Paperwork

1099 Employee Paperwork Requirements

Introduction to 1099 Employee Paperwork Requirements

As a business owner, it’s essential to understand the paperwork requirements for 1099 employees, also known as independent contractors or freelancers. The Internal Revenue Service (IRS) requires specific forms and documentation to ensure compliance with tax laws and regulations. In this article, we’ll delve into the world of 1099 employee paperwork requirements, exploring the necessary forms, deadlines, and best practices for businesses and independent contractors alike.

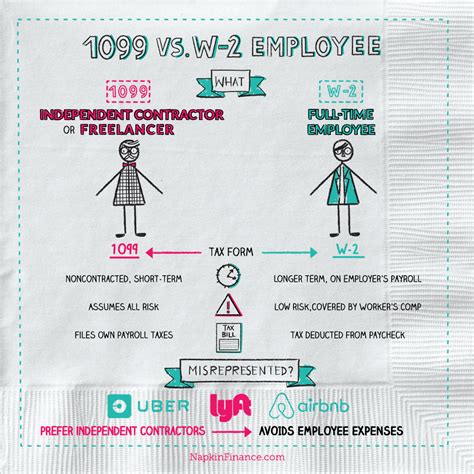

Understanding 1099 Employees

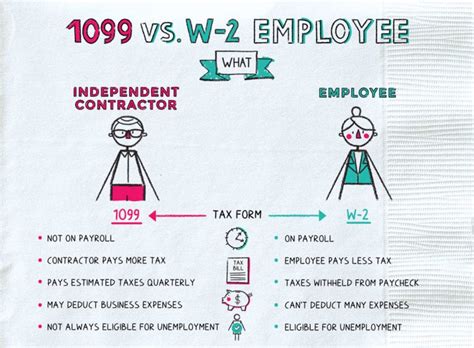

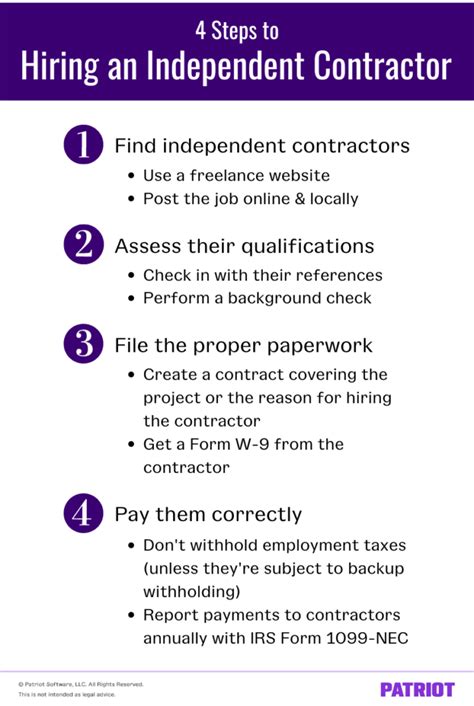

Before diving into the paperwork requirements, it’s crucial to understand who qualifies as a 1099 employee. The IRS considers an individual a 1099 employee if they meet the following criteria: * They are not employed by the company (i.e., they are not on the company’s payroll). * They provide services to the company as an independent contractor or freelancer. * They have control over their work schedule and methods. * They are responsible for their own expenses and equipment. * They can work for multiple clients or companies simultaneously.

Required Forms for 1099 Employees

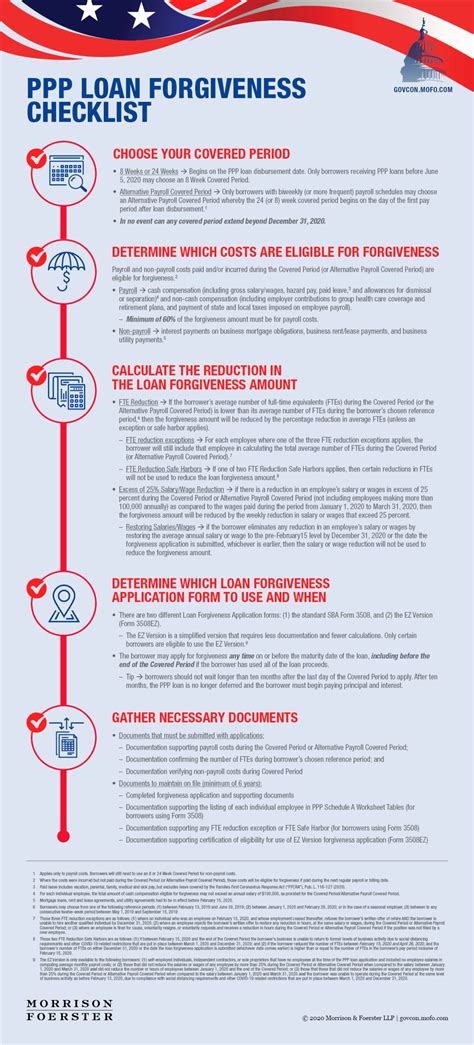

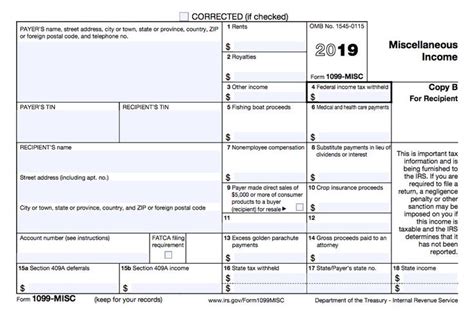

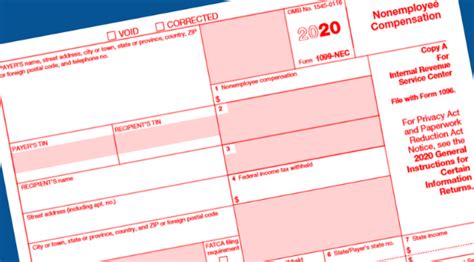

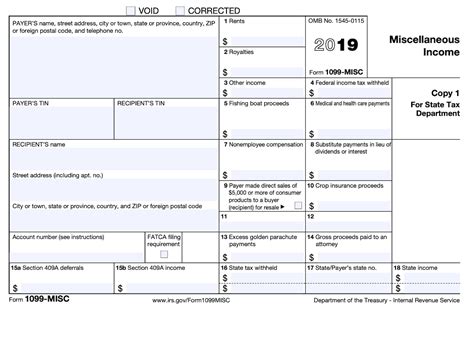

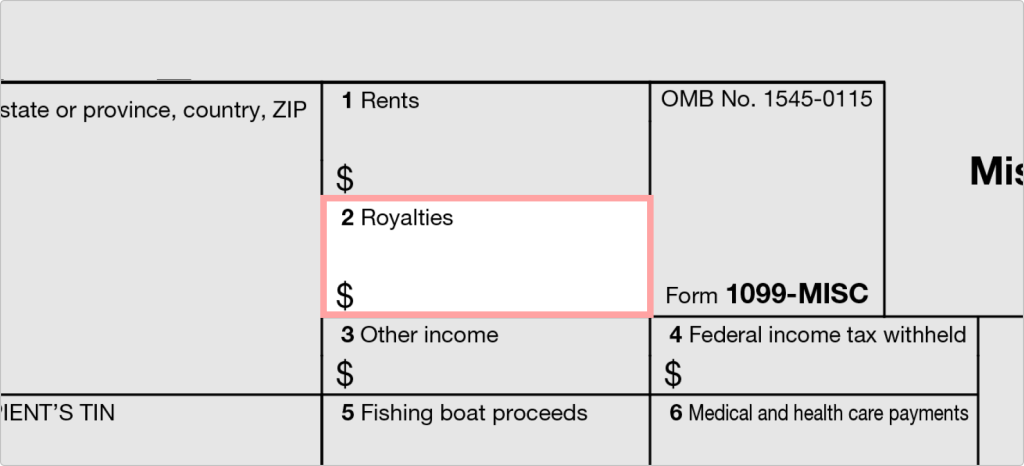

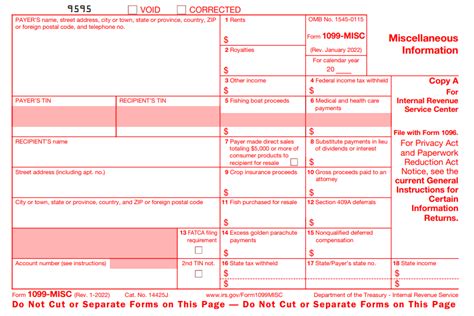

The IRS requires businesses to complete and submit specific forms for 1099 employees. These forms include: * Form W-9: This form is used to collect the independent contractor’s name, address, and taxpayer identification number (TIN). Businesses must have a completed Form W-9 on file for each 1099 employee. * Form 1099-MISC: This form is used to report payments made to 1099 employees. Businesses must complete and submit Form 1099-MISC to the IRS and provide a copy to the independent contractor by January 31st of each year. * Form 1096: This form is used to summarize the total amount of payments reported on Form 1099-MISC. Businesses must submit Form 1096 to the IRS by January 31st of each year.

Deadlines and Filing Requirements

It’s essential to meet the deadlines and filing requirements for 1099 employee paperwork. The following deadlines apply: * January 31st: Businesses must provide a copy of Form 1099-MISC to the independent contractor and submit Form 1096 to the IRS. * February 28th: Businesses must submit paper copies of Form 1099-MISC to the IRS. * March 31st: Businesses must submit electronic copies of Form 1099-MISC to the IRS.

📝 Note: The IRS may impose penalties for late or incomplete filings, so it’s crucial to meet these deadlines and ensure accurate completion of the required forms.

Best Practices for Businesses

To ensure compliance with 1099 employee paperwork requirements, businesses should follow these best practices: * Maintain accurate records: Keep detailed records of payments made to 1099 employees, including dates, amounts, and services provided. * Verify independent contractor status: Ensure that individuals classified as 1099 employees meet the IRS criteria for independent contractors. * Provide clear payment terms: Establish clear payment terms and conditions with 1099 employees, including payment schedules and methods. * Communicate with independent contractors: Maintain open communication with 1099 employees regarding payment, tax obligations, and any changes to their status or payment terms.

Best Practices for Independent Contractors

Independent contractors should also follow best practices to ensure compliance with 1099 employee paperwork requirements: * Keep accurate records: Maintain detailed records of services provided, payments received, and expenses incurred. * Understand tax obligations: Familiarize yourself with tax laws and regulations, including self-employment tax obligations and deductions. * Provide necessary documentation: Ensure that you provide businesses with a completed Form W-9 and any other required documentation. * Stay organized: Keep track of deadlines, payment schedules, and communication with businesses to ensure a smooth working relationship.

Conclusion

In conclusion, 1099 employee paperwork requirements are crucial for businesses and independent contractors to understand and comply with. By following the necessary forms, deadlines, and best practices, businesses can ensure accurate and timely filings, while independent contractors can maintain accurate records and understand their tax obligations. By working together and following these guidelines, both parties can navigate the complex world of 1099 employee paperwork requirements with confidence.

What is the deadline for submitting Form 1099-MISC to the IRS?

+

The deadline for submitting Form 1099-MISC to the IRS is January 31st for paper copies and March 31st for electronic copies.

What is the purpose of Form W-9?

+

Form W-9 is used to collect the independent contractor’s name, address, and taxpayer identification number (TIN) for businesses to maintain accurate records.

What are the consequences of late or incomplete filings?

+

The IRS may impose penalties for late or incomplete filings, so it’s crucial to meet deadlines and ensure accurate completion of the required forms.