Paperwork

Buy a House Paperwork Requirements

Introduction to Buying a House

Buying a house can be a daunting and complex process, involving numerous steps and a significant amount of paperwork. The requirements for buying a house vary depending on the location, type of property, and the buyer’s financial situation. In this article, we will guide you through the typical paperwork requirements involved in buying a house, helping you to navigate the process with confidence.

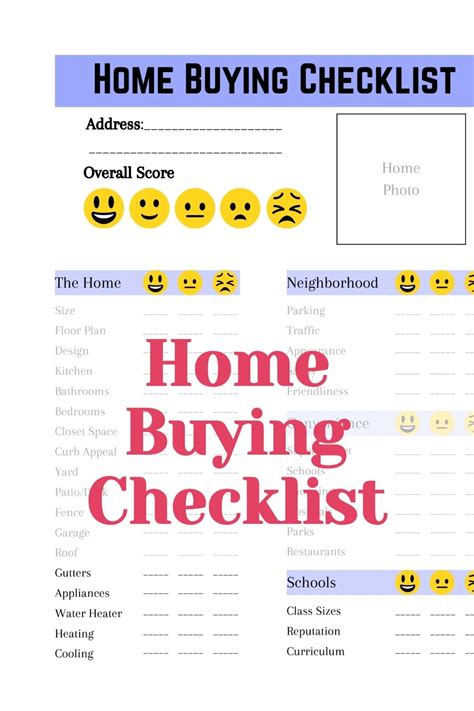

Pre-Purchase Paperwork

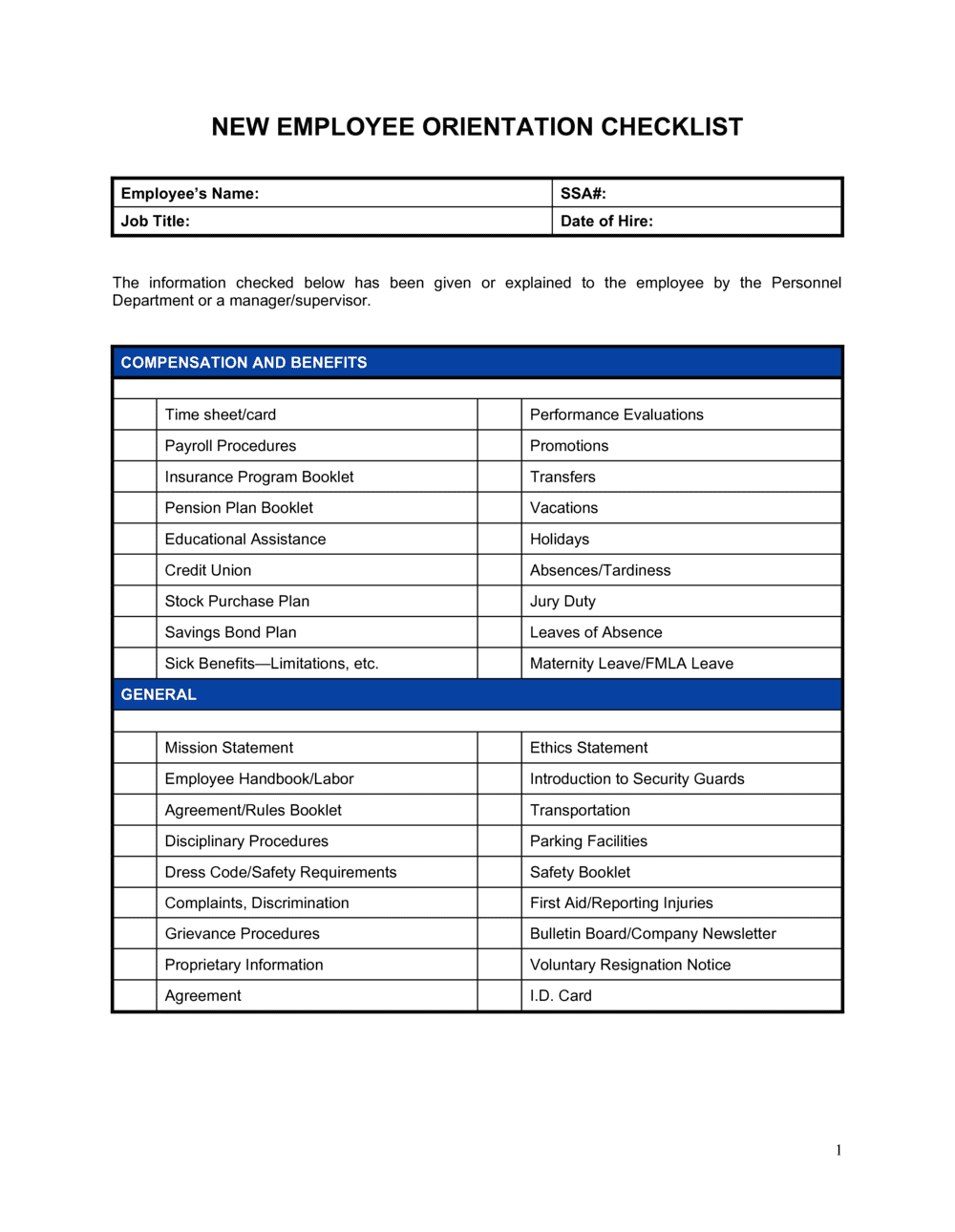

Before starting your house hunt, it’s essential to get your finances in order. This involves gathering various documents to demonstrate your income, creditworthiness, and savings. The following are some of the key documents you’ll need: * Identification documents: Passport, driver’s license, or state ID * Proof of income: Pay stubs, W-2 forms, or tax returns * Credit reports: Obtain a copy of your credit report to check for errors and improve your credit score * Bank statements: Provide statements showing your savings and account activity * Employment verification: Letter from your employer confirming your employment status and income

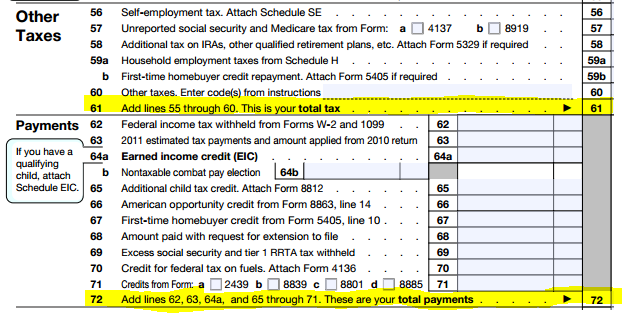

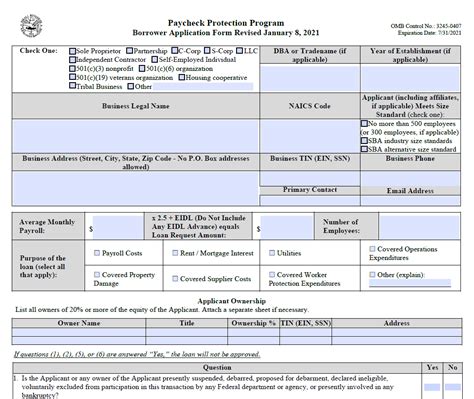

Mortgage Application Paperwork

Once you’ve found a house you’d like to purchase, you’ll need to apply for a mortgage. The mortgage application process involves submitting a range of documents to your lender, including: * Mortgage application form: Completed and signed application form * Financial statements: Provide detailed financial statements, including assets, liabilities, and income * Credit reports: Lenders will review your credit reports to assess your creditworthiness * Appraisal report: An independent appraisal of the property’s value * Title report: A report detailing the property’s ownership history and any outstanding liens

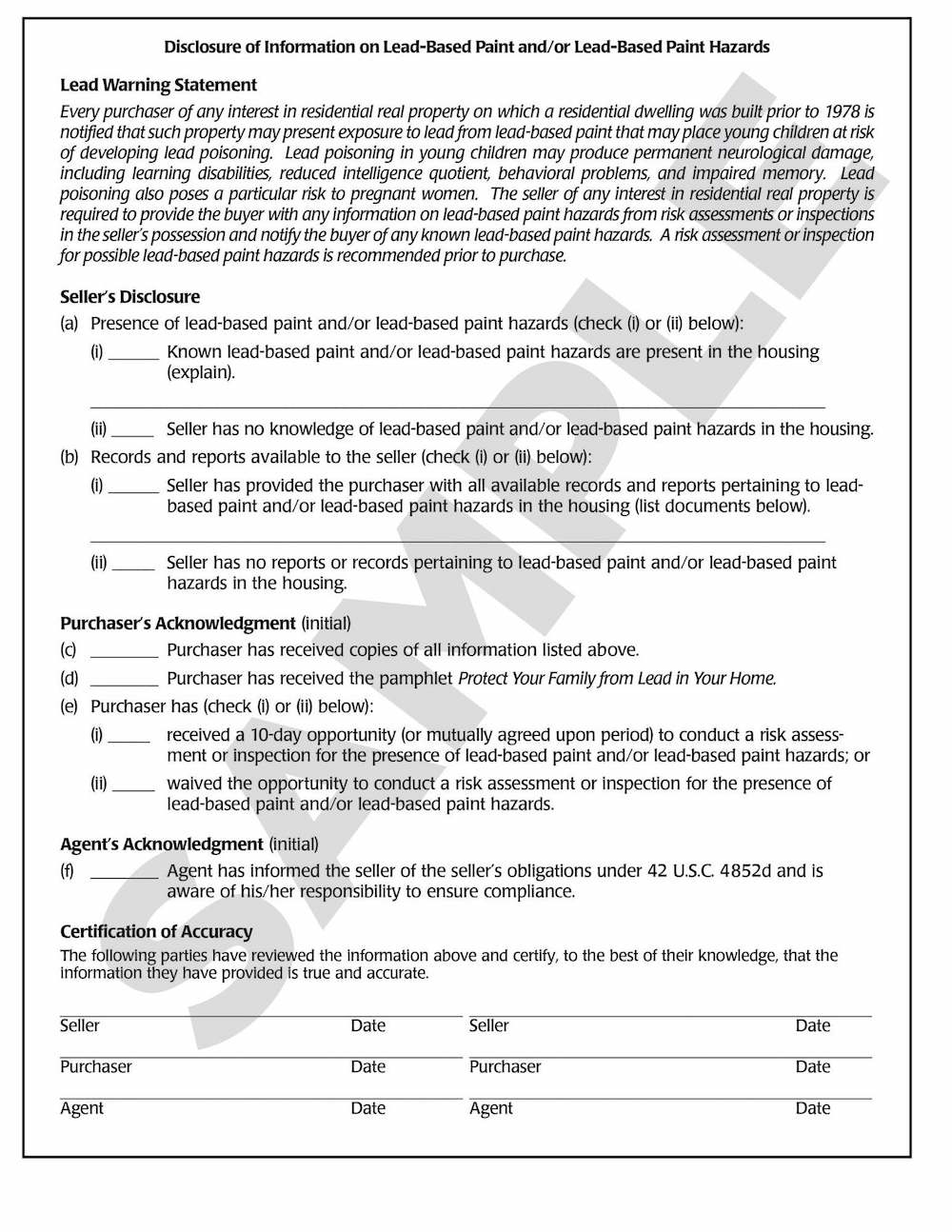

Property-Related Paperwork

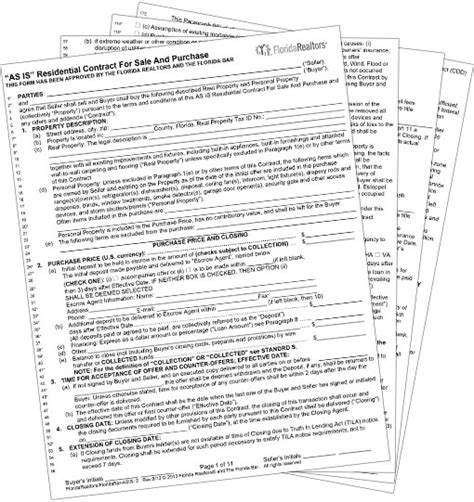

In addition to the mortgage application paperwork, you’ll also need to review and sign various property-related documents, including: * Purchase agreement: A contract outlining the terms of the sale, including price, closing date, and contingencies * Property inspection report: A report detailing the condition of the property and any potential issues * Title insurance: Insurance protecting you against any defects in the property’s title * Survey report: A report detailing the property’s boundaries and any potential encroachments

Closing Paperwork

The final stage of the home-buying process involves closing, where you’ll sign the remaining documents and transfer ownership of the property. The following are some of the key documents you’ll need to sign: * Closing disclosure: A document outlining the final terms of the loan, including interest rate, repayment terms, and closing costs * Deed: A document transferring ownership of the property from the seller to you * Mortgage note: A document outlining the terms of the mortgage, including repayment terms and interest rate * Property transfer taxes: Taxes paid to the government to transfer ownership of the property

📝 Note: It's essential to carefully review all paperwork before signing, ensuring you understand the terms and conditions of the sale and mortgage.

Conclusion and Final Thoughts

Buying a house involves a significant amount of paperwork, but being prepared and understanding the requirements can make the process less overwhelming. By gathering the necessary documents, reviewing and signing the various agreements, and carefully reviewing the closing paperwork, you’ll be well on your way to owning your dream home. Remember to stay organized, ask questions, and seek professional advice when needed to ensure a smooth and successful transaction.

What is the typical timeframe for closing on a house?

+

The typical timeframe for closing on a house is 30-60 days, but this can vary depending on the complexity of the transaction and the efficiency of the parties involved.

What are the most common contingencies included in a purchase agreement?

+

The most common contingencies included in a purchase agreement are financing contingencies, inspection contingencies, and appraisal contingencies.

Can I negotiate the terms of the mortgage with the lender?

+

Yes, you can negotiate the terms of the mortgage with the lender, including the interest rate, repayment terms, and closing costs. It’s essential to shop around and compare offers from different lenders to find the best deal.