Paperwork

5 Tips Keep Paid Loan Papers

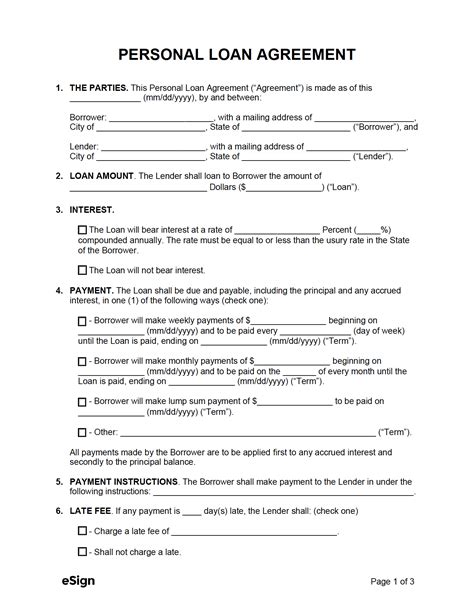

Introduction to Paid Loan Papers

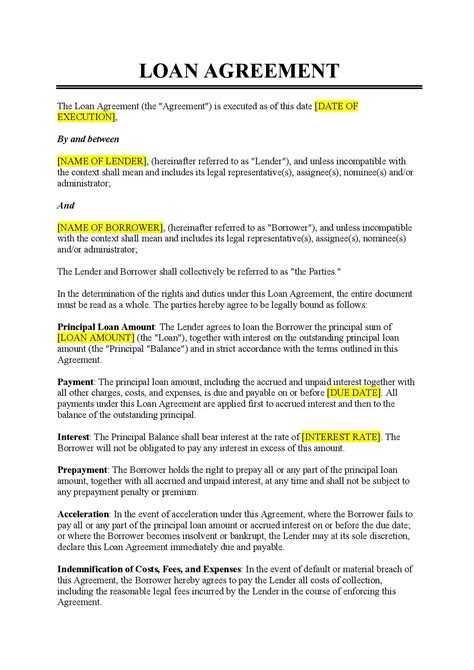

When you finally pay off a loan, it’s a significant accomplishment, and you might be tempted to get rid of all the paperwork associated with it. However, keeping your paid loan papers is crucial for several reasons. These documents serve as proof that you’ve fulfilled your loan obligations, which can be essential for future financial transactions, audits, or even identity verification. In this article, we’ll explore the importance of retaining these documents and provide tips on how to manage them efficiently.

Why Keep Paid Loan Papers?

Before diving into the tips, it’s essential to understand why keeping these papers is necessary. Paid loan documents can help you: - Verify your credit history and score - Prove that a loan has been paid off, which can be useful in case of errors on your credit report - Support tax deductions or credits related to the loan - Establish a record of your financial responsibility

Tips for Keeping Paid Loan Papers

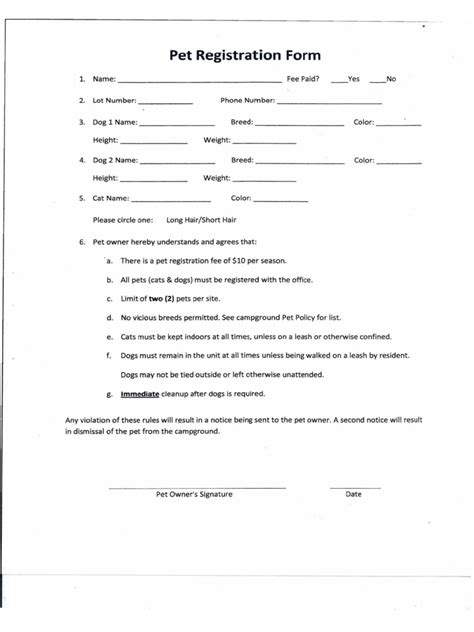

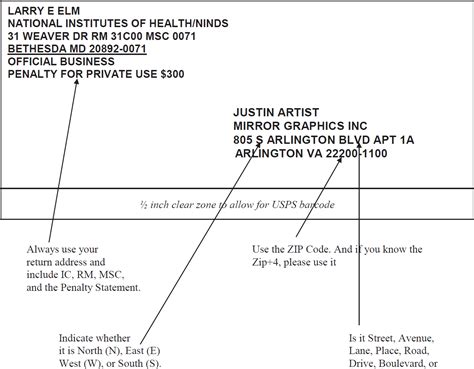

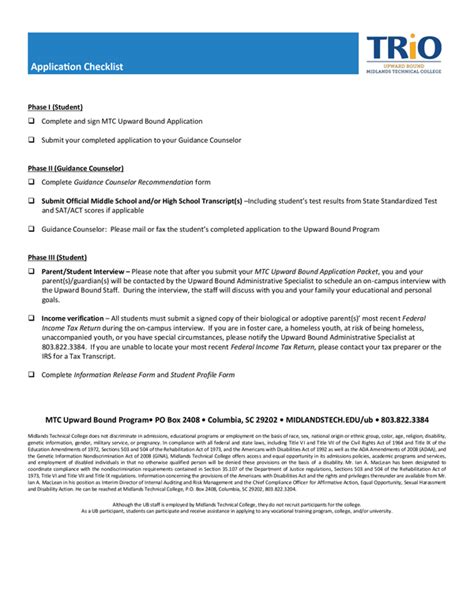

Here are five tips to help you manage your paid loan documents effectively: - Digitize Your Documents: Scanning your papers and saving them digitally can help reduce clutter and make them easier to access. Ensure you store them in a secure, password-protected location. - Organize a Filing System: Create a dedicated folder or file for each loan, including the loan agreement, payment records, and the final payoff statement. This organization will help you find documents quickly when needed. - Secure Storage: Whether physical or digital, ensure your documents are stored in a secure location. For physical documents, consider a fireproof safe or a safe deposit box at your bank. Digitally, use encrypted storage solutions. - Retention Period: It’s generally recommended to keep financial documents for at least three to seven years. However, for significant loans like mortgages, it might be wise to keep them indefinitely. - Regular Review: Periodically review your stored documents to ensure they are still relevant and to update your storage system as necessary. This can also help in identifying any documents that might be missing.

Best Practices for Digital Storage

Digital storage offers convenience and security, but it requires some best practices to ensure your documents remain accessible and protected:

- Use Cloud Storage: Services like Google Drive, Dropbox, or OneDrive can provide easy access to your documents from anywhere.

- Password Protection: Ensure your digital storage is password-protected, and consider two-factor authentication for added security.

- Backup Your Data: Regularly backup your digital documents to prevent loss in case of a technical failure or cyber attack.

Managing Physical Documents

For those who prefer physical copies or need them for specific reasons, here are some tips: - Use a Fireproof Safe: This can protect your documents from fire damage. - Safe Deposit Box: Renting a safe deposit box at a bank can provide a secure, off-site location for your valuable documents. - Labeling and Organization: Clearly label your folders and files, and organize them in a logical manner to facilitate easy access.

📝 Note: Always ensure that any storage method you choose, whether digital or physical, is secure and protected against unauthorized access.

Conclusion and Final Thoughts

Keeping your paid loan papers organized, whether digitally or physically, is a crucial aspect of financial management. It not only helps in maintaining a clean credit record but also provides a reference point for future financial planning. By following the tips outlined above, you can ensure that your documents are safe, accessible, and serve their purpose when needed. Remember, a well-organized financial record is a key component of overall financial health.

How long should I keep my paid loan documents?

+

It’s recommended to keep financial documents for at least three to seven years. However, for significant loans, consider keeping them indefinitely.

What is the best way to store my loan documents digitally?

+

Using cloud storage services like Google Drive, Dropbox, or OneDrive, and ensuring your storage is password-protected, can provide a secure and convenient way to store your documents.

Why is it important to keep paid loan papers?

+

Keeping paid loan papers can help verify your credit history, prove loan payoff, support tax deductions, and establish a record of financial responsibility.