Paperwork Retention Periods

Understanding Paperwork Retention Periods

In today’s digital age, paperwork and documentation are still essential components of any business or organization. With the vast amount of paperwork generated, it’s crucial to establish a system for managing and retaining documents. Paperwork retention periods refer to the length of time that documents should be kept, either physically or digitally, to ensure compliance with regulations, support business operations, and maintain historical records. In this article, we’ll delve into the world of paperwork retention periods, exploring their importance, benefits, and best practices for implementation.

Why Are Paperwork Retention Periods Important?

Paperwork retention periods are vital for several reasons: * Compliance: Many industries are subject to regulations that require specific documents to be retained for a certain period. For example, financial institutions must retain customer records for a minimum of five years, while healthcare providers must keep patient records for at least ten years. * Business Operations: Retaining documents can help organizations track progress, identify trends, and make informed decisions. For instance, retaining sales records can help businesses analyze customer purchasing patterns and adjust their marketing strategies accordingly. * Historical Records: Documents can serve as a historical record of an organization’s activities, decisions, and achievements. Retaining these records can provide valuable insights for future generations and support organizational memory.

Benefits of Implementing Paperwork Retention Periods

Implementing paperwork retention periods can bring numerous benefits to an organization, including: * Reduced Storage Costs: By establishing retention periods, organizations can eliminate unnecessary documents, reducing storage costs and minimizing the risk of document loss or damage. * Improved Compliance: Retaining documents for the required period can help organizations avoid non-compliance fines and penalties. * Enhanced Productivity: A well-organized document management system can save employees time and effort, allowing them to focus on core business activities. * Better Decision-Making: Retaining relevant documents can provide organizations with valuable data and insights, supporting informed decision-making and strategic planning.

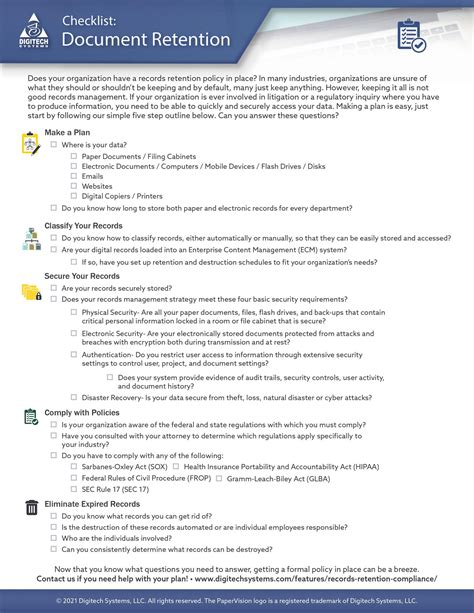

Best Practices for Implementing Paperwork Retention Periods

To implement effective paperwork retention periods, organizations should follow these best practices: * Conduct a Document Audit: Identify the types of documents generated, their purpose, and the relevant retention periods. * Establish a Retention Policy: Develop a clear policy outlining the retention periods for each document type, ensuring compliance with regulatory requirements. * Designate a Document Manager: Appoint a responsible individual to oversee document management, ensuring that documents are properly stored, retained, and disposed of. * Use a Document Management System: Implement a digital or physical document management system to store, track, and retrieve documents efficiently.

Common Document Retention Periods

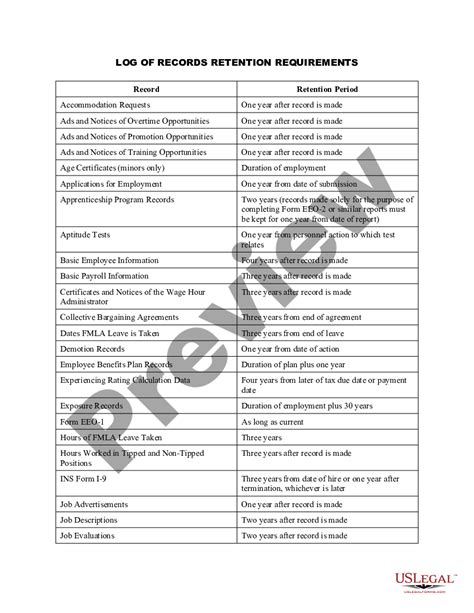

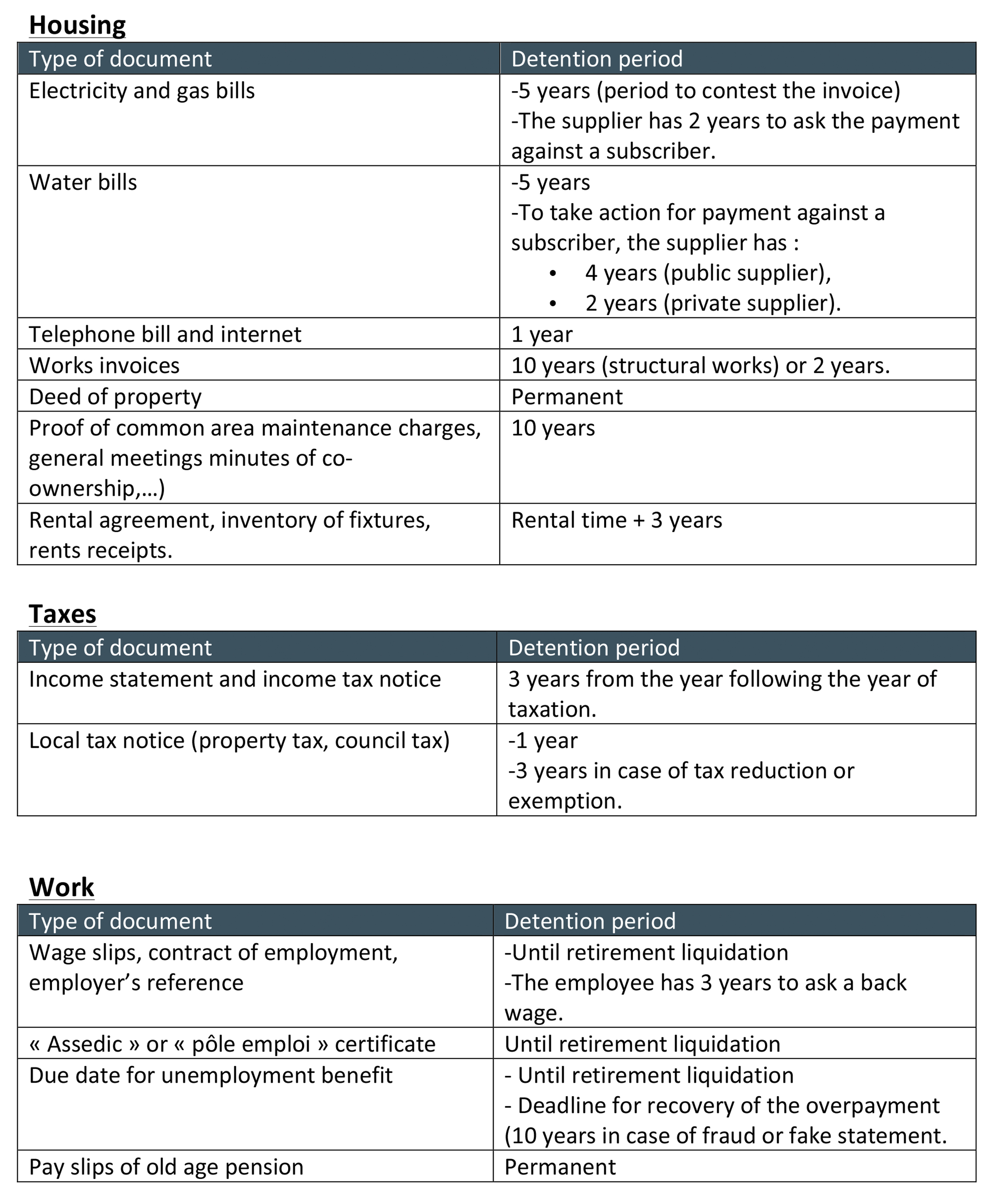

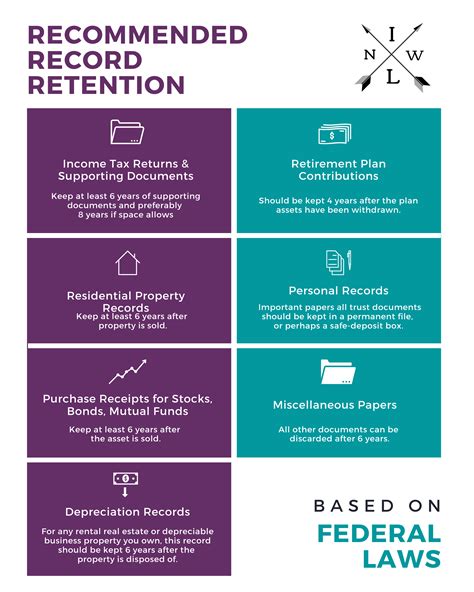

The retention periods for documents vary depending on the industry, type of document, and regulatory requirements. Here are some common document retention periods:

| Document Type | Retention Period |

|---|---|

| Financial Records | 5-7 years |

| Employee Records | 3-5 years |

| Customer Records | 5-10 years |

| Contractual Documents | 5-10 years |

| Tax Records | 3-7 years |

📝 Note: These retention periods are general guidelines and may vary depending on the specific industry, regulatory requirements, and organizational policies.

Challenges and Opportunities

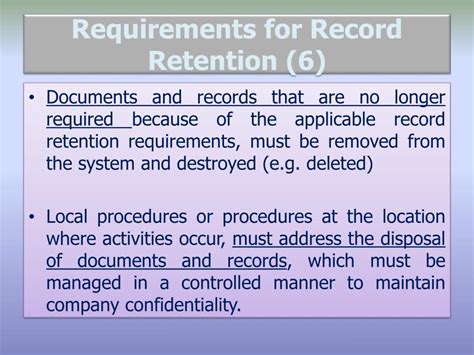

Implementing paperwork retention periods can pose challenges, such as: * Information Overload: The sheer volume of documents generated can make it difficult to manage and retain them effectively. * Digital Storage: The increasing use of digital documents requires organizations to invest in secure and reliable digital storage solutions. * Compliance Risks: Failure to comply with regulatory requirements can result in fines, penalties, and reputational damage.

However, these challenges also present opportunities for organizations to: * Invest in Digital Solutions: Implementing digital document management systems can improve efficiency, reduce storage costs, and enhance compliance. * Develop Strategic Partnerships: Collaborating with external experts can help organizations stay up-to-date with regulatory requirements and best practices. * Enhance Employee Training: Providing employees with training on document management and retention can improve compliance and reduce the risk of document loss or damage.

In summary, paperwork retention periods are a crucial aspect of document management, ensuring compliance, supporting business operations, and maintaining historical records. By understanding the importance of retention periods, implementing best practices, and addressing challenges, organizations can improve their document management systems, reduce risks, and enhance their overall efficiency.

What is the purpose of paperwork retention periods?

+

Paperwork retention periods serve to ensure compliance with regulatory requirements, support business operations, and maintain historical records.

How long should financial records be retained?

+

Financial records should be retained for a minimum of 5-7 years, depending on the specific regulatory requirements and organizational policies.

What are the benefits of implementing a document management system?

+

The benefits of implementing a document management system include reduced storage costs, improved compliance, enhanced productivity, and better decision-making.