5 IRA Inheritance Forms

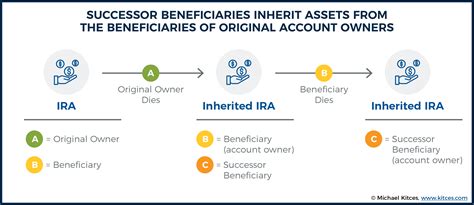

Understanding the Complexities of IRA Inheritance

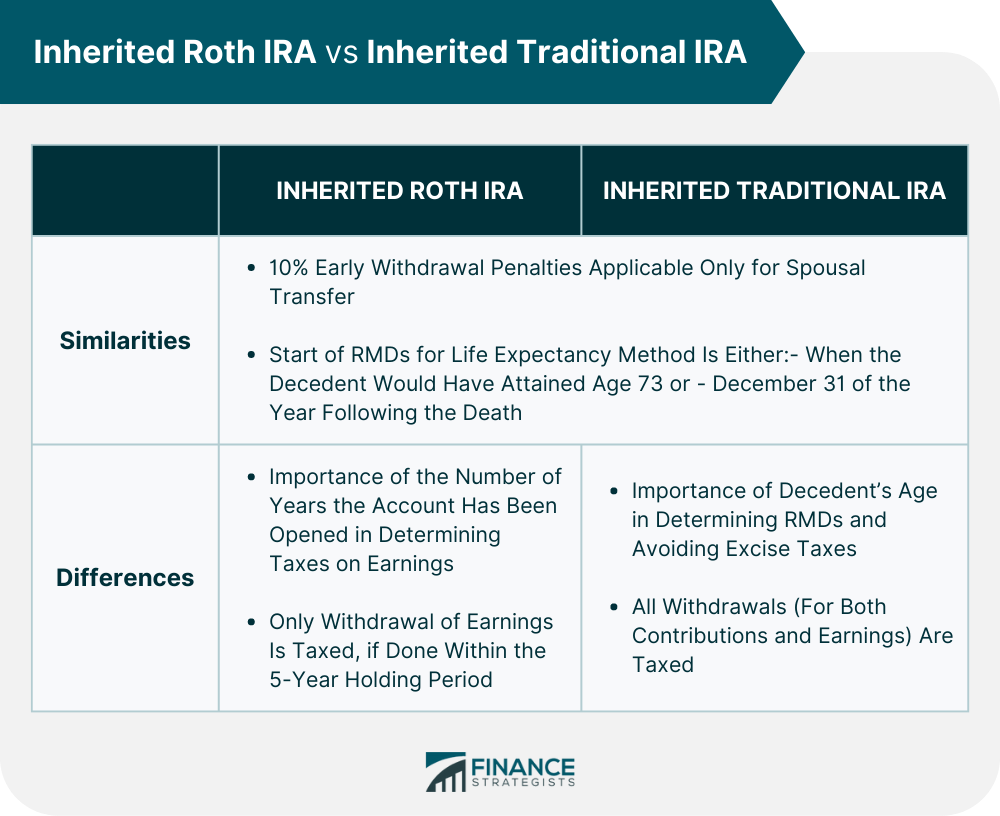

Inheriting an Individual Retirement Account (IRA) can be a complex process, filled with potential pitfalls and benefits. The rules governing IRA inheritance are multifaceted and depend on various factors, including the relationship between the beneficiary and the original account holder, the type of IRA, and the actions taken by the beneficiary upon inheriting the account. One of the critical steps in managing an inherited IRA is completing the necessary forms, which can vary depending on the financial institution and the specific circumstances of the inheritance.

Types of IRA Inheritance Forms

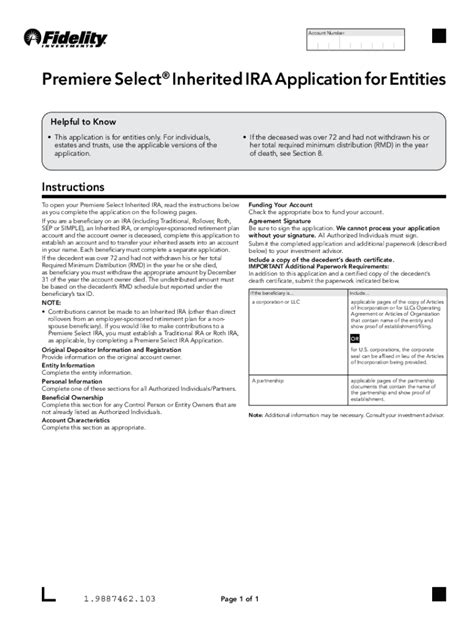

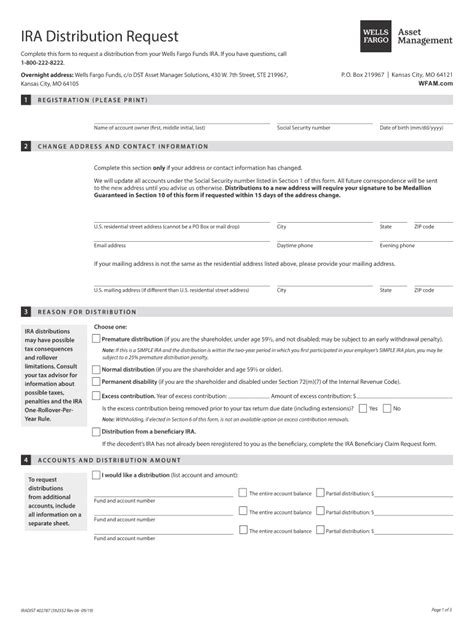

There are several types of forms that beneficiaries may need to complete when inheriting an IRA. These forms are essential for establishing the inherited IRA, choosing the distribution method, and ensuring compliance with tax laws. The primary forms include: - Beneficiary Designation Form: This form is used by the original account holder to designate beneficiaries for their IRA. Beneficiaries should review this form to understand their rights and obligations. - Inherited IRA Application: Upon the account holder’s death, beneficiaries must complete an application to establish an inherited IRA. This form typically requires personal and financial information. - Distribution Election Form: Beneficiaries must decide how they want to receive distributions from the inherited IRA. This form allows them to choose from available distribution options, such as a lump-sum payment or required minimum distributions (RMDs). - RMD Calculation Form: For beneficiaries who choose to receive RMDs, this form helps calculate the amount of the annual distribution based on the beneficiary’s life expectancy and the account balance. - Tax Withholding Form: Beneficiaries may need to complete a tax withholding form to specify how much, if any, of their IRA distributions should be withheld for federal income taxes.

Steps to Complete IRA Inheritance Forms

Completing the necessary forms for an inherited IRA involves several steps: - Review the Beneficiary Designation: Ensure you are listed as a beneficiary and understand your status (primary or secondary). - Gather Required Documents: Typically, you will need a copy of the death certificate, the original IRA documents, and identification. - Choose a Distribution Method: Decide whether to take a lump-sum distribution, establish an inherited IRA with RMDs, or use another available option. - Fill Out the Forms Accurately: Complete all required forms with precise and thorough information to avoid delays or errors. - Submit the Forms: Return the completed forms to the financial institution according to their instructions, usually by mail or online.

Importance of Accuracy and Timeliness

Accuracy and timeliness are crucial when completing IRA inheritance forms. Errors or delays can result in missed deadlines for distributions, unnecessary taxes, or even penalties. It is highly recommended that beneficiaries consult with a financial advisor or tax professional to ensure they are making the most beneficial choices for their situation.

Table of Common Forms and Their Uses

| Form Type | Description |

|---|---|

| Beneficiary Designation | Designates who will inherit the IRA |

| Inherited IRA Application | Establishes an inherited IRA for beneficiaries |

| Distribution Election | Chooses the method of distribution (lump-sum, RMDs, etc.) |

| RMD Calculation | Calculates the annual required minimum distribution |

| Tax Withholding | Specifies the amount of federal income tax to withhold from distributions |

📝 Note: It's essential to carefully review and understand the implications of each form before submission, as this can significantly impact tax obligations and the management of the inherited IRA.

As one navigates the process of inheriting and managing an IRA, the complexity of the required forms and the decisions surrounding distribution methods can be overwhelming. However, with careful planning, accurate completion of necessary forms, and possibly the guidance of a financial advisor, beneficiaries can make informed decisions that align with their financial goals and comply with regulatory requirements. Ultimately, the goal is to maximize the benefits of the inherited IRA while minimizing tax liabilities and potential penalties, ensuring a smoother transition and better financial outcomes for the beneficiaries.