Get Your HUD 1 Paperwork

Introduction to HUD 1 Paperwork

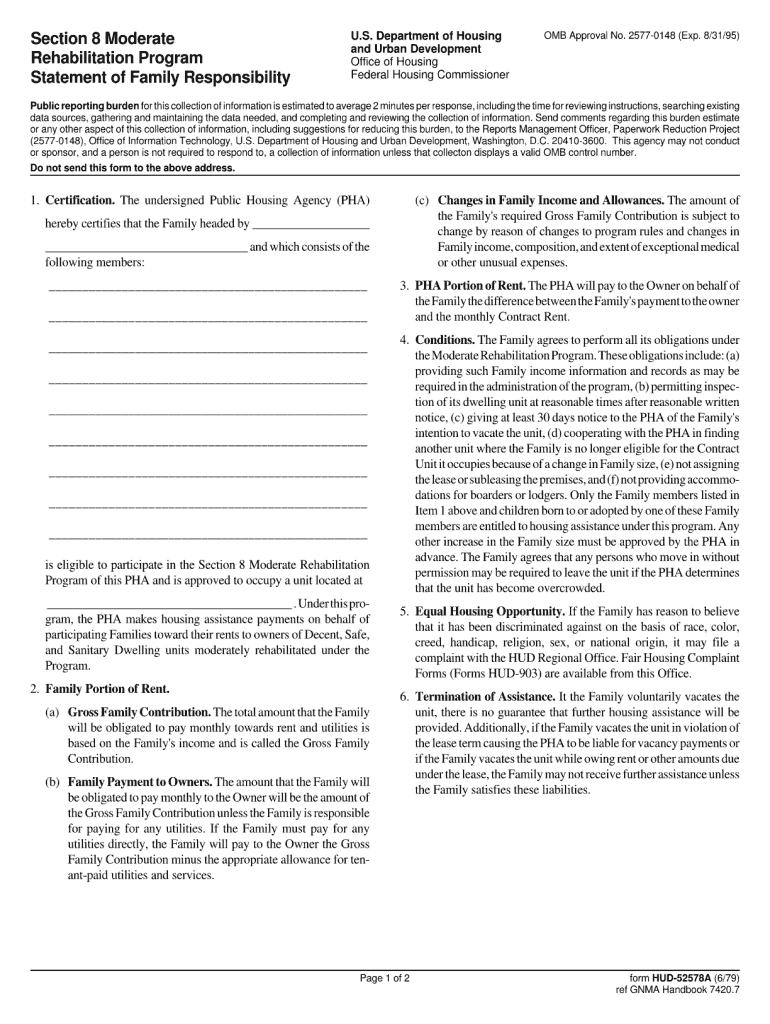

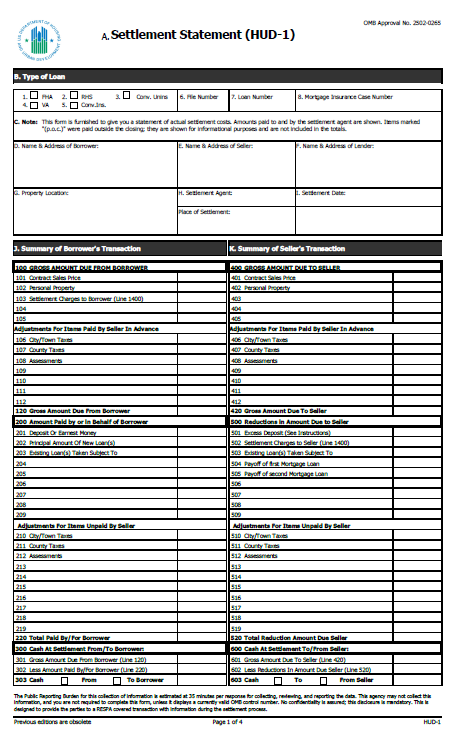

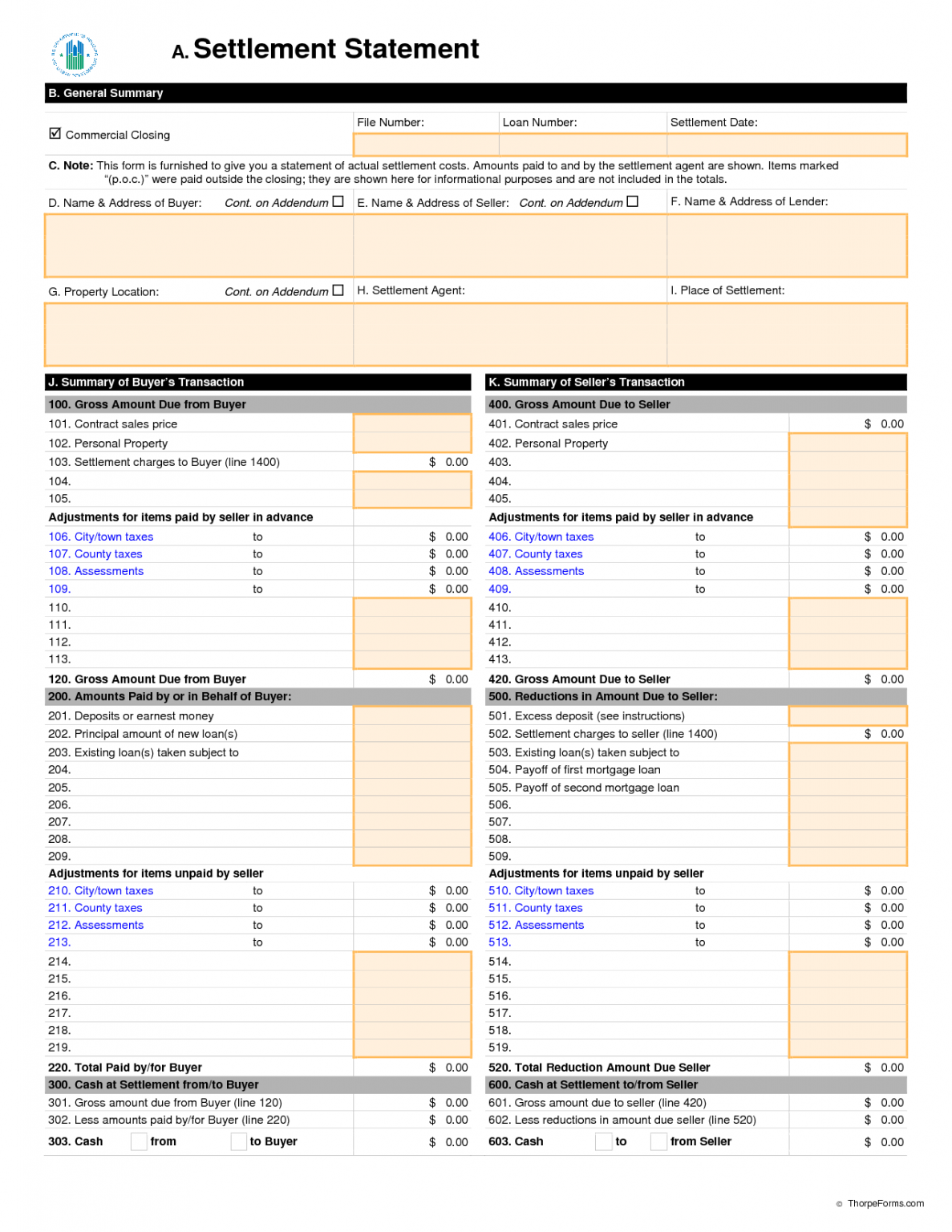

When it comes to real estate transactions, there are numerous documents that need to be processed and understood. One of the most critical documents in this process is the HUD 1 paperwork, also known as the Settlement Statement. This document is a standardized form used by the United States Department of Housing and Urban Development (HUD) to itemize all the costs associated with the buying and selling of a property. The purpose of the HUD 1 is to provide transparency and clarity to both the buyer and the seller about the financial aspects of the transaction.

Understanding the Components of HUD 1

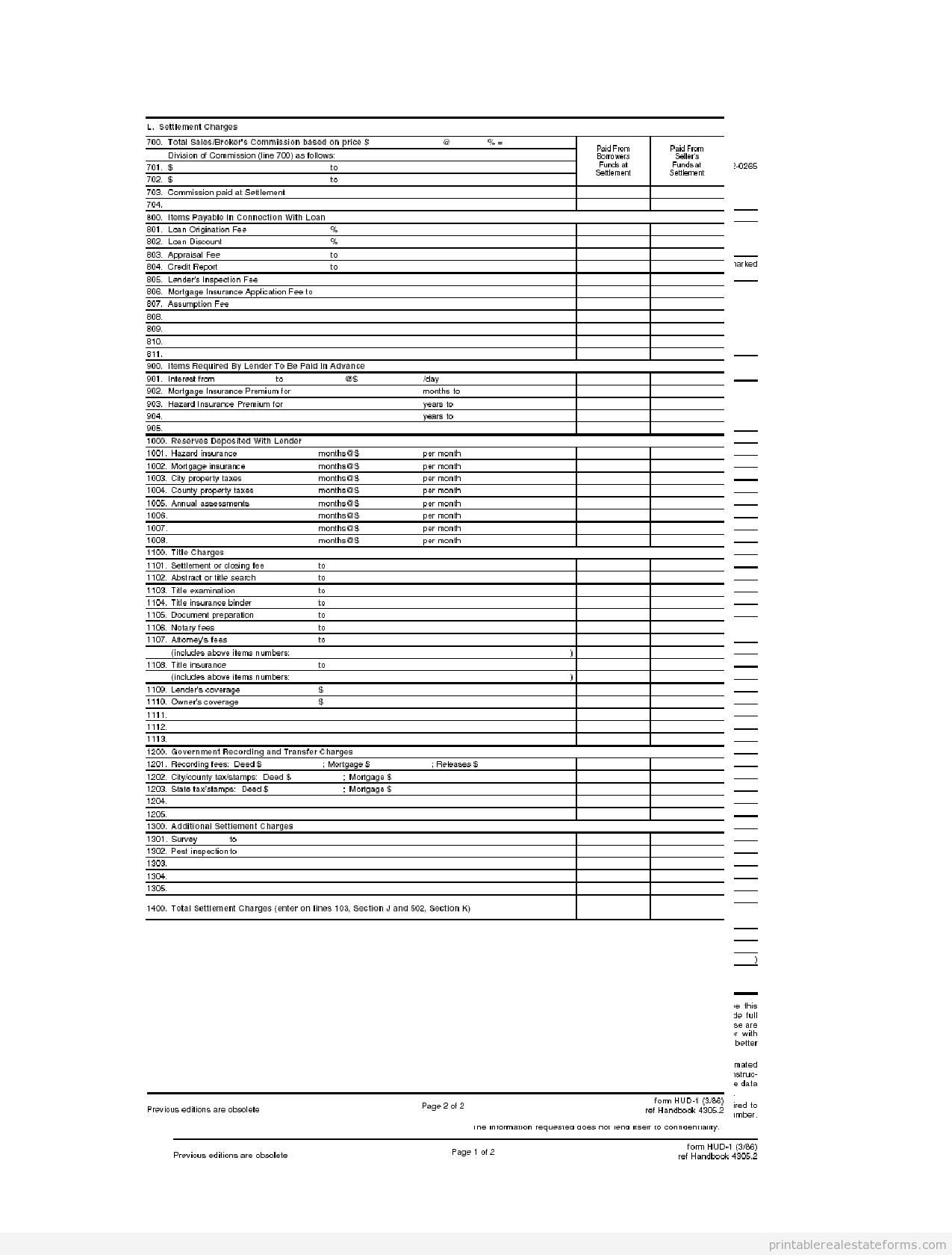

The HUD 1 form is divided into several sections, each detailing different aspects of the transaction costs. These sections include: - Section 100: Gross Amount Due from Borrower: This section outlines the total amount the borrower owes, including the loan amount and any other costs associated with the loan. - Section 200-500: Items Payable in Connection with Loan: These sections break down the various costs related to the loan, such as origination fees, discount points, and appriasal fees. - Section 600-800: Items Payable in Connection with Title: This part of the form lists costs associated with the transfer of the property title, including title insurance and escrow fees. - Section 900-1100: Additional Settlement Costs: These sections cover other expenses, such as survey fees and inspection fees.

Obtaining Your HUD 1 Paperwork

Receiving and reviewing the HUD 1 settlement statement is a crucial step in the home buying or selling process. By law, the borrower must receive the HUD 1 at least one day before the settlement (also known as the closing) of the transaction. This allows time to review the document, ask questions, and ensure that all the costs are understood and agreed upon. It’s essential to carefully examine the HUD 1 to avoid any misunderstandings or unexpected costs at the closing table.

Key Points to Review in Your HUD 1

When reviewing the HUD 1, there are several key points to pay attention to: - Loan Terms: Verify that the loan amount, interest rate, and repayment terms match the agreement. - Fees and Charges: Understand all the fees listed and question any that seem unclear or excessive. - Prorations: Ensure that any prorated costs, such as property taxes or homeowners association fees, are correctly calculated. - Credits: Confirm any credits you are due, such as a seller credit towards closing costs.

Changes to the HUD 1 Form

As of 2015, the HUD 1 form was replaced by the Closing Disclosure (CD) for most real estate transactions involving a mortgage. The Closing Disclosure is part of the Know Before You Owe rule implemented by the Consumer Financial Protection Bureau (CFPB) to make the closing process more transparent and consumer-friendly. However, the HUD 1 may still be used in certain transactions, such as cash sales or reverse mortgages.

📝 Note: It's crucial to work with a reputable lender and title company to ensure that all documents, including the HUD 1 or Closing Disclosure, are accurate and compliant with current regulations.

Conclusion and Next Steps

In summary, the HUD 1 paperwork, or its equivalent in current use, is a vital document in real estate transactions. It provides a detailed breakdown of the costs involved, ensuring transparency and protecting the interests of both buyers and sellers. Understanding the components of the HUD 1 and carefully reviewing it before closing is essential for a smooth transaction. Whether you’re a seasoned real estate professional or a first-time buyer, familiarity with the HUD 1 and its successors can help navigate the complex process of property transactions.

To finalize the transaction process, it’s essential to: - Review all documents carefully. - Ask questions if any aspect of the transaction is unclear. - Ensure all parties are in agreement before proceeding to closing.

| Document | Purpose |

|---|---|

| HUD 1 | Itemizes all costs in a real estate transaction. |

| Closing Disclosure | Replaced HUD 1 for most mortgage transactions, providing a detailed breakdown of costs. |

What is the purpose of the HUD 1 form?

+

The HUD 1 form is used to itemize all the costs associated with the buying and selling of a property, providing transparency to both parties in the transaction.

Has the HUD 1 form been replaced?

+

Yes, for most mortgage transactions, the HUD 1 has been replaced by the Closing Disclosure as part of the Know Before You Owe rule.

How do I obtain my HUD 1 paperwork?

+

You should receive the HUD 1 or its equivalent from your lender at least one day before the closing of the transaction. Review it carefully and ask questions if necessary.