5 Steps To Federal ID

Introduction to Federal ID

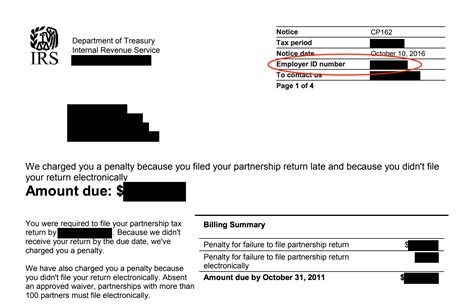

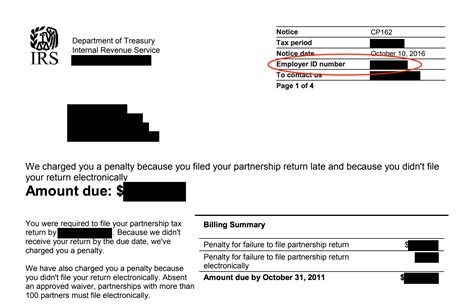

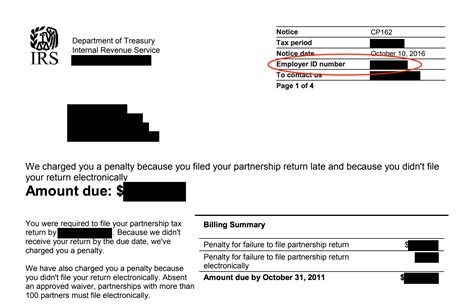

The process of obtaining a Federal ID, also known as an Employer Identification Number (EIN), is a crucial step for any business or organization operating in the United States. This unique identifier is used by the Internal Revenue Service (IRS) to track tax returns and other financial activities related to the entity. In this article, we will guide you through the 5 essential steps to apply for a Federal ID, ensuring that you understand the requirements and the process thoroughly.

Step 1: Determine Your Eligibility

Before applying for a Federal ID, it’s essential to determine if your business or organization is eligible. The IRS issues EINs to various entities, including: * Corporations * Partnerships * Limited Liability Companies (LLCs) * Estates * Trusts * Non-profit organizations * Government agencies If your business falls into any of these categories, you can proceed with the application process. It’s also important to note that you will need a Federal ID to: * Open a business bank account * Hire employees * File tax returns * Apply for business licenses and permits

Step 2: Gather Required Information

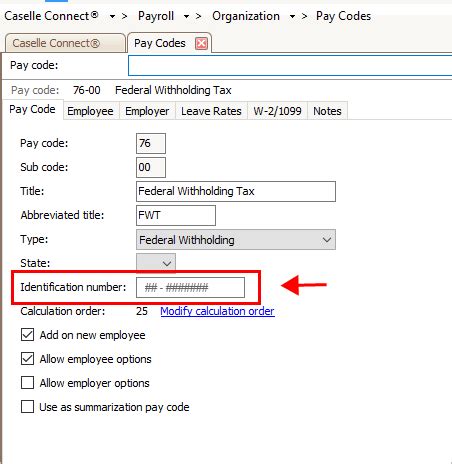

To apply for a Federal ID, you will need to provide specific information about your business or organization. Make sure you have the following details ready: * Business name and address * Type of business entity (corporation, partnership, LLC, etc.) * Business structure (sole proprietorship, single-member LLC, etc.) * Owner’s or responsible party’s name and Social Security number or Individual Taxpayer Identification Number (ITIN) * Reason for applying for an EIN (e.g., starting a new business, hiring employees, etc.) Having this information readily available will streamline the application process.

Step 3: Choose Your Application Method

You can apply for a Federal ID online, by phone, or by mail. The online application is the fastest and most convenient method, as it allows you to receive your EIN immediately after submitting your application. To apply online, visit the IRS website and follow these steps: * Go to the IRS website (www.irs.gov) * Click on the “Apply for an Employer Identification Number (EIN)” link * Fill out the online application (Form SS-4) * Submit your application and receive your EIN If you prefer to apply by phone, you can call the IRS Business and Specialty Tax Line at (800) 829-4933. For mail applications, you will need to complete Form SS-4 and mail it to the IRS address listed on the form.

Step 4: Complete the Application

Regardless of the application method you choose, you will need to provide the required information and answer questions about your business or organization. The application will ask for: * Business information (name, address, type of entity, etc.) * Owner’s or responsible party’s information (name, Social Security number or ITIN, etc.) * Reason for applying for an EIN * Other relevant details (business structure, number of employees, etc.) Make sure to answer all questions accurately and completely, as this will help ensure that your application is processed efficiently.

Step 5: Receive Your EIN

After submitting your application, you will receive your Federal ID (EIN) immediately if you applied online. If you applied by phone or mail, it may take several days or weeks to receive your EIN. Once you have your EIN, you can use it to: * Open a business bank account * Hire employees * File tax returns * Apply for business licenses and permits It’s essential to keep your EIN confidential and secure, as it can be used to access your business’s financial information.

💡 Note: It's crucial to apply for a Federal ID only when your business is ready to operate, as the IRS may cancel your EIN if you don't file tax returns or make deposits for an extended period.

In summary, applying for a Federal ID involves determining your eligibility, gathering required information, choosing your application method, completing the application, and receiving your EIN. By following these 5 steps, you can ensure a smooth and efficient application process.

What is a Federal ID, and why do I need it?

+

A Federal ID, also known as an Employer Identification Number (EIN), is a unique identifier used by the IRS to track tax returns and other financial activities related to your business or organization. You need a Federal ID to open a business bank account, hire employees, file tax returns, and apply for business licenses and permits.

How long does it take to receive a Federal ID?

+

If you apply online, you will receive your Federal ID (EIN) immediately after submitting your application. If you apply by phone or mail, it may take several days or weeks to receive your EIN.

Can I apply for a Federal ID if I’m a sole proprietor?

+

Yes, as a sole proprietor, you can apply for a Federal ID. However, you may not need an EIN if you don’t have employees and don’t file tax returns. But having an EIN can help you separate your personal and business finances and provide an additional layer of security.