Home Equity Loan Paperwork Needed

Understanding the Home Equity Loan Process

When considering a home equity loan, it’s essential to understand the process and the necessary paperwork involved. A home equity loan allows homeowners to borrow money using the equity in their home as collateral. This type of loan can be used for various purposes, such as financing home improvements, paying off high-interest debt, or covering unexpected expenses. To initiate the process, applicants must gather specific documents and information, which will be discussed in detail below.

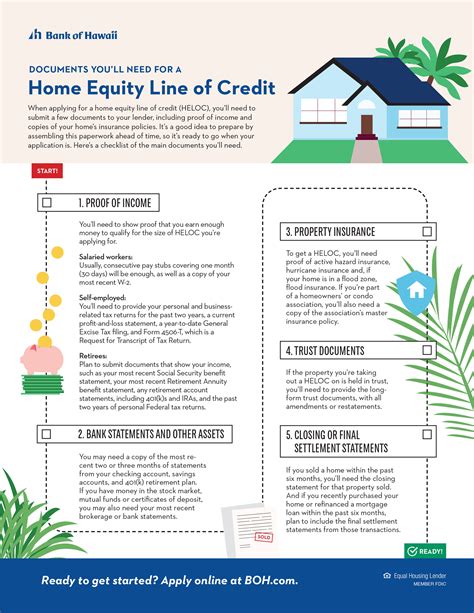

Required Paperwork for Home Equity Loan Application

The following documents are typically required for a home equity loan application:

- Identification documents: A valid government-issued ID, such as a driver’s license or passport, is necessary to verify the applicant’s identity.

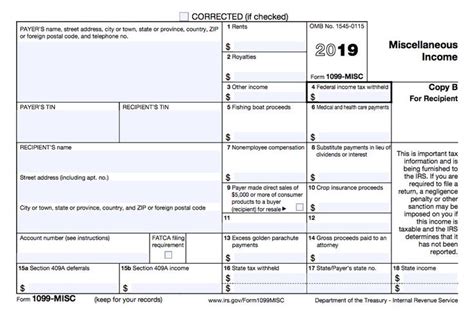

- Proof of income: Recent pay stubs, W-2 forms, or tax returns are required to demonstrate the applicant’s income and employment status.

- Proof of employment: A letter from the employer or a copy of the employment contract may be requested to confirm the applicant’s job and income stability.

- Proof of homeownership: A copy of the property deed, title report, or mortgage statement is necessary to verify the applicant’s ownership of the property.

- Appraisal report: An appraisal report may be required to determine the current market value of the property and the available equity.

- Credit reports: The lender will typically pull the applicant’s credit reports to evaluate their creditworthiness and determine the interest rate and loan terms.

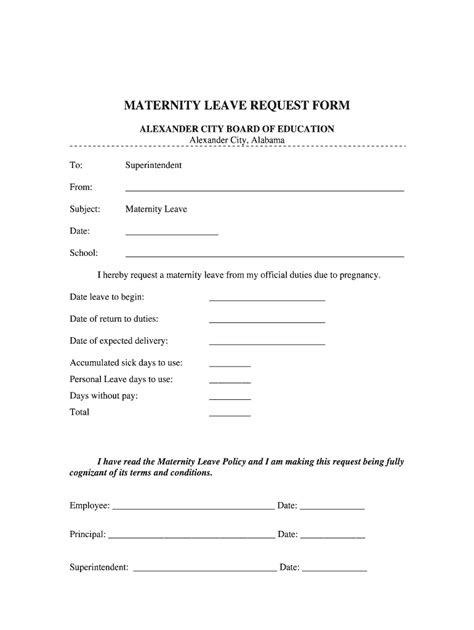

- Loan application: A completed loan application form, which includes personal and financial information, is required to initiate the loan process.

Additional Documents for Complex Financial Situations

In some cases, additional documentation may be required to support the loan application, such as:

- Divorce or separation agreements: If the applicant is divorced or separated, a copy of the agreement may be requested to verify income, assets, and debt obligations.

- Bankruptcy or foreclosure documents: If the applicant has experienced bankruptcy or foreclosure in the past, relevant documents, such as discharge papers or foreclosure notices, may be required.

- Self-employment documents: Self-employed individuals may need to provide additional documentation, such as business tax returns, financial statements, or a letter from their accountant, to verify their income and business stability.

Table of Required Documents

The following table summarizes the necessary documents for a home equity loan application:

| Document Type | Description |

|---|---|

| Identification documents | Valid government-issued ID, such as a driver’s license or passport |

| Proof of income | Recent pay stubs, W-2 forms, or tax returns |

| Proof of employment | Letter from employer or copy of employment contract |

| Proof of homeownership | Copy of property deed, title report, or mortgage statement |

| Appraisal report | Current market value of the property and available equity |

| Credit reports | Evaluation of creditworthiness and determination of interest rate and loan terms |

| Loan application | Completed loan application form with personal and financial information |

📝 Note: The specific documents required may vary depending on the lender, loan program, and individual circumstances. It's essential to review the lender's requirements and provide all necessary documentation to ensure a smooth loan process.

As the loan application process progresses, the lender may request additional information or documentation to support the application. It’s crucial to respond promptly to these requests to avoid delays or potential loan denials. By understanding the necessary paperwork and requirements, applicants can better navigate the home equity loan process and increase their chances of approval.

In the end, the key to a successful home equity loan application lies in providing complete and accurate documentation, as well as a thorough understanding of the loan process and requirements. By being prepared and responsive, applicants can unlock the equity in their home and achieve their financial goals.

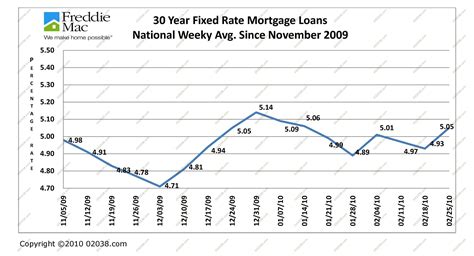

What is the typical interest rate for a home equity loan?

+

The interest rate for a home equity loan varies depending on the lender, loan program, and individual circumstances. However, typical interest rates range from 4% to 12% APR.

How long does the home equity loan application process typically take?

+

The application process for a home equity loan can take anywhere from a few days to several weeks, depending on the lender and the complexity of the application.

Can I use a home equity loan to pay off high-interest debt?

+