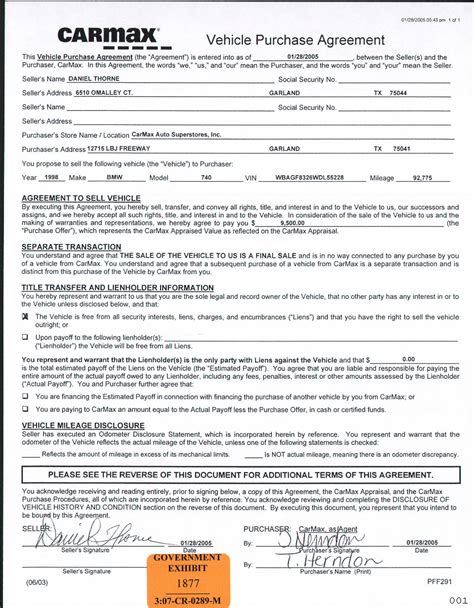

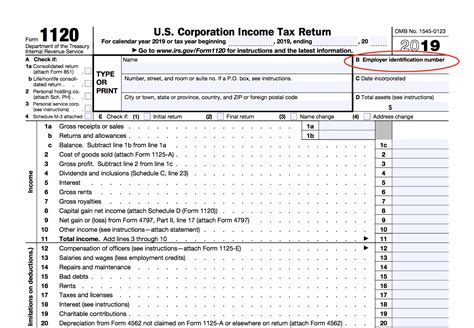

Paperwork

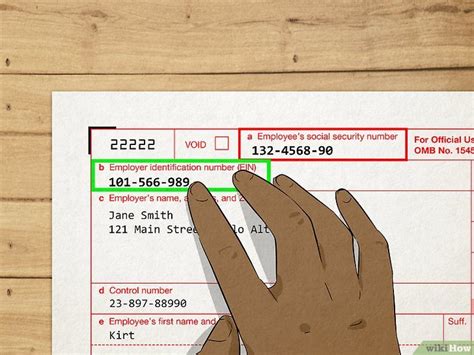

ID Documents With Federal ID Number

Introduction to Federal ID Numbers

A Federal ID number, also known as an Employer Identification Number (EIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses and other entities for tax purposes. However, when discussing ID documents, the term “Federal ID number” often refers to the identification number assigned to individuals, such as a Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN). These numbers are crucial for various administrative tasks, including filing taxes, opening bank accounts, and applying for jobs.

Types of ID Documents

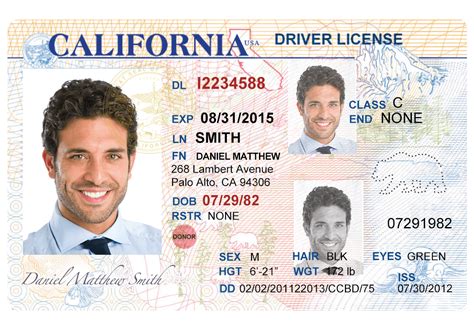

There are several types of ID documents that may include a Federal ID number:

- Passport: While a passport does not typically display a Federal ID number, it is a critical identification document used for international travel and can be required for certain domestic purposes.

- Driver’s License or State ID: These are issued by individual states and may include a unique identifier, but they are not Federal ID numbers. They are essential for driving, voting, and other identification purposes.

- Social Security Card: This card displays a Social Security Number (SSN), which is a type of Federal ID number used for employment, tax purposes, and accessing government services.

- Individual Taxpayer Identification Number (ITIN) Letter: The ITIN is assigned to individuals who are not eligible for a SSN but need to file taxes or claim a refund. The ITIN letter serves as proof of this number.

Obtaining a Federal ID Number

To obtain a Federal ID number, such as a SSN or ITIN, individuals must apply through the appropriate channels:

- SSN Application: U.S. citizens and certain non-citizens can apply for a SSN by submitting Form SS-5 to the Social Security Administration (SSA). Required documents typically include proof of age, identity, and citizenship or immigration status.

- ITIN Application: Individuals who are not eligible for a SSN can apply for an ITIN by submitting Form W-7 to the IRS, along with required documentation such as a valid passport and proof of foreign status.

Uses of Federal ID Numbers

Federal ID numbers are essential for various purposes, including:

- Tax Filing: Both SSNs and ITINs are used to file tax returns and claim refunds.

- Employment: A SSN is required for most employment in the United States, as it is used to report wages and taxes.

- Banking and Finance: Many financial institutions require a Federal ID number to open bank accounts, apply for credit, or obtain loans.

- Government Services: Federal ID numbers may be required to access certain government services, benefits, and programs.

Protecting Your Federal ID Number

Given the importance of Federal ID numbers, it is crucial to protect them from identity theft and misuse:

- Keep Documents Secure: Store ID documents and related papers in a safe place, such as a locked cabinet or safe deposit box.

- Avoid Sharing Unnecessarily: Only share your Federal ID number when absolutely necessary, and ensure the recipient has a legitimate need for the information.

- Monitor Accounts and Credit: Regularly check bank and credit card statements, as well as credit reports, for any suspicious activity.

🔔 Note: Be cautious when sharing personal and financial information online or in person, as this can increase the risk of identity theft and fraud.

Conclusion and Final Thoughts

In summary, Federal ID numbers, such as SSNs and ITINs, play a vital role in identifying individuals for tax, employment, and other administrative purposes. Understanding the types of ID documents, how to obtain a Federal ID number, and its uses is essential for navigating everyday life in the United States. Additionally, protecting these numbers from misuse is critical to preventing identity theft and ensuring personal and financial security.

What is the difference between a SSN and an ITIN?

+

A SSN is assigned to U.S. citizens and certain non-citizens for work and tax purposes, while an ITIN is assigned to individuals who are not eligible for a SSN but need to file taxes or claim a refund.

How do I apply for a SSN or ITIN?

+

To apply for a SSN, submit Form SS-5 to the SSA, and for an ITIN, submit Form W-7 to the IRS, along with required documentation.

Why is it important to protect my Federal ID number?

+

Protecting your Federal ID number is crucial to prevent identity theft and misuse, which can lead to financial loss, damage to credit, and other serious consequences.