Paperwork

Florida New Employee Paperwork Requirements

New Employee Paperwork Requirements in Florida

When hiring new employees in Florida, it is essential to comply with various federal and state regulations. One of the critical aspects of the hiring process is completing the necessary paperwork. In this blog post, we will outline the required paperwork for new employees in Florida, highlighting the importance of each document and providing guidance on how to obtain them.

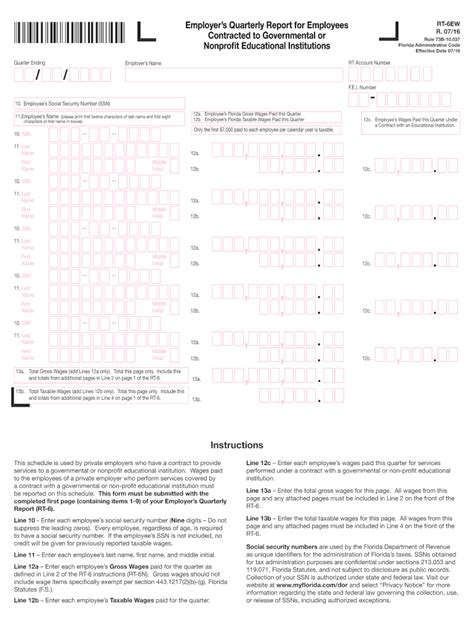

Federal Requirements

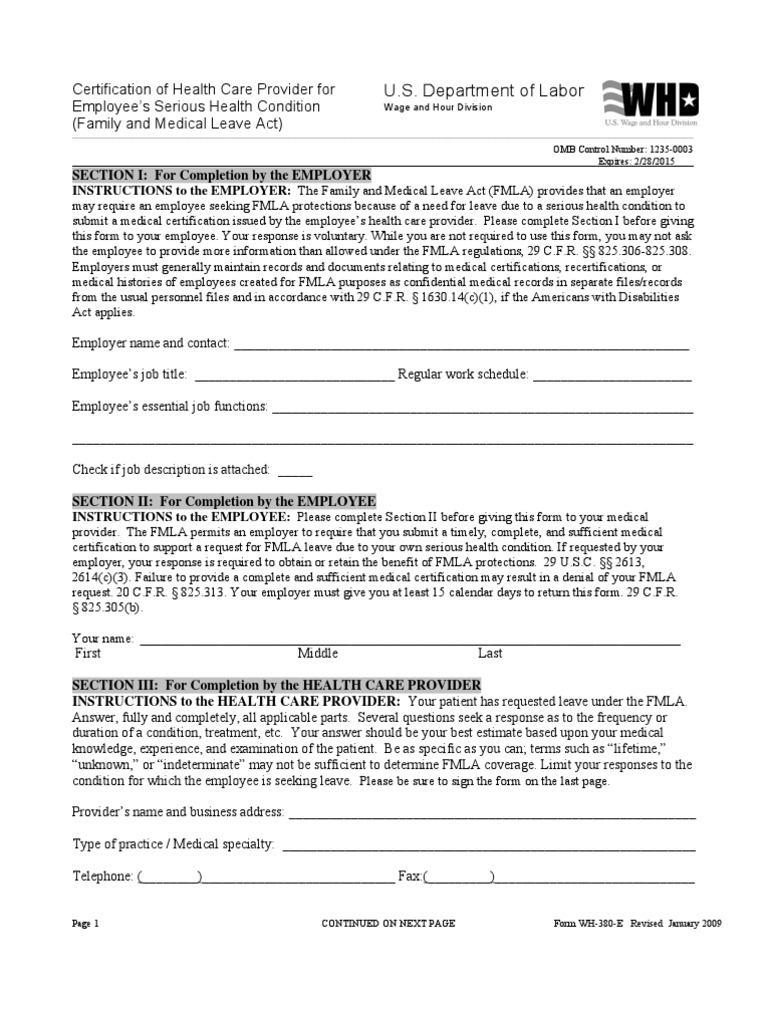

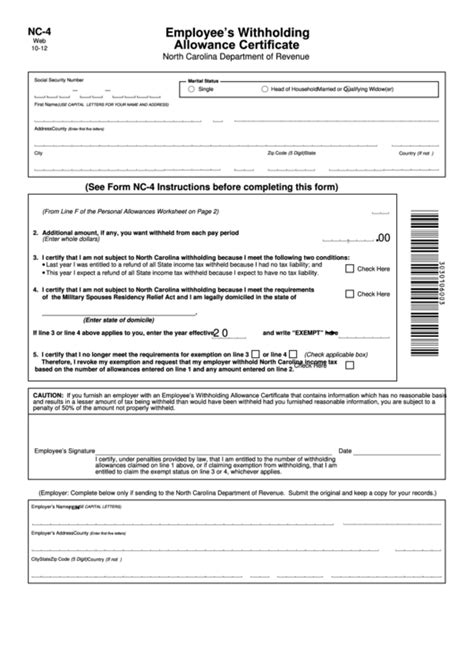

Before diving into the state-specific requirements, it is crucial to understand the federal paperwork requirements for new employees. These include: * Form I-9: Employment Eligibility Verification: This form verifies the employee’s identity and eligibility to work in the United States. Employers must complete Section 1 on the first day of employment, and the employee must provide supporting documents to verify their identity and work authorization. * Form W-4: Employee’s Withholding Certificate: This form determines the amount of federal income tax to be withheld from the employee’s wages. Employees must complete this form on or before their first day of work. * Social Security Number Verification: Employers must verify the employee’s Social Security number using the Social Security Administration’s (SSA) online verification system.

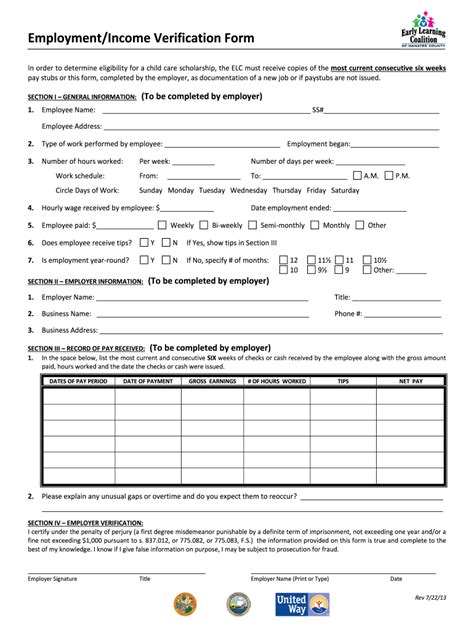

Florida State Requirements

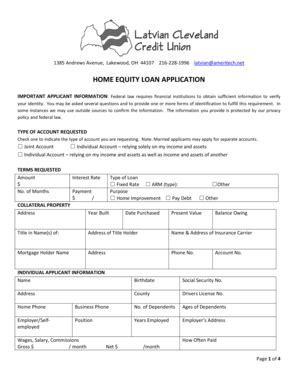

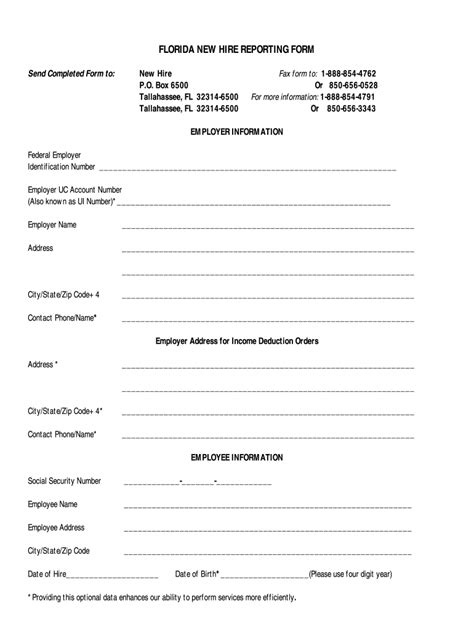

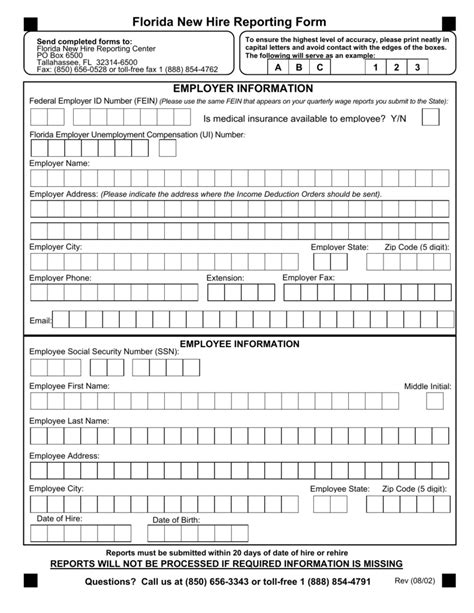

In addition to the federal requirements, Florida has its own set of paperwork requirements for new employees. These include: * New Hire Reporting: Employers must report new hires to the Florida Department of Revenue within 20 days of the employee’s start date. This report includes the employee’s name, address, Social Security number, and date of hire. * Florida Unemployment Compensation: Employers must provide new employees with information about the Florida unemployment compensation program, including the employee’s rights and responsibilities. * Workers’ Compensation: Employers must provide new employees with information about the workers’ compensation program, including the employee’s rights and responsibilities.

Other Requirements

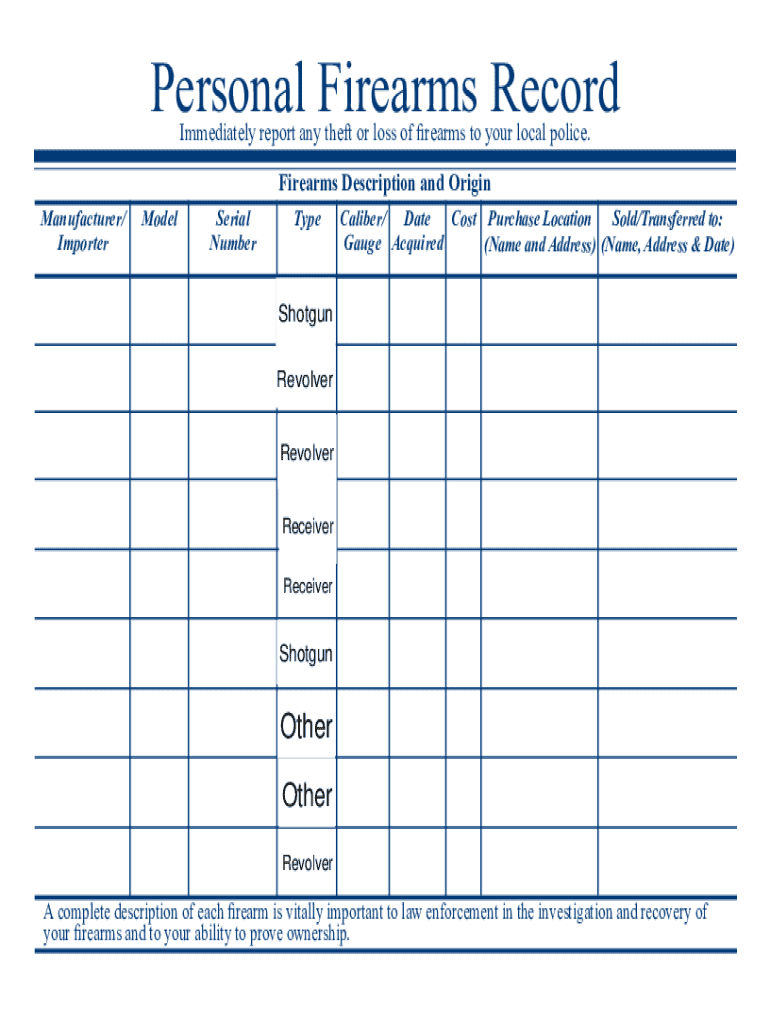

Depending on the industry or type of business, there may be additional paperwork requirements for new employees in Florida. These include: * Background Checks: Certain industries, such as healthcare or childcare, may require background checks for new employees. * Professional Licenses: Employees in certain professions, such as nursing or law, may need to provide proof of licensure or certification. * Benefits Enrollment: Employers may need to provide new employees with information about benefits, such as health insurance or retirement plans, and enroll them in these programs.

Best Practices for Completing New Employee Paperwork

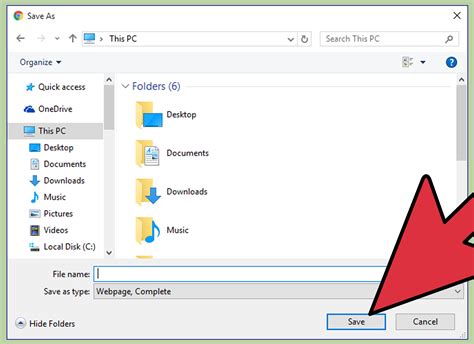

To ensure compliance with federal and state regulations, employers should follow these best practices when completing new employee paperwork: * Use the most up-to-date forms: Ensure that all forms are the latest version and comply with current regulations. * Complete forms accurately and thoroughly: Double-check all information for accuracy and completeness. * Keep records securely: Store completed forms and supporting documents in a secure and confidential manner. * Provide clear instructions: Ensure that new employees understand the purpose and requirements of each form.

📝 Note: Employers should consult with their HR department or a qualified attorney to ensure compliance with all federal and state regulations regarding new employee paperwork.

Penalties for Non-Compliance

Failure to comply with new employee paperwork requirements can result in significant penalties, including: * Fines: Employers may face fines for non-compliance with federal and state regulations. * Back Pay: Employers may be required to pay back wages or benefits to employees who were not properly enrolled in benefits programs. * Reputational Damage: Non-compliance can damage an employer’s reputation and lead to loss of business or talent.

Conclusion and Summary

In conclusion, completing the necessary paperwork for new employees in Florida is a critical aspect of the hiring process. Employers must comply with federal and state regulations, including Form I-9, Form W-4, and new hire reporting. By following best practices and ensuring compliance, employers can avoid penalties and maintain a positive reputation. It is essential for employers to stay up-to-date on the latest regulations and requirements to ensure a smooth and efficient hiring process.

What is the deadline for reporting new hires to the Florida Department of Revenue?

+

The deadline for reporting new hires to the Florida Department of Revenue is within 20 days of the employee’s start date.

What is the purpose of Form I-9?

+

The purpose of Form I-9 is to verify the employee’s identity and eligibility to work in the United States.

What are the consequences of non-compliance with new employee paperwork requirements?

+

The consequences of non-compliance with new employee paperwork requirements can include fines, back pay, and reputational damage.