Refinancing Paperwork Needed

Introduction to Refinancing

When considering refinancing a mortgage, it’s essential to understand the process and the paperwork required. Refinancing involves replacing an existing mortgage with a new one, often to secure a better interest rate, lower monthly payments, or to tap into home equity. The refinancing process can be complex, and gathering the necessary paperwork is crucial for a smooth and successful transaction.

Types of Refinancing

There are several types of refinancing options available, including: * Rate-and-Term Refinancing: This involves refinancing the existing mortgage to secure a better interest rate or to change the loan term. * Cash-Out Refinancing: This type of refinancing allows homeowners to tap into their home equity and receive a lump sum of cash. * Streamline Refinancing: This option is available for government-backed loans, such as FHA or VA loans, and involves a simplified refinancing process.

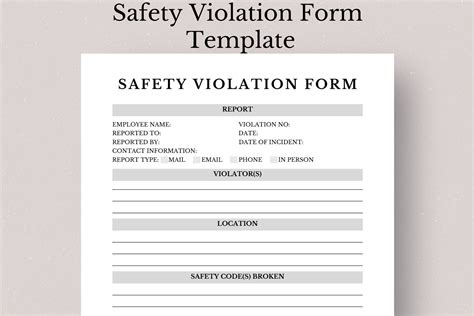

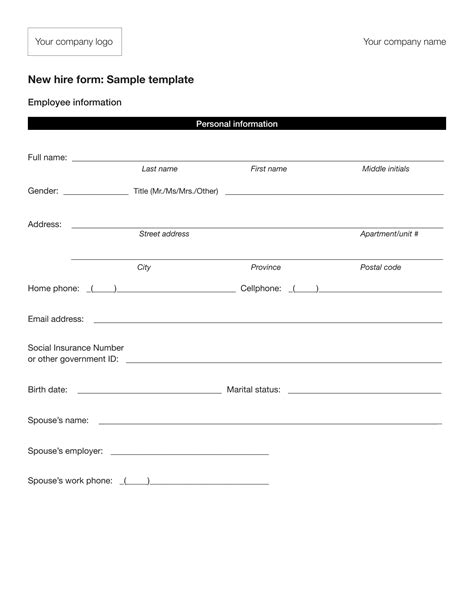

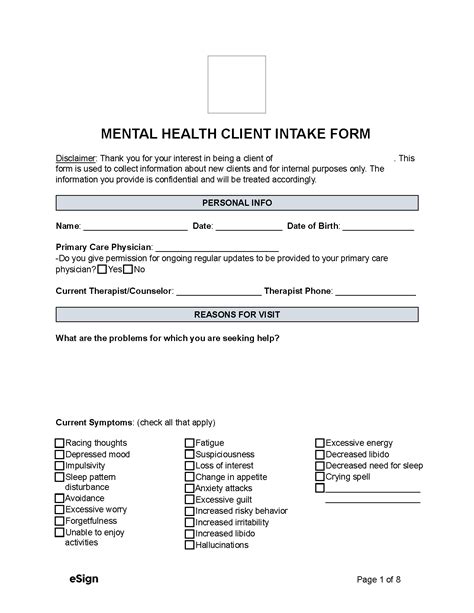

Required Paperwork

To refinance a mortgage, homeowners will need to gather various documents, including: * Identification: A valid government-issued ID, such as a driver’s license or passport. * Income Verification: Pay stubs, W-2 forms, and tax returns to demonstrate income stability. * Credit Reports: Lenders will review credit reports to assess creditworthiness. * Property Valuation: An appraisal or valuation report to determine the property’s value. * Loan Documents: The existing mortgage note, deed of trust, and any other relevant loan documents. * Insurance Information: Proof of homeowners insurance and any other relevant insurance policies.

📝 Note: The specific paperwork required may vary depending on the lender, loan type, and individual circumstances.

Refinancing Process

The refinancing process typically involves the following steps: * Pre-approval: Homeowners apply for pre-approval to determine how much they can borrow. * Loan Application: The homeowner submits a loan application, providing the required paperwork. * Processing and Underwriting: The lender reviews the application, orders an appraisal, and underwrites the loan. * Closing: The homeowner signs the final loan documents, and the new mortgage is recorded.

Benefits and Considerations

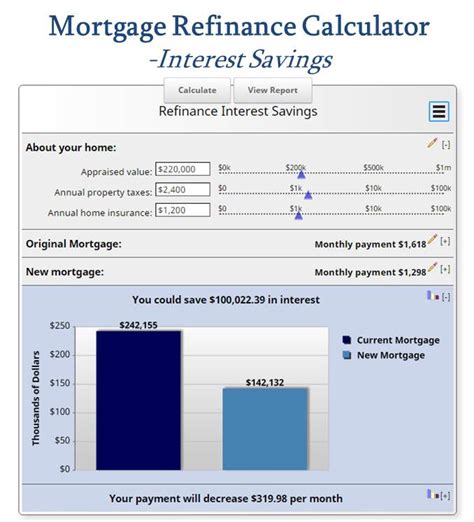

Refinancing can offer several benefits, including: * Lower Monthly Payments: A lower interest rate or extended loan term can reduce monthly payments. * Tap into Home Equity: Cash-out refinancing allows homeowners to access their home equity. * Debt Consolidation: Refinancing can provide an opportunity to consolidate debt into a single, lower-interest loan. However, refinancing also involves considerations, such as: * Closing Costs: Refinancing typically involves paying closing costs, which can range from 2% to 5% of the loan amount. * Interest Rates: Homeowners should carefully evaluate the new interest rate and terms to ensure they are beneficial.

| Loan Type | Interest Rate | Loan Term |

|---|---|---|

| Fixed-Rate Loan | 4.5% | 30 years |

| Adjustable-Rate Loan | 3.5% | 5/1 ARM |

In summary, refinancing a mortgage requires careful consideration and preparation. Homeowners should gather the necessary paperwork, evaluate their options, and weigh the benefits and considerations before making a decision. By understanding the refinancing process and requirements, homeowners can navigate the transaction with confidence and achieve their financial goals.

What is the difference between rate-and-term refinancing and cash-out refinancing?

+

Rate-and-term refinancing involves refinancing the existing mortgage to secure a better interest rate or to change the loan term, while cash-out refinancing allows homeowners to tap into their home equity and receive a lump sum of cash.

What are the typical closing costs associated with refinancing a mortgage?

+

Closing costs for refinancing a mortgage can range from 2% to 5% of the loan amount, depending on the lender, loan type, and individual circumstances.

Can I refinance my mortgage with bad credit?

+

It may be more challenging to refinance a mortgage with bad credit, but it’s not impossible. Homeowners with poor credit may need to explore alternative loan options or work with a lender that specializes in subprime lending.