1031 Exchange Paperwork Requirements

Introduction to 1031 Exchange

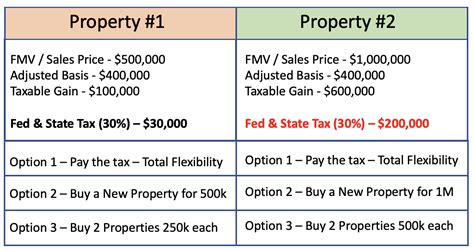

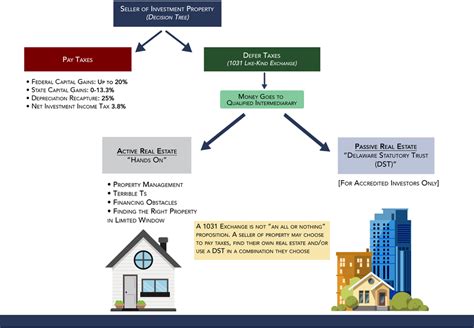

A 1031 exchange, also known as a like-kind exchange, is a tax-deferred exchange that allows investors to swap one investment property for another without incurring capital gains taxes. This tax strategy is authorized by Section 1031 of the Internal Revenue Code and is used by real estate investors, businesses, and individuals to defer taxes on the sale of properties. The process involves several steps, including the identification of replacement properties, the facilitation of the exchange by a qualified intermediary, and the completion of specific paperwork.

Understanding the Paperwork Requirements

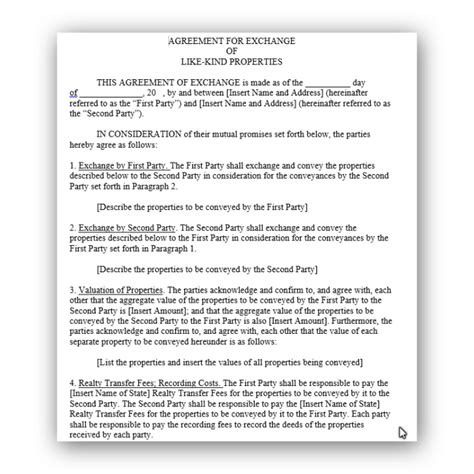

The paperwork requirements for a 1031 exchange are crucial to ensure the exchange is properly executed and recognized by the IRS. The primary documents involved in a 1031 exchange include the exchange agreement, assignment of rights, notice of assignment, and the like-kind exchange identification form. Each of these documents plays a vital role in the exchange process and must be carefully prepared and executed to meet the IRS requirements.

Key Documents for a 1031 Exchange

- Exchange Agreement: This document outlines the terms and conditions of the exchange, including the properties involved, the exchange period, and the roles and responsibilities of all parties. - Assignment of Rights: This document assigns the exchanger’s rights in the sale agreement to the qualified intermediary, allowing the intermediary to facilitate the exchange. - Notice of Assignment: The notice of assignment informs the seller of the assignment of the exchanger’s rights to the qualified intermediary. - Like-Kind Exchange Identification Form: This form, typically Form 8824, is used to identify the replacement properties and is filed with the IRS as part of the exchanger’s tax return.

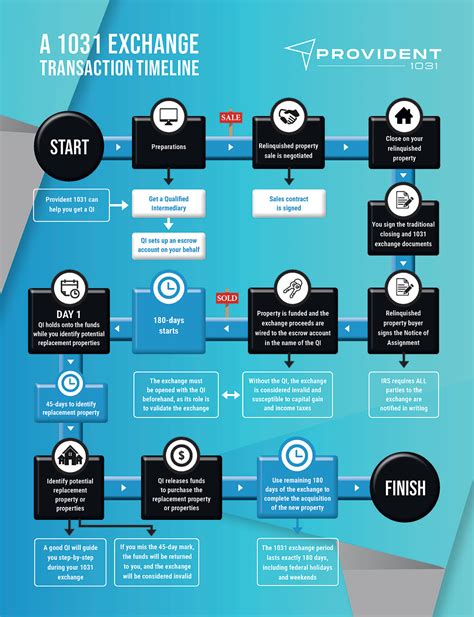

Role of a Qualified Intermediary

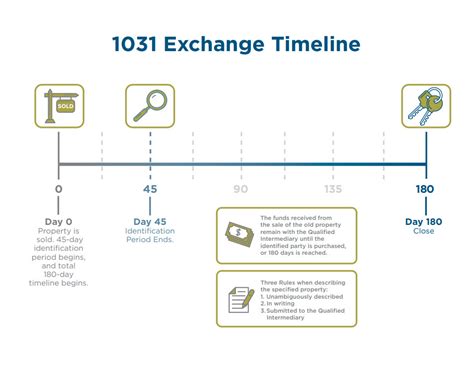

A qualified intermediary (QI) is an independent third party that facilitates the 1031 exchange. The QI holds the proceeds from the sale of the relinquished property and uses these funds to acquire the replacement property. The involvement of a QI is crucial because it ensures the exchanger does not have actual or constructive receipt of the proceeds, which would disqualify the exchange from tax-deferred treatment.

Timeline for a 1031 Exchange

The timeline for a 1031 exchange is strict and must be adhered to in order to qualify for tax-deferred treatment. Key deadlines include: - Identification Period: The exchanger has 45 days from the close of the sale of the relinquished property to identify potential replacement properties. - Exchange Period: The replacement property must be acquired within 180 days of the close of the sale of the relinquished property.

Requirements for Like-Kind Property

For a property to qualify as like-kind, it must be used for investment or business purposes. Examples of like-kind properties include: - Real Property: This can range from raw land, residential properties, and commercial buildings to leaseholds with 30 years or more remaining. - Not Like-Kind: Personal property, such as stocks, bonds, and personal residences, does not qualify for a 1031 exchange.

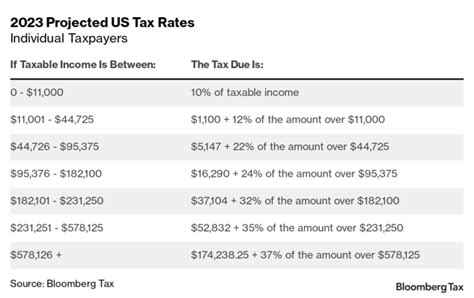

Benefits of a 1031 Exchange

The primary benefit of a 1031 exchange is the deferment of capital gains taxes, which can be substantial. Other benefits include the ability to reinvest the full proceeds from the sale of a property into a new investment, thereby increasing potential future earnings.

Potential Risks and Considerations

While a 1031 exchange offers significant tax benefits, there are risks and considerations, including the complexity of the process, the possibility of IRS audit, and the strict timelines that must be adhered to. It is essential to work with a qualified intermediary and seek professional tax advice to navigate the process successfully.

📝 Note: It's crucial to consult with a tax professional to ensure compliance with all IRS regulations and to discuss the specifics of your situation to maximize the benefits of a 1031 exchange.

Best Practices for a Successful 1031 Exchange

To ensure a successful 1031 exchange, consider the following best practices: - Plan Ahead: Start planning the exchange well in advance of the sale of the relinquished property. - Seek Professional Advice: Work with a qualified intermediary and a tax professional experienced in 1031 exchanges. - Understand the Rules: Familiarize yourself with the IRS guidelines and timelines for a 1031 exchange.

| Document | Purpose |

|---|---|

| Exchange Agreement | Outlines the terms and conditions of the exchange |

| Assignment of Rights | Assigns the exchanger's rights to the qualified intermediary |

| Notice of Assignment | Notifies the seller of the assignment |

| Like-Kind Exchange Identification Form (Form 8824) | Identifies the replacement properties |

In the final analysis, a 1031 exchange can be a powerful tool for real estate investors and businesses looking to defer capital gains taxes and reinvest in new properties. By understanding the paperwork requirements, timeline, and best practices for executing a 1031 exchange, individuals can navigate this complex process with confidence and achieve their investment goals.

What is the primary benefit of a 1031 exchange?

+

The primary benefit of a 1031 exchange is the deferment of capital gains taxes, allowing investors to reinvest the full proceeds from the sale of a property into a new investment.

What are the key documents required for a 1031 exchange?

+

The key documents include the exchange agreement, assignment of rights, notice of assignment, and the like-kind exchange identification form (typically Form 8824).

What is the role of a qualified intermediary in a 1031 exchange?

+

A qualified intermediary facilitates the exchange by holding the proceeds from the sale of the relinquished property and using these funds to acquire the replacement property, ensuring the exchanger does not have actual or constructive receipt of the proceeds.