EV Tax Credit Paperwork Needed

Introduction to EV Tax Credit

The electric vehicle (EV) tax credit is a government incentive designed to encourage the adoption of environmentally friendly vehicles. The credit allows individuals and businesses to claim a tax deduction on their income tax return for the purchase of a qualifying electric vehicle. However, to claim this credit, certain paperwork and documentation are required. In this article, we will explore the necessary paperwork and steps to follow to claim the EV tax credit.

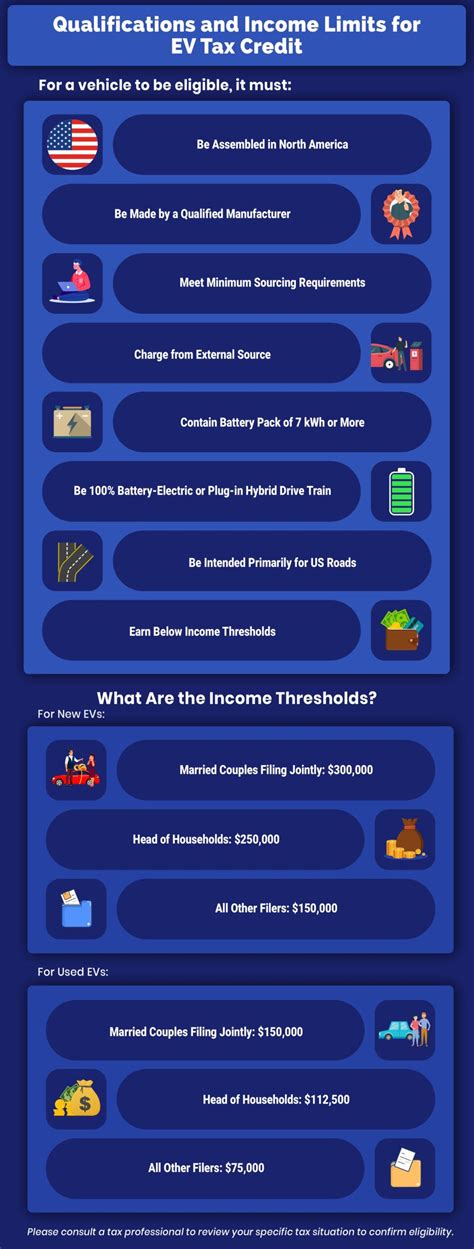

Qualifying for the EV Tax Credit

To qualify for the EV tax credit, the vehicle must meet certain requirements. These include: * The vehicle must be an electric vehicle with a battery propulsion system * The vehicle must have a gross vehicle weight rating of less than 14,000 pounds * The vehicle must be purchased for use or lease by the taxpayer, and not for resale * The vehicle must be made by a manufacturer that has not exceeded the production limit of 200,000 qualifying vehicles Some examples of qualifying vehicles include the Nissan Leaf, Chevrolet Bolt, and Tesla Model 3.

Required Paperwork for the EV Tax Credit

To claim the EV tax credit, the following paperwork is required: * Form 8936: This is the Qualified Plug-in Electric Drive Motor Vehicle Credit form, which must be completed and attached to the taxpayer’s income tax return * Vehicle sales contract: A copy of the sales contract or lease agreement for the vehicle * Vehicle manufacturer’s certification: A certification from the vehicle manufacturer that the vehicle qualifies for the credit * Proof of purchase or lease: A receipt or invoice showing the purchase or lease of the vehicle

Step-by-Step Guide to Claiming the EV Tax Credit

To claim the EV tax credit, follow these steps: * Purchase or lease a qualifying electric vehicle * Obtain the required paperwork, including the vehicle sales contract, vehicle manufacturer’s certification, and proof of purchase or lease * Complete Form 8936 and attach it to the taxpayer’s income tax return * File the income tax return with the IRS * Claim the credit on the tax return, using the information from Form 8936

📝 Note: The EV tax credit is subject to phase-out once a manufacturer has sold 200,000 qualifying vehicles. It is essential to check the IRS website for the latest information on manufacturer sales and credit phase-out.

Benefits of the EV Tax Credit

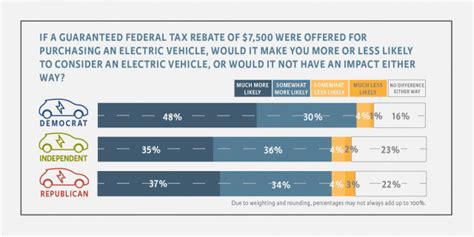

The EV tax credit offers several benefits, including: * A tax credit of up to $7,500 for qualifying vehicles * Reduced greenhouse gas emissions and air pollution * Lower operating costs for electric vehicles compared to traditional gasoline-powered vehicles * Increased energy independence and reduced reliance on foreign oil

Comparison of EV Tax Credit with Other Incentives

The EV tax credit is one of several incentives available for electric vehicle adoption. Other incentives include: * State and local tax credits * Rebates and incentives from utilities and other organizations * Free or reduced-fee charging infrastructure * Access to high-occupancy vehicle (HOV) lanes and other traffic perks

| Incentive | Amount | Eligibility |

|---|---|---|

| EV Tax Credit | Up to $7,500 | Qualifying electric vehicles |

| State Tax Credit | Varies by state | Qualifying electric vehicles, state residency |

| Utility Rebate | Varies by utility | Qualifying electric vehicles, utility customer |

In summary, the EV tax credit is a valuable incentive for individuals and businesses to adopt electric vehicles. By understanding the required paperwork and following the step-by-step guide, taxpayers can claim the credit and enjoy the benefits of electric vehicle ownership.

To finalize, the key points of the EV tax credit are the qualification requirements, necessary paperwork, and step-by-step guide to claiming the credit. The benefits of the EV tax credit, including the tax credit amount and environmental benefits, make it an attractive incentive for those considering electric vehicle adoption. As the world continues to transition towards more sustainable transportation options, the EV tax credit will play an essential role in encouraging the adoption of environmentally friendly vehicles.

What is the maximum amount of the EV tax credit?

+

The maximum amount of the EV tax credit is $7,500.

Which vehicles qualify for the EV tax credit?

+

Vehicles with a battery propulsion system, a gross vehicle weight rating of less than 14,000 pounds, and made by a manufacturer that has not exceeded the production limit of 200,000 qualifying vehicles qualify for the credit.

How do I claim the EV tax credit?

+

To claim the EV tax credit, complete Form 8936 and attach it to your income tax return. You will also need to provide the required paperwork, including the vehicle sales contract, vehicle manufacturer’s certification, and proof of purchase or lease.