Paperwork

New Employee Paperwork Requirements

Introduction to New Employee Paperwork Requirements

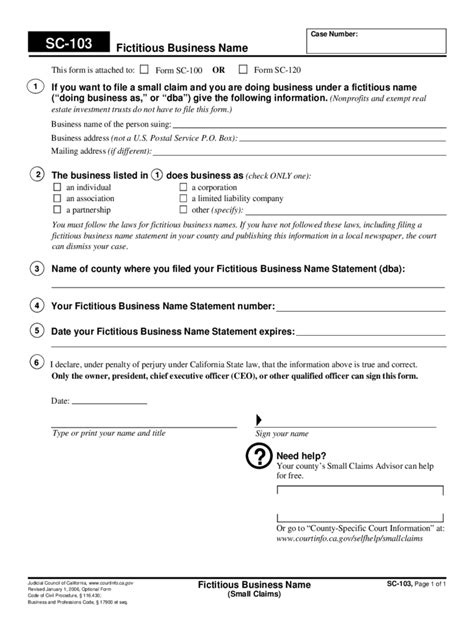

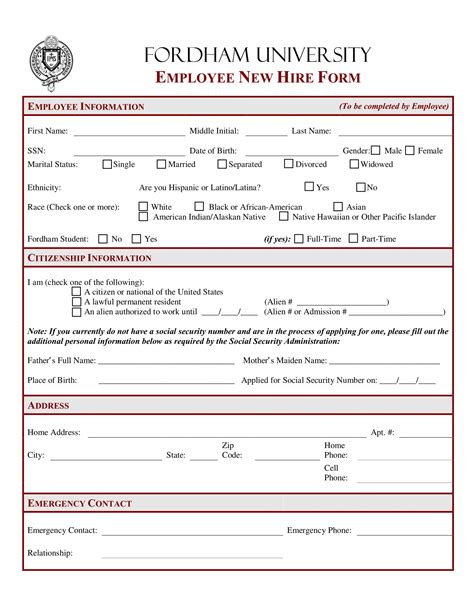

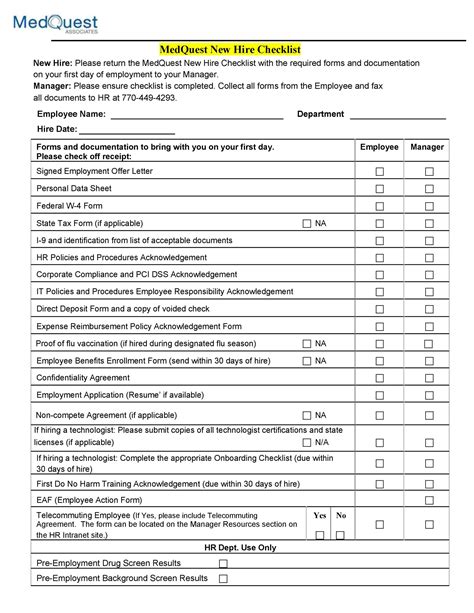

When a new employee joins an organization, there are several paperwork requirements that must be completed to ensure a smooth and compliant onboarding process. These requirements vary by country, state, or region, but they generally include documents related to employment eligibility, tax withholding, benefits enrollment, and other administrative tasks. In this article, we will delve into the details of new employee paperwork requirements, exploring the necessary documents, the process of completing them, and the importance of accuracy and timeliness.

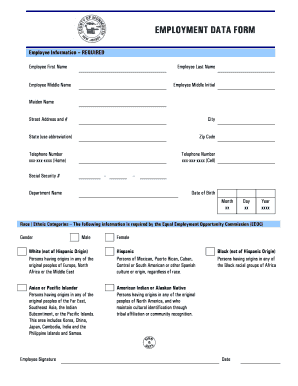

Employment Eligibility Verification

One of the primary paperwork requirements for new employees is the verification of their employment eligibility. In the United States, for example, this is typically done using Form I-9, which is used to verify the identity and employment authorization of new hires. The form requires employees to provide documentation, such as a passport, driver’s license, or social security card, to prove their eligibility to work in the country. Employers must review and verify the documents, ensuring they are genuine and valid, and then complete their section of the form.

Tax Withholding and Benefits Enrollment

Another crucial aspect of new employee paperwork is tax withholding and benefits enrollment. The W-4 form is used to determine the amount of federal income tax to withhold from an employee’s wages. Employees must complete this form to provide their withholding information, including their filing status, number of dependents, and any additional withholding amounts. Additionally, employees may need to enroll in benefits, such as health insurance, retirement plans, or life insurance, which often require separate paperwork and elections.

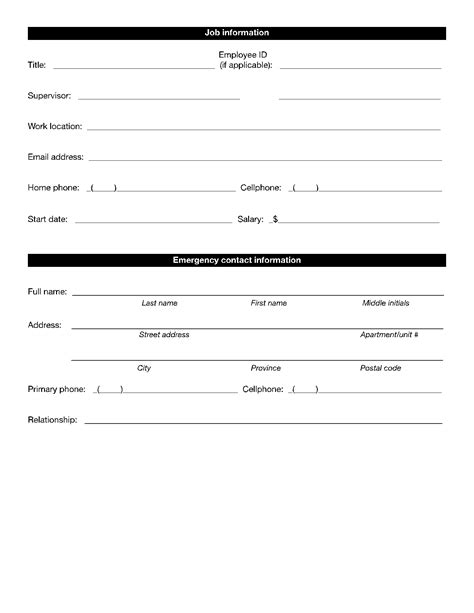

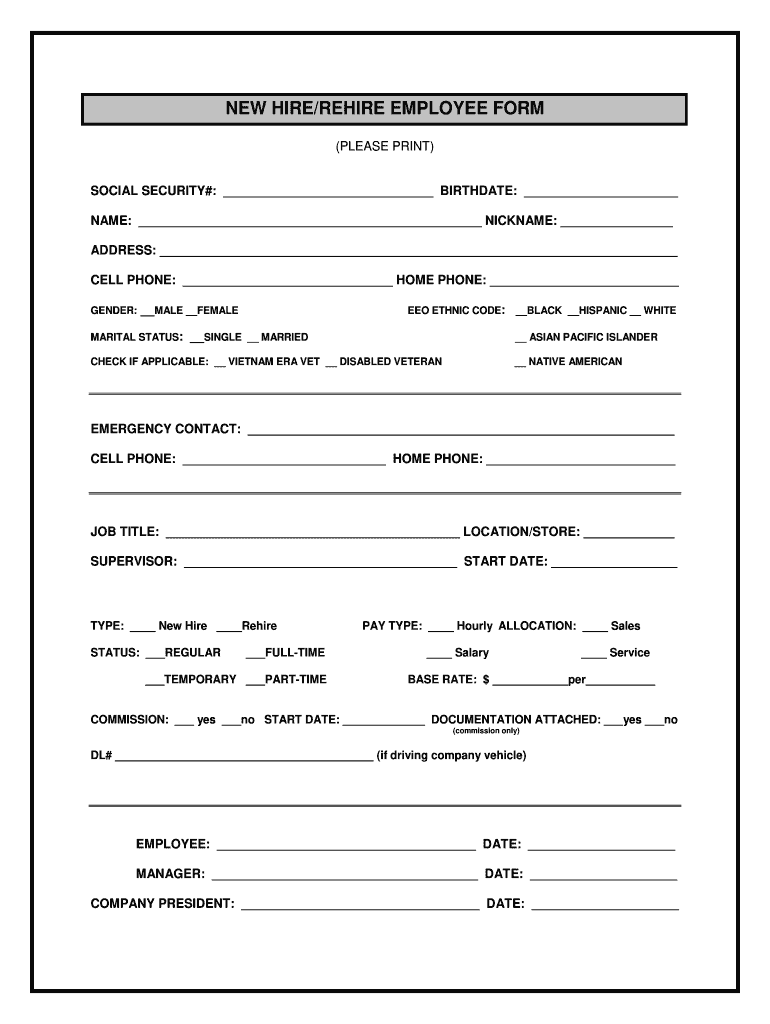

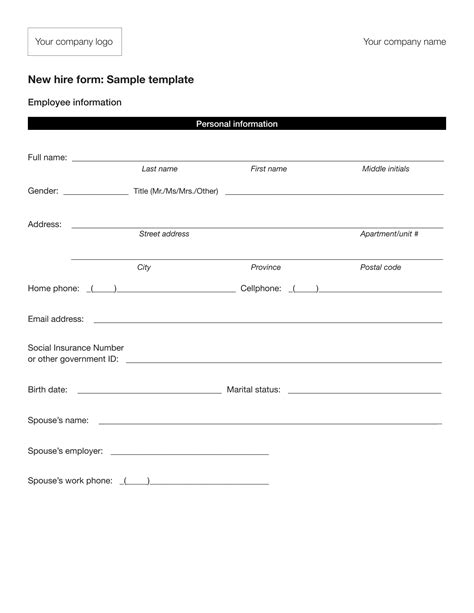

Other Administrative Tasks

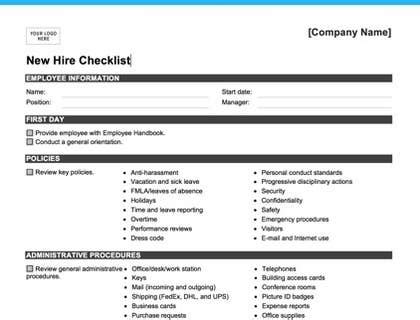

Beyond employment eligibility and tax withholding, there are several other administrative tasks that require paperwork completion. These may include: * Direct deposit setup: Employees may need to provide their bank account information to set up direct deposit for their paychecks. * Employee handbook acknowledgement: Employees may be required to sign an acknowledgement form indicating they have received and read the employee handbook. * Confidentiality and non-disclosure agreements: Employees may need to sign agreements protecting company confidential information and trade secrets. * Emergency contact information: Employees may need to provide emergency contact information, such as the name and phone number of a spouse or family member.

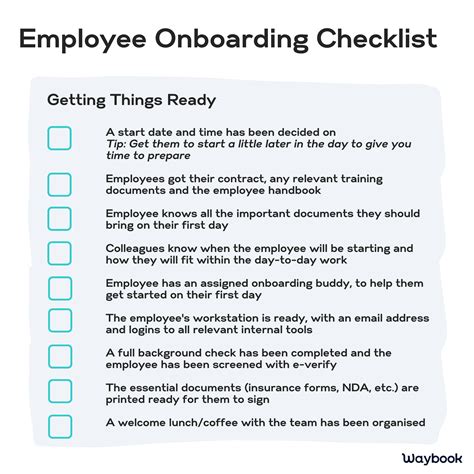

Best Practices for Completing New Employee Paperwork

To ensure a seamless onboarding process, employers should follow best practices when completing new employee paperwork. These include: * Using digital onboarding platforms: Electronic platforms can streamline the paperwork process, reducing errors and increasing efficiency. * Providing clear instructions: Employers should provide clear instructions and guidance to new employees, ensuring they understand what paperwork is required and how to complete it. * Establishing deadlines: Employers should set deadlines for completing paperwork, ensuring new employees understand the urgency and importance of timely completion. * Conducting thorough reviews: Employers should conduct thorough reviews of completed paperwork, ensuring accuracy and completeness.

📝 Note: Employers should maintain accurate and up-to-date records of all completed paperwork, storing them securely and in accordance with relevant laws and regulations.

Conclusion and Final Thoughts

In summary, new employee paperwork requirements are a critical aspect of the onboarding process, ensuring compliance with laws and regulations, as well as setting the foundation for a successful and productive employment relationship. By understanding the necessary documents, following best practices, and maintaining accurate records, employers can streamline the paperwork process, reducing errors and increasing efficiency. As the employment landscape continues to evolve, it is essential for employers to stay informed about changing regulations and requirements, adapting their paperwork processes to meet the needs of their organization and new employees.

What is the purpose of Form I-9?

+

Form I-9 is used to verify the identity and employment authorization of new hires, ensuring they are eligible to work in the United States.

What information is required on the W-4 form?

+

The W-4 form requires employees to provide their withholding information, including their filing status, number of dependents, and any additional withholding amounts.

Why is it important to maintain accurate records of completed paperwork?

+

Maintaining accurate and up-to-date records of completed paperwork is essential for ensuring compliance with laws and regulations, as well as providing a clear audit trail in case of disputes or investigations.