5 PPP Loan Paperworks

Introduction to PPP Loan Paperwork

The Paycheck Protection Program (PPP) was established by the CARES Act to provide financial assistance to small businesses affected by the COVID-19 pandemic. To apply for a PPP loan, businesses must submit various documents to verify their eligibility and demonstrate their need for financial support. In this article, we will discuss the essential paperwork required for a PPP loan application.

Required Documents for PPP Loan Application

To apply for a PPP loan, businesses must provide the following documents:

- Business Tax Returns: Provide complete copies of business tax returns for the last two years, including all schedules.

- Financial Statements: Submit financial statements, such as balance sheets and income statements, to demonstrate the business’s financial health.

- Payroll Records: Provide payroll records, including payroll tax filings and employee compensation records, to verify the number of employees and payroll costs.

- Identification Documents: Submit identification documents, such as a driver’s license or passport, for all owners with a 20% or greater ownership stake in the business.

- Average Monthly Payroll Calculation: Calculate the average monthly payroll costs for the business, excluding costs over $100,000 on an annualized basis for each employee.

Additional Documentation for PPP Loan Application

In addition to the required documents, businesses may need to provide additional documentation to support their PPP loan application:

- Business License: Provide a copy of the business license or certification from the state or local government.

- Articles of Incorporation: Submit a copy of the articles of incorporation or organization documents for the business.

- Partnership Agreement: If the business is a partnership, provide a copy of the partnership agreement.

- Lease Agreement: If the business has a lease agreement, provide a copy of the lease to verify the business’s physical location.

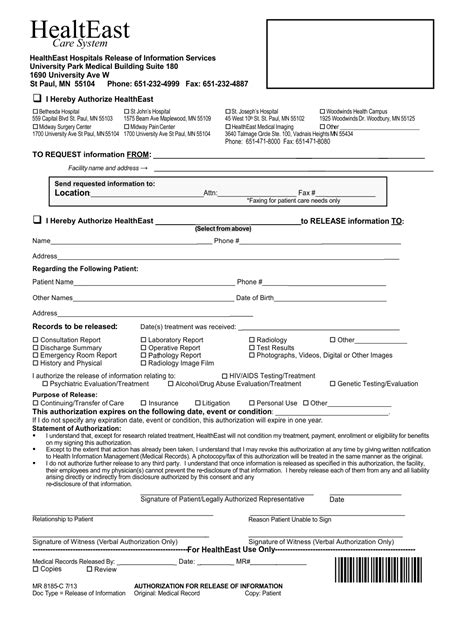

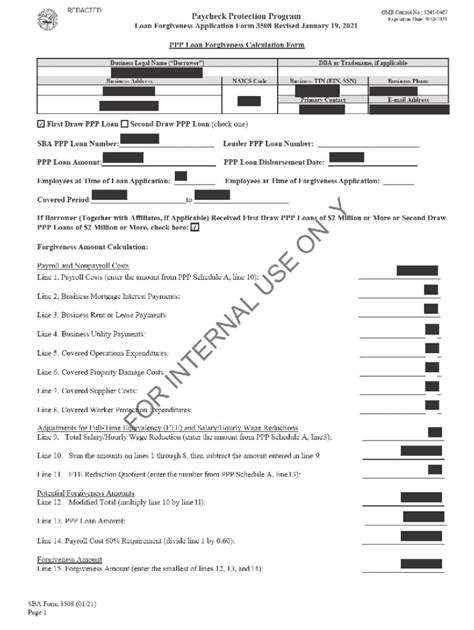

PPP Loan Application Form

The Small Business Administration (SBA) provides a standard application form for PPP loans, which includes:

- Borrower Information: Provide business and owner information, including names, addresses, and tax identification numbers.

- Loan Amount: Calculate and request the desired loan amount, based on the average monthly payroll costs.

- Use of Funds: Describe the intended use of the loan funds, which must be used for eligible expenses, such as payroll costs, rent, and utilities.

- Certifications: Certify that the business meets the eligibility requirements and will use the loan funds for eligible expenses.

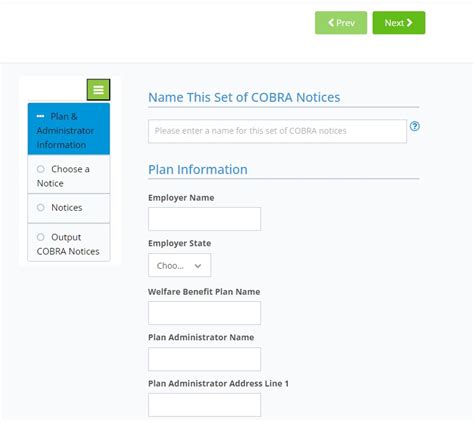

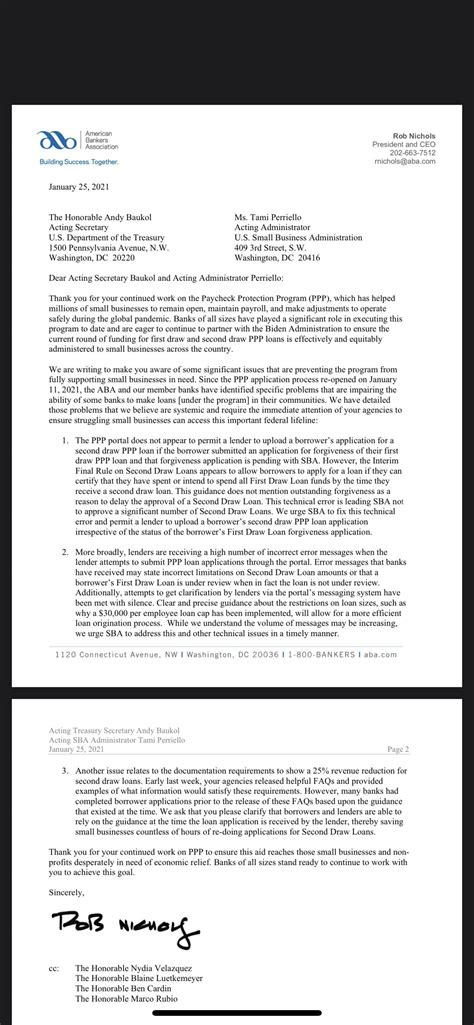

Submission and Review of PPP Loan Application

Once the application is complete, businesses can submit it to an approved lender, such as a bank or credit union. The lender will review the application and verify the information provided. If the application is approved, the lender will disburse the loan funds and the business can begin using them for eligible expenses.

💡 Note: Businesses should carefully review the application and ensure all information is accurate and complete to avoid delays or rejection of the application.

PPP Loan Forgiveness

After receiving the loan, businesses can apply for loan forgiveness, which allows them to have a portion or all of the loan forgiven. To be eligible for loan forgiveness, businesses must:

- Maintain Employee Headcount: Maintain the same number of employees during the covered period as they did during the reference period.

- Maintain Salary Levels: Maintain salary levels for employees during the covered period, with no more than a 25% reduction in wages.

- Use of Funds: Use at least 60% of the loan funds for payroll costs and no more than 40% for non-payroll costs, such as rent and utilities.

| Loan Forgiveness | Eligible Expenses |

|---|---|

| Payroll Costs | Salary, wages, and tips |

| Non-Payroll Costs | Rent, utilities, and mortgage interest |

In summary, the PPP loan application process requires businesses to submit various documents to verify their eligibility and demonstrate their need for financial support. By understanding the required documents and additional documentation, businesses can ensure a smooth application process and increase their chances of receiving a PPP loan.

The key points to take away are the importance of accurate and complete documentation, the need to maintain employee headcount and salary levels, and the eligible use of funds for loan forgiveness. By following these guidelines and submitting a thorough application, businesses can access the financial support they need to navigate the challenges of the COVID-19 pandemic.

What is the purpose of the PPP loan program?

+

The purpose of the PPP loan program is to provide financial assistance to small businesses affected by the COVID-19 pandemic, helping them to maintain their workforce and cover eligible expenses.

What documents are required for a PPP loan application?

+

The required documents for a PPP loan application include business tax returns, financial statements, payroll records, identification documents, and average monthly payroll calculation.

How can businesses apply for loan forgiveness?

+

Businesses can apply for loan forgiveness by submitting an application to their lender, demonstrating that they have maintained employee headcount and salary levels, and used the loan funds for eligible expenses.