Paperwork

Paperwork Needed When Someone Dies

Introduction to Dealing with Death

When someone dies, it can be a challenging and emotional time for the loved ones they leave behind. Apart from dealing with the grief, there are several practical tasks that need to be attended to, including handling the paperwork and legal requirements. This process can be overwhelming, especially during a time of mourning. Understanding what paperwork is needed and how to navigate the system can help alleviate some of the stress associated with this difficult period.

Immediate Steps and Documentation

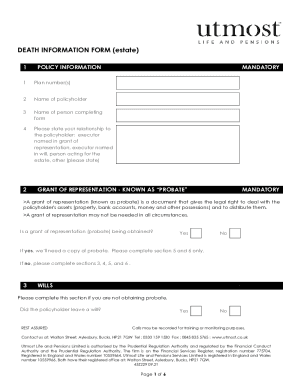

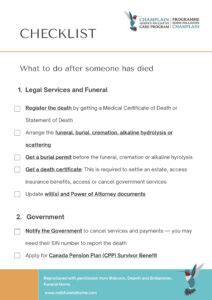

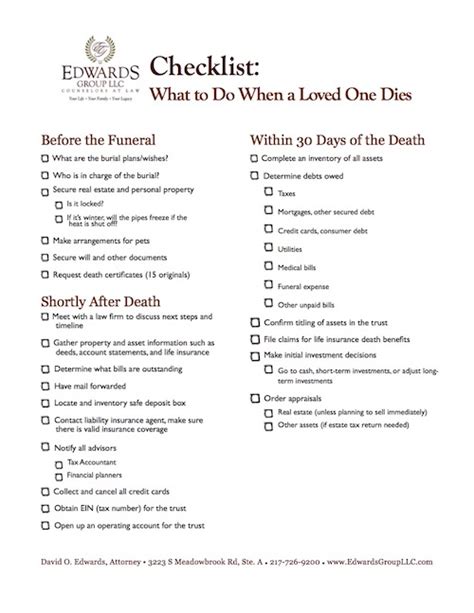

Upon the death of an individual, certain documents and notifications are required immediately. These include: - Death Certificate: This is a crucial document that serves as proof of death. It’s issued by the local authorities or the hospital where the death occurred. Multiple copies are often needed for various purposes, such as insurance claims, pension plans, and estate settlements. - Notification of Next of Kin and Relevant Parties: Informing the next of kin, as well as other relevant parties such as the deceased’s employer, insurance companies, and any creditors, is essential. - Obtaining a Medical Certificate of Cause of Death: This is usually provided by the doctor who treated the deceased or by the coroner if the death was sudden or under investigation.

Legal and Estate Documents

There are several legal documents that need to be located, reviewed, and sometimes acted upon following a death. These can include: - Will: If the deceased left a will, it dictates how their estate should be distributed among beneficiaries. The executor of the will is responsible for ensuring the wishes of the deceased are carried out. - Trust Documents: If the deceased had set up trusts, these documents will outline how certain assets are to be managed and distributed. - Power of Attorney: Although this document is used during the lifetime of the individual to grant someone else the authority to make decisions on their behalf, it’s still relevant after death as it can provide insight into the individual’s wishes and intentions.

Tax and Financial Considerations

Dealing with the financial aspects of someone’s death involves several steps, including: - Notifying the Tax Authority: The tax authority needs to be informed of the death to stop any tax payments and to deal with any tax refunds or payments due. - Managing the Deceased’s Assets: This includes bank accounts, investments, and other financial assets. In some cases, these may need to be frozen until the estate is settled. - Pension and Benefits: Notifying the relevant bodies about pensions, social security benefits, and other government benefits is crucial.

Insurance Claims

If the deceased had any insurance policies, such as life insurance, the beneficiaries will need to file a claim. This process typically involves: - Locating the Policy Documents: Finding the actual policy documents or contacting the insurance provider to initiate the claim process. - Gathering Required Information: This can include the death certificate, policy number, and sometimes additional medical information. - Filing the Claim: Submitting the claim to the insurance company, which will then review and process it according to the policy terms.

Social Media and Digital Presence

In today’s digital age, handling the deceased’s online presence is also important. This may involve: - Notifying Social Media Platforms: Informing platforms like Facebook, Twitter, and Instagram about the death, which can lead to the account being memorialized or closed. - Securing Digital Assets: Ensuring that digital assets, such as computers, smartphones, and online storage, are secure and dealt with appropriately.

💡 Note: It's essential to act quickly on securing digital assets to prevent unauthorized access or data loss.

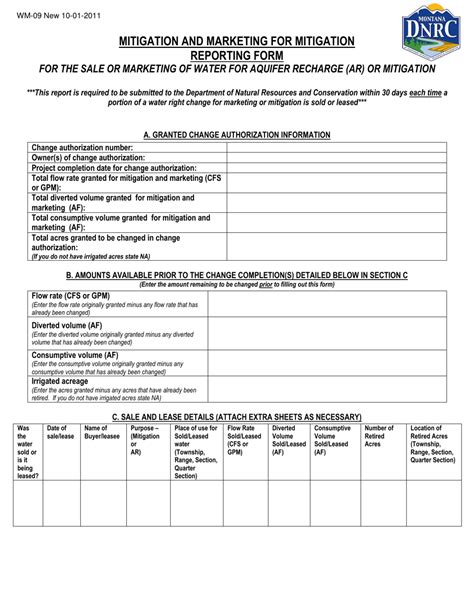

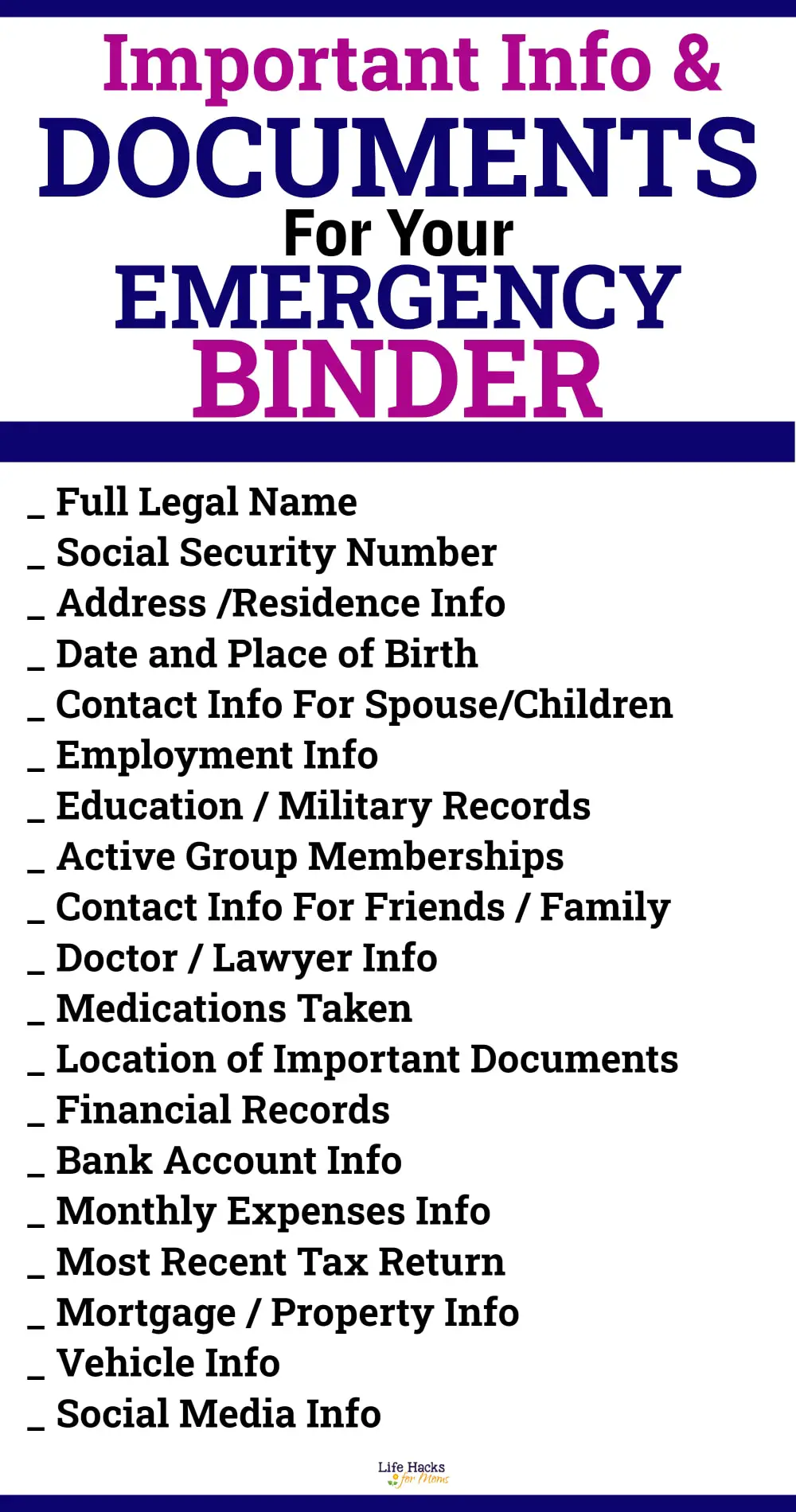

Checklist for Paperwork

To keep track of the paperwork and tasks involved, it can be helpful to create a checklist. This might include: - Death certificate - Medical certificate of cause of death - Will and any codicils - Trust documents - Power of attorney - Tax returns and any outstanding tax bills - Pension and benefits information - Insurance policy documents - Bank and investment account details - Digital asset information

| Document | Purpose | Needed For |

|---|---|---|

| Death Certificate | Proof of death | Insurance claims, pension plans, estate settlement |

| Will | Dictates distribution of estate | Estate settlement, legal proceedings |

| Power of Attorney | Grants decision-making authority | Managing deceased's affairs before death, insight into wishes |

Conclusion and Final Thoughts

Dealing with the death of a loved one is never easy, and the paperwork and legal requirements that follow can add to the stress of the situation. However, understanding what needs to be done and having a clear guide can make the process more manageable. It’s also important to remember that you don’t have to go through this alone; seeking help from professionals, such as lawyers and financial advisors, can provide valuable support during this difficult time.

What is the first step to take after someone dies?

+

The first steps include obtaining a death certificate, notifying the next of kin and relevant parties, and securing any property or assets of the deceased to prevent loss or damage.

How do I handle the deceased’s digital assets?

+

Handling digital assets involves notifying social media platforms, securing devices and online accounts, and considering what to do with digital content such as emails, photos, and other files.

Do I need a lawyer to settle the estate?

+

While it’s possible to settle an estate without a lawyer, especially if the estate is simple and small, consulting with a legal professional can be highly beneficial, especially in complex cases or when disputes arise.