House Buying Paperwork Needed

Introduction to House Buying Paperwork

When purchasing a house, it’s essential to understand the various documents and paperwork involved in the process. The sheer amount of paperwork can be overwhelming, but being prepared and knowing what to expect can make the experience less stressful. In this article, we will guide you through the necessary paperwork needed when buying a house, highlighting key documents, and providing tips on how to navigate the process.

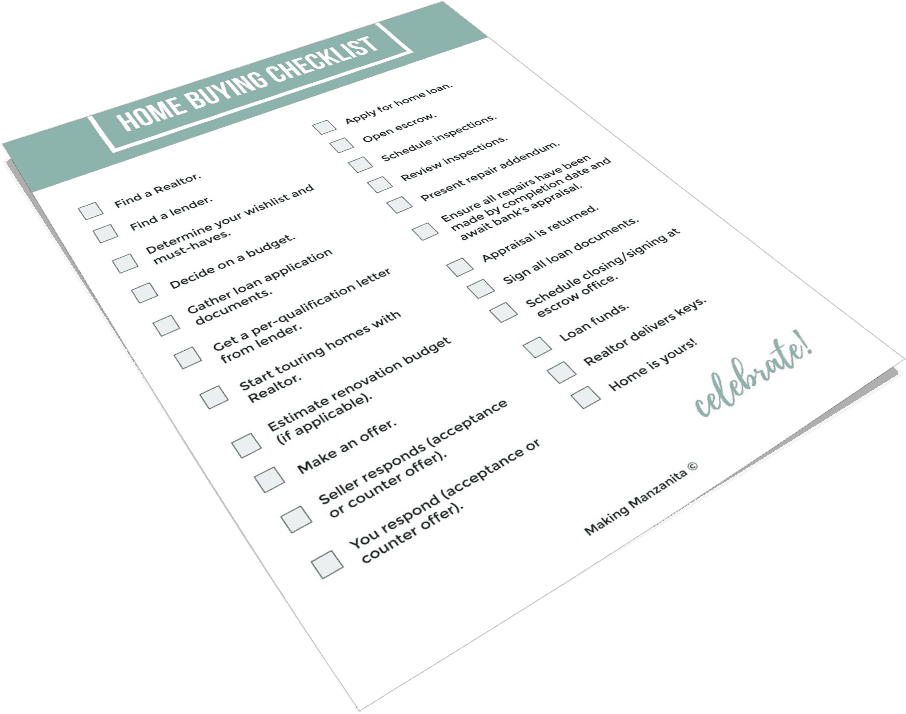

Pre-Approval and Pre-Qualification

Before starting your house hunt, it’s crucial to get pre-approved or pre-qualified for a mortgage. This step involves contacting a lender and providing financial information to determine how much you can borrow. The lender will review your credit score, income, and other factors to provide a pre-approval letter, which is usually valid for 30 to 60 days. This letter will specify the loan amount and interest rate you’re eligible for. Keep in mind that pre-approval and pre-qualification are not the same, as pre-approval is a more formal process that requires more documentation.

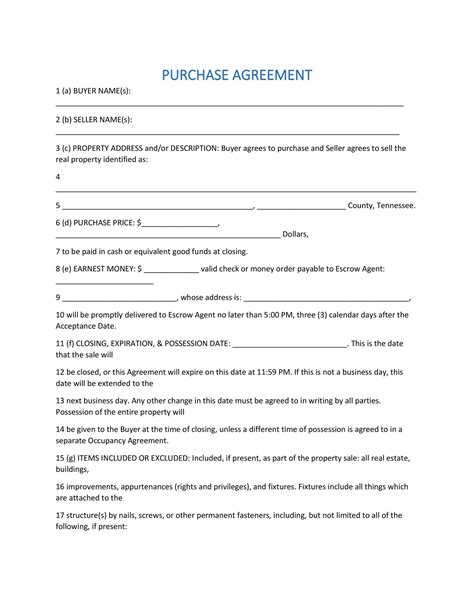

Offer and Acceptance

Once you find a house you like, you’ll need to make an offer, which typically includes: * The price you’re willing to pay * Contingencies, such as a home inspection or financing * Your proposed closing date * Other terms, like inclusions or exclusions If the seller accepts your offer, you’ll receive a signed copy of the offer, which becomes a binding contract. It’s essential to carefully review the contract before signing, as it outlines the terms and conditions of the sale.

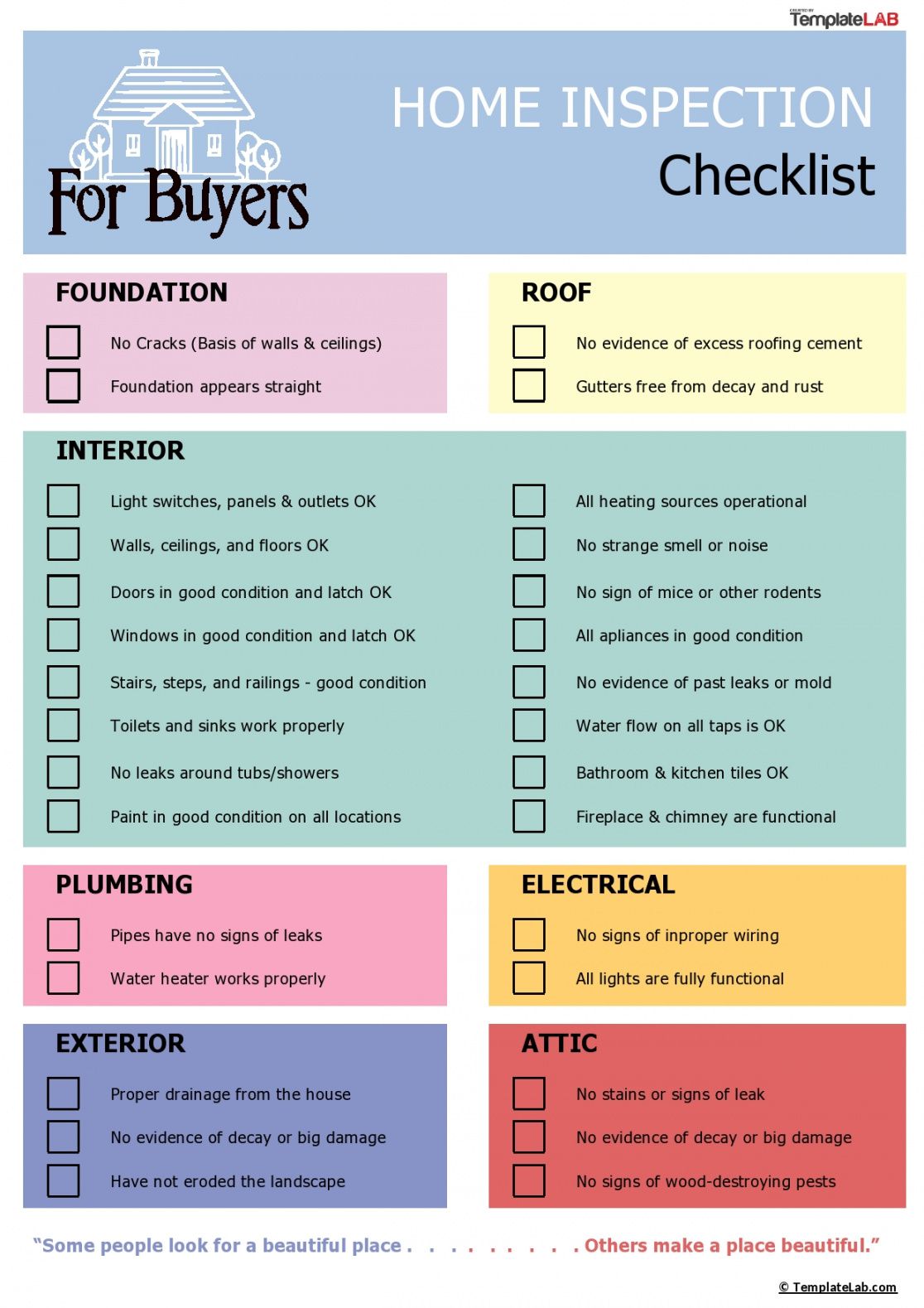

Inspections and Due Diligence

After the offer is accepted, you’ll typically have a certain period (usually 10 to 14 days) to conduct inspections and due diligence. This may include: * Home inspection: to identify any potential issues with the property * Termite inspection: to check for termite damage * Review of property records: to ensure the seller has clear ownership * Review of neighborhood zoning and land-use laws These inspections can help you identify potential problems and negotiate with the seller or even back out of the deal if necessary.

Loan Application and Processing

With your offer accepted, you’ll need to formally apply for a mortgage. This involves providing the lender with: * Identification and income verification * Bank statements and asset documentation * Credit reports and credit score * Property appraisal (if required) The lender will review your application and order an appraisal of the property to ensure its value. This process can take several weeks, so it’s essential to plan ahead and stay in communication with your lender.

Closing and Settlement

The final step in the house buying process is closing and settlement. This typically involves: * Reviewing and signing the final loan documents * Transferring the ownership of the property * Paying closing costs, such as title insurance and escrow fees * Receiving the keys to your new home It’s essential to carefully review the closing disclosure before signing, as it outlines the final terms of the loan and the costs associated with the transaction.

📝 Note: Be sure to ask questions and seek clarification if you're unsure about any part of the process.

Key Documents Needed

Here are some of the key documents you’ll need when buying a house: * Identification: driver’s license, passport, or state ID * Income verification: pay stubs, W-2 forms, or tax returns * Bank statements: to verify assets and income * Credit reports: to check credit score and history * Appraisal report: to determine the value of the property * Title report: to ensure the seller has clear ownership * Home inspection report: to identify potential issues with the property * Loan application: to formally apply for a mortgage * Closing disclosure: to outline the final terms of the loan

Additional Tips and Reminders

Here are some additional tips to keep in mind when navigating the house buying paperwork: * Stay organized: keep all documents and paperwork in a designated folder or file * Ask questions: don’t be afraid to ask your lender, real estate agent, or attorney for clarification * Review carefully: take the time to review each document and contract before signing * Plan ahead: anticipate potential delays and stay in communication with your lender and other parties involved

What is the difference between pre-approval and pre-qualification?

+

Pre-approval is a more formal process that requires more documentation and provides a more accurate estimate of the loan amount and interest rate. Pre-qualification is a less formal process that provides a general idea of the loan amount and interest rate.

What are closing costs, and how much can I expect to pay?

+

Closing costs are fees associated with the home buying process, such as title insurance, escrow fees, and appraisal fees. The amount of closing costs can vary, but typically ranges from 2% to 5% of the purchase price.

How long does the home buying process typically take?

+

The home buying process can take anywhere from 30 to 60 days, depending on the complexity of the transaction and the speed of the parties involved.

In summary, buying a house involves a significant amount of paperwork and documentation. By understanding the key documents and steps involved, you can navigate the process with confidence and ensure a smooth transaction. Remember to stay organized, ask questions, and review carefully to avoid potential pitfalls and delays. With the right mindset and preparation, you can successfully navigate the house buying paperwork and achieve your dream of homeownership.