Open Checking Account Paperwork Needed

Introduction to Opening a Checking Account

When it comes to managing your finances, having a checking account is essential. It provides a safe and convenient way to store your money, write checks, and make purchases using a debit card. However, before you can start using your new account, you’ll need to go through the process of opening one. This typically involves filling out paperwork and providing certain documents to verify your identity and address. In this article, we’ll guide you through the necessary steps and paperwork needed to open a checking account.

Required Documents

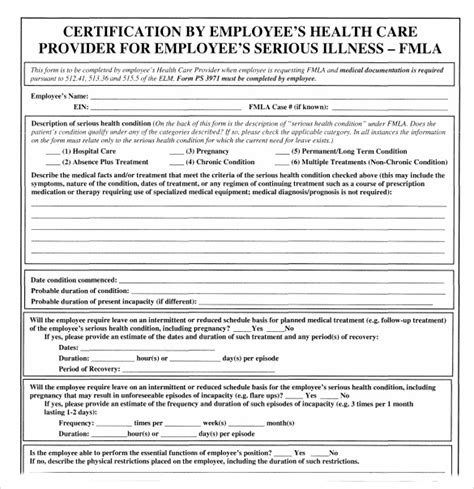

To open a checking account, you’ll typically need to provide some personal and identification documents. These may include:

- Government-issued ID: This can be a driver’s license, state ID, or passport.

- Social Security number or Individual Taxpayer Identification Number (ITIN): You may need to provide your Social Security card or a document showing your ITIN.

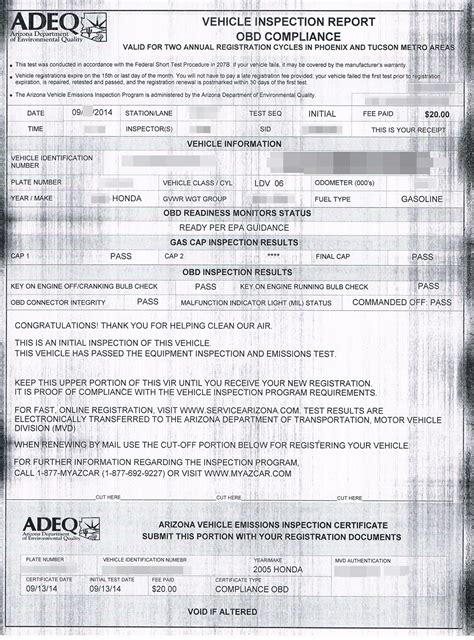

- Proof of address: This can be a utility bill, lease agreement, or another document showing your current address.

- Employment information: You may need to provide your employer’s name and address, as well as your job title and income information.

Application Process

The application process for opening a checking account typically involves the following steps:

- Filling out the application: You’ll need to provide your personal and contact information, as well as answer some questions about your financial history and employment status.

- Providing required documents: You’ll need to submit the documents mentioned earlier, such as your ID, Social Security number, and proof of address.

- Funding your account: You’ll need to make an initial deposit to open your account. This can be done using cash, a check, or a transfer from another account.

- Reviewing and signing the account agreement: Once your application is approved, you’ll need to review and sign the account agreement, which outlines the terms and conditions of your account.

Types of Checking Accounts

There are several types of checking accounts to choose from, each with its own features and benefits. Some common types of checking accounts include:

- Basic checking accounts: These accounts typically have low or no monthly maintenance fees and are a good option for those who just need a simple account for everyday expenses.

- Interest-bearing checking accounts: These accounts earn interest on your balance, but may have higher monthly maintenance fees or require a minimum balance to avoid fees.

- Student checking accounts: These accounts are designed for students and may have lower fees and more flexible terms.

- Senior checking accounts: These accounts are designed for seniors and may have lower fees and more benefits, such as free checks and ATM withdrawals.

Online Checking Accounts

With the rise of online banking, it’s now possible to open a checking account entirely online. This can be a convenient option for those who prefer to bank from the comfort of their own home. To open an online checking account, you’ll typically need to:

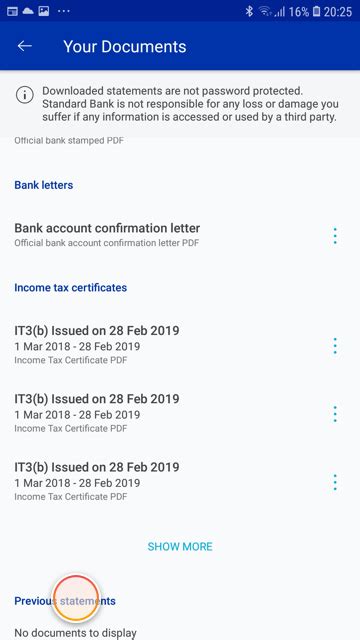

- Fill out the online application: You’ll need to provide your personal and contact information, as well as answer some questions about your financial history and employment status.

- Upload required documents: You’ll need to upload scanned copies of your ID, Social Security number, and proof of address.

- Fund your account: You can fund your account using a transfer from another account or by mailing a check.

📝 Note: When opening an online checking account, make sure to carefully review the account agreement and terms before signing.

Checking Account Fees

When opening a checking account, it’s essential to understand the fees associated with the account. Some common fees include:

- Monthly maintenance fees: These fees are charged every month, regardless of your account activity.

- Overdraft fees: These fees are charged when you withdraw more money than you have in your account.

- ATM fees: These fees are charged when you use an out-of-network ATM.

- Minimum balance fees: These fees are charged when your account balance falls below a certain minimum.

| Fee Type | Description |

|---|---|

| Monthly Maintenance Fee | A monthly fee charged to maintain your account |

| Overdraft Fee | A fee charged when you withdraw more money than you have in your account |

| ATM Fee | A fee charged when you use an out-of-network ATM |

| Minimum Balance Fee | A fee charged when your account balance falls below a certain minimum |

In summary, opening a checking account requires some paperwork and documentation, but it’s a relatively straightforward process. By understanding the different types of checking accounts, online checking accounts, and associated fees, you can make an informed decision and choose the best account for your needs.

What documents do I need to open a checking account?

+

To open a checking account, you’ll typically need to provide a government-issued ID, Social Security number or ITIN, and proof of address.

Can I open a checking account online?

+

Yes, many banks and credit unions offer online checking accounts that can be opened entirely online.

What are some common fees associated with checking accounts?

+

Common fees include monthly maintenance fees, overdraft fees, ATM fees, and minimum balance fees.