5 Refinance Papers Needed

Introduction to Refinance Papers

When considering refinancing a mortgage, there are several key documents that borrowers need to gather and understand. These documents, often referred to as refinance papers, are crucial for a smooth and successful refinancing process. In this article, we will delve into the details of the 5 primary refinance papers needed, their significance, and how they contribute to the overall refinancing journey.

Understanding Refinance Papers

Refinancing a mortgage involves replacing an existing mortgage with a new one, typically to secure a better interest rate, lower monthly payments, or to tap into the home’s equity. The process requires careful consideration and the preparation of various documents. These documents serve as the foundation of the refinancing application, providing lenders with the necessary information to assess the borrower’s creditworthiness and the property’s value.

1. Loan Application

The loan application is the initial document in the refinancing process. It provides comprehensive information about the borrower, including employment history, income, credit score, and the purpose of the loan. This document is crucial as it sets the stage for the lender’s evaluation of the borrower’s eligibility for refinancing.

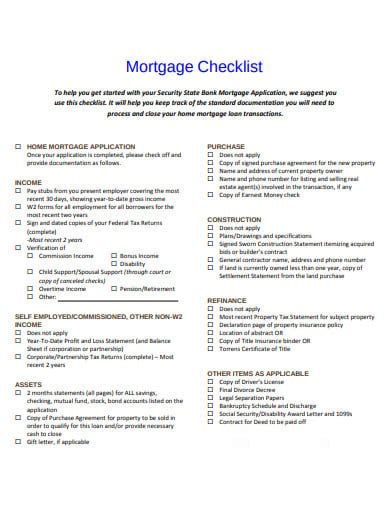

2. Pay Stubs and W-2 Forms

Income verification is a critical aspect of the refinancing process. Borrowers are required to submit recent pay stubs and W-2 forms to demonstrate their income stability and capacity to repay the loan. These documents help lenders understand the borrower’s financial situation and make informed decisions about the loan amount and terms.

3. Bank Statements

Bank statements are essential for verifying the borrower’s savings, investments, and debt obligations. Lenders review these statements to assess the borrower’s financial health, ensuring they have sufficient funds for down payments, closing costs, and ongoing mortgage payments. Bank statements also provide insight into the borrower’s spending habits and credit management.

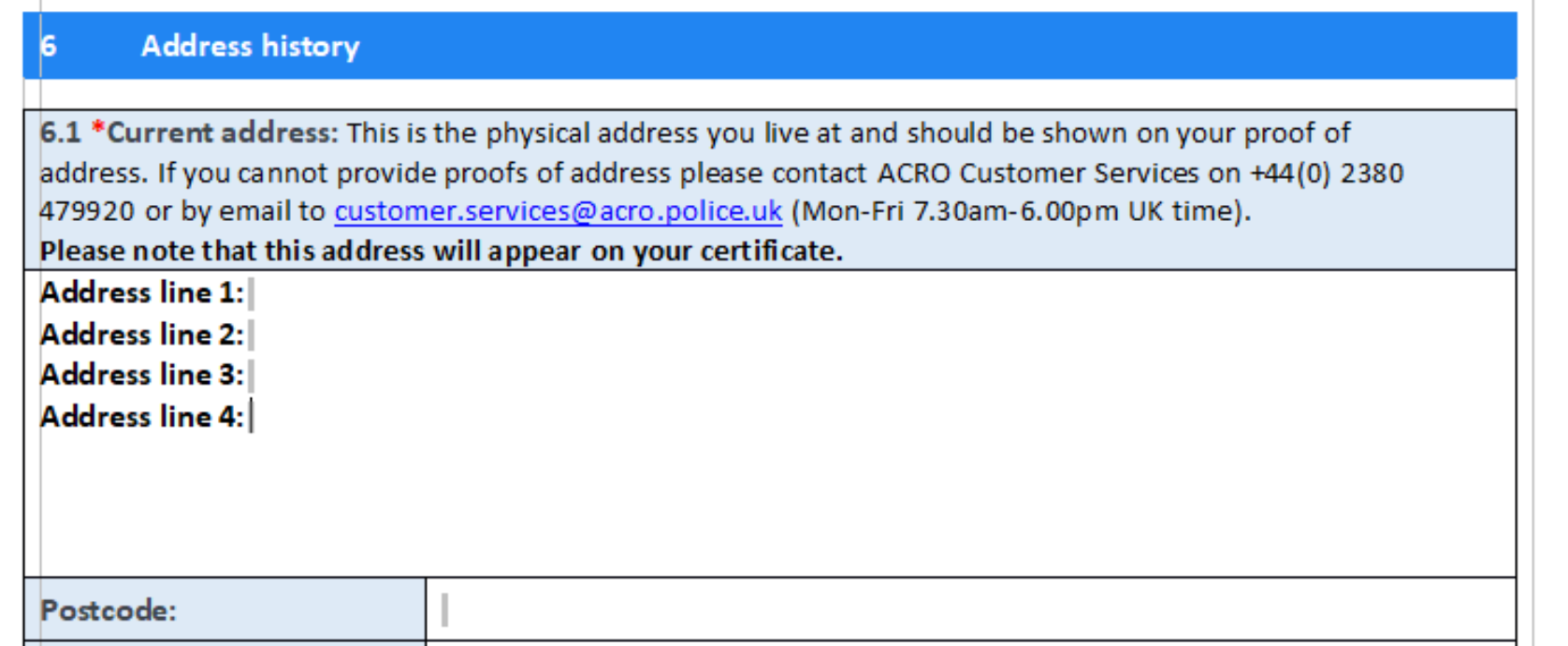

4. Identification Documents

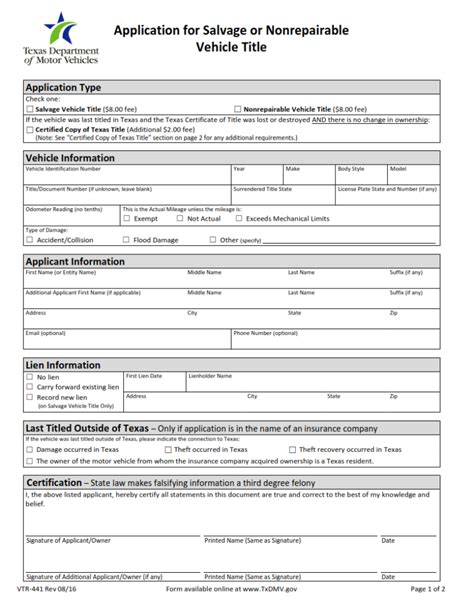

Identification documents, such as a driver’s license or passport, are necessary for verifying the borrower’s identity. These documents protect against fraud and ensure that the person applying for the refinance is who they claim to be. Lenders may also require additional identification documents, depending on their specific requirements and regulatory guidelines.

5. Property Deed and Title

The property deed and title are vital documents that prove ownership of the property. These documents are used to verify the borrower’s legal right to refinance the property and to ensure that the property can be used as collateral for the new loan. Lenders will review these documents to identify any potential issues with the property’s title, such as liens or other encumbrances.

💡 Note: It is essential to ensure that all documents are accurate, complete, and up-to-date to avoid delays in the refinancing process.

Additional Considerations

In addition to the primary refinance papers, borrowers may need to provide other documents, such as: - Appraisal report: to determine the property’s value - Credit report: to evaluate the borrower’s credit history - Insurance documents: to verify property insurance coverage - Tax returns: to confirm income and employment status

| Document | Description |

|---|---|

| Loan Application | Initial document providing borrower information |

| Pay Stubs and W-2 Forms | Income verification documents |

| Bank Statements | Financial health and savings verification |

| Identification Documents | Verification of borrower identity |

| Property Deed and Title | Proof of property ownership |

In summary, refinancing a mortgage requires the preparation and submission of various documents, known as refinance papers. These documents are critical for the lender’s evaluation of the borrower’s eligibility and the property’s value. By understanding the significance of each document and ensuring their accuracy and completeness, borrowers can navigate the refinancing process with confidence and achieve their financial goals.

What is the primary purpose of refinancing a mortgage?

+

The primary purpose of refinancing a mortgage is to replace an existing mortgage with a new one, often to secure a better interest rate, lower monthly payments, or to tap into the home’s equity.

What documents are typically required for a refinance application?

+

The documents typically required for a refinance application include a loan application, pay stubs and W-2 forms, bank statements, identification documents, and property deed and title.

Why is it essential to ensure the accuracy and completeness of refinance papers?

+

Ensuring the accuracy and completeness of refinance papers is crucial to avoid delays in the refinancing process and to ensure that the lender has all the necessary information to make an informed decision about the loan application.