PPP Loan Forgiveness Paperwork Deadline

Introduction to PPP Loan Forgiveness

The Paycheck Protection Program (PPP) was introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act to help small businesses and other eligible entities cope with the economic impact of the COVID-19 pandemic. One of the key benefits of the PPP is the potential for loan forgiveness, allowing businesses to use the funds for specific expenses without having to repay the loan, provided they meet certain conditions. Understanding the PPP loan forgiveness paperwork deadline is crucial for businesses seeking to take advantage of this benefit.

Eligibility for PPP Loan Forgiveness

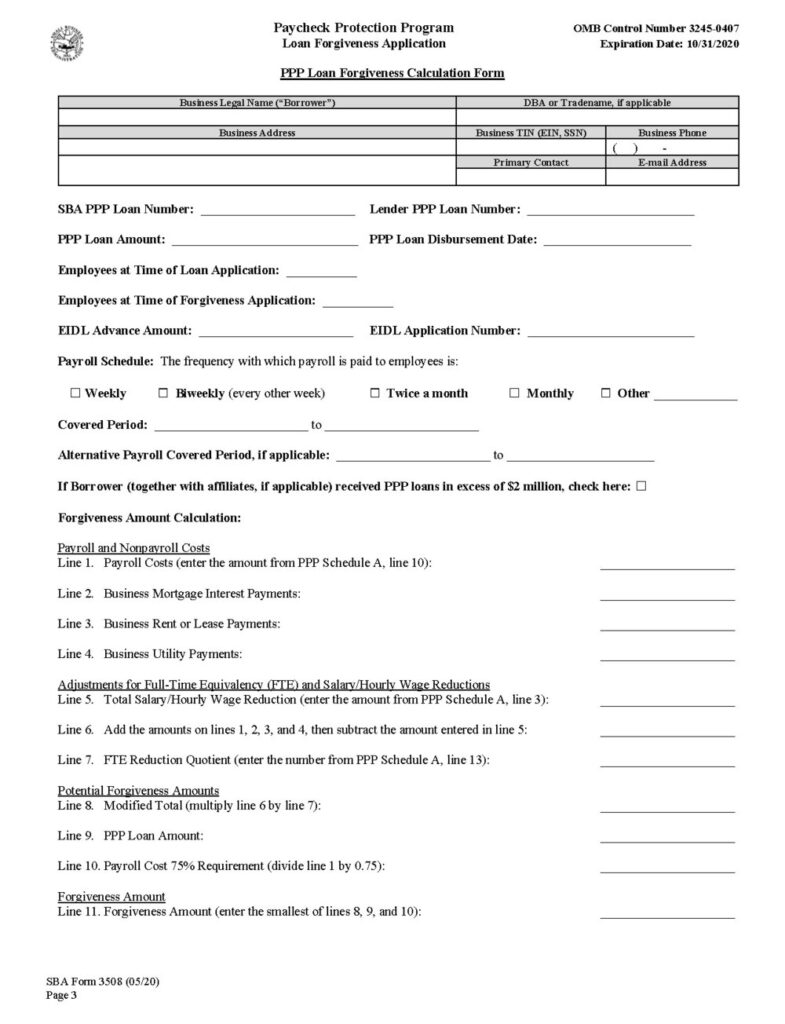

To be eligible for PPP loan forgiveness, businesses must use the loan proceeds for eligible expenses, which include: * Payload costs, such as rent or lease payments * Utilities, including electricity, gas, water, transportation, and internet access * Interest on mortgages in place before February 15, 2020 * Refinancing an SBA EIDL loan made between January 31, 2020, and April 3, 2020 * Worker protection expenses related to COVID-19, such as personal protective equipment * Unpaid expenses from the previous quarter for small businesses that were in operation before February 15, 2020

Businesses must also maintain employee and compensation levels to maximize forgiveness. The specific requirements can vary depending on when the loan was received and the size of the business.

PPP Loan Forgiveness Application Process

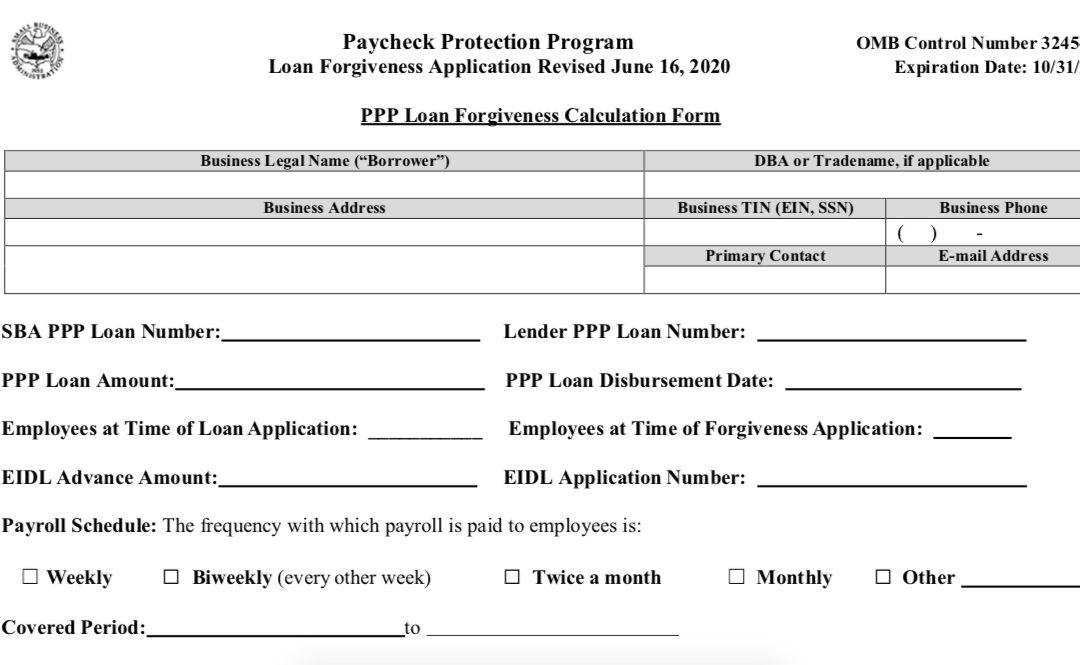

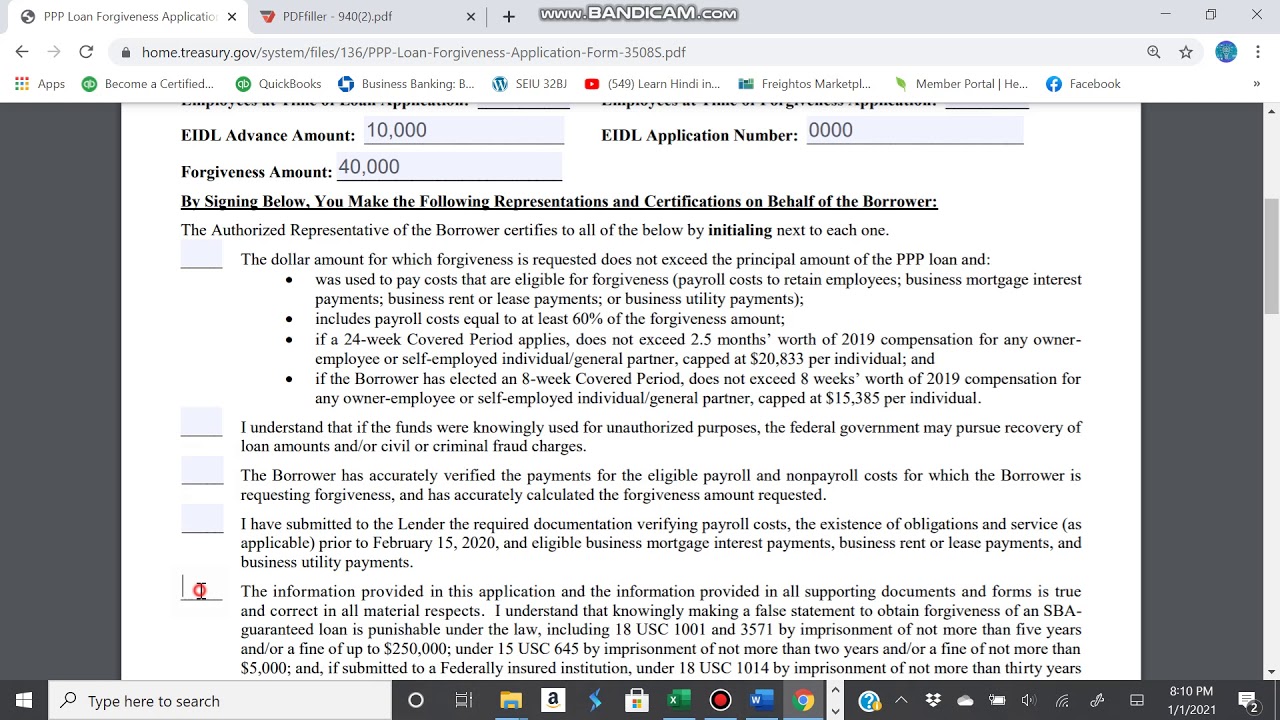

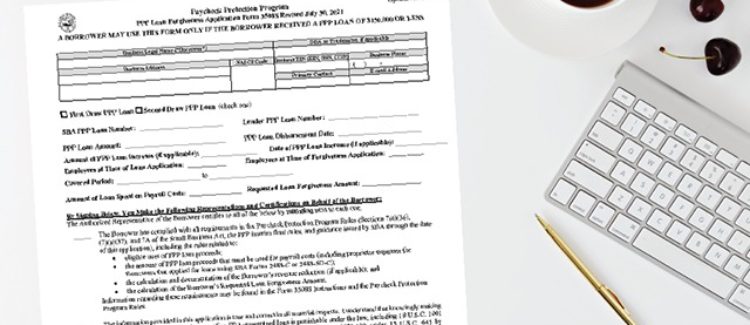

The process for applying for PPP loan forgiveness involves submitting an application to the lender that serviced the PPP loan. The application typically requires documentation to support the eligible expenses and to demonstrate compliance with the employee and compensation level requirements. There are three main forms used for the application process: * Form 3508: The standard form for loan forgiveness, which requires detailed documentation of expenses and staffing levels. * Form 3508EZ: A simplified form for borrowers who meet specific criteria, such as not reducing employee numbers or salaries. * Form 3508S: For loans of $150,000 or less, offering a more streamlined process with less documentation required.

PPP Loan Forgiveness Paperwork Deadline

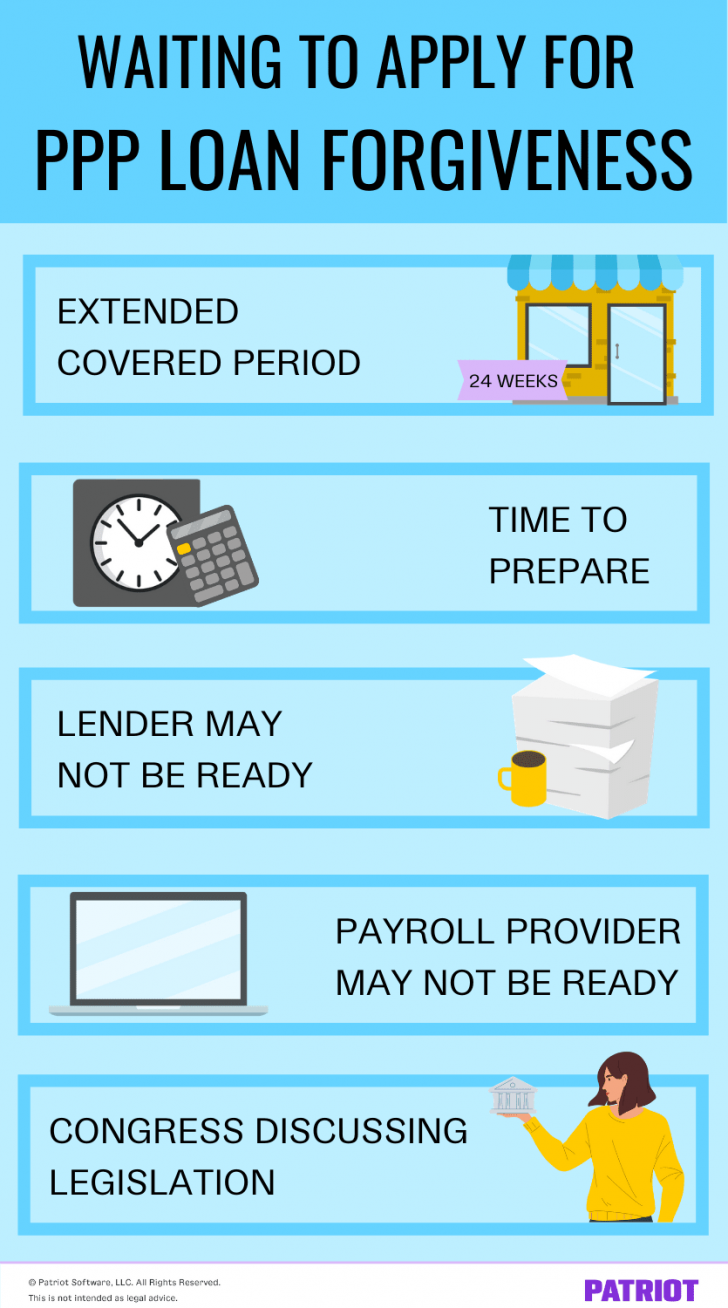

The deadline for submitting the PPP loan forgiveness application is 10 months after the end of the covered period for the loan. The covered period is the time during which the borrower can use the PPP loan funds for eligible expenses, and it can last anywhere from 8 to 24 weeks, depending on the borrower’s choice. If a borrower does not apply for loan forgiveness within this 10-month window, they will be required to begin making payments on the loan.

📝 Note: It's essential for borrowers to keep accurate records of their expenses and staffing levels throughout the covered period to ensure a smooth loan forgiveness application process.

Preparation for the Application

To prepare for the loan forgiveness application, businesses should: * Keep detailed records of all eligible expenses. * Document any changes in employee numbers or compensation levels. * Ensure compliance with all PPP requirements. * Choose the correct application form based on their situation. * Submit the application within the specified deadline.

Importance of Meeting the Deadline

Meeting the PPP loan forgiveness paperwork deadline is crucial. Failure to submit the application on time could result in the borrower being responsible for repaying the loan, including interest. Given the economic challenges posed by the pandemic, avoiding unnecessary debt can be vital for the survival and success of small businesses.

Conclusion and Next Steps

In summary, understanding and meeting the PPP loan forgiveness paperwork deadline is a critical step for businesses that have received a PPP loan. By being aware of the eligibility criteria, the application process, and the deadline, businesses can navigate the loan forgiveness process effectively. It is also important for businesses to stay informed about any updates or changes to the PPP program, as these can impact the loan forgiveness process.

What is the main requirement for PPP loan forgiveness?

+

The main requirement is to use the loan proceeds for eligible expenses, such as payroll costs, utilities, and interest on mortgages, and to maintain employee and compensation levels.

How long do borrowers have to apply for loan forgiveness?

+

Borrowers have 10 months after the end of the covered period to apply for loan forgiveness.

What happens if a borrower misses the loan forgiveness application deadline?

+

If a borrower misses the deadline, they will be required to begin making payments on the loan, including interest.