5 Tax Forms Needed

Introduction to Tax Forms

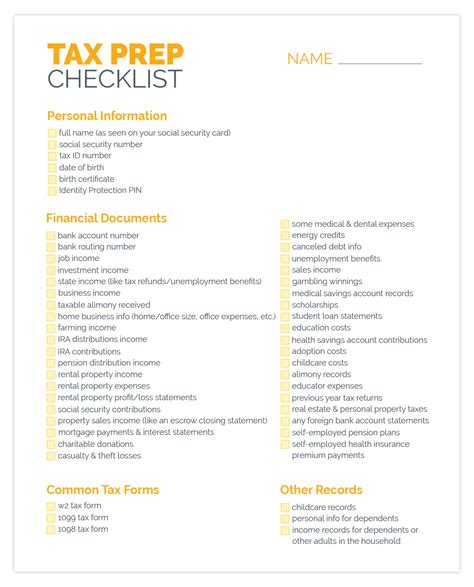

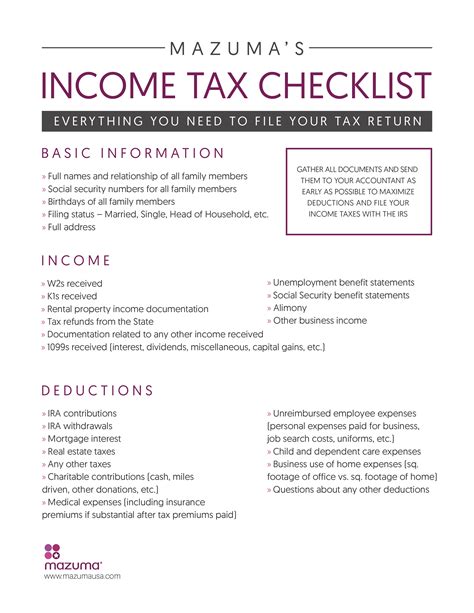

Filing taxes can be a daunting task, especially with the numerous forms and deadlines to keep track of. In the United States, the Internal Revenue Service (IRS) requires individuals and businesses to submit various tax forms to report their income, expenses, and other financial information. This article will highlight five essential tax forms that individuals and businesses need to be familiar with.

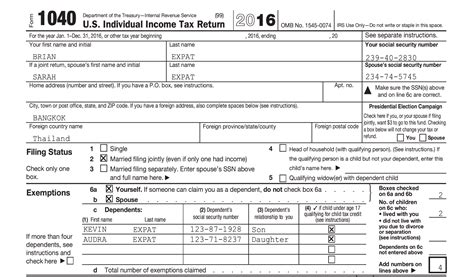

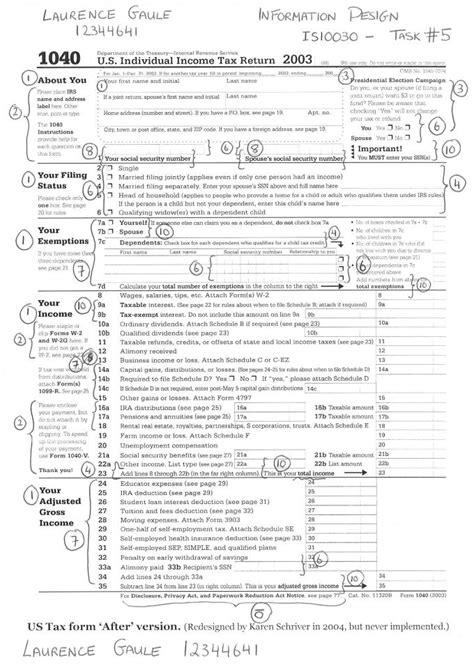

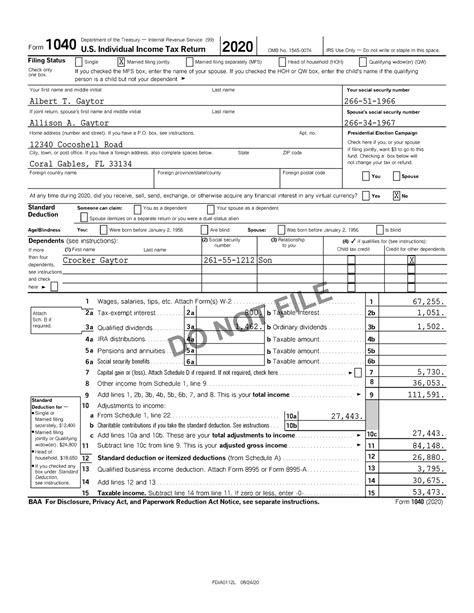

1. Form 1040: Personal Income Tax Return

The Form 1040 is the standard form used by individuals to file their personal income tax returns. It is used to report income from various sources, such as employment, investments, and self-employment. The form also allows individuals to claim deductions and credits, such as the standard deduction, mortgage interest, and charitable donations. The IRS requires individuals to file Form 1040 by April 15th of each year, unless an extension is requested.

2. Form W-2: Wage and Tax Statement

Employers are required to provide their employees with a Form W-2 by January 31st of each year. This form shows the employee’s income, taxes withheld, and other relevant information. Employees use the information on Form W-2 to complete their personal income tax returns (Form 1040). The form includes details such as: * Gross income * Federal income tax withheld * Social Security tax withheld * Medicare tax withheld

3. Form 1099: Miscellaneous Income

The Form 1099 series is used to report various types of income, such as: * Freelance work * Rent * Royalties * Dividends * Interest income Recipients of these forms use the information to report their income on their personal income tax returns (Form 1040). Payers are required to provide Form 1099 to recipients by January 31st of each year.

4. Form 8949: Sales and Other Dispositions of Capital Assets

The Form 8949 is used to report the sale or exchange of capital assets, such as stocks, bonds, and real estate. The form requires individuals to provide detailed information about the asset, including: * Description of the asset * Date acquired * Date sold * Sales price * Cost basis This form is used to calculate capital gains and losses, which are reported on Schedule D (Form 1040).

5. Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return

The Form 4868 is used to request an automatic six-month extension of time to file a personal income tax return (Form 1040). This form can be filed electronically or by mail, and it must be submitted by the original deadline (April 15th). The extension gives individuals more time to gather necessary documents and complete their tax returns. However, it is essential to note that an extension of time to file is not an extension of time to pay. Any taxes owed must still be paid by the original deadline to avoid penalties and interest.

📝 Note: It is crucial to keep accurate records and supporting documentation for all tax-related forms and submissions.

In summary, these five tax forms are essential for individuals and businesses to report their income, expenses, and other financial information to the IRS. Understanding the purpose and requirements of each form can help ensure accurate and timely tax filings.

What is the deadline for filing Form 1040?

+

The deadline for filing Form 1040 is April 15th of each year, unless an extension is requested using Form 4868.

What is the purpose of Form W-2?

+

Form W-2 is used by employers to provide employees with a statement of their income, taxes withheld, and other relevant information for the tax year.

Can I file for an extension of time to file my tax return?

+

Yes, you can file for an automatic six-month extension of time to file your tax return using Form 4868. However, this is not an extension of time to pay, and any taxes owed must still be paid by the original deadline.