5 Refinance Papers

Understanding Refinance Papers: A Comprehensive Guide

Refinancing a loan or mortgage can be a complex process, involving numerous documents and paperwork. Among these, refinance papers play a crucial role in facilitating the refinancing process. In this article, we will delve into the world of refinance papers, exploring their significance, types, and the information they typically contain.

What are Refinance Papers?

Refinance papers refer to the documents required to refinance a loan or mortgage. These papers serve as a formal agreement between the borrower and the lender, outlining the terms and conditions of the new loan. The refinance papers typically include detailed information about the loan, such as the interest rate, repayment terms, and the borrower’s obligations.

Types of Refinance Papers

There are several types of refinance papers, each serving a specific purpose in the refinancing process. Some of the most common types of refinance papers include: * Loan application: This document initiates the refinancing process, providing the lender with the borrower’s personal and financial information. * Loan estimate: This document outlines the terms and conditions of the new loan, including the interest rate, fees, and repayment terms. * Appraisal report: This document provides an independent assessment of the property’s value, which is used to determine the loan-to-value ratio. * Title report: This document verifies the borrower’s ownership of the property and identifies any potential issues with the title. * Refinance agreement: This document serves as a formal agreement between the borrower and the lender, outlining the terms and conditions of the new loan.

Information Contained in Refinance Papers

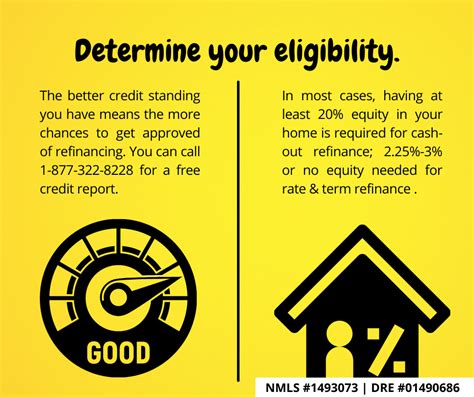

Refinance papers typically contain a wealth of information, including: * Borrower’s personal and financial information: This includes the borrower’s name, address, income, credit score, and employment history. * Loan details: This includes the loan amount, interest rate, repayment terms, and fees associated with the loan. * Property information: This includes the property’s address, value, and any outstanding liens or encumbrances. * Lender’s terms and conditions: This includes the lender’s requirements, such as income verification, credit checks, and appraisal reports. * Borrower’s obligations: This includes the borrower’s responsibilities, such as making timely payments, maintaining insurance, and complying with the loan’s terms and conditions.

Importance of Refinance Papers

Refinance papers play a critical role in the refinancing process, serving as a formal agreement between the borrower and the lender. These documents ensure that both parties are aware of their obligations and responsibilities, reducing the risk of disputes or misunderstandings. Furthermore, refinance papers provide a paper trail, which can be useful in case of any issues or problems that may arise during the loan’s term.

📝 Note: It is essential to carefully review and understand the refinance papers before signing, as they can have a significant impact on the borrower's financial situation.

Common Mistakes to Avoid

When dealing with refinance papers, it is essential to avoid common mistakes that can lead to delays or even loan rejection. Some of these mistakes include: * Inaccurate or incomplete information: Failing to provide accurate or complete information can lead to delays or loan rejection. * Insufficient documentation: Failing to provide sufficient documentation, such as income verification or credit reports, can lead to delays or loan rejection. * Failure to review and understand the loan terms: Failing to carefully review and understand the loan terms can lead to unexpected surprises or problems down the line.

Best Practices for Managing Refinance Papers

To ensure a smooth and successful refinancing process, it is essential to follow best practices for managing refinance papers. Some of these best practices include: * Keeping accurate and detailed records: Keeping accurate and detailed records of all refinance papers and correspondence can help prevent errors or misunderstandings. * Carefully reviewing and understanding the loan terms: Carefully reviewing and understanding the loan terms can help prevent unexpected surprises or problems down the line. * Seeking professional advice: Seeking professional advice from a financial advisor or attorney can help ensure that the borrower’s interests are protected and that the refinancing process is successful.

| Document | Purpose |

|---|---|

| Loan application | Initiates the refinancing process |

| Loan estimate | Outlines the terms and conditions of the new loan |

| Appraisal report | Provides an independent assessment of the property's value |

| Title report | Verifies the borrower's ownership of the property |

| Refinance agreement | Serves as a formal agreement between the borrower and the lender |

In summary, refinance papers are a critical component of the refinancing process, serving as a formal agreement between the borrower and the lender. By understanding the different types of refinance papers, the information they contain, and the importance of carefully reviewing and understanding the loan terms, borrowers can ensure a successful and stress-free refinancing experience. Whether you are refinancing a mortgage or a loan, it is essential to approach the process with caution and careful planning, seeking professional advice when necessary to ensure that your interests are protected.

What is the purpose of refinance papers?

+

Refinance papers serve as a formal agreement between the borrower and the lender, outlining the terms and conditions of the new loan.

What types of documents are typically included in refinance papers?

+

Refinance papers typically include documents such as the loan application, loan estimate, appraisal report, title report, and refinance agreement.

Why is it essential to carefully review and understand the refinance papers?

+

Carefully reviewing and understanding the refinance papers can help prevent unexpected surprises or problems down the line, ensuring a successful and stress-free refinancing experience.