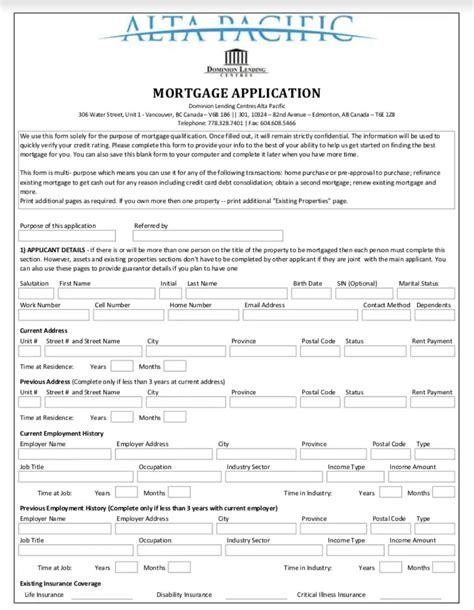

Mortgage Application Paperwork Needed

Introduction to Mortgage Application Process

When considering purchasing a home, one of the most critical steps is the mortgage application process. This process can be daunting, especially for first-time homebuyers, due to the extensive paperwork required. Understanding what documents are needed and why they are necessary can make the process less overwhelming. The primary goal of the mortgage application paperwork is to provide lenders with a comprehensive view of the applicant’s financial situation, ensuring they can afford the mortgage payments.

Preparation is Key

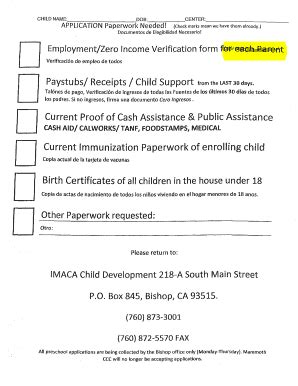

Before starting the mortgage application, it’s essential to gather all the necessary documents. This preparation can significantly speed up the application process. The required paperwork typically includes, but is not limited to, identification documents, income verification, credit reports, and asset information. Each of these categories plays a crucial role in the lender’s decision-making process.

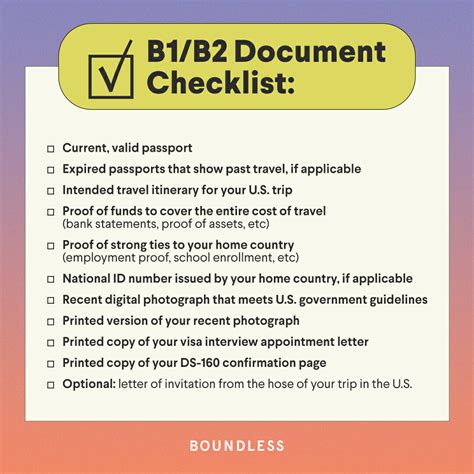

Types of Documents Needed

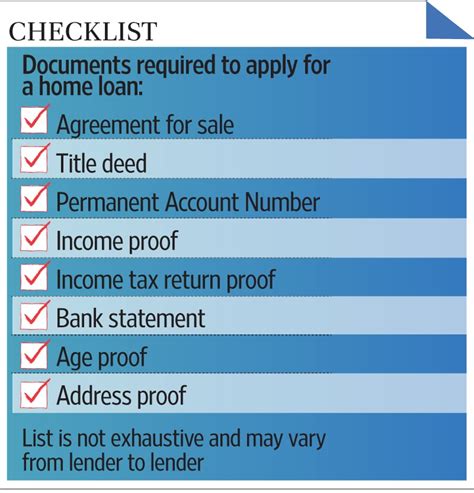

- Identification Documents: These are crucial for verifying the applicant’s identity. Common identification documents include a valid passport, driver’s license, or state ID. - Income Verification: Lenders need to confirm the applicant’s income to ensure they can afford the mortgage payments. This can be done with pay stubs, W-2 forms, or tax returns for the self-employed. - Credit Reports: Credit reports are used to assess the applicant’s creditworthiness. A good credit score can lead to better interest rates on the mortgage. - Asset Information: This includes bank statements, investment accounts, and any other assets that could be used to secure the loan or demonstrate the ability to make payments.

Detailed List of Required Documents

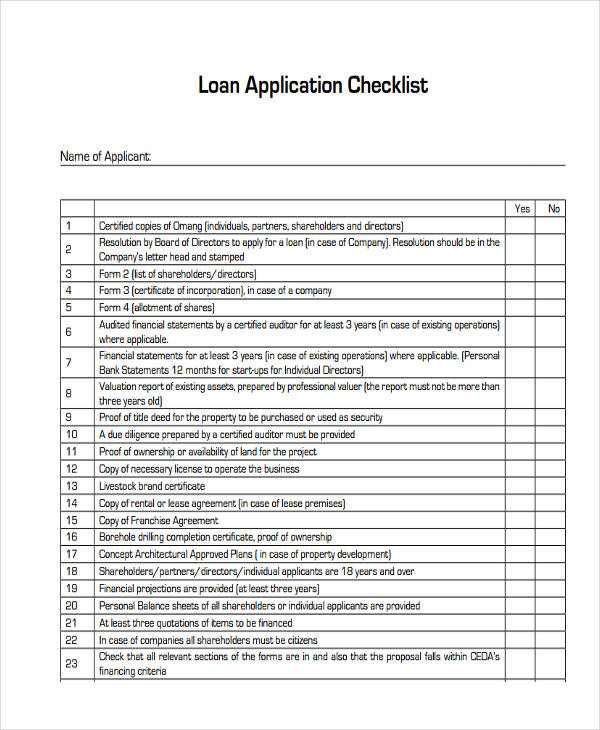

Here is a more detailed list of what might be required: * Personal Documents: + Valid government-issued ID + Social Security number or Individual Taxpayer Identification Number * Income Documents: + Recent pay stubs + W-2 forms from the last two years + Tax returns (especially for the self-employed) * Asset Documents: + Bank statements + Investment accounts statements + Retirement account statements * Credit Documents: + Credit report (though this is often obtained by the lender) + Explanation for any negative marks on the credit report * Employment Documents: + Letter from employer confirming employment status + Business cards or other professional identification

Why Each Document is Important

Each document serves a specific purpose in the mortgage application process: - Verification of Identity and Income: Ensures the applicant is who they claim to be and can afford the mortgage. - Assessment of Creditworthiness: Helps lenders determine the risk of lending to the applicant. - Evaluation of Assets: Provides a complete picture of the applicant’s financial situation, including their ability to make a down payment and cover closing costs.

Table of Common Documents Needed

| Document Type | Description |

|---|---|

| Identification | Passport, Driver’s License, State ID |

| Income Verification | Pay Stubs, W-2 Forms, Tax Returns |

| Credit Reports | Obtained by the lender to assess creditworthiness |

| Asset Information | Bank Statements, Investment Accounts, Retirement Accounts |

💡 Note: The specific documents required may vary depending on the lender and the type of mortgage applied for.

Conclusion and Final Thoughts

In conclusion, the mortgage application process involves a significant amount of paperwork, each piece serving a vital role in the lender’s assessment of the applicant’s financial situation. By understanding what documents are needed and why, applicants can better prepare themselves for the process, potentially leading to a smoother and more successful application. It’s also crucial to remember that the requirements can vary, so staying in touch with the lender and being prepared to provide additional information as needed is key.

What is the most important document in a mortgage application?

+

While all documents are crucial, income verification documents (like pay stubs and W-2 forms) are often considered among the most important as they directly impact the lender’s assessment of the applicant’s ability to repay the loan.

Can I apply for a mortgage without a good credit score?

+

Yes, it is possible to apply for a mortgage with a less-than-perfect credit score. However, the interest rates might be higher, and the terms less favorable. Some mortgage programs are specifically designed for applicants with lower credit scores.

How long does the mortgage application process typically take?

+

The length of the mortgage application process can vary significantly depending on the lender, the complexity of the application, and how quickly the applicant can provide the necessary documents. On average, it can take anywhere from a few weeks to a couple of months.