IRS Paperwork Requirements

Introduction to IRS Paperwork Requirements

The Internal Revenue Service (IRS) has a plethora of paperwork requirements that individuals and businesses must comply with to avoid penalties and fines. These requirements can be overwhelming, especially for those who are not familiar with the tax laws and regulations. In this article, we will delve into the various IRS paperwork requirements, including tax returns, forms, and notices, to help individuals and businesses navigate the complex world of taxation.

Tax Returns

Tax returns are a crucial part of the IRS paperwork requirements. Individuals and businesses are required to file tax returns annually to report their income, deductions, and credits. The most common tax returns include: * Form 1040: Personal income tax return * Form 1120: Corporate income tax return * Form 1065: Partnership income tax return * Form 1120S: S corporation income tax return

These tax returns must be filed by the designated deadline, which is typically April 15th for individuals and March 15th for businesses.

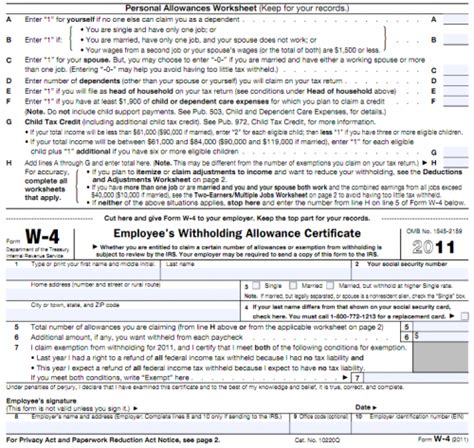

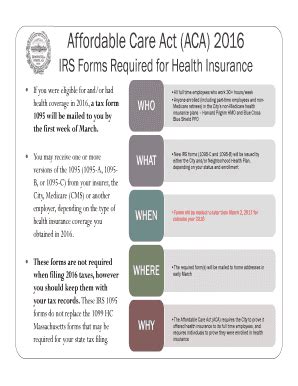

Forms and Schedules

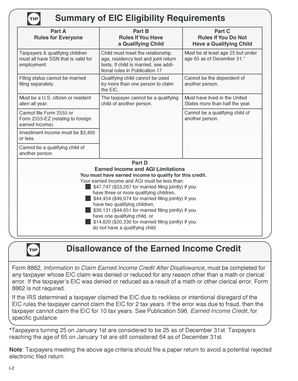

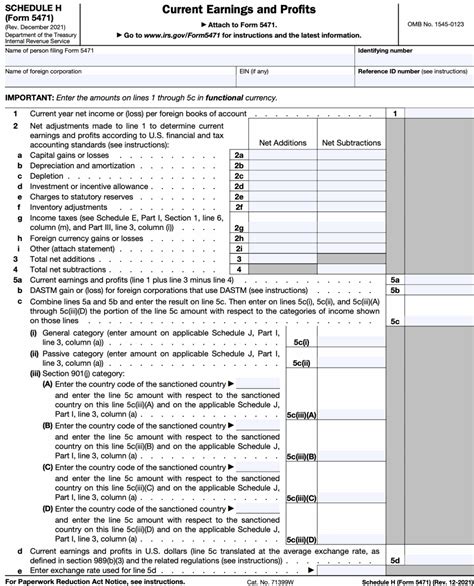

In addition to tax returns, the IRS requires individuals and businesses to file various forms and schedules to report specific information. Some common forms and schedules include: * Form W-2: Wage and tax statement * Form 1099: Miscellaneous income statement * Schedule A: Itemized deductions * Schedule C: Business income and expenses * Schedule D: Capital gains and losses

These forms and schedules must be filed with the tax return or separately, depending on the specific requirements.

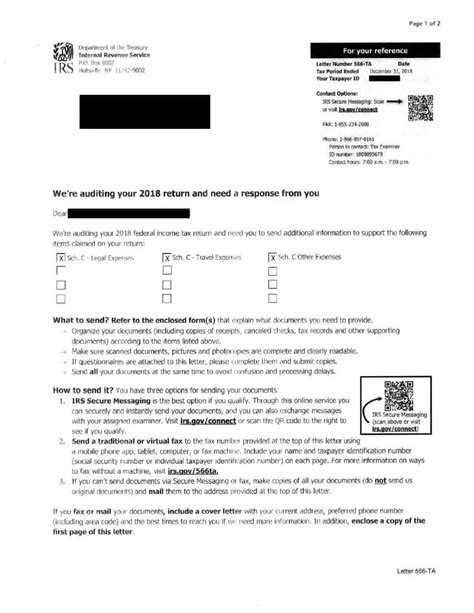

Notices and Communications

The IRS sends various notices and communications to individuals and businesses throughout the year. These notices may include: * Notice of deficiency: A notice informing the taxpayer of a deficiency in their tax return * Notice of audit: A notice informing the taxpayer of an audit or examination * Notice of collection: A notice informing the taxpayer of a collection action

It is essential to respond to these notices promptly to avoid penalties and fines.

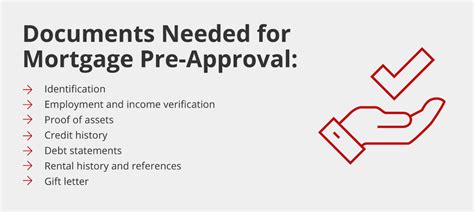

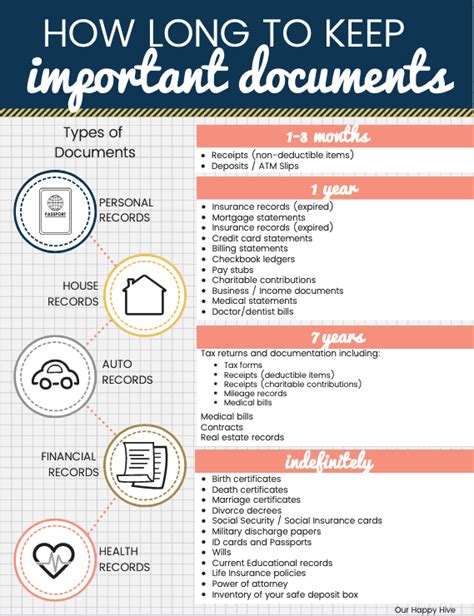

Record-Keeping Requirements

The IRS requires individuals and businesses to maintain accurate and complete records to support their tax returns. These records may include: * Income statements * Expense reports * Bank statements * Invoices and receipts

These records must be kept for a minimum of three years in case of an audit or examination.

Electronic Filing Requirements

The IRS encourages individuals and businesses to file their tax returns electronically. Electronic filing can help reduce errors and improve the processing time of tax returns. Some benefits of electronic filing include: * Faster refunds * Improved accuracy * Reduced errors

Individuals and businesses can file their tax returns electronically through the IRS website or through a tax professional.

Penalties and Fines

Failure to comply with the IRS paperwork requirements can result in penalties and fines. Some common penalties and fines include: * Failure to file penalty: A penalty for failing to file a tax return * Failure to pay penalty: A penalty for failing to pay taxes owed * Accuracy-related penalty: A penalty for errors or inaccuracies on a tax return

These penalties and fines can be substantial, so it is essential to comply with the IRS paperwork requirements to avoid them.

📝 Note: It is crucial to consult with a tax professional or seek guidance from the IRS to ensure compliance with the paperwork requirements.

Conclusion and Summary

In conclusion, the IRS paperwork requirements can be complex and overwhelming, but it is essential to comply with them to avoid penalties and fines. By understanding the various tax returns, forms, and schedules, as well as the record-keeping and electronic filing requirements, individuals and businesses can navigate the world of taxation with confidence. Remember to consult with a tax professional or seek guidance from the IRS to ensure compliance with the paperwork requirements.

What is the deadline for filing a personal income tax return?

+

The deadline for filing a personal income tax return is typically April 15th.

What is the penalty for failing to file a tax return?

+

The penalty for failing to file a tax return can be substantial and may include a failure to file penalty, failure to pay penalty, and accuracy-related penalty.

Can I file my tax return electronically?

+

Yes, you can file your tax return electronically through the IRS website or through a tax professional.