5 Ways Full Pension

Introduction to Full Pension

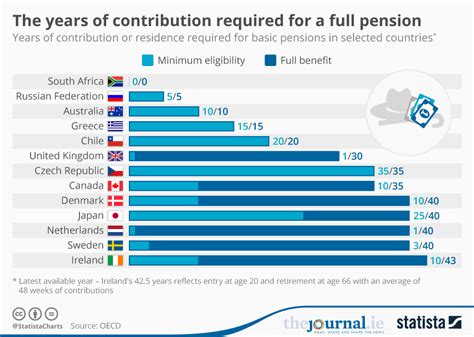

The concept of a full pension is a vital aspect of retirement planning, ensuring that individuals have a stable financial foundation upon which to build their post-work lives. A full pension typically refers to the maximum amount of pension benefit that an individual can receive, often calculated based on their years of service, salary, and the specific rules of their pension plan. Achieving a full pension is a significant goal for many, as it can provide a substantial income stream in retirement, helping to maintain a comfortable standard of living. In this discussion, we will explore five key ways to approach the concept of a full pension, considering both the accumulation phase, where one is working towards retirement, and the distribution phase, where the pension is being paid out.

Understanding Pension Plans

Before diving into the strategies for achieving a full pension, it’s essential to understand the basics of pension plans. There are several types of pension plans, including defined benefit plans, defined contribution plans, and hybrid plans. Defined benefit plans promise a certain benefit amount upon retirement, usually based on salary and years of service. Defined contribution plans, on the other hand, involve contributions from the employee, the employer, or both, into an individual account, with the benefit amount at retirement depending on the account balance. Understanding which type of plan you have and its specifics is crucial for planning towards a full pension.

Strategies for Achieving a Full Pension

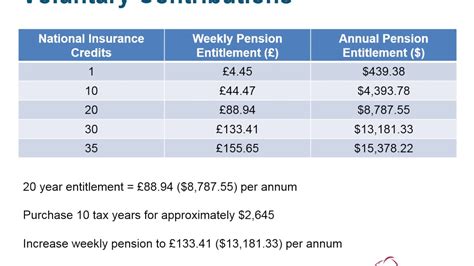

Achieving a full pension requires careful planning, consistent action, and sometimes, making strategic decisions about your career and finances. Here are five ways to work towards a full pension: - Start Early: The power of compounding is a significant factor in pension savings. Starting to contribute to your pension plan early in your career can make a substantial difference in the amount you accumulate by the time you retire. - Maximize Contributions: Contributing the maximum allowed to your pension plan each year can help build your pension fund more quickly. This is especially beneficial in plans where the employer matches your contributions, essentially providing free money towards your retirement. - Consider Career Implications: For defined benefit plans, the formula for calculating the pension benefit often includes years of service and final salary. Therefore, planning your career to maximize these factors (e.g., avoiding early retirement or ensuring significant salary increases towards the end of your career) can impact your pension amount. - Invest Wisely: In defined contribution plans, the investment performance of your pension fund can significantly affect the final amount available at retirement. Educating yourself on investment options and potentially seeking professional advice can help ensure your pension fund grows optimally. - Plan for the Distribution Phase: Once you reach retirement, deciding how to take your pension benefits is crucial. This might involve choosing between a lump sum and an annuity, considering tax implications, and ensuring that your pension income is sustainable throughout your retirement.

Challenges and Considerations

While working towards a full pension, several challenges and considerations must be kept in mind. These include: - Funding Risks: In defined benefit plans, there’s a risk that the plan may not be fully funded, potentially affecting the pension amount you receive. - Investment Risks: For defined contribution plans, investment risks can affect the growth of your pension fund. - Legislative Changes: Pension rules and regulations can change, impacting how pensions are calculated or taxed. - Inflation: The purchasing power of your pension can be eroded by inflation if not adequately indexed.

💡 Note: It's essential to review and adjust your pension plan regularly to ensure it remains aligned with your retirement goals and adapts to any changes in your circumstances or pension regulations.

Conclusion

Achieving a full pension is a complex process that requires a deep understanding of pension plans, strategic financial planning, and a commitment to saving and investing wisely. By starting early, maximizing contributions, considering career implications, investing wisely, and planning carefully for the distribution phase, individuals can work effectively towards securing a full pension. However, it’s also crucial to be aware of the challenges and considerations that can affect pension outcomes, such as funding risks, investment risks, legislative changes, and inflation. With the right approach and ongoing management, a full pension can provide a secure and comfortable retirement, allowing individuals to enjoy their post-work life without significant financial stress.

What is the difference between a defined benefit and a defined contribution pension plan?

+

A defined benefit plan promises a specified benefit amount at retirement, based on a formula that considers salary and years of service. A defined contribution plan, on the other hand, involves contributions to an individual account, with the benefit at retirement depending on the account balance.

How can I maximize my pension contributions?

+

Maximizing pension contributions involves contributing as much as possible to your pension plan each year, especially in plans where the employer matches your contributions. It’s also essential to start early to benefit from compound interest.

What are some common challenges in achieving a full pension?

+

Common challenges include funding risks, investment risks, legislative changes that affect pension rules, and inflation, which can erode the purchasing power of your pension.