5 Tips to Trade

Introduction to Trading

Trading, whether in stocks, commodities, or currencies, is a highly competitive and potentially lucrative field. It requires a deep understanding of the markets, a well-thought-out strategy, and the discipline to stick to your plans. For those looking to venture into trading, it’s essential to start with a solid foundation. This includes understanding the basics of trading, learning from experienced traders, and adopting strategies that minimize risk while maximizing potential gains.

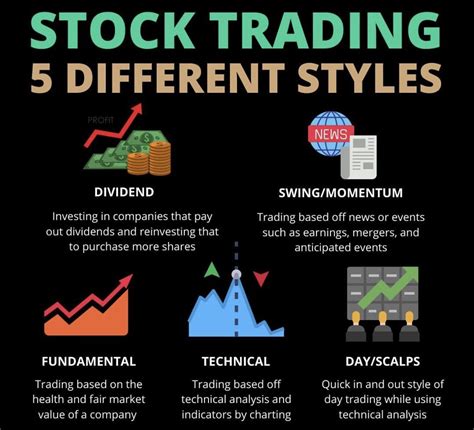

Understanding the Basics

Before diving into the world of trading, it’s crucial to grasp the fundamentals. This includes understanding what trading involves, the different types of trades (long and short positions), and the various instruments available for trading (stocks, options, futures, forex, etc.). Knowledge is power in the trading world, and a thorough understanding of these basics will help in making informed decisions.

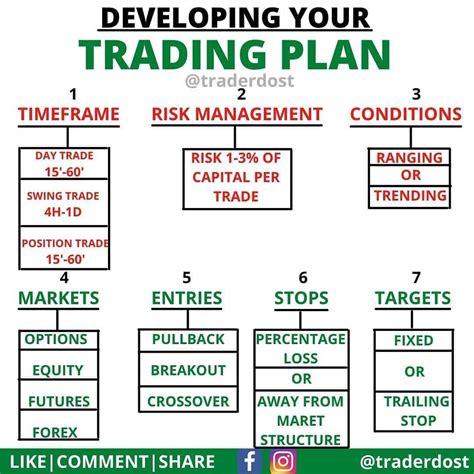

Key Strategies for Successful Trading

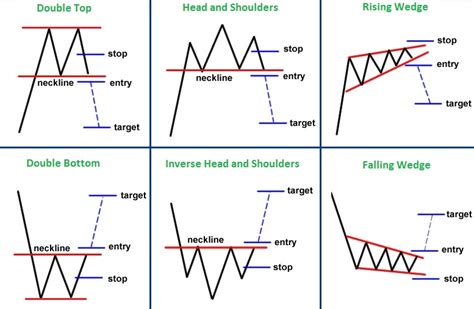

Successful trading isn’t just about making the right predictions; it’s also about managing risk and maintaining a disciplined approach. Here are some key strategies that traders, especially beginners, should consider: - Set Clear Goals: Before you start trading, define what you want to achieve. Are you looking for short-term gains or long-term investments? Your goals will influence your strategy. - Use Stop-Loss Orders: A stop-loss order is a tool that helps limit potential losses by automatically selling a security when it reaches a certain price. This can protect your investments from significant downturns. - Diversify Your Portfolio: Spreading your investments across different asset classes can help reduce risk. If one investment performs poorly, others may compensate. - Stay Informed but Avoid Emotional Decisions: Stay updated with market news and trends, but avoid making trading decisions based on emotions. Fear and greed are significant obstacles to successful trading. - Continuously Learn and Adapt: The trading environment is constantly changing. Stay ahead by learning new strategies and adapting to market conditions.

Tools and Resources for Traders

In today’s digital age, traders have access to a wide range of tools and resources that can help in making informed decisions. This includes: - Trading Platforms: These are software programs that enable traders to place trades and monitor their accounts. Examples include MetaTrader, TradingView, and eToro. - Technical Analysis Tools: Tools like charts, indicators, and oscillators help traders analyze market trends and predict future price movements. - Financial News and Websites: Staying updated with the latest financial news is crucial. Websites like Bloomberg, CNBC, and Reuters provide real-time market data and news.

| Tool/Resource | Description |

|---|---|

| Trading Platforms | Software for placing trades and managing accounts |

| Technical Analysis Tools | Charts, indicators, and oscillators for market analysis |

| Financial News and Websites | Real-time market data and news |

📝 Note: The choice of tool or resource often depends on the trader's specific needs and preferences. It's essential to explore different options to find what works best for you.

Psychological Aspects of Trading

The psychological aspect of trading is often overlooked but is equally important as the technical knowledge. Discipline and emotional control are key to avoiding impulsive decisions that can lead to significant losses. Developing a trading mindset involves setting realistic expectations, managing stress, and maintaining a positive attitude towards losses and gains. It’s also important to recognize when to take a break and step away from trading to avoid burnout.

As traders navigate the complex world of trading, they must remember that success rarely happens overnight. It’s a journey that requires patience, persistence, and continuous learning. By understanding the basics, adopting effective strategies, utilizing the right tools, and maintaining a healthy mindset, traders can set themselves up for success in the competitive world of trading.

In the end, trading is not just about making money; it’s about the journey of learning, adapting, and growing. Whether you’re a seasoned trader or just starting out, the key to success lies in your ability to evolve with the markets and stay true to your trading philosophy. This involves not just mastering the technical aspects of trading but also understanding the importance of risk management, discipline, and continuous education.

What is the most important aspect of trading?

+

Discipline and risk management are often considered the most critical aspects of trading, as they help protect investments and ensure long-term success.

How do I start trading?

+

To start trading, you should first learn the basics of trading, choose a trading platform, and then begin with a demo account to gain practical experience before moving to a live trading account.

What are the risks involved in trading?

+

Trading involves several risks, including market volatility, leverage risks, and the potential for significant losses. It’s essential to understand these risks and manage them effectively through proper risk management strategies.