Paperwork

Bankruptcy Paperwork Mailed

Understanding Bankruptcy Paperwork

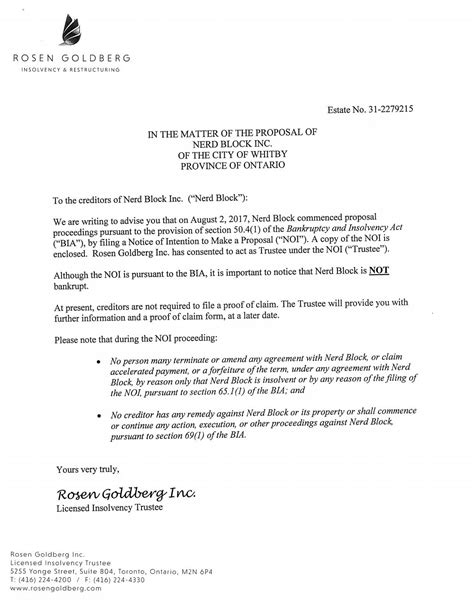

Receiving bankruptcy paperwork in the mail can be a daunting and overwhelming experience, especially if you are not familiar with the bankruptcy process. Bankruptcy is a legal procedure that allows individuals or businesses to reorganize or eliminate debts under the protection of the federal bankruptcy court. The paperwork you receive is an essential part of this process, and it is crucial to understand what it entails and how to proceed.

Types of Bankruptcy

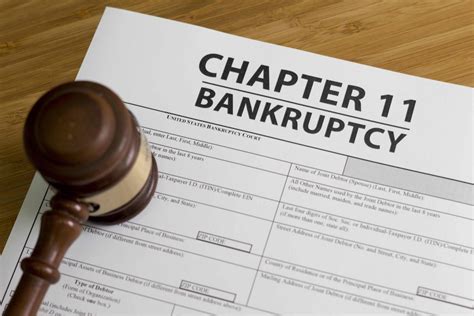

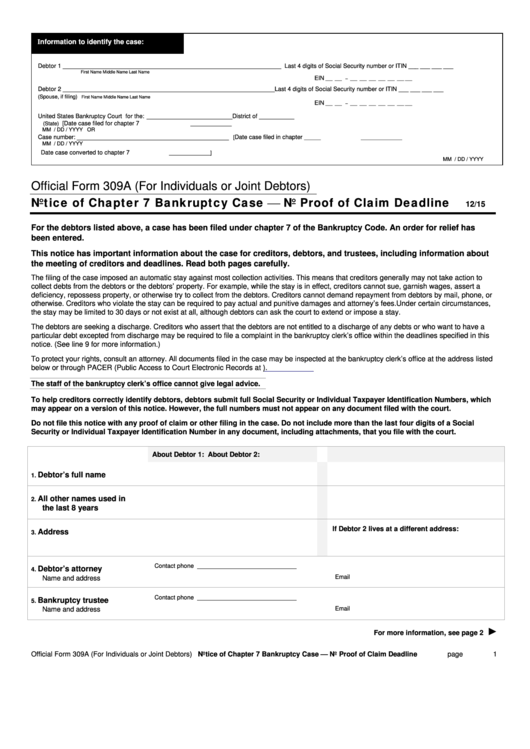

There are several types of bankruptcy, including: * Chapter 7 Bankruptcy: Also known as liquidation bankruptcy, this type involves the sale of non-exempt assets to pay off creditors. * Chapter 13 Bankruptcy: This type involves creating a repayment plan to pay off debts over time. * Chapter 11 Bankruptcy: This type is typically used by businesses to reorganize debts and continue operating.

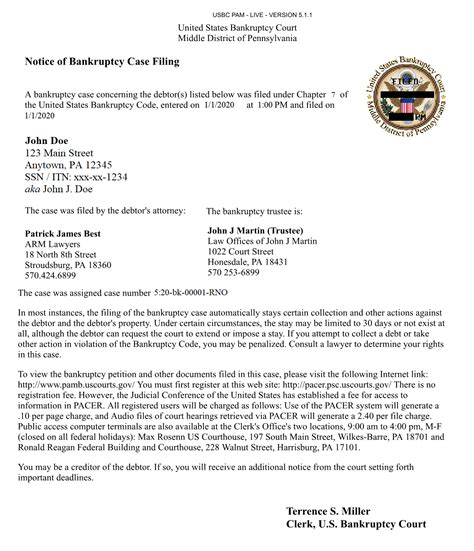

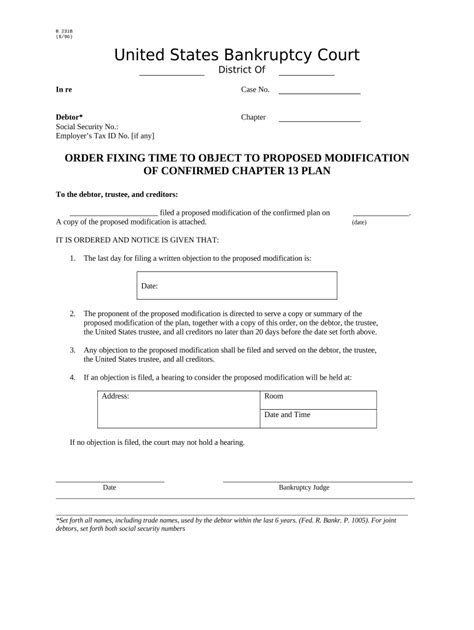

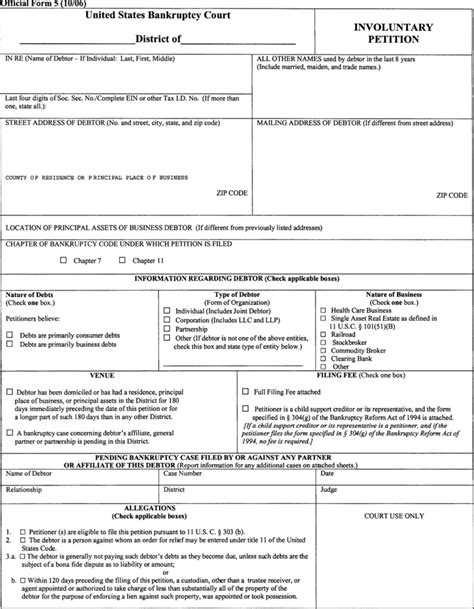

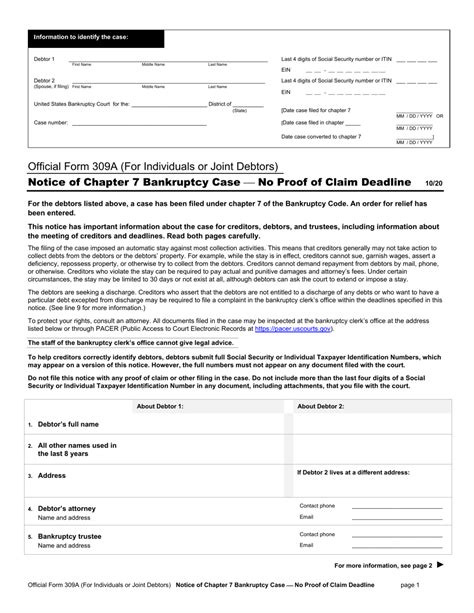

Bankruptcy Paperwork

The bankruptcy paperwork you receive will depend on the type of bankruptcy you are filing for. However, some common documents you may encounter include: * Voluntary Petition: This is the initial document filed with the court to begin the bankruptcy process. * Schedules: These documents provide detailed information about your assets, liabilities, and financial transactions. * Statement of Financial Affairs: This document provides a comprehensive overview of your financial situation, including income, expenses, and debts.

What to Do When You Receive Bankruptcy Paperwork

If you receive bankruptcy paperwork in the mail, it is essential to take immediate action to ensure you understand the process and your rights. Here are some steps to follow: * Read the paperwork carefully: Take the time to thoroughly review the documents and understand what is being requested of you. * Seek legal counsel: Consult with a qualified bankruptcy attorney to guide you through the process and ensure you are making informed decisions. * Respond to the paperwork: If required, respond to the paperwork by the specified deadline to avoid any adverse consequences.

📝 Note: It is crucial to respond to the bankruptcy paperwork promptly to avoid any delays or complications in the process.

Consequences of Not Responding to Bankruptcy Paperwork

Failure to respond to bankruptcy paperwork can have severe consequences, including: * Default judgment: The court may enter a default judgment against you, which can result in the loss of assets or other negative outcomes. * Discharge of debts: If you do not respond to the paperwork, you may miss the opportunity to discharge certain debts, which can lead to ongoing financial obligations. * Damage to credit score: Bankruptcy can already have a significant impact on your credit score; failing to respond to the paperwork can exacerbate this damage.

Bankruptcy Paperwork Timeline

The timeline for bankruptcy paperwork can vary depending on the type of bankruptcy and the complexity of the case. However, here is a general outline of what you can expect: * Filing: The bankruptcy petition is filed with the court, and the paperwork is sent to creditors and other parties involved. * Meeting of creditors: A meeting is held with creditors to discuss the repayment plan or asset distribution. * Discharge: The court issues a discharge, which releases you from personal liability for certain debts.

| Bankruptcy Type | Timeline |

|---|---|

| Chapter 7 | 3-6 months |

| Chapter 13 | 3-5 years |

| Chapter 11 | 6-12 months |

Conclusion and Next Steps

Receiving bankruptcy paperwork in the mail can be a stressful experience, but it is essential to take immediate action to ensure you understand the process and your rights. By seeking legal counsel, responding to the paperwork, and understanding the timeline, you can navigate the bankruptcy process with confidence. Remember to stay informed, ask questions, and seek guidance when needed to ensure the best possible outcome.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves the sale of non-exempt assets to pay off creditors, while Chapter 13 bankruptcy involves creating a repayment plan to pay off debts over time.

How long does the bankruptcy process take?

+

The length of the bankruptcy process varies depending on the type of bankruptcy and the complexity of the case. Chapter 7 bankruptcy typically takes 3-6 months, while Chapter 13 bankruptcy can take 3-5 years.

Can I keep my assets in bankruptcy?

+

It depends on the type of bankruptcy and the assets in question. In Chapter 7 bankruptcy, non-exempt assets may be sold to pay off creditors, while in Chapter 13 bankruptcy, you may be able to keep your assets by creating a repayment plan.