Auto Pre Approved Loan Paperwork Needed

Introduction to Auto Pre Approved Loan Paperwork

When it comes to purchasing a vehicle, auto pre approved loan can be a game-changer. It provides buyers with the assurance that they have the financial backing to make a purchase, giving them more negotiating power and flexibility. However, to secure such a loan, certain paperwork is necessary. In this article, we will delve into the details of the paperwork required for an auto pre approved loan, making the process clearer and more manageable for potential car buyers.

Understanding Auto Pre Approved Loans

An auto pre approved loan is essentially a preliminary approval for a loan that a lender offers to a borrower before they have selected a vehicle to purchase. This approval is based on the borrower’s creditworthiness and other financial factors. It specifies the maximum amount that the lender is willing to lend and the interest rate they will charge. This type of loan is beneficial as it allows buyers to know exactly how much they can spend on a car, making their shopping experience more focused and efficient.

Necessary Paperwork for Auto Pre Approved Loan

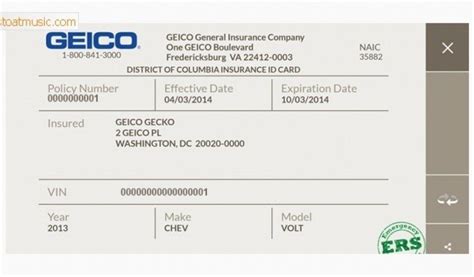

The paperwork needed for an auto pre approved loan typically includes: - Identification Documents: These are essential to verify the borrower’s identity. Commonly required documents include a driver’s license, state ID, or passport. - Income Proof: Borrowers need to provide documents that prove their income. This can include pay stubs, W-2 forms, or tax returns for the self-employed. - Employment Verification: Lenders often require verification of employment to ensure that the borrower has a stable income source. This can be a letter from the employer or recent pay stubs. - Credit Reports: While a pre-approval is based on creditworthiness, lenders may still require access to credit reports to assess the borrower’s credit history and score. - Bank Statements: Providing recent bank statements can help lenders understand the borrower’s financial situation, including their savings and spending habits. - Vehicle Information: Once a vehicle is selected, buyers will need to provide its details, such as the Vehicle Identification Number (VIN), make, model, and year, to finalize the loan.

Steps to Get Auto Pre Approved Loan

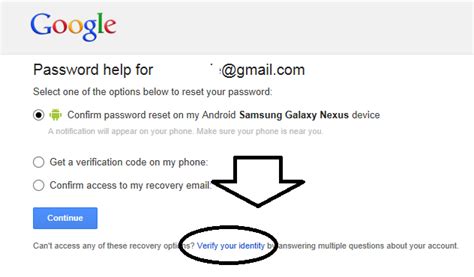

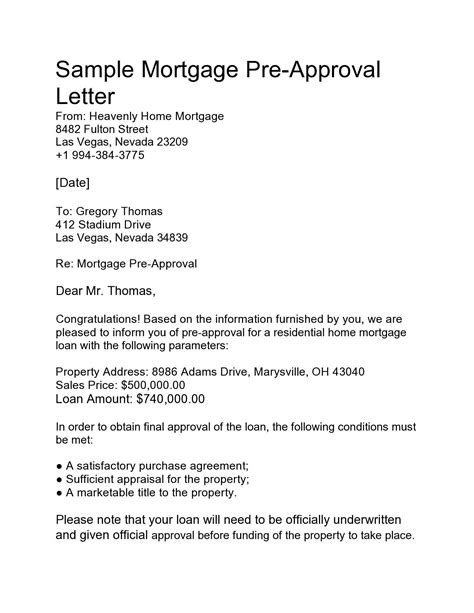

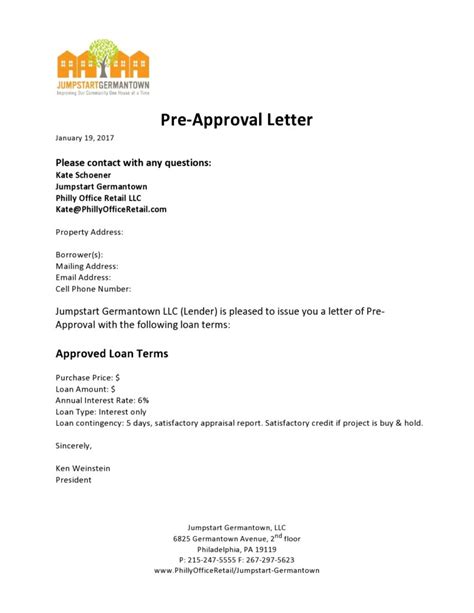

The process of getting an auto pre approved loan involves several steps: - Check Credit Score: Knowing your credit score beforehand can give you an idea of your eligibility and the interest rates you might qualify for. - Research Lenders: Look for lenders that offer auto pre approved loans and compare their terms, including interest rates and repayment conditions. - Apply for Pre Approval: Submit an application to the chosen lender, providing all the required paperwork. - Receive Pre Approval: If approved, the lender will provide a pre approval letter stating the loan amount and terms. - Shop for Your Vehicle: With the pre approval in hand, you can start looking for your vehicle, knowing exactly how much you can spend.

Benefits of Auto Pre Approved Loan

There are several benefits to auto pre approved loans: - Enhanced Negotiating Power: Knowing exactly how much you can spend gives you a stronger position in negotiations with car sellers. - Time Efficiency: It streamlines the car-buying process, as you’re only considering vehicles within your approved budget. - Financial Clarity: You have a clear understanding of your financial commitment before making a purchase.

Managing Your Auto Loan

After securing your auto pre approved loan and purchasing your vehicle, it’s crucial to manage your loan effectively: - Set Up Payments: Ensure you understand the repayment terms, including the amount and due date of each payment. - Monitor Credit Score: Continue to monitor your credit score, as improvements can potentially lead to better loan terms in the future. - Consider Insurance: Ensure you have appropriate insurance coverage for your vehicle to protect against unexpected expenses.

📝 Note: Always review the terms and conditions of your loan carefully before signing any agreement to ensure you understand all the obligations and potential penalties.

In the end, an auto pre approved loan can be a powerful tool for car buyers, offering them clarity and confidence in their purchasing decision. By understanding the necessary paperwork and the process of securing such a loan, buyers can navigate the car market with more ease and assurance. The key to a successful auto loan experience is thorough preparation, careful financial management, and a clear understanding of the loan terms. With these elements in place, buyers can enjoy their new vehicle, knowing they’ve made a well-informed financial decision.

What is the primary benefit of an auto pre approved loan?

+

The primary benefit of an auto pre approved loan is that it gives buyers a clear understanding of their budget and enhances their negotiating power when purchasing a vehicle.

What paperwork is typically required for an auto pre approved loan?

+

Typically, paperwork includes identification documents, income proof, employment verification, credit reports, and bank statements. Once a vehicle is chosen, additional details about the vehicle may also be required.

How does a pre approved auto loan affect my credit score?

+

Applying for a pre approved auto loan may result in a hard inquiry on your credit report, which can temporarily lower your credit score. However, making timely payments on the loan can help improve your credit score over time.