5 Mortgage Forms Needed

Introduction to Mortgage Forms

When purchasing a home, one of the most critical steps is securing a mortgage. The process involves a significant amount of paperwork, including various forms that are essential for the lender to assess the borrower’s creditworthiness and for the borrower to understand the terms of the loan. In this article, we will explore five key mortgage forms that are typically required during the mortgage application process. Understanding these forms can help borrowers navigate the process more smoothly and make informed decisions about their mortgage.

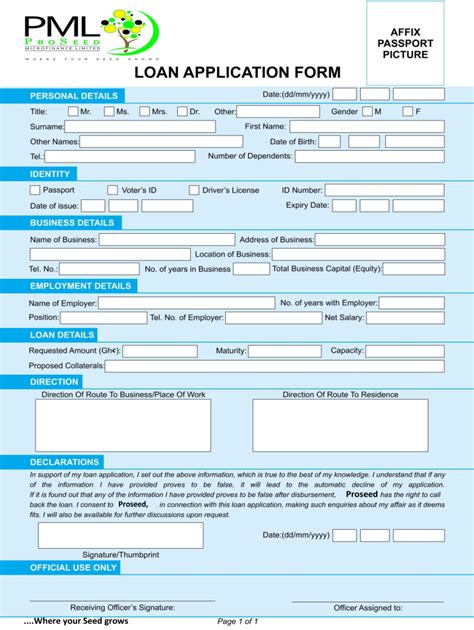

1. Uniform Residential Loan Application (URLA)

The Uniform Residential Loan Application (URLA) is one of the first forms borrowers will encounter when applying for a mortgage. This form, also known as the Fannie Mae Form 1003, is used by lenders to collect detailed information about the borrower’s financial situation, including income, employment history, credit history, and the property being purchased. The URLA is crucial because it provides lenders with the information they need to determine whether to approve the loan and under what terms.

2. Good Faith Estimate (GFE)

The Good Faith Estimate (GFE) is a document that lenders must provide to borrowers within three business days of receiving a loan application. This form outlines the estimated costs associated with the loan, including the interest rate, monthly payment, and closing costs. The GFE is designed to give borrowers a clear understanding of what they will pay over the life of the loan, helping them compare offers from different lenders and make an informed decision.

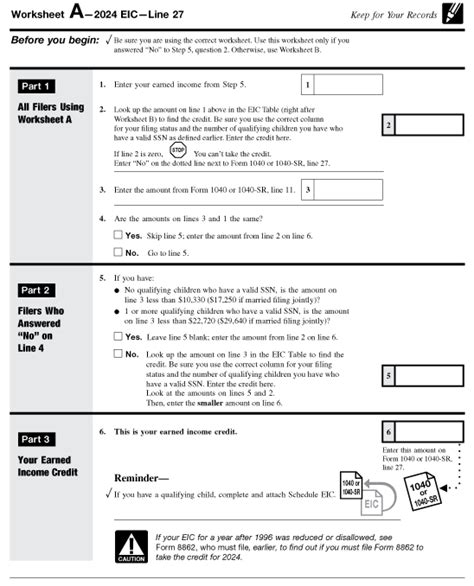

3. Truth-in-Lending Disclosure (TIL)

The Truth-in-Lending Disclosure (TIL) is another critical document that lenders must provide to borrowers. This form discloses the terms of the loan, including the Annual Percentage Rate (APR), the finance charge, the amount financed, and the total payments. The TIL is essential because it helps borrowers understand the true cost of the loan and compare it with other loan offers. It also includes information about the borrower’s right to rescind the loan under certain conditions.

4. HUD-1 Settlement Statement

The HUD-1 Settlement Statement is a detailed document that outlines all the costs associated with the home purchase and mortgage. This form is typically provided to the borrower at least one day before closing and itemizes all the charges, including title insurance, appraisal fees, and closing costs. The HUD-1 Settlement Statement is crucial for ensuring that the borrower understands all the costs involved in the transaction and can verify that the costs match the estimates provided in the GFE.

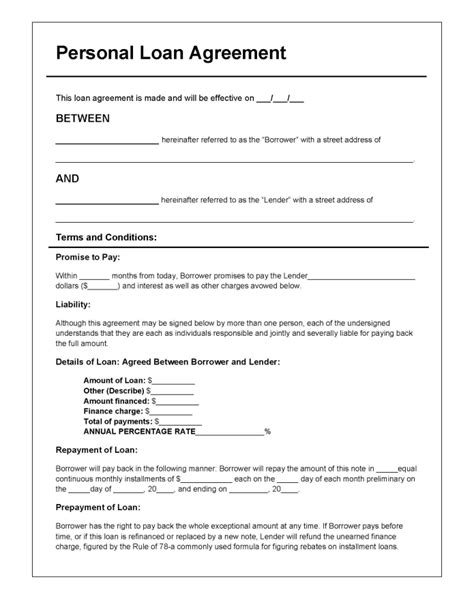

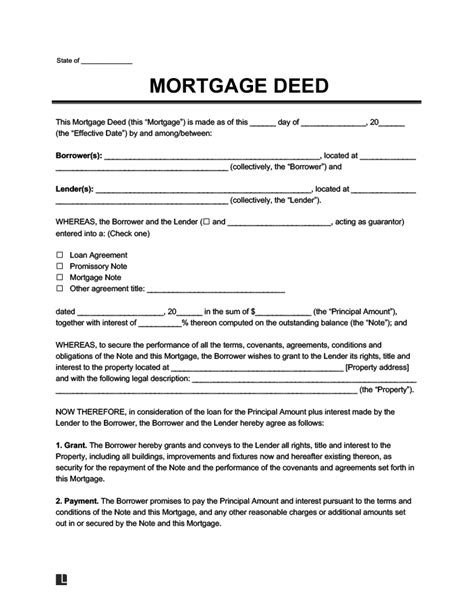

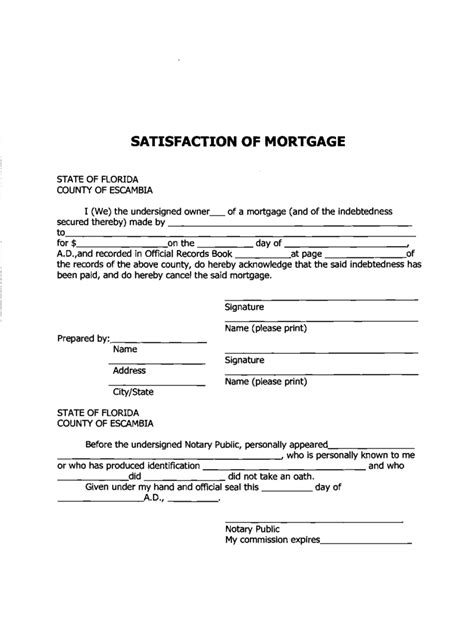

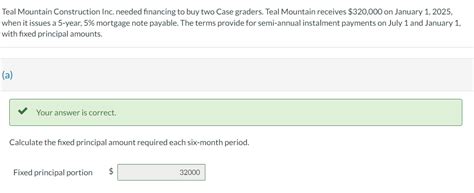

5. Mortgage Note

The Mortgage Note, also known as the promissory note, is a legal document that outlines the terms of the loan, including the loan amount, interest rate, repayment terms, and the borrower’s promise to repay the loan. This form is a critical part of the mortgage process because it serves as the borrower’s contractual agreement to the loan terms. Understanding the Mortgage Note is essential for borrowers to know their obligations and the consequences of defaulting on the loan.

💡 Note: Borrowers should carefully review all mortgage forms to ensure they understand the terms and conditions of the loan. It's also a good idea to consult with a financial advisor or attorney if there are any questions or concerns about the forms or the mortgage process.

In the end, securing a mortgage involves a complex process with numerous legal and financial implications. By understanding the key mortgage forms involved, such as the Uniform Residential Loan Application, Good Faith Estimate, Truth-in-Lending Disclosure, HUD-1 Settlement Statement, and Mortgage Note, borrowers can better navigate this process and make informed decisions about their home purchase. Whether you’re a first-time buyer or an experienced homeowner, being knowledgeable about these forms can help you avoid potential pitfalls and find the mortgage that best suits your needs.

What is the purpose of the Uniform Residential Loan Application?

+

The Uniform Residential Loan Application is used by lenders to collect detailed information about the borrower’s financial situation, which is essential for determining whether to approve the loan and under what terms.

What information does the Good Faith Estimate provide?

+

The Good Faith Estimate outlines the estimated costs associated with the loan, including the interest rate, monthly payment, and closing costs, giving borrowers a clear understanding of what they will pay over the life of the loan.

Why is the Truth-in-Lending Disclosure important?

+

The Truth-in-Lending Disclosure is important because it helps borrowers understand the true cost of the loan and compare it with other loan offers, including information about the Annual Percentage Rate, finance charge, and total payments.