5 Tips Insure Car

Introduction to Car Insurance

When it comes to protecting your vehicle, car insurance is an essential investment. It not only provides financial protection against physical damage or loss but also covers legal liabilities that may arise from accidents. With so many options available in the market, choosing the right car insurance policy can be overwhelming. Here are five tips to help you make an informed decision and ensure your car is adequately insured.

Understanding Your Needs

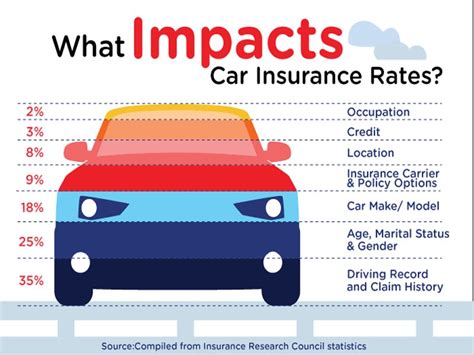

Before purchasing a car insurance policy, it’s crucial to assess your needs. Consider the value of your vehicle, your driving habits, and the level of coverage you require. If you have a brand-new car, you may want to opt for comprehensive coverage, which includes collision and comprehensive insurance. On the other hand, if you have an older vehicle, liability insurance might be sufficient.

Some key factors to consider when evaluating your needs include: * The value of your vehicle * Your driving history * The level of coverage you require * Your budget

Comparing Insurance Providers

With numerous insurance providers in the market, it’s essential to compare policies and choose the one that best suits your needs. Look for providers that offer flexible coverage options, competitive premiums, and excellent customer service. You can research online, read reviews, or consult with friends and family to find the most suitable insurer.

Some key factors to consider when comparing insurance providers include: * Coverage options * Premium rates * Customer service * Claim settlement process

Policy Add-Ons and Riders

In addition to the basic coverage, insurance providers offer various add-ons and riders that can enhance your policy. These may include features like roadside assistance, zero depreciation cover, or engine protector. While these add-ons can increase your premium, they provide additional protection and benefits in the event of a claim.

Some common policy add-ons and riders include: * Roadside assistance * Zero depreciation cover * Engine protector * Accessories cover

Discounts and Offers

Insurance providers often offer discounts and offers to attract new customers or retain existing ones. These may include discounts for good driving habits, loyalty rewards, or bundle discounts for multiple policies. Be sure to ask about these offers when purchasing your policy, as they can help reduce your premium.

Some common discounts and offers include: * Good driving habits discount * Loyalty rewards * Bundle discounts * Student discounts

Claims Process

In the event of a claim, it’s essential to understand the claims process. Look for insurance providers with a simple and efficient claims settlement process. Check if they have a 24⁄7 claims support hotline, online claims filing option, or a dedicated claims team.

Some key factors to consider when evaluating the claims process include: * Claims support hotline * Online claims filing option * Dedicated claims team * Claim settlement timeline

📝 Note: Always read the policy documents carefully and ask questions if you're unsure about any aspect of the coverage.

In summary, choosing the right car insurance policy requires careful consideration of your needs, insurance providers, policy add-ons, discounts, and claims process. By following these five tips, you can ensure your car is adequately insured and enjoy peace of mind on the road.

What is the difference between comprehensive and liability insurance?

+

Comprehensive insurance covers physical damage or loss to your vehicle, while liability insurance covers legal liabilities arising from accidents.

How can I reduce my car insurance premium?

+

You can reduce your premium by maintaining a good driving record, installing safety devices, or opting for a higher deductible.

What is the importance of reading policy documents carefully?

+

Reading policy documents carefully helps you understand the terms and conditions, coverage, and exclusions, ensuring you make an informed decision and avoid any surprises during claims.