Mortgage Paperwork Requirements

Introduction to Mortgage Paperwork Requirements

When applying for a mortgage, it’s essential to understand the various paperwork requirements involved in the process. The mortgage application process can be complex and time-consuming, but being prepared with the necessary documents can help streamline the process. In this article, we’ll delve into the different types of paperwork required for a mortgage application, including income verification, credit reports, and property valuation.

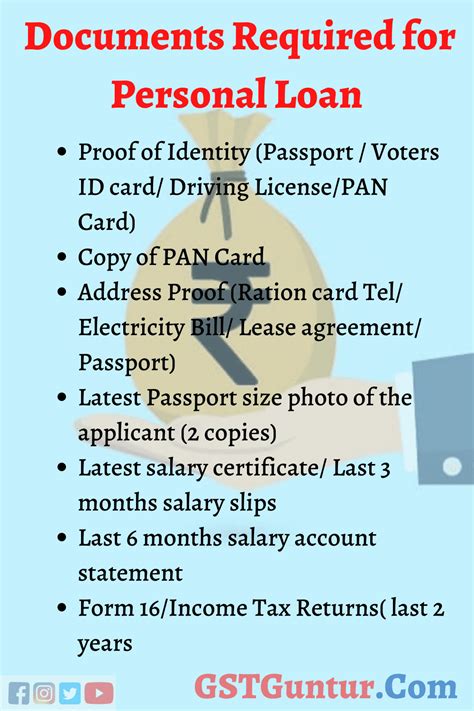

Income Verification Documents

To verify your income, you’ll typically need to provide the following documents: * Pay stubs from the past 30 days * W-2 forms from the past two years * Tax returns from the past two years * Letters from your employer confirming your employment status and salary * Any other documents that demonstrate your income, such as investment accounts or retirement accounts

These documents will help your lender determine your ability to repay the mortgage. It’s crucial to ensure that your income is stable and sufficient to cover your monthly mortgage payments.

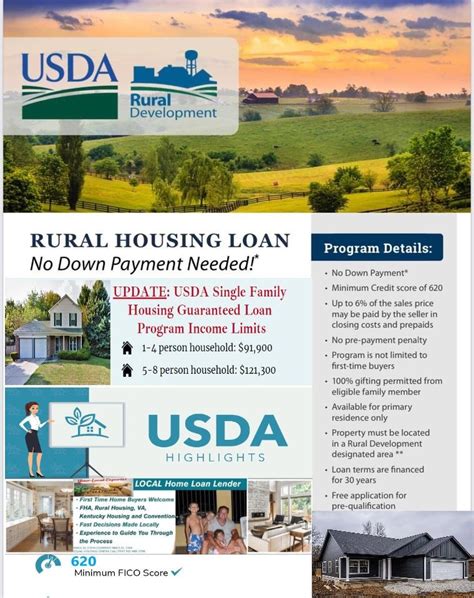

Credit Report Requirements

Your credit report plays a significant role in determining your mortgage eligibility. Lenders will typically require: * A credit score of at least 620, although some lenders may have stricter requirements * A credit history that demonstrates responsible borrowing and repayment habits * Any credit accounts you’ve opened or closed in the past few years * Information about any bankruptcies, foreclosures, or collections on your credit report

It’s essential to review your credit report before applying for a mortgage to ensure there are no errors or surprises that could affect your application.

Property Valuation Documents

To determine the value of the property you’re purchasing, you’ll need to provide: * An appraisal report from a licensed appraiser * A property inspection report that highlights any potential issues with the property * Any title reports or title insurance that demonstrate clear ownership of the property * Information about any outstanding liens or encumbrances on the property

These documents will help your lender determine the value of the property and ensure that it’s sufficient to secure the mortgage.

Additional Documents

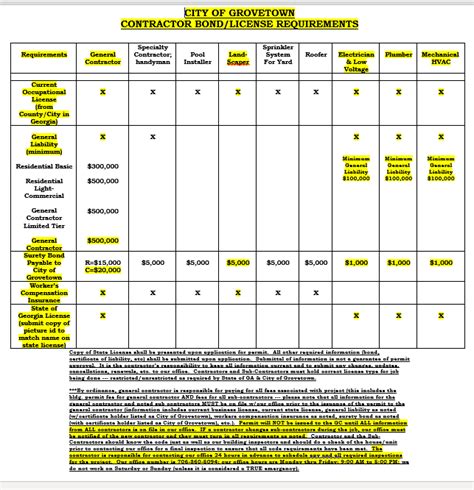

In addition to the documents mentioned above, you may need to provide: * Identification documents, such as a driver’s license or passport * Proof of insurance for the property * Any other documents that your lender requires to process your application

It’s essential to be prepared and have all the necessary documents ready to go when you apply for a mortgage.

💡 Note: The specific documents required may vary depending on your lender and the type of mortgage you're applying for. Be sure to check with your lender to determine their specific requirements.

Table of Mortgage Paperwork Requirements

The following table summarizes the typical paperwork requirements for a mortgage application:

| Document Type | Description |

|---|---|

| Income Verification | Pay stubs, W-2 forms, tax returns, letters from employer |

| Credit Report | Credit score, credit history, credit accounts, bankruptcies, foreclosures, collections |

| Property Valuation | Appraisal report, property inspection report, title reports, title insurance |

| Additional Documents | Identification documents, proof of insurance, other documents as required by lender |

In summary, the mortgage application process involves providing a range of paperwork to verify your income, creditworthiness, and the value of the property you’re purchasing. By being prepared and having all the necessary documents ready, you can help streamline the process and increase your chances of approval. It’s essential to work closely with your lender to determine their specific requirements and ensure that you have everything you need to secure your mortgage.

What is the minimum credit score required for a mortgage?

+

The minimum credit score required for a mortgage varies depending on the lender and the type of mortgage. However, most lenders require a credit score of at least 620.

How long does the mortgage application process typically take?

+

The mortgage application process can take anywhere from a few days to several weeks, depending on the complexity of the application and the speed of the lender.

Can I apply for a mortgage online?

+

Yes, many lenders offer online mortgage applications. However, you may still need to provide physical documentation and attend an in-person meeting with a loan officer.