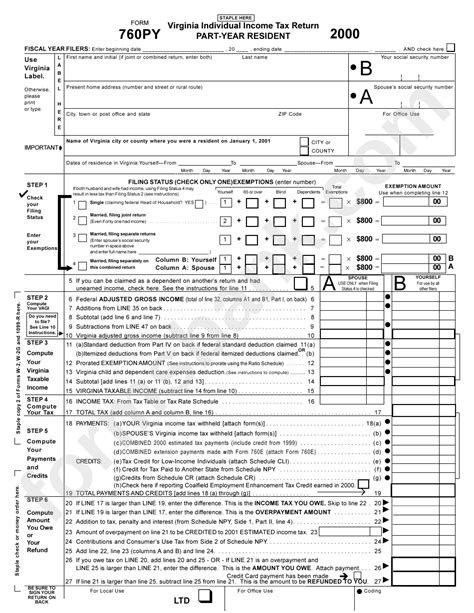

7 Tax Papers Needed

Understanding the Importance of Tax Papers

When it comes to managing your finances, one of the most critical aspects is dealing with taxes. Whether you’re an individual or a business, having the right tax papers is essential for compliance with tax laws and regulations. In this article, we will delve into the world of tax papers, exploring the different types you might need and their significance in the tax filing process.

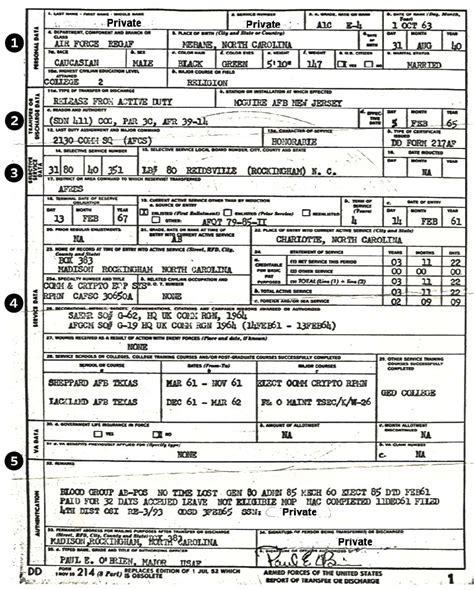

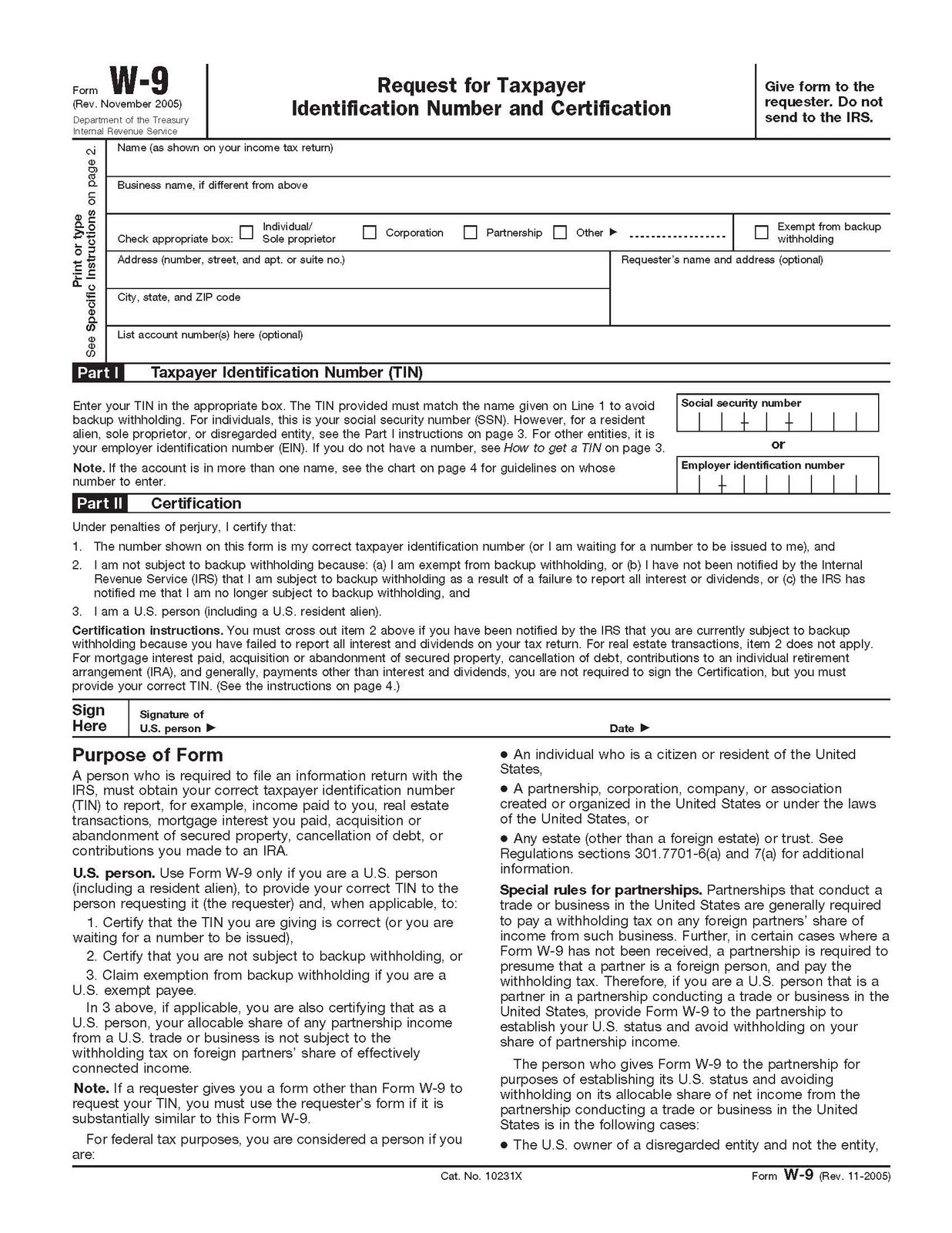

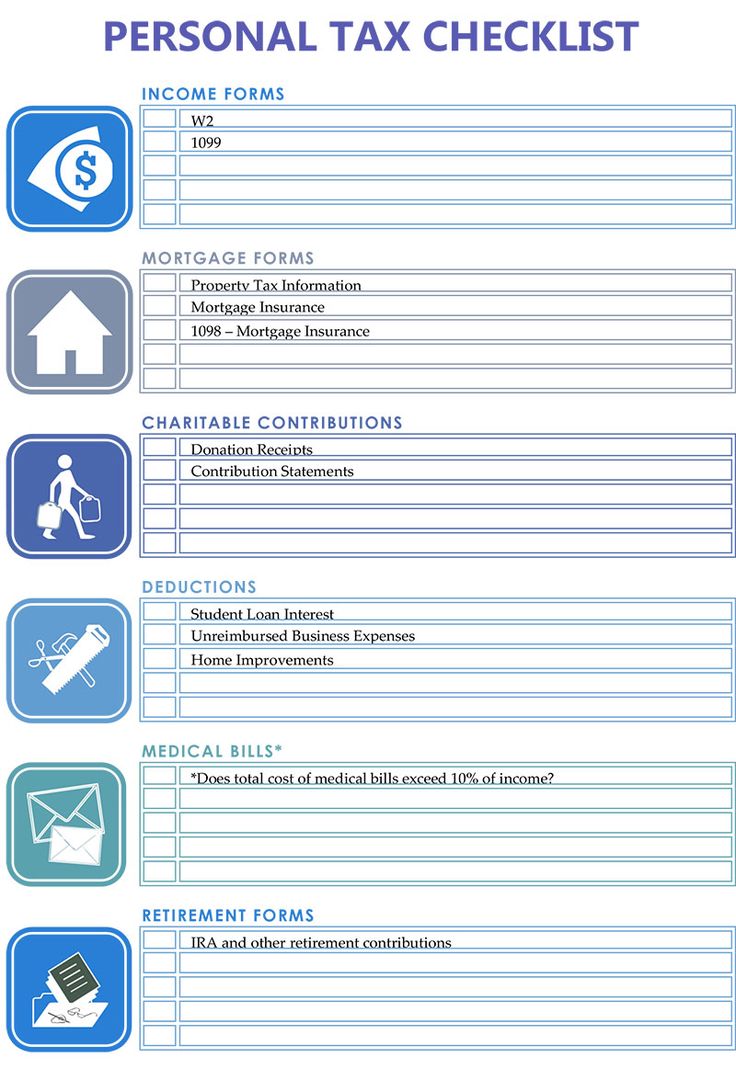

Types of Tax Papers

There are numerous tax papers that individuals and businesses may need to file with the tax authorities. Here are seven key types: * W-2 Forms: These are used by employers to report the income and taxes withheld from their employees’ wages. * 1099 Forms: These forms are used to report various types of income that are not subject to withholding, such as freelance work, interest, dividends, and capital gains. * Form 1040: This is the standard form used for personal income tax returns. * Schedule C (Form 1040): If you’re self-employed, you’ll need to file this form to report your business income and expenses. * Form 1098: This form is used to report mortgage interest and points. * Form 8829: If you use a portion of your home for business, you can deduct expenses for business use of your home using this form. * Form W-4: This form is used by employers to determine the amount of tax to withhold from an employee’s wages.

Why Are Tax Papers Important?

Tax papers are crucial for several reasons: - Compliance: Filing the correct tax papers ensures that you are in compliance with tax laws, avoiding potential penalties and fines. - Accurate Tax Calculation: These papers help in accurately calculating your tax liability, ensuring you don’t overpay or underpay your taxes. - Refund Claims: If you’re due a refund, the right tax papers are necessary to claim it. - Audit Purposes: In case of an audit, having all the necessary tax papers can significantly ease the process and support your tax return claims.

Organizing Your Tax Papers

To make the tax filing process smoother, it’s essential to keep all your tax papers well-organized. Here are some tips: - Use a file folder or digital storage to keep all your tax-related documents in one place. - Label each document clearly so you can easily find what you need. - Consider scanning your documents to create digital copies, which can be more secure and easier to store. - Make sure to backup your digital files to prevent loss in case of a technical issue.

| Document Type | Purpose |

|---|---|

| W-2 | Report income and taxes withheld |

| 1099 | Report non-withheld income |

| Form 1040 | Personal income tax return |

Tax Paper Management for Businesses

For businesses, managing tax papers can be more complex due to the variety of forms and the scale of operations. Here are some additional considerations: - Hire a professional: If your business’s tax situation is complex, consider hiring an accountant or tax professional. - Use tax software: There are many software solutions available that can help with tax preparation and filing. - Keep detailed records: Accurate and detailed financial records are crucial for filling out tax papers correctly.

📝 Note: Always keep your tax papers for at least three years in case of an audit, and consider keeping them for up to seven years for more complex tax situations.

In essence, tax papers are the foundation of the tax filing process, ensuring compliance, accurate tax calculation, and the ability to claim refunds. By understanding the different types of tax papers and organizing them effectively, individuals and businesses can navigate the tax season with confidence.

What is the purpose of a W-2 form?

+

The W-2 form is used by employers to report the income and taxes withheld from their employees’ wages to the Social Security Administration and the Internal Revenue Service.

How do I organize my tax papers effectively?

+

Use a file folder or digital storage to keep all your tax-related documents in one place, label each document clearly, and consider scanning your documents to create digital copies.

Why is it important to keep tax papers for several years?

+

Keeping tax papers for at least three years, and up to seven years for more complex situations, is important in case of an audit, where you may need to provide evidence to support your tax return claims.