Kansas Paperwork Requirements

Kansas Paperwork Requirements: A Comprehensive Guide

When it comes to paperwork requirements in Kansas, there are several key documents and regulations that individuals and businesses must be aware of. From vehicle registration to business licenses, understanding the necessary paperwork can help streamline processes and avoid potential penalties. In this guide, we will delve into the various paperwork requirements in Kansas, highlighting the most critical documents and providing step-by-step instructions on how to obtain them.

Vehicle Registration and Titling

In Kansas, vehicle registration and titling are handled by the Kansas Department of Revenue. To register a vehicle, individuals must provide the following documents:

- Proof of ownership (title or manufacturer’s certificate of origin)

- Proof of insurance

- Proof of identity (driver’s license or state ID)

- Completed registration application (form TR-212)

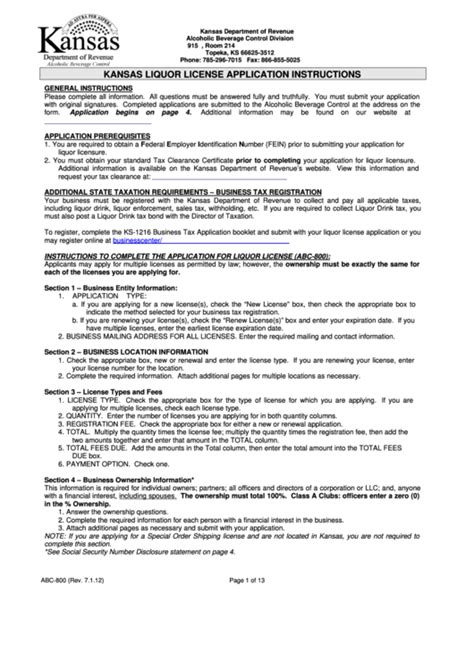

Business Licenses and Permits

Starting a business in Kansas requires obtaining the necessary licenses and permits. The type of license or permit required depends on the business type, location, and industry. Some common business licenses and permits in Kansas include:

- Sales tax permit

- Withholding tax permit

- Unemployment insurance tax permit

- Business license (varies by city or county)

Employment Law Requirements

Kansas employers must comply with various employment laws, including those related to minimum wage, overtime pay, and workers’ compensation. Employers must also provide employees with certain notices and postings, such as:

- Minimum wage notice

- Family and Medical Leave Act (FMLA) notice

- Workers’ compensation notice

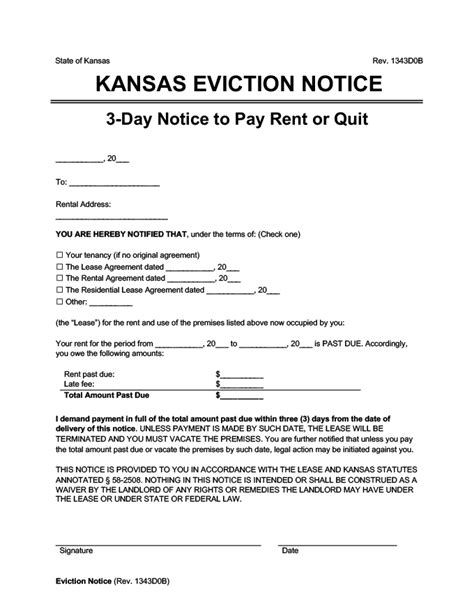

Real Estate and Property Requirements

When buying or selling real estate in Kansas, individuals must comply with various paperwork requirements. These include:

- Deed (warranty deed or quitclaim deed)

- Title insurance

- Property tax statement

- Inspection reports (termite, mold, or environmental)

Tax Requirements

Kansas residents and businesses must comply with various tax requirements, including income tax, sales tax, and property tax. Individuals must file a state income tax return (form K-40) by April 15th, while businesses must file a corporate income tax return (form K-120) by March 15th. Sales tax permits are required for businesses that sell taxable goods or services, and property tax statements must be paid annually.

📝 Note: It is crucial to consult with a tax professional or attorney to ensure compliance with all tax requirements in Kansas.

Environmental and Health Requirements

Kansas has various environmental and health regulations that individuals and businesses must comply with. These include:

- Water quality permits

- Air quality permits

- Hazardous waste disposal permits

- Food service permits

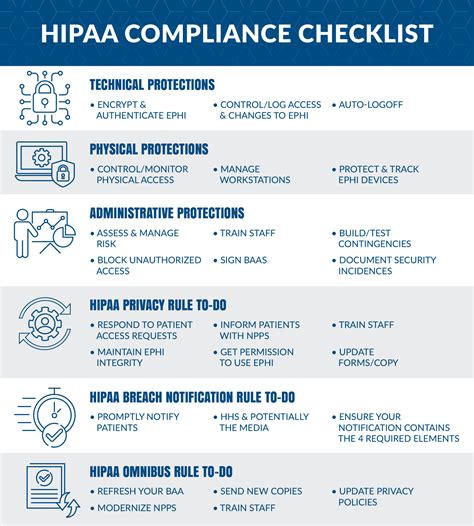

Insurance Requirements

Kansas has various insurance requirements, including:

- Automobile insurance

- Workers’ compensation insurance

- Unemployment insurance

- Health insurance (for certain employers)

| Document | Purpose | Required By |

|---|---|---|

| Vehicle registration | Register vehicle | Kansas Department of Revenue |

| Business license | Operate business | City or county government |

| Employment law notices | Comply with employment laws | Employers |

| Real estate deed | Transfer property ownership | Buyer and seller |

| Tax returns | File taxes | Kansas Department of Revenue |

In summary, Kansas has various paperwork requirements that individuals and businesses must comply with. From vehicle registration to business licenses, tax returns, and environmental permits, understanding the necessary documents and regulations can help streamline processes and avoid potential penalties. It is essential to consult with a licensed professional, such as an attorney or accountant, to ensure compliance with all applicable laws and regulations.

What are the requirements for registering a vehicle in Kansas?

+

To register a vehicle in Kansas, individuals must provide proof of ownership, proof of insurance, proof of identity, and a completed registration application.

What types of business licenses are required in Kansas?

+

The type of business license required in Kansas depends on the business type, location, and industry. Common business licenses include sales tax permits, withholding tax permits, and unemployment insurance tax permits.

What are the tax requirements for individuals and businesses in Kansas?

+

Individuals and businesses in Kansas must comply with various tax requirements, including income tax, sales tax, and property tax. Individuals must file a state income tax return by April 15th, while businesses must file a corporate income tax return by March 15th.

Related Terms:

- Javier Derritt

- Caleb Taylor

- Sevion Morrison

- Dre Doiron

- Cobee Bryant

- Jalon Daniels