time, usually three to five years.

Necessary Paperwork for Bankruptcy Filing

The paperwork required for bankruptcy can be extensive. Here are the key documents and information you’ll need:

- Voluntary Petition: The official document that begins the bankruptcy process.

- Schedules A-J: These schedules provide detailed information about your assets, liabilities, income, and expenses.

- Statement of Financial Affairs: A form that outlines your financial transactions and history.

- Means Test: For Chapter 7, this calculates your income to determine if you qualify. For Chapter 13, it helps determine your repayment amount.

- Plan (for Chapter 13): If you’re filing for Chapter 13, you’ll need to propose a repayment plan.

- Credit Counseling Certificate: Before filing, you must undergo credit counseling from an approved agency.

- Income Documentation: Pay stubs, tax returns, and other proof of income.

- Expense Documentation: Records of your monthly expenses.

- Asset Documentation: Information about your assets, including real estate, vehicles, and personal property.

- Debt Documentation: Lists of your creditors, including debts, addresses, and account numbers.

Bankruptcy Forms

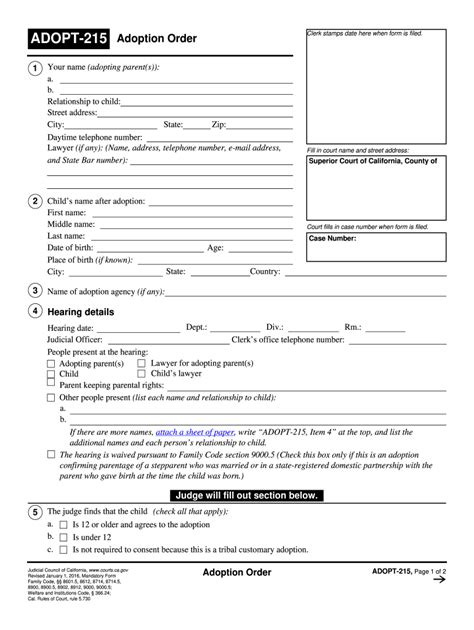

The United States Courts website provides official bankruptcy forms that you’ll need to fill out. These forms are standardized and must be completed accurately to ensure your bankruptcy filing is processed correctly. The primary forms include:

- Form 101: Voluntary Petition for Individuals Filing for Bankruptcy

- Form 106A/B: Schedule A/B: Property

- Form 106C: Schedule C: The Property You Claim as Exempt

- Form 106D: Schedule D: Creditors Who Hold Claims Secured By Property

- Form 106E/F: Schedule E/F: Creditors Who Unsecured Claims

- Form 106G: Schedule G: Executory Contracts and Unexpired Leases

- Form 106H: Schedule H: Your Codebtors

- Form 107: Statement of Financial Affairs for Individuals Filing for Bankruptcy

- Form 122A-1: Chapter 7 Statement of Your Current Monthly Income

- Form 122C-1: Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period

Table of Common Bankruptcy Forms

| Form Number | Form Name | Description |

|---|---|---|

| 101 | Voluntary Petition | The initial document to start the bankruptcy process. |

| 106A/B | Schedule A/B: Property | Lists your real and personal property. |

| 107 | Statement of Financial Affairs | Details your financial transactions. |

| 122A-1 | Chapter 7 Means Test | Determines eligibility for Chapter 7 based on income. |

| 122C-1 | Chapter 13 Means Test | Calculates your Chapter 13 repayment plan based on income and expenses. |

📝 Note: It's crucial to fill out these forms accurately and completely to avoid delays or dismissal of your case.

Conclusion and Next Steps

Filing for bankruptcy is a significant decision that requires careful consideration and preparation. Understanding the necessary paperwork and ensuring you have all the required documents will make the process smoother. It’s highly recommended to consult with a bankruptcy attorney who can guide you through the complexities of the bankruptcy process, ensuring you comply with all legal requirements and make the most informed decisions about your financial future.

What is the first step in filing for bankruptcy?

+

The first step in filing for bankruptcy is to determine which type of bankruptcy you qualify for and then to file a voluntary petition with the bankruptcy court.

How long does the bankruptcy process take?

+

The length of the bankruptcy process can vary significantly depending on the type of bankruptcy. Chapter 7 cases are typically quicker, often taking a few months, while Chapter 13 cases involve a repayment plan that can last three to five years.

Will filing for bankruptcy stop creditor harassment?

+

Yes, filing for bankruptcy triggers an automatic stay, which stops most collection activities, including creditor harassment, immediately after filing.