7 Tax Papers Needed

Introduction to Tax Papers

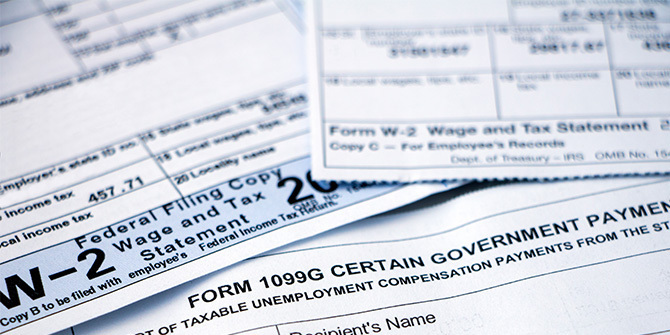

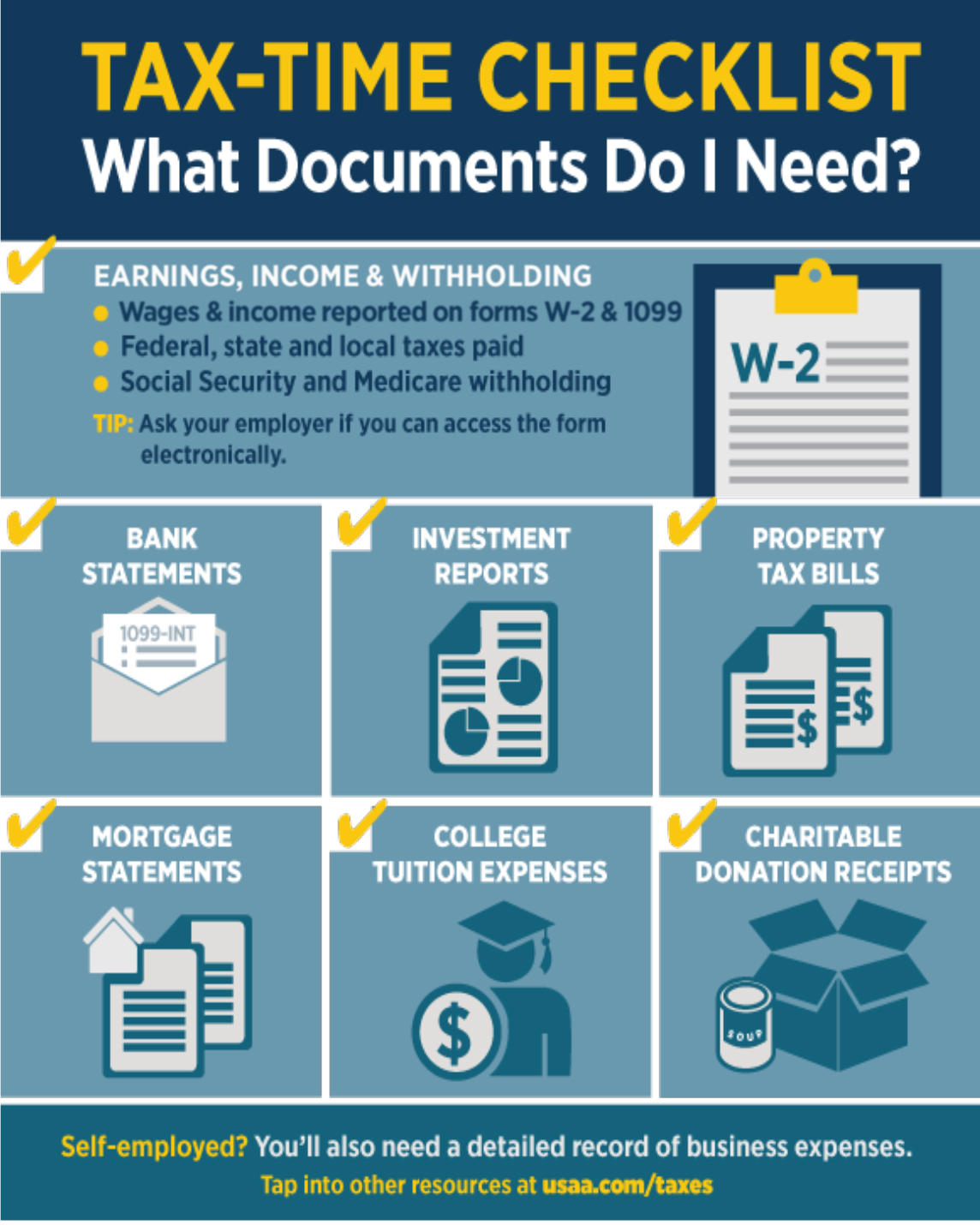

When it comes to managing your finances, one of the most critical aspects is dealing with tax papers. Tax papers are essential documents that provide proof of your income, expenses, and other financial transactions. They are required for filing tax returns, applying for loans, and other financial purposes. In this article, we will discuss the 7 tax papers that you need to have in order to manage your finances effectively.

Importance of Tax Papers

Tax papers are vital documents that help you keep track of your financial transactions. They provide a record of your income, expenses, and tax payments, which can be useful in case of an audit or when applying for loans. Having the right tax papers can also help you avoid penalties and fines for non-compliance with tax laws. Moreover, tax papers can help you identify areas where you can reduce your tax liability and optimize your financial performance.

7 Tax Papers Needed

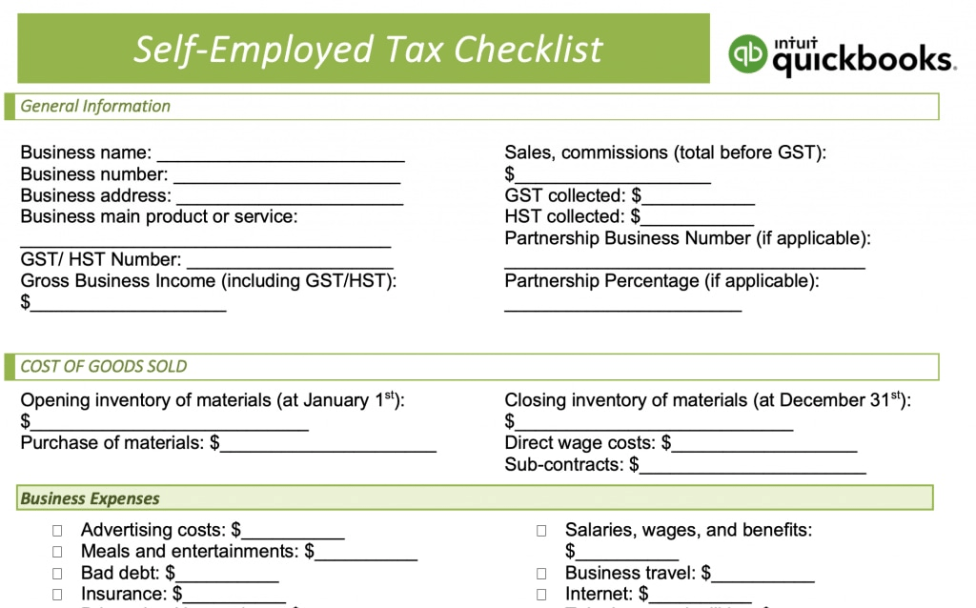

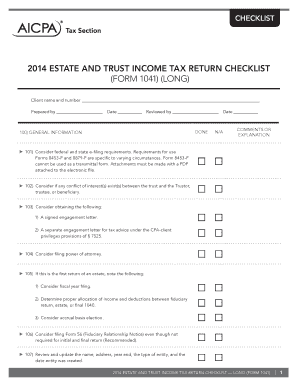

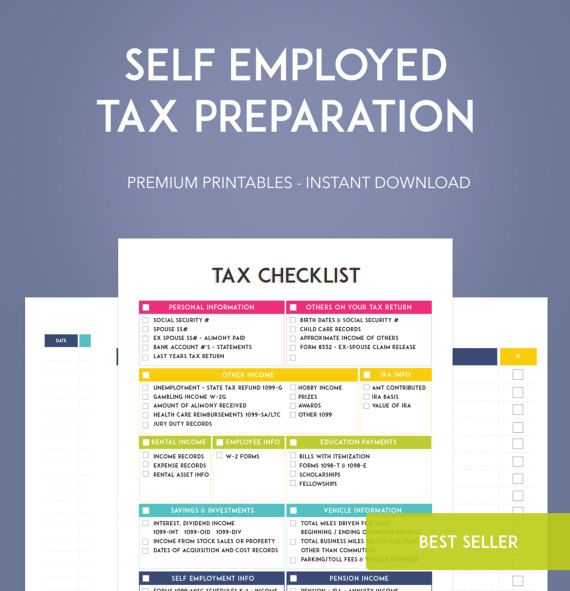

Here are the 7 tax papers that you need to have: * Form W-2: This is the most common tax paper, which shows your income and taxes withheld from your employer. * Form 1099: This form shows income earned from freelance work, interest, dividends, and capital gains. * Form 1040: This is the standard form for personal income tax returns, which includes information about your income, deductions, and tax credits. * Schedule A: This form is used to itemize deductions, such as mortgage interest, charitable donations, and medical expenses. * Schedule C: This form is used to report business income and expenses, including profits and losses from self-employment. * Form 1098: This form shows mortgage interest paid, which can be deducted from your taxable income. * Form 5498: This form shows contributions to retirement accounts, such as 401(k) or IRA, which can be deducted from your taxable income.

📝 Note: It's essential to keep these tax papers organized and easily accessible, as you may need to refer to them during tax season or when applying for loans.

Additional Tax Papers

In addition to the 7 tax papers mentioned above, you may need to have other documents, such as: * Receipts for charitable donations * Medical expense receipts * Business expense receipts * Investment statements * Retirement account statements

These documents can help you claim deductions and credits on your tax return, which can reduce your tax liability.

Managing Tax Papers

Managing tax papers can be overwhelming, especially if you have multiple sources of income or complex financial transactions. Here are some tips to help you manage your tax papers effectively: * Keep all tax papers in one place, such as a file folder or digital storage device. * Organize tax papers by category, such as income, expenses, and deductions. * Use a tax preparation software to help you prepare and file your tax return. * Consult a tax professional if you have complex tax questions or need help with tax planning.

| Tax Paper | Purpose |

|---|---|

| Form W-2 | Shows income and taxes withheld from employer |

| Form 1099 | Shows income earned from freelance work, interest, dividends, and capital gains |

| Form 1040 | Standard form for personal income tax returns |

| Schedule A | Itemizes deductions, such as mortgage interest, charitable donations, and medical expenses |

| Schedule C | Reports business income and expenses, including profits and losses from self-employment |

| Form 1098 | Shows mortgage interest paid, which can be deducted from taxable income |

| Form 5498 | Shows contributions to retirement accounts, which can be deducted from taxable income |

In summary, having the right tax papers is essential for managing your finances effectively. The 7 tax papers mentioned above, including Form W-2, Form 1099, Form 1040, Schedule A, Schedule C, Form 1098, and Form 5498, provide a comprehensive record of your financial transactions and can help you claim deductions and credits on your tax return. By keeping these tax papers organized and easily accessible, you can reduce your tax liability and optimize your financial performance.

What is the purpose of Form W-2?

+

Form W-2 shows your income and taxes withheld from your employer.

What is the difference between Form 1099 and Form W-2?

+

Form 1099 shows income earned from freelance work, interest, dividends, and capital gains, while Form W-2 shows income and taxes withheld from an employer.

How do I file my tax return?

+

You can file your tax return using tax preparation software or by consulting a tax professional.