Federal Tax Forms for Home Sale

Introduction to Federal Tax Forms for Home Sale

When selling a home, it’s essential to understand the federal tax forms involved in the process. The sale of a primary residence can have significant tax implications, and completing the correct forms is crucial to ensure compliance with the IRS. In this article, we will delve into the world of federal tax forms for home sales, exploring the necessary forms, instructions, and tips to help you navigate the process.

Understanding the Primary Forms

The primary federal tax forms for home sales are:

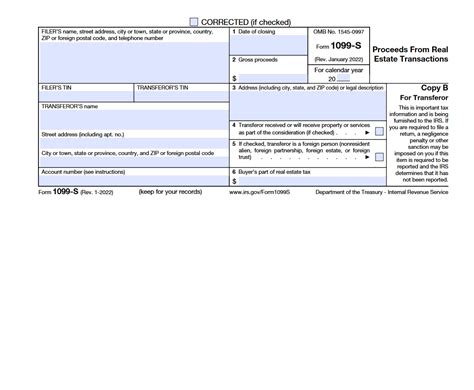

- Form 1099-S: Proceeds From Real Estate Transactions - This form is used to report the sale of real estate, including primary residences. It shows the gross proceeds from the sale, which is essential for calculating capital gains tax.

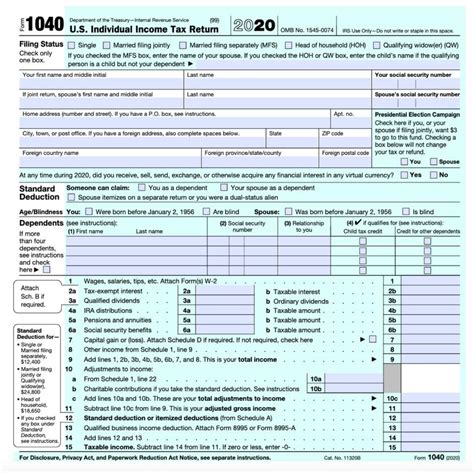

- Form 1040: U.S. Individual Income Tax Return - This form is used to report income, deductions, and credits, including capital gains from the sale of a primary residence.

- Schedule D: Capital Gains and Losses - This schedule is used to calculate and report capital gains and losses from the sale of investments, including real estate.

- Form 8949: Sales and Other Dispositions of Capital Assets - This form is used to report the details of capital asset sales, including the sale of a primary residence.

Calculating Capital Gains Tax

To calculate capital gains tax, you’ll need to determine the gain from the sale of your primary residence. The gain is calculated by subtracting the adjusted basis from the gross proceeds. The adjusted basis includes the original purchase price, plus any improvements or additions made to the property.

| Gross Proceeds | Adjusted Basis | Gain |

|---|---|---|

| 500,000</td> <td>300,000 | 200,000</td>

</tr>

</table>

In this example, the gain from the sale is 200,000.

Exclusions and Deductions There are exclusions and deductions available to reduce the tax liability from the sale of a primary residence. These include:

Reporting the Sale on Tax Forms To report the sale of a primary residence, you’ll need to complete the following forms:

📝 Note: It's essential to keep accurate records of the sale, including the gross proceeds, adjusted basis, and selling expenses, to ensure accurate reporting on tax forms. Tips and Reminders When completing federal tax forms for home sales, keep the following tips and reminders in mind:

As you navigate the process of selling a home and completing federal tax forms, remember to stay organized, keep accurate records, and seek professional guidance when needed. By following these tips and understanding the necessary forms and instructions, you’ll be well-equipped to handle the tax implications of your home sale. What is the deadline for filing Form 1099-S? + The deadline for filing Form 1099-S is February 1st of the year following the sale. Can I exclude the entire gain from tax if I sell my primary residence? + Up to $250,000 of gain may be excluded from tax for single filers, and up to $500,000 for joint filers, if the property was used as a primary residence for at least two of the five years preceding the sale. What expenses can I deduct from the gross proceeds of the sale? + Expenses related to the sale, such as real estate agent commissions and closing costs, may be deducted from the gross proceeds. In summary, selling a home involves navigating complex federal tax forms and regulations. By understanding the necessary forms, instructions, and tips outlined in this article, you’ll be better equipped to handle the tax implications of your home sale and ensure compliance with the IRS. Remember to keep accurate records, consult a tax professional when needed, and file your tax return on time to avoid penalties and interest. |