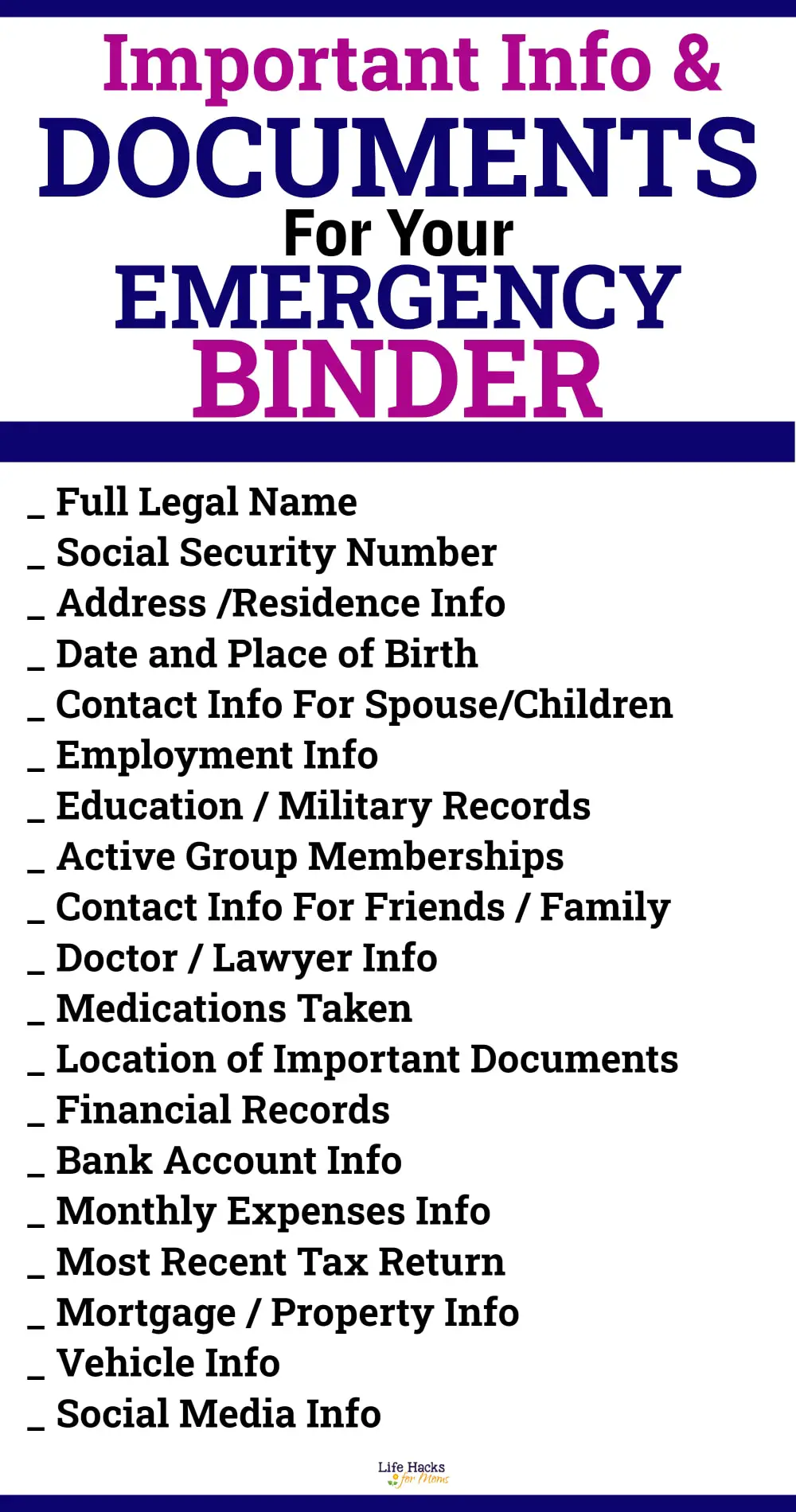

5 Needed Papers

Introduction to Essential Documents

When it comes to legal, financial, and personal matters, having the right documents in place can make a significant difference. These papers not only serve as proof of identity, ownership, and agreements but also play a crucial role in ensuring that one’s wishes are respected and rights are protected. In this article, we will explore five essential documents that everyone should have, highlighting their importance and the consequences of not having them.

1. Last Will and Testament

A Last Will and Testament is a document that outlines how a person wants their assets to be distributed after they pass away. It is a critical document for ensuring that one’s property, including real estate, investments, and personal belongings, is divided according to their wishes. Without a Will, the distribution of assets will be determined by the laws of the state, which may not align with the deceased person’s intentions. This can lead to disputes among family members and unnecessary legal complications.

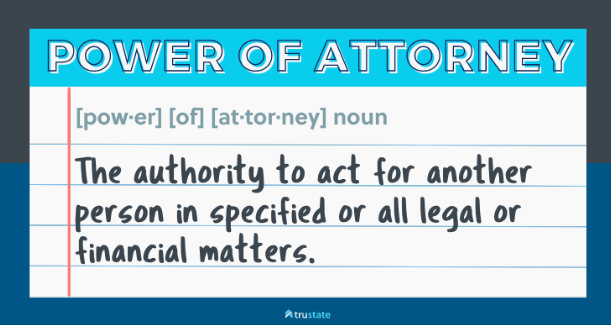

2. Power of Attorney

A Power of Attorney (POA) is a document that grants someone the authority to act on another person’s behalf in legal and financial matters. This can be particularly useful if someone becomes incapacitated and cannot make decisions for themselves. There are different types of POA, including: - General Power of Attorney: Grants broad powers to manage financial and legal affairs. - Special Power of Attorney: Limits the powers granted to specific areas, such as managing a particular business or property. - Durable Power of Attorney: Remains in effect even if the person granting it becomes incapacitated. Having a POA in place can prevent the need for costly and time-consuming court proceedings to appoint a guardian.

3. Advance Directive

An Advance Directive, often including a Living Will, is a document that specifies the type of medical care an individual wants to receive if they become unable to make decisions for themselves. This can include preferences regarding life-sustaining treatments, such as ventilators or feeding tubes. It also typically includes a Healthcare Proxy or Durable Power of Attorney for Healthcare, which designates someone to make medical decisions on the person’s behalf. Having an Advance Directive ensures that one’s wishes regarding medical treatment are respected, even if they cannot communicate them.

4. Insurance Policies

Insurance Policies, such as life insurance, disability insurance, and long-term care insurance, provide financial protection against various risks. These policies can help ensure that loved ones are not burdened with significant expenses in the event of illness, injury, or death. For example: - Life Insurance can provide a death benefit to help pay for funeral expenses, outstanding debts, and ongoing living expenses. - Disability Insurance replaces a portion of income if someone becomes unable to work due to illness or injury. - Long-term Care Insurance helps cover the costs of care when someone needs assistance with daily living activities.

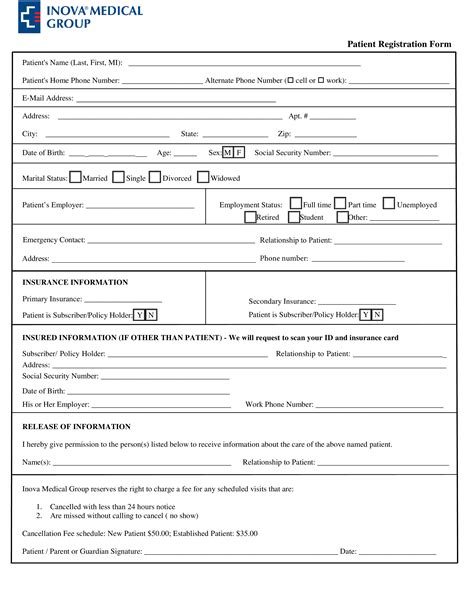

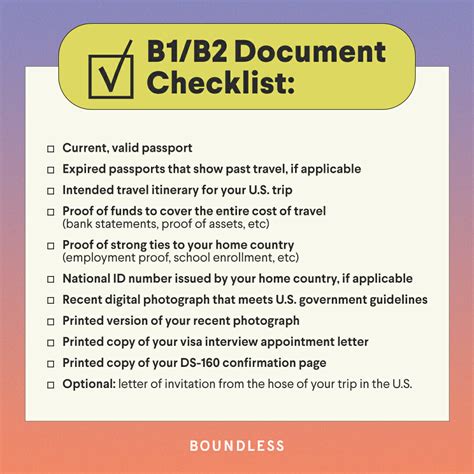

5. Identity and Ownership Documents

Finally, having identity and ownership documents in order is crucial. This includes: - Passport - Driver’s License or State ID - Birth Certificate - Marriage Certificate (if applicable) - Deeds to property - Vehicle titles These documents are essential for proving identity, citizenship, marital status, and ownership of assets. They are often required for various legal, financial, and administrative tasks.

📝 Note: It's essential to review and update these documents periodically to ensure they remain relevant and effective.

In essence, these five types of documents are foundational to managing one’s legal, financial, and personal affairs effectively. They provide a framework for ensuring that wishes are respected, rights are protected, and loved ones are cared for, even in the most challenging circumstances. By understanding the importance and function of each document, individuals can take proactive steps to secure their future and the future of those they care about.

What happens if I don’t have a Last Will and Testament?

+

If you don’t have a Will, the distribution of your assets will be determined by the laws of your state, which may not align with your wishes. This can lead to disputes among family members and unnecessary legal complications.

How often should I review my essential documents?

+

You should review your essential documents periodically, such as every 5 years or when significant life changes occur, like marriage, divorce, the birth of a child, or a move to a new state. This ensures they remain up-to-date and reflective of your current wishes and circumstances.

Can I create these documents on my own, or do I need a lawyer?

+

While it’s possible to create some of these documents on your own using online templates, consulting with a lawyer can ensure that your documents are legally binding and tailored to your specific situation. This is particularly recommended for complex estates or unique family situations.