Car Insurance Paperwork Requirements

Introduction to Car Insurance Paperwork

When it comes to car insurance, understanding the paperwork requirements is essential to ensure that you are adequately covered in case of an accident or other unforeseen events. The process of obtaining car insurance involves submitting various documents to verify your identity, vehicle ownership, and driving history. In this article, we will delve into the details of the car insurance paperwork requirements, the importance of each document, and how to navigate the application process efficiently.

Required Documents for Car Insurance

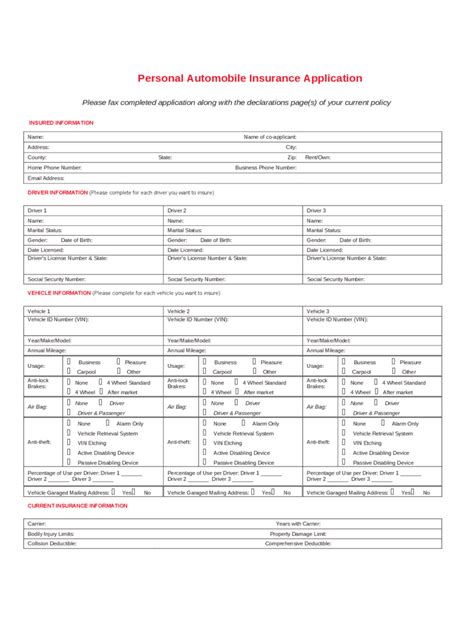

To apply for car insurance, you will typically need to provide the following documents:

- Valid Driver’s License: This is the most critical document, as it verifies your identity and driving eligibility.

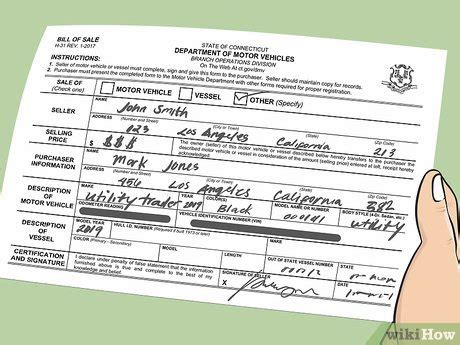

- Vehicle Registration: This document proves that you are the owner of the vehicle and provides essential details about the car, such as its make, model, and year of manufacture.

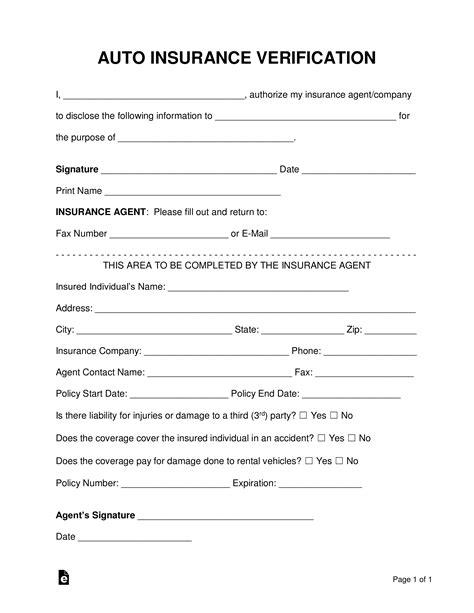

- Proof of Insurance: If you are switching from another insurance provider, you may need to provide proof of your current insurance coverage.

- Vehicle Identification Number (VIN): The VIN is a unique 17-digit code that can be found on the driver’s side dashboard or on the driver’s side doorjamb. It is used to verify the vehicle’s identity and check its history.

Understanding Car Insurance Policies

Car insurance policies can be complex, with various terms and conditions that need to be understood. Here are some key aspects to consider:

- Limits of Liability: This refers to the maximum amount that the insurance company will pay in case of an accident or other covered events.

- Deductible: This is the amount that you need to pay out of pocket before the insurance coverage kicks in.

- Coverage Types: There are different types of coverage, including collision, comprehensive, and liability coverage. Each type of coverage provides protection against specific risks, such as accidents, theft, or natural disasters.

Applying for Car Insurance

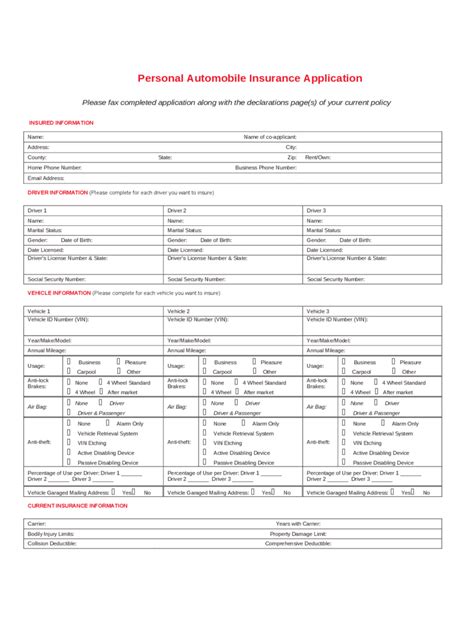

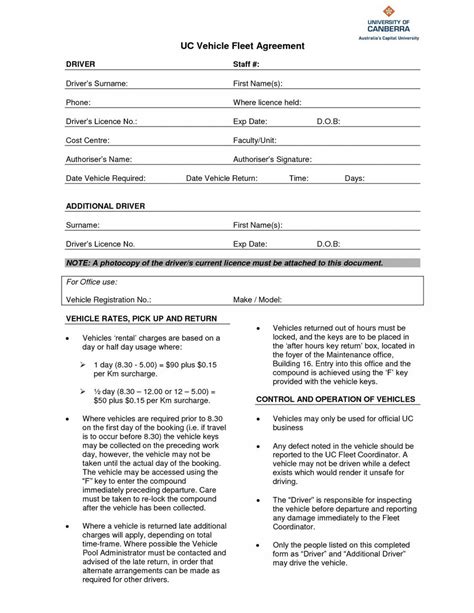

The process of applying for car insurance typically involves the following steps:

- Gather Required Documents: Collect all the necessary documents, including your driver’s license, vehicle registration, and proof of insurance.

- Choose an Insurance Provider: Research and compare different insurance providers to find the one that best suits your needs and budget.

- Fill Out the Application Form: Complete the application form, providing accurate and detailed information about yourself and your vehicle.

- Submit the Application: Submit the application form and supporting documents to the insurance provider.

📝 Note: It is crucial to provide accurate and complete information when applying for car insurance, as any discrepancies or omissions can lead to delays or even policy cancellation.

Table of Required Documents

The following table summarizes the required documents for car insurance:

| Document | Description |

|---|---|

| Valid Driver’s License | Verifies identity and driving eligibility |

| Vehicle Registration | Proves vehicle ownership and provides vehicle details |

| Proof of Insurance | Verifies current insurance coverage (if applicable) |

| Vehicle Identification Number (VIN) | Verifies vehicle identity and checks vehicle history |

This table provides a quick reference guide to the required documents, helping you to ensure that you have all the necessary paperwork before applying for car insurance.

In summary, understanding the car insurance paperwork requirements is vital to ensure that you are adequately covered and compliant with regulatory requirements. By providing accurate and complete information, you can navigate the application process efficiently and avoid any potential issues or delays. As you move forward with your car insurance application, remember to carefully review your policy documents and ask questions if you are unsure about any aspect of your coverage.

What is the minimum coverage required for car insurance?

+

The minimum coverage required for car insurance varies by state or country, but it typically includes liability coverage for bodily injury and property damage.

How do I choose the right car insurance provider?

+

When choosing a car insurance provider, consider factors such as premium rates, coverage options, customer service, and financial stability. It is essential to research and compare different providers to find the one that best suits your needs and budget.

Can I customize my car insurance policy?

+

Yes, many car insurance providers offer customizable policies that allow you to tailor your coverage to your specific needs. You can choose from various coverage options, such as collision, comprehensive, and liability coverage, and select the limits and deductibles that work best for you.