File Bankruptcy Paperwork Requirements

Introduction to Bankruptcy Paperwork Requirements

When considering filing for bankruptcy, it’s essential to understand the various paperwork requirements involved in the process. Filing for bankruptcy can be a complex and time-consuming task, and it’s crucial to ensure that all necessary documents are completed and submitted accurately. In this article, we will delve into the world of bankruptcy paperwork requirements, exploring the different types of documents needed, the information required, and the steps involved in filing for bankruptcy.

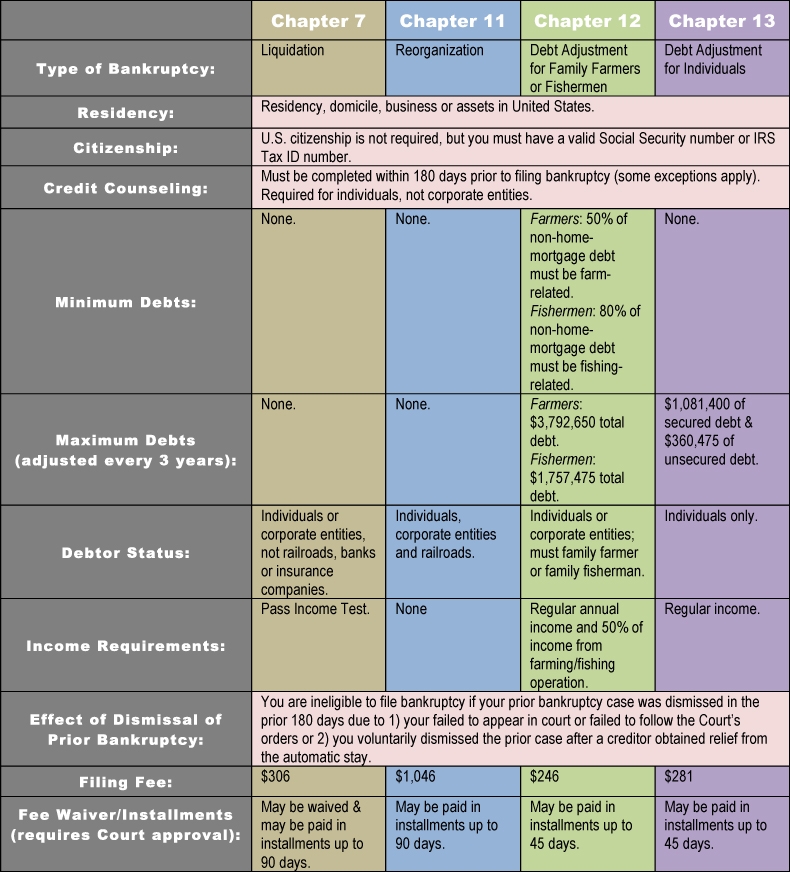

Types of Bankruptcy

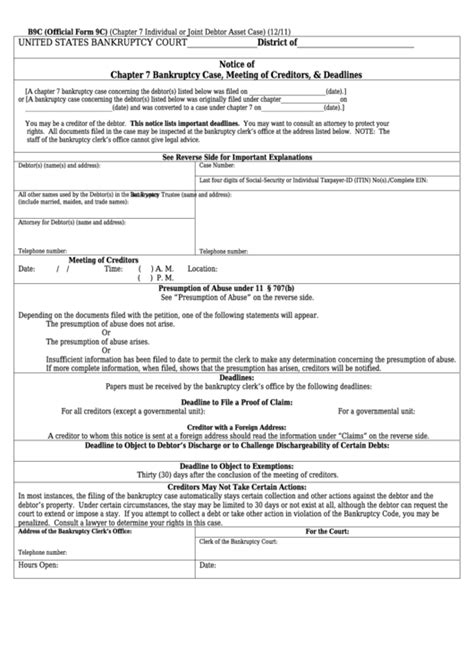

Before diving into the paperwork requirements, it’s essential to understand the different types of bankruptcy. The most common types of bankruptcy are: * Chapter 7 Bankruptcy: Also known as liquidation bankruptcy, this type of bankruptcy involves the sale of non-exempt assets to pay off creditors. * Chapter 13 Bankruptcy: This type of bankruptcy involves creating a repayment plan to pay off a portion of debts over time. * Chapter 11 Bankruptcy: This type of bankruptcy is typically used by businesses to restructure debts and continue operating.

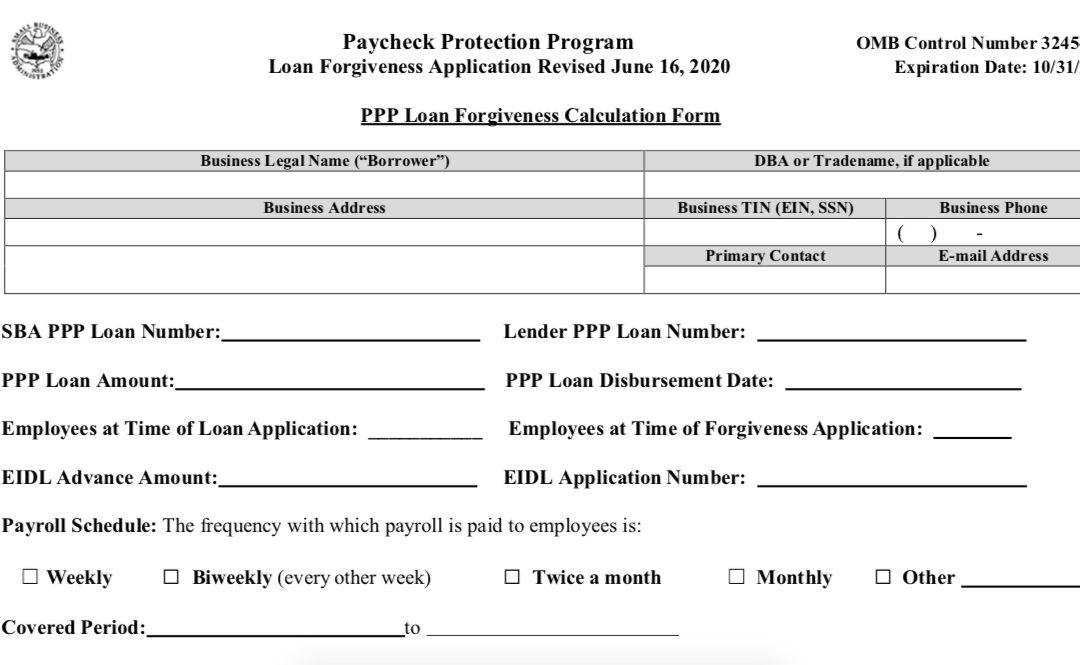

Bankruptcy Paperwork Requirements

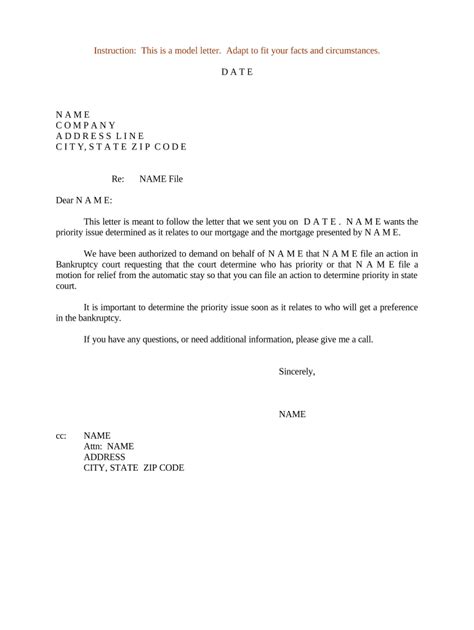

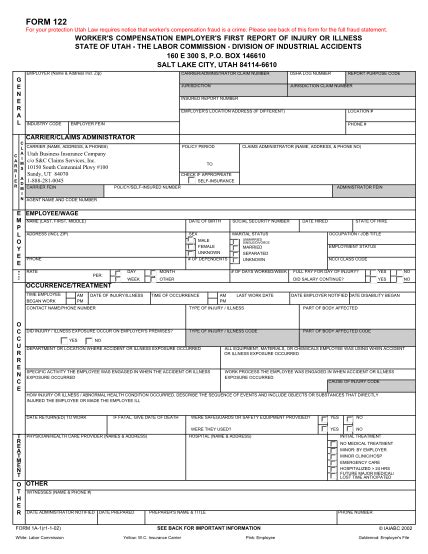

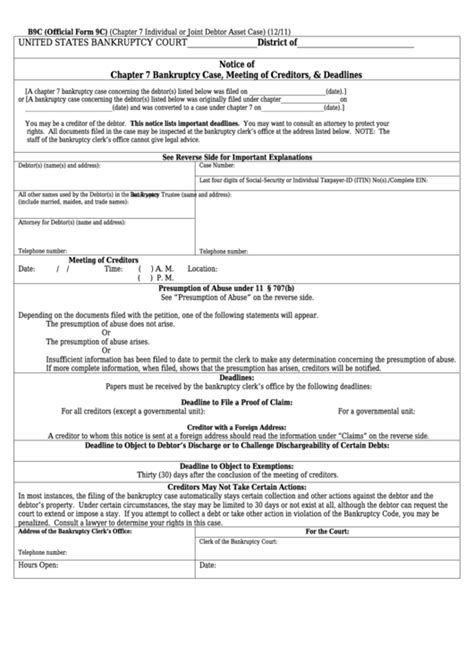

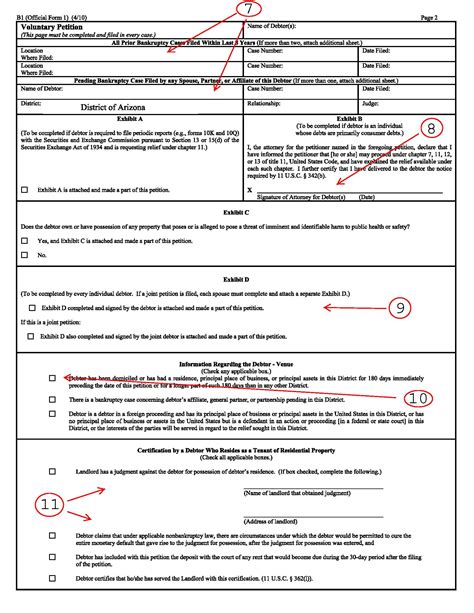

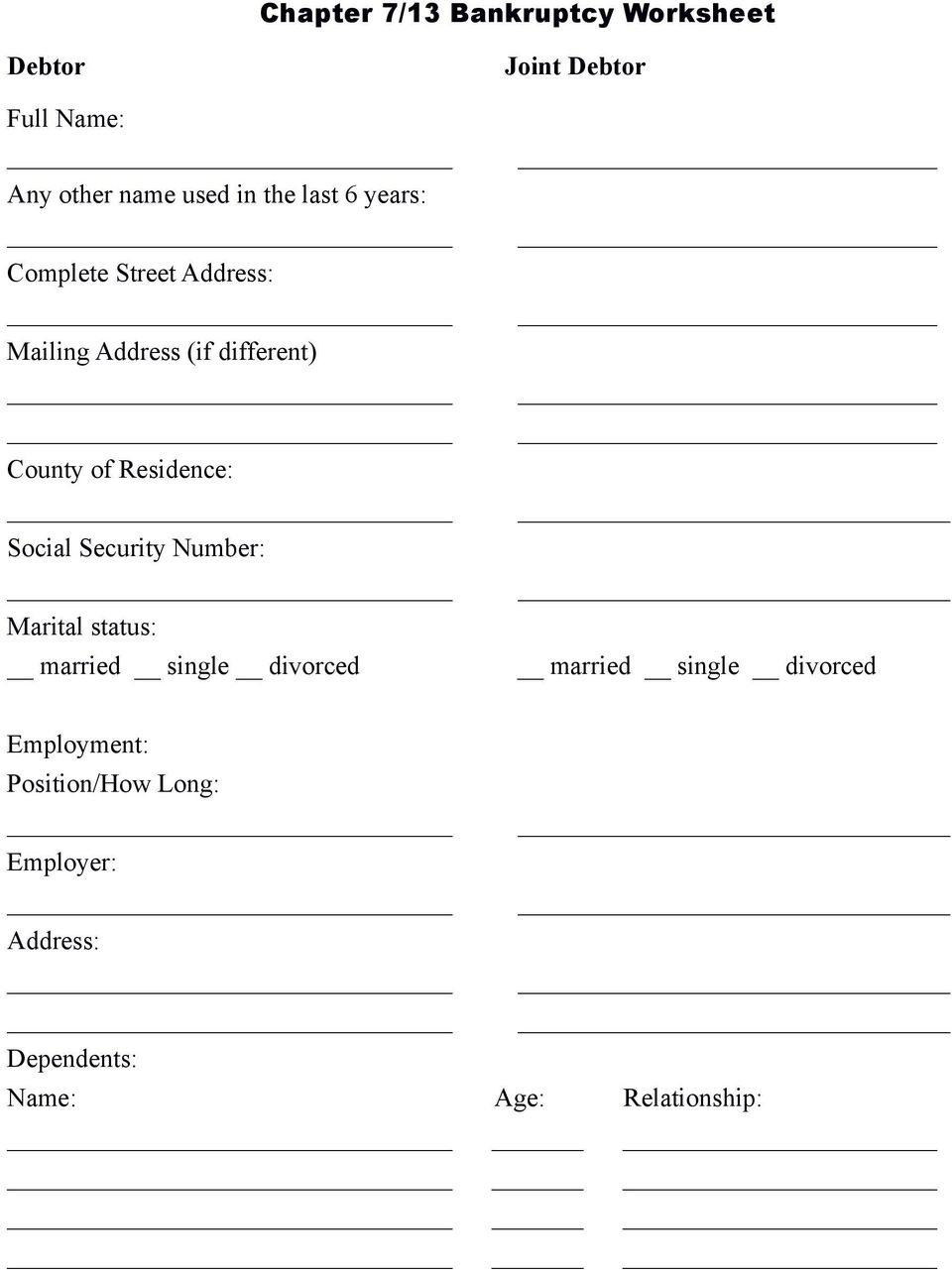

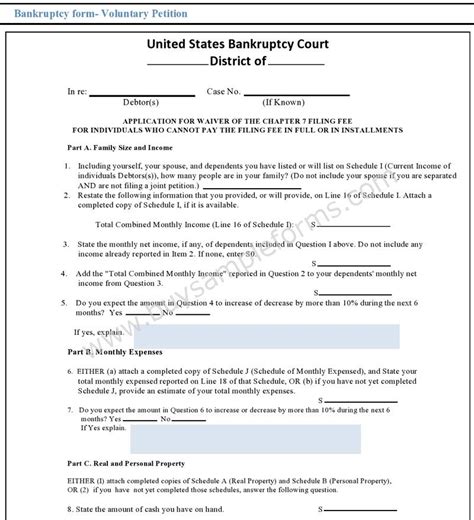

The paperwork requirements for bankruptcy vary depending on the type of bankruptcy being filed. However, some common documents required for bankruptcy include: * Petition: The petition is the initial document filed with the court to begin the bankruptcy process. * Schedules: Schedules are documents that provide detailed information about the debtor’s assets, liabilities, and income. * Statement of Financial Affairs: This document provides a detailed overview of the debtor’s financial transactions and activities. * Means Test: The means test is used to determine whether the debtor is eligible for Chapter 7 bankruptcy or if they must file for Chapter 13 bankruptcy. * Plan: In Chapter 13 bankruptcy, a plan is required to outline the repayment terms and conditions.

Information Required for Bankruptcy Paperwork

When completing bankruptcy paperwork, debtors will need to provide a significant amount of personal and financial information, including: * Personal identification information: Name, address, social security number, and date of birth. * Financial information: Income, expenses, assets, liabilities, and debt obligations. * Employment information: Employment status, income, and job history. * Asset information: Value and description of assets, including real estate, vehicles, and personal property.

Steps Involved in Filing for Bankruptcy

The steps involved in filing for bankruptcy vary depending on the type of bankruptcy being filed. However, some common steps include: * Pre-bankruptcy counseling: Debtors are required to complete pre-bankruptcy counseling before filing for bankruptcy. * Filing the petition: The petition is filed with the court to begin the bankruptcy process. * Submitting schedules and statements: Schedules and statements are submitted to provide detailed information about the debtor’s financial situation. * Means test: The means test is completed to determine eligibility for Chapter 7 bankruptcy. * Plan confirmation: In Chapter 13 bankruptcy, the plan is confirmed by the court.

| Document | Description |

|---|---|

| Petition | Initial document filed with the court to begin the bankruptcy process |

| Schedules | Documents that provide detailed information about the debtor's assets, liabilities, and income |

| Statement of Financial Affairs | Document that provides a detailed overview of the debtor's financial transactions and activities |

💡 Note: It's essential to seek the advice of a qualified bankruptcy attorney to ensure that all necessary documents are completed and submitted accurately.

Conclusion and Final Thoughts

Filing for bankruptcy can be a complex and time-consuming process, requiring a significant amount of paperwork and documentation. By understanding the different types of bankruptcy, the paperwork requirements, and the steps involved in filing for bankruptcy, debtors can better navigate the process and achieve a fresh financial start. It’s essential to seek the advice of a qualified bankruptcy attorney to ensure that all necessary documents are completed and submitted accurately, and to provide guidance and support throughout the bankruptcy process.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves the sale of non-exempt assets to pay off creditors, while Chapter 13 bankruptcy involves creating a repayment plan to pay off a portion of debts over time.

What is the means test, and how is it used in bankruptcy?

+

The means test is used to determine whether the debtor is eligible for Chapter 7 bankruptcy or if they must file for Chapter 13 bankruptcy. It takes into account the debtor’s income, expenses, and debt obligations to determine their ability to repay debts.

Do I need to hire a bankruptcy attorney to file for bankruptcy?

+

While it’s not required to hire a bankruptcy attorney, it’s highly recommended. A qualified bankruptcy attorney can provide guidance and support throughout the bankruptcy process, ensuring that all necessary documents are completed and submitted accurately.