Keeping Deceased Person's Paperwork

Introduction to Managing Deceased Person’s Paperwork

When a loved one passes away, managing their paperwork and estate can be a daunting task. It involves a range of activities, from sorting through their personal documents to notifying relevant authorities and institutions. Organizing and maintaining these documents is crucial for several reasons, including facilitating the distribution of assets according to the deceased’s will, handling tax obligations, and ensuring that the family can access necessary information during a difficult time. In this article, we will explore the importance of keeping a deceased person’s paperwork, the types of documents that should be maintained, and provide guidance on how to manage these documents efficiently.

Why Keep a Deceased Person’s Paperwork?

Keeping a deceased person’s paperwork is essential for administrative and legal purposes. It helps in the settlement of the estate, which includes the distribution of assets, payment of debts, and management of taxes. Without proper documentation, the process can become complicated, leading to potential disputes among beneficiaries or unnecessary delays. Furthermore, certain documents may be required for tax returns and benefit claims, making it imperative to have them readily available.

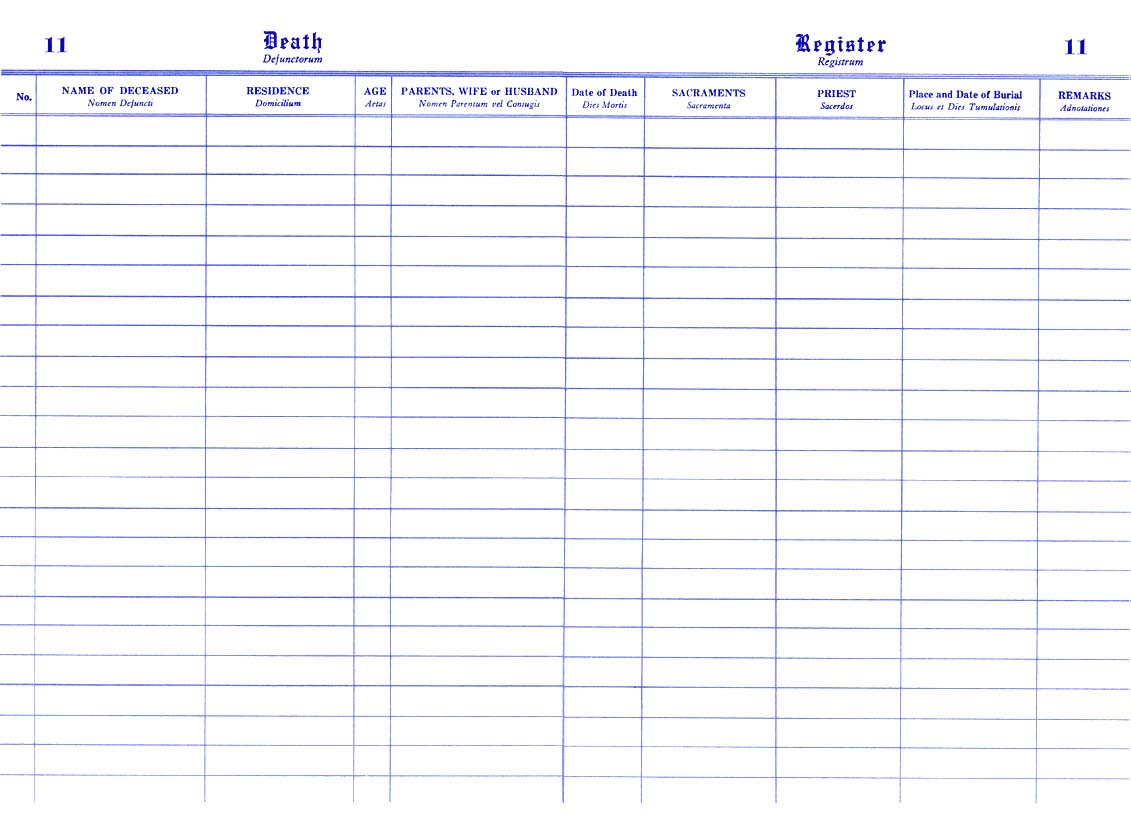

Types of Documents to Keep

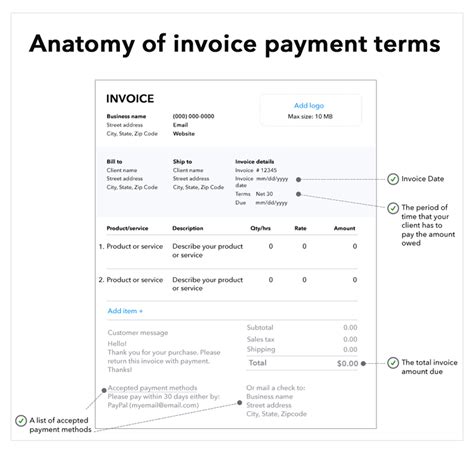

There are several types of documents that should be kept when a person passes away. These include: - Will and Testament: The legal document that outlines how the deceased wanted their estate to be distributed. - Death Certificate: Official proof of death, required for various legal and administrative tasks. - Insurance Policies: Life insurance, health insurance, and other policies that may provide benefits to the family. - Bank and Investment Statements: Records of the deceased’s financial assets, necessary for estate settlement. - Tax Returns: Past tax returns can be important for resolving tax obligations and claiming refunds. - Deeds and Titles: Documents proving ownership of real estate and vehicles. - Retirement and Pension Documents: Records of the deceased’s retirement accounts and any pension benefits. - Funeral Expenses and Arrangements: Documents related to the funeral costs and arrangements.

How to Manage a Deceased Person’s Paperwork

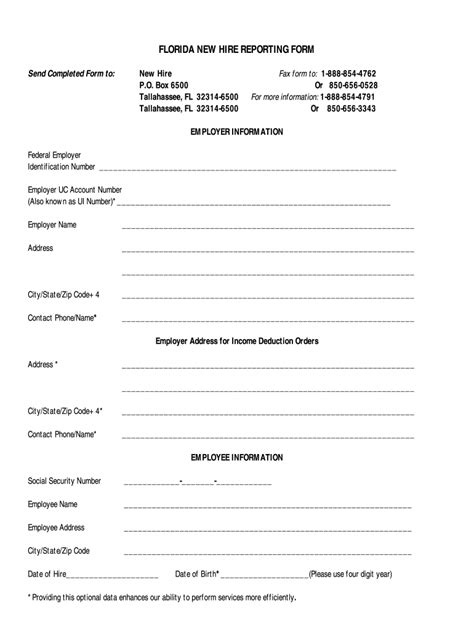

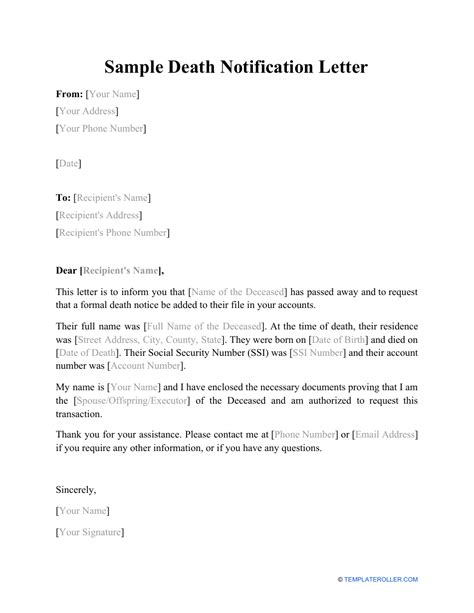

Managing a deceased person’s paperwork involves several steps: 1. Gather All Documents: Start by collecting all relevant documents. This can involve searching through the deceased’s home, safe deposit boxes, and contacting relevant institutions directly. 2. Organize the Documents: Use a systematic approach to organize the documents. This could involve categorizing them by type or creating a digital archive. 3. Notify Relevant Parties: Inform banks, insurance companies, the Social Security Administration, and other relevant institutions about the deceased’s passing. 4. Seek Professional Advice: Consider consulting with a lawyer or financial advisor to ensure that all legal and financial matters are handled correctly.

📝 Note: It's crucial to keep digital copies of important documents in a secure location, such as an encrypted cloud storage service, to protect against loss or damage.

Tools and Resources for Managing Paperwork

Several tools and resources can aid in managing a deceased person’s paperwork: - Document Scanners: For digitizing physical documents. - Cloud Storage Services: Secure online spaces for storing digital documents. - Estate Management Software: Programs designed to help organize and manage estate documents and tasks. - Legal and Financial Advisors: Professionals who can provide guidance on legal and financial matters related to the estate.

| Document Type | Purpose | Importance |

|---|---|---|

| Will and Testament | Outlines distribution of estate | High |

| Death Certificate | Proof of death | High |

| Insurance Policies | Provides benefits to family | Medium to High |

| Bank and Investment Statements | Records financial assets | High |

Challenges and Considerations

Managing a deceased person’s paperwork can be challenging, especially when dealing with complex legal or financial issues. Emotional distress can also make the process more difficult. It’s essential to be patient and seek help when needed. Additionally, considering the environmental impact of paperwork, digitizing documents can be a more sustainable approach.

In the end, managing a deceased person’s paperwork is a critical task that requires attention to detail, organization, and sometimes professional guidance. By understanding the importance of these documents and how to efficiently manage them, families can navigate the complex process of estate settlement with greater ease, ensuring that the wishes of the deceased are respected and their loved ones are supported during a difficult time.

What documents are most important to keep after someone passes away?

+

The most important documents to keep include the will and testament, death certificate, insurance policies, bank and investment statements, and deeds and titles. These documents are crucial for the settlement of the estate and for accessing benefits and assets.

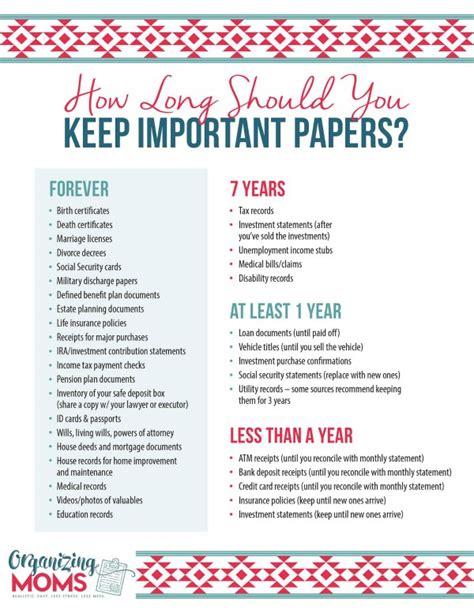

How long should I keep a deceased person’s paperwork?

+

The duration for keeping a deceased person’s paperwork can vary depending on the type of document. Generally, it’s advisable to keep tax returns and related documents for at least three years, while wills, deeds, and other legal documents should be kept permanently.

Can I digitize a deceased person’s paperwork for easier management?

+

Yes, digitizing a deceased person’s paperwork can make it easier to manage and reduce physical storage needs. Consider scanning documents and storing them securely in the cloud or on an external hard drive. However, ensure that sensitive information is protected with appropriate security measures.