Importing from China Paperwork Requirements

Introduction to Importing from China

When it comes to importing goods from China, understanding the paperwork requirements is crucial for a smooth and successful transaction. The process involves various documents that must be accurately prepared and submitted to the relevant authorities. In this article, we will delve into the essential paperwork needed for importing from China, highlighting the key documents, their purposes, and the steps involved in preparing them.

Key Documents for Importing from China

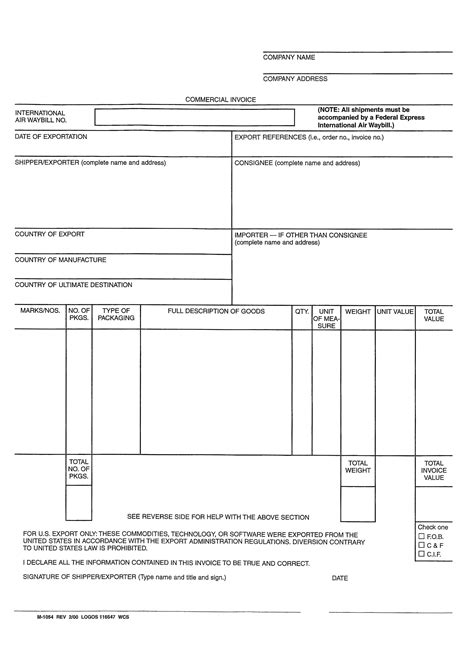

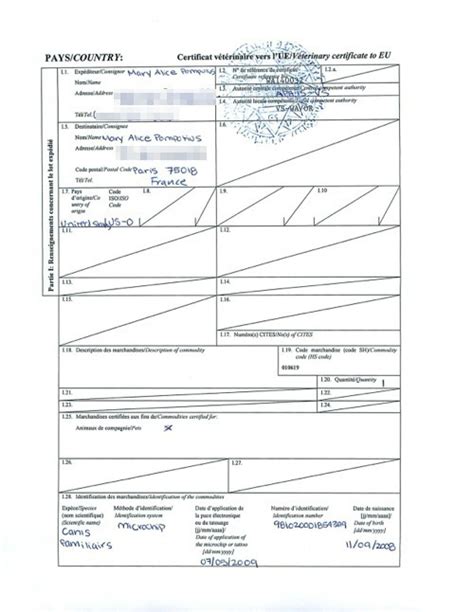

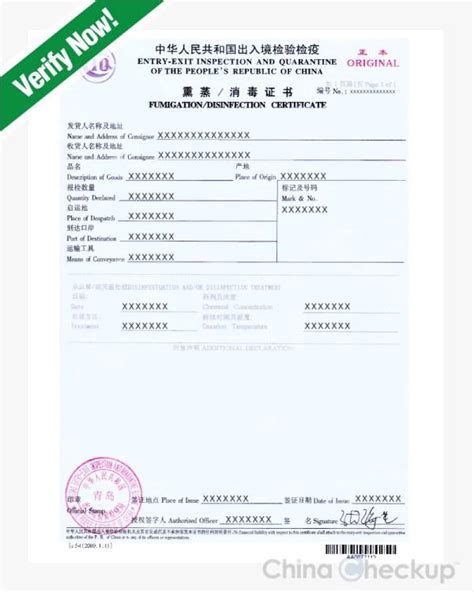

The following are the primary documents required for importing goods from China: * Commercial Invoice: A document issued by the seller that includes details such as the type, quantity, and value of the goods being sold. * Packing List: A document that provides information about the goods being shipped, including their weight, dimensions, and packaging materials. * Bill of Lading: A document issued by the carrier that confirms the receipt of goods for transportation and serves as a contract between the shipper and the carrier. * Certificate of Origin: A document that certifies the country of origin of the goods being imported. * Customs Declaration: A document that provides detailed information about the goods being imported, including their value, quantity, and harmonized system (HS) code.

Preparing the Paperwork

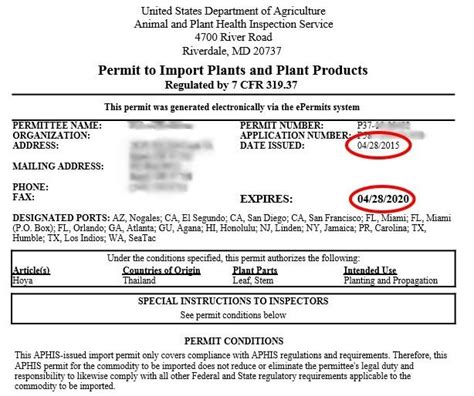

To prepare the necessary paperwork for importing from China, follow these steps: 1. Obtain a Commercial Invoice: The seller must provide a commercial invoice that includes all the necessary details, such as the type, quantity, and value of the goods being sold. 2. Prepare a Packing List: The seller must also provide a packing list that includes information about the goods being shipped, such as their weight, dimensions, and packaging materials. 3. Obtain a Bill of Lading: The carrier will issue a bill of lading that confirms the receipt of goods for transportation and serves as a contract between the shipper and the carrier. 4. Get a Certificate of Origin: The seller must provide a certificate of origin that certifies the country of origin of the goods being imported. 5. Prepare a Customs Declaration: The importer must prepare a customs declaration that provides detailed information about the goods being imported, including their value, quantity, and HS code.

Understanding the Customs Declaration

The customs declaration is a critical document in the import process. It provides detailed information about the goods being imported, including: * Harmonized System (HS) Code: A code that classifies the goods being imported according to their type and characteristics. * Value and Quantity: The value and quantity of the goods being imported. * Country of Origin: The country where the goods were manufactured or produced. * Tariff and Tax: The applicable tariff and tax rates for the goods being imported.

Table of Required Documents

The following table summarizes the required documents for importing from China:

| Document | Purpose |

|---|---|

| Commercial Invoice | Details the type, quantity, and value of the goods being sold |

| Packing List | Provides information about the goods being shipped |

| Bill of Lading | Confirms the receipt of goods for transportation and serves as a contract between the shipper and the carrier |

| Certificate of Origin | Certifies the country of origin of the goods being imported |

| Customs Declaration | Provides detailed information about the goods being imported |

📝 Note: It is essential to ensure that all documents are accurately prepared and submitted to avoid any delays or penalties in the import process.

Import Regulations and Compliance

Importing from China requires compliance with various regulations, including: * Customs Regulations: Compliance with customs regulations, such as the submission of required documents and payment of applicable duties and taxes. * Product Safety Regulations: Compliance with product safety regulations, such as the testing and certification of products to ensure they meet safety standards. * Environmental Regulations: Compliance with environmental regulations, such as the proper disposal of packaging materials and the reduction of carbon emissions.

Conclusion and Final Thoughts

In conclusion, importing from China requires a thorough understanding of the paperwork requirements and regulations involved. By accurately preparing and submitting the necessary documents, importers can ensure a smooth and successful transaction. It is essential to stay up-to-date with the latest regulations and compliance requirements to avoid any delays or penalties. With the right knowledge and expertise, importing from China can be a lucrative and rewarding experience.

What is the purpose of a commercial invoice in importing from China?

+

The commercial invoice is a document issued by the seller that includes details such as the type, quantity, and value of the goods being sold. It serves as a contract between the buyer and the seller and is used to determine the value of the goods for customs purposes.

What is the difference between a packing list and a commercial invoice?

+

A packing list provides information about the goods being shipped, such as their weight, dimensions, and packaging materials, while a commercial invoice includes details such as the type, quantity, and value of the goods being sold.

What is the purpose of a certificate of origin in importing from China?

+

The certificate of origin certifies the country of origin of the goods being imported and is used to determine the applicable tariff and tax rates.